============================================

In the world of finance and data science, covariance plays a pivotal role in understanding how variables move together. For quantitative analysts (quants), traders, and researchers, the ability to measure and interpret covariance can significantly enhance risk management, portfolio construction, and predictive modeling. This article provides a deep dive into how covariance impacts quantitative analysis, highlighting practical methods, strategies, and real-world applications.

Understanding Covariance in Quantitative Analysis

Definition of Covariance

Covariance is a statistical measure that indicates the degree to which two variables move together:

- Positive covariance: When one variable increases, the other tends to increase.

- Negative covariance: When one variable increases, the other tends to decrease.

- Zero covariance: No linear relationship between the variables.

In quantitative finance, covariance is primarily used to evaluate the relationships between asset returns.

Formula

The formula for covariance between two variables XXX and YYY is:

Cov(X,Y)=∑i=1n(Xi−Xˉ)(Yi−Yˉ)n−1Cov(X, Y) = \frac{\sum_{i=1}^{n} (X_i - \bar{X})(Y_i - \bar{Y})}{n-1}Cov(X,Y)=n−1∑i=1n(Xi−Xˉ)(Yi−Yˉ)

Where:

- Xi,YiX_i, Y_iXi,Yi = individual data points

- Xˉ,Yˉ\bar{X}, \bar{Y}Xˉ,Yˉ = mean values

- nnn = number of data points

Why Covariance Matters in Quantitative Analysis

- Portfolio Management

Covariance helps determine how assets interact within a portfolio. A well-diversified portfolio aims to include assets with low or negative covariance to reduce overall volatility.

(Internal link: why covariance is important in portfolio management)

- Risk Assessment

By understanding the covariance between assets or market factors, traders can quantify and hedge risks effectively.

(Internal link: how to use covariance in risk assessment)

- Quantitative Trading Models

Covariance matrices form the backbone of many quantitative strategies, from mean-variance optimization to factor modeling.

- Machine Learning Applications

In ML-driven quantitative analysis, covariance structures often feed into feature engineering, PCA (principal component analysis), and dimensionality reduction techniques.

Methods of Applying Covariance in Quantitative Analysis

1. Covariance in Portfolio Diversification

Modern portfolio theory (MPT) relies heavily on covariance. By combining assets with low or negative covariance, traders can achieve better risk-adjusted returns.

- Pros: Improves portfolio stability, reduces drawdowns.

- Cons: Historical covariance may not always reflect future market behavior.

2. Covariance in Statistical Arbitrage

Statistical arbitrage strategies often hinge on the covariance between asset pairs or baskets. For instance, if two currency pairs exhibit strong positive covariance, divergence from the historical relationship can signal a trading opportunity.

- Pros: Provides measurable, systematic entry/exit signals.

- Cons: Sensitive to regime changes; covariance structures may break down in crises.

3. Covariance in Risk Models

Value-at-Risk (VaR) and stress testing frequently incorporate covariance matrices to assess potential losses under various scenarios.

- Pros: Strengthens institutional risk oversight.

- Cons: Computationally intensive for large portfolios.

Manual vs Automated Covariance Analysis

| Approach | Description | Advantages | Disadvantages |

|---|---|---|---|

| Manual Analysis | Traders or analysts calculate and interpret covariance using spreadsheets or small datasets. | Easy to learn, suitable for education. | Limited scalability, prone to errors. |

| Automated Systems | Algorithmic models calculate covariance in real-time across multiple assets. | Scalable, consistent, supports advanced strategies. | Requires technical expertise, risk of overfitting. |

Recommendation: Beginners should learn manual covariance calculations to build intuition, while professional quants should leverage automated systems for high-frequency or large-scale strategies.

Case Study: Covariance in Forex Pairs

Suppose a quant analyzes EUR/USD and GBP/USD. Historically, these pairs have a strong positive covariance because both involve USD.

- If EUR/USD rises, GBP/USD often rises too.

- A sudden divergence (e.g., EUR/USD up, GBP/USD flat) might signal a trading anomaly.

- Incorporating covariance into models helps detect such inefficiencies for arbitrage strategies.

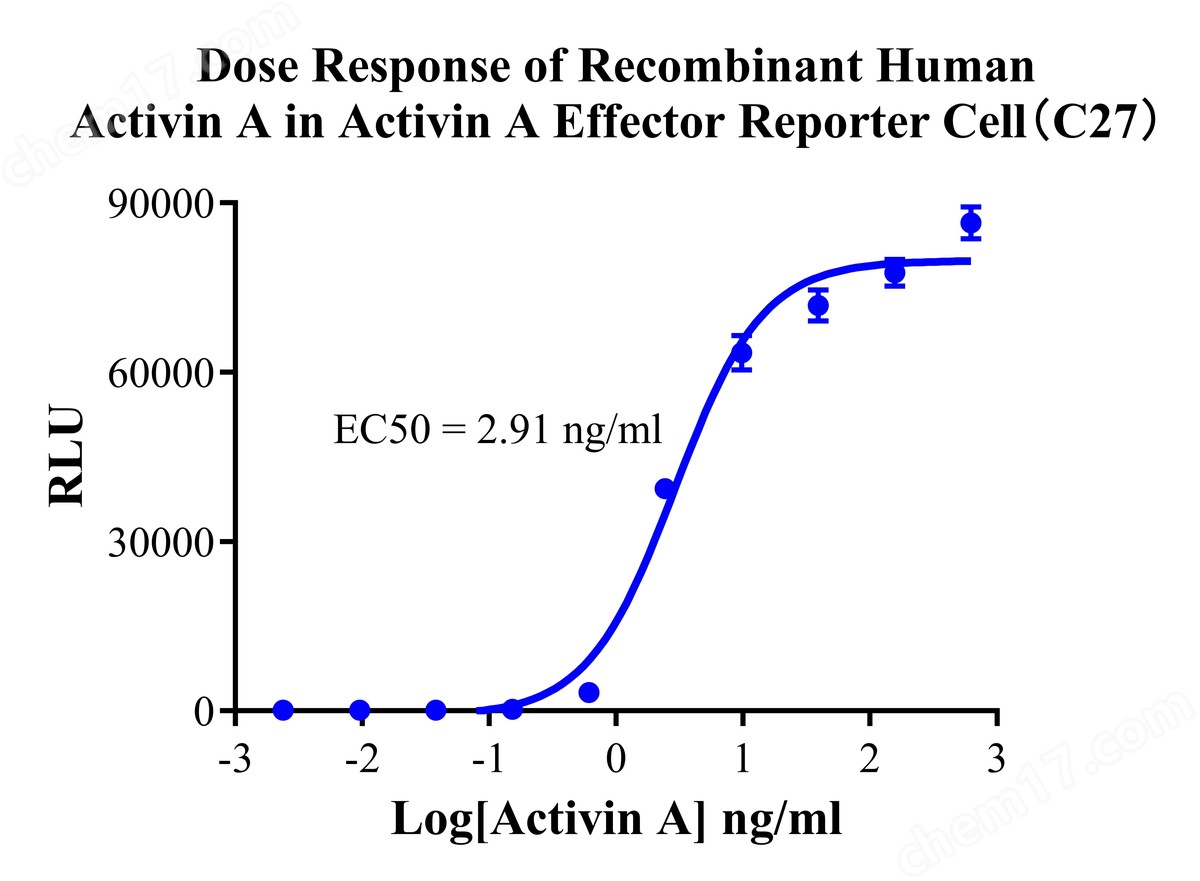

Visualization of Covariance Concepts

Covariance in Asset Returns

Heatmap showing the covariance matrix across multiple asset classes. Positive covariance (red) indicates co-movement, while negative covariance (blue) shows diversification potential.

Portfolio Risk with and without Covariance

Portfolios that consider covariance achieve lower volatility compared to naïve diversification.

Advanced Covariance Techniques for Quantitative Analysts

Shrinkage Estimation

In high-dimensional portfolios, traditional covariance estimates may be unstable. Shrinkage techniques (e.g., Ledoit-Wolf) stabilize covariance matrices for more reliable results.

Dynamic Covariance Models

GARCH and DCC (Dynamic Conditional Correlation) models capture time-varying covariance, crucial for volatile markets.

Factor-Based Covariance

Factor models reduce dimensionality by modeling asset covariance through common risk factors, such as market, size, and momentum.

Frequently Asked Questions (FAQ)

1. How do I calculate covariance in quantitative trading?

Covariance can be calculated manually with the formula, but most quants rely on statistical software like Python (NumPy, Pandas) or R. Automated tools allow for large-scale, real-time covariance calculations.

2. Why is covariance important for risk managers?

Covariance provides insights into how different assets interact under market stress. Without it, risk models would underestimate or misprice potential portfolio drawdowns.

3. Can covariance predict market trends?

Covariance itself does not predict direction but highlights relationships. For instance, strong positive covariance between equities and commodities might signal broader macroeconomic trends.

Conclusion

Understanding how covariance impacts quantitative analysis is fundamental for quants, traders, and risk managers. From portfolio optimization to statistical arbitrage, covariance provides the framework for measuring relationships and managing uncertainty.

By combining manual intuition with automated analytical tools, professionals can unlock deeper insights and build resilient strategies in an increasingly data-driven financial world.

If you found this guide valuable, share it with your network and join the conversation—how do you apply covariance in your trading or research strategies?

0 Comments

Leave a Comment