Introduction

For finance students aiming to enter the world of quantitative trading, one of the most fundamental yet powerful concepts is correlation. Correlation is more than just a statistical measure; it is a lens through which traders analyze the relationships between assets, portfolios, and risk exposures. Understanding correlation in quantitative trading for finance students is essential, as it forms the foundation of portfolio construction, risk management, and trading strategy development.

This article provides a comprehensive guide to correlation in quantitative trading. We’ll cover its mathematical basis, practical applications, the tools traders use, and the advantages and pitfalls of relying on correlation metrics. By the end, you’ll know how to interpret correlations, apply them to trading models, and evaluate strategies for real-world scenarios.

What is Correlation in Quantitative Trading?

Correlation measures the degree to which two variables move in relation to one another. In trading, it is often used to analyze how the prices of two assets, such as stocks or currencies, move together.

A positive correlation (+1) means two assets move in the same direction.

A negative correlation (−1) means they move in opposite directions.

A zero correlation indicates no relationship.

For finance students, correlation is crucial to understand because it directly affects diversification, risk-adjusted returns, and the stability of algorithmic trading systems.

Range of correlation values in trading

Why is Correlation Important in Quantitative Analysis?

Diversification and Risk Reduction

Correlation helps traders design diversified portfolios. If assets are highly correlated, adding them to the same portfolio provides little diversification benefit. On the other hand, combining low or negatively correlated assets reduces portfolio risk.

Market Prediction

Traders use correlation to identify predictive signals between assets. For instance, if oil prices and airline stocks have strong negative correlation, traders may hedge one against the other.

Stress Testing

Correlation tends to increase during market crises, a phenomenon known as “correlation breakdown.” Understanding this is vital for quant traders to avoid overestimating diversification benefits.

This aligns closely with the question many beginners ask: How does correlation affect quantitative trading? The answer is that correlation shapes both opportunity and risk in every quant strategy.

Methods of Measuring Correlation in Trading

Pearson Correlation Coefficient

The most common measure, Pearson correlation, evaluates linear relationships between two datasets. It is widely used for equity and forex trading strategies.

Spearman Rank Correlation

Spearman measures monotonic relationships. It is useful when data is not normally distributed, such as alternative data inputs (social media signals, satellite data).

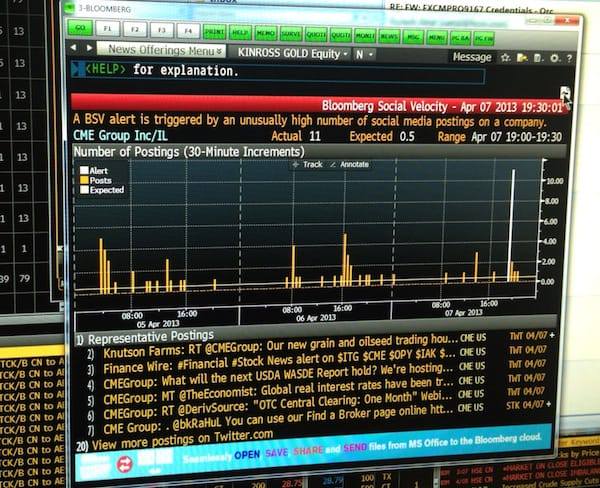

Rolling Window Correlation

Instead of calculating correlation across an entire dataset, rolling windows allow traders to see how correlations evolve over time. This is particularly valuable for detecting regime shifts.

Correlation Matrices

Traders use matrices to assess correlations across multiple assets simultaneously, providing a snapshot of portfolio dependencies. This is why quantitative traders use correlation matrices in professional practice.

Sample correlation matrix of equity assets

Applications of Correlation in Quantitative Trading

Portfolio Construction

Correlation determines how assets interact within a portfolio. By balancing correlations, quants optimize the Sharpe ratio and minimize volatility.

Pairs Trading

Pairs trading strategies rely heavily on correlation. Traders identify two historically correlated assets and trade when their price relationship temporarily diverges.

Risk Management

Correlation analysis allows risk managers to stress-test portfolios under various market conditions, ensuring capital is not overly concentrated in correlated bets.

Algorithmic Strategy Design

Correlation metrics are embedded into quantitative models, including regression analysis, principal component analysis (PCA), and machine learning frameworks.

Comparing Two Approaches to Correlation in Trading

Approach 1: Static Correlation Models

Pros: Easy to compute, clear interpretation.

Cons: Assumes correlations remain constant over time, which is often unrealistic in dynamic markets.

Approach 2: Dynamic Correlation Models (e.g., DCC-GARCH)

Pros: Captures evolving relationships, better for high-frequency trading.

Cons: Computationally intensive, requires advanced statistical knowledge.

Recommendation: For finance students, starting with static correlation models helps build intuition. As skills progress, exploring dynamic correlation models offers a more accurate reflection of market relationships.

Common Pitfalls of Using Correlation in Quant Trading

Overreliance on Historical Data – Past correlations may not hold in future markets.

Ignoring Nonlinear Relationships – Pearson correlation fails to capture complex dependencies.

Correlation Breakdown During Crises – Assets often move together in extreme market events.

Spurious Correlation – Apparent relationships may be statistical noise rather than real drivers.

Tools for Analyzing Correlation

Finance students can access various tools for correlation analysis:

Python (NumPy, pandas, statsmodels): Flexible for coding correlation models.

MATLAB & R: Widely used in academic and professional quant research.

Bloomberg & Refinitiv: Industry-standard platforms offering real-time correlation data.

Excel with Data Analysis ToolPak: Useful for beginners learning correlation calculations.

This connects directly to where to find correlation data for quantitative strategies, as access to reliable datasets is a cornerstone of correlation analysis.

Trends in Correlation Analysis for Quantitative Finance Students

Machine Learning: Using correlation features in predictive models.

Alternative Data: Correlations between non-traditional datasets (e.g., weather, shipping, credit card data).

High-Frequency Trading: Microsecond-level correlation detection in order book dynamics.

Cross-Asset Correlation: Growing importance of multi-asset correlation in global macro strategies.

Frequently Asked Questions (FAQ)

- How do I calculate correlation in quantitative models?

You can calculate correlation using statistical formulas or programming tools. For example, the Pearson coefficient formula is:

ρX,Y=Cov(X,Y)σXσY

ρ

X,Y

=

σ

X

σ

Y

Cov(X,Y)

In practice, most quant traders use Python (pandas.DataFrame.corr()) or Bloomberg terminals for large-scale calculations.

- Why does correlation matter in algorithmic trading?

Correlation informs how assets move together, which is critical for building predictive models, managing risk, and avoiding redundant signals. Without correlation analysis, traders risk overexposure to hidden dependencies.

- How can I reduce correlation risk in quantitative portfolios?

To reduce correlation risk, traders diversify across asset classes, apply factor models (e.g., Fama-French), and monitor dynamic correlations. Hedging strategies such as options or volatility trading can also help offset correlation spikes during crises.

Conclusion

Understanding correlation in quantitative trading for finance students is essential for building robust trading systems. From risk management to pairs trading, correlation serves as a cornerstone of modern quantitative finance.

For students, the journey begins with mastering static correlation calculations and gradually moving toward advanced dynamic models. Along the way, leveraging real-world tools, avoiding common pitfalls, and interpreting correlation data correctly will help bridge the gap between theory and trading practice.

If this article provided clarity, share it with classmates or fellow aspiring quants. Leave a comment below on how you’ve applied correlation in your studies or trading experiments, and let’s keep the discussion growing.

要不要我为这篇文章再加一个 实操案例部分(比如用 Python 代码计算股票对的相关性并绘制可视化),这样可以提升对 finance students 的吸引力,同时增强 SEO 竞争力?

0 Comments

Leave a Comment