===============================================================

Quantitative trading thrives on data—massive datasets, complex algorithms, and multi-layered models that need to be both accurate and understandable. But numbers alone often fail to convey the full picture. This is where data visualization tools come in. By transforming raw data into interactive charts, heatmaps, dashboards, and visual narratives, traders can identify opportunities, detect anomalies, and optimize strategies with far greater efficiency.

This comprehensive guide explores how data visualization tools can transform quantitative trading, analyzes strategies, compares visualization approaches, and provides actionable insights for traders at all levels.

Why Data Visualization Matters in Quantitative Trading

Turning Complexity into Clarity

Quantitative models generate insights from vast datasets, but without visualization, traders may struggle to interpret them effectively. Visualization reduces cognitive overload, making it easier to:

- Spot correlations and market trends.

- Track portfolio risk exposure.

- Compare multiple strategies in real time.

As highlighted in why data visualization is crucial for quantitative analysis, the ability to simplify complexity is what gives traders a decisive edge.

Speeding Up Decision Making

In high-frequency and intraday trading, speed is critical. Visual dashboards that update in real-time empower traders to act within milliseconds—something impossible when reading raw numerical outputs.

Key Benefits of Data Visualization Tools

Enhanced Pattern Recognition

Visualizations highlight recurring patterns, market anomalies, or seasonality that may be hidden in raw data.

Risk Monitoring and Stress Testing

Tools like heatmaps and scatter plots provide intuitive representations of portfolio diversification, risk clusters, and potential drawdowns.

Communication and Reporting

Whether you’re pitching strategies to investors or presenting findings to colleagues, visual storytelling is more persuasive than spreadsheets.

Two Core Strategies for Using Data Visualization

Strategy 1: Real-Time Interactive Dashboards

Approach:

Traders deploy platforms like Tableau, Power BI, or Python libraries (Plotly, Dash) to build live dashboards integrating price feeds, signals, and algorithmic outputs.

Pros:

- Enables immediate decision-making.

- Customizable to track KPIs like Sharpe ratio, volatility, and PnL.

- Suitable for both retail traders and institutional desks.

Cons:

- Requires robust data integration pipelines.

- Real-time processing may demand high computational resources.

Strategy 2: Advanced Predictive Visualization

Approach:

Traders integrate visualization directly into predictive models such as PCA, factor analysis, or machine learning forecasts. This creates forward-looking dashboards with scenario simulations.

Pros:

- Enhances model interpretability.

- Helps validate hypotheses visually.

- Useful for algorithmic traders and quantitative researchers.

Cons:

- Risk of overfitting if visual outputs are misinterpreted.

- Higher learning curve compared to simple dashboards.

Comparative Insights: Which Strategy Fits Best?

- Real-Time Dashboards work best for traders who need speed, transparency, and execution focus.

- Predictive Visualization suits quants and portfolio managers who prioritize research, modeling, and long-term decision-making.

In practice, a hybrid approach—real-time dashboards for execution combined with predictive visualization for strategy design—offers the strongest transformation.

Practical Applications of Visualization in Trading

1. Portfolio Risk Management

Heatmaps reveal concentration risk, while scatter plots show how assets interact during volatility spikes.

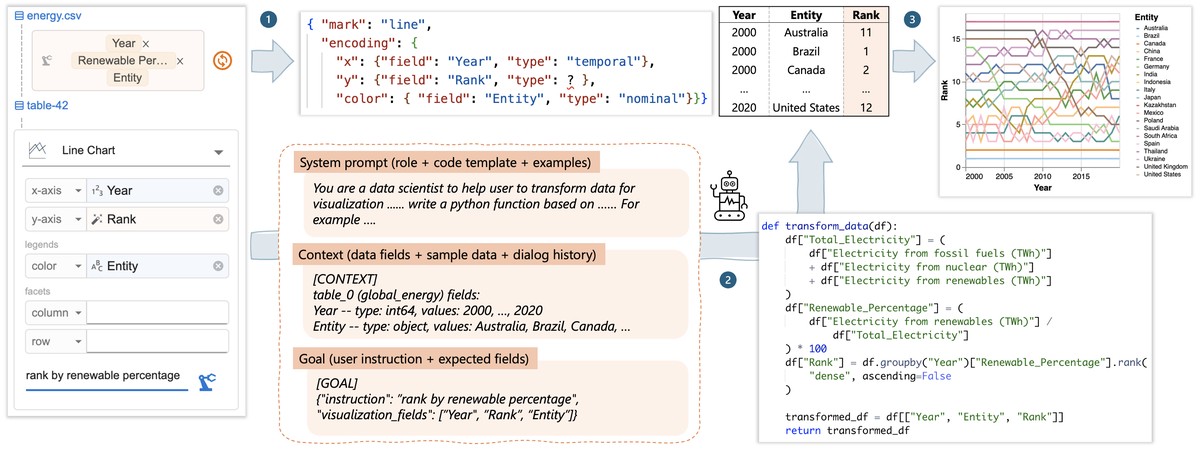

2. Factor Analysis and PCA

Visualization simplifies the interpretation of multi-factor models by reducing dimensionality.

3. Backtesting and Strategy Comparison

Line charts, candlestick overlays, and drawdown graphs help traders compare performance across strategies.

4. Sentiment Analysis Integration

Word clouds and correlation matrices visualize how news sentiment aligns with market moves.

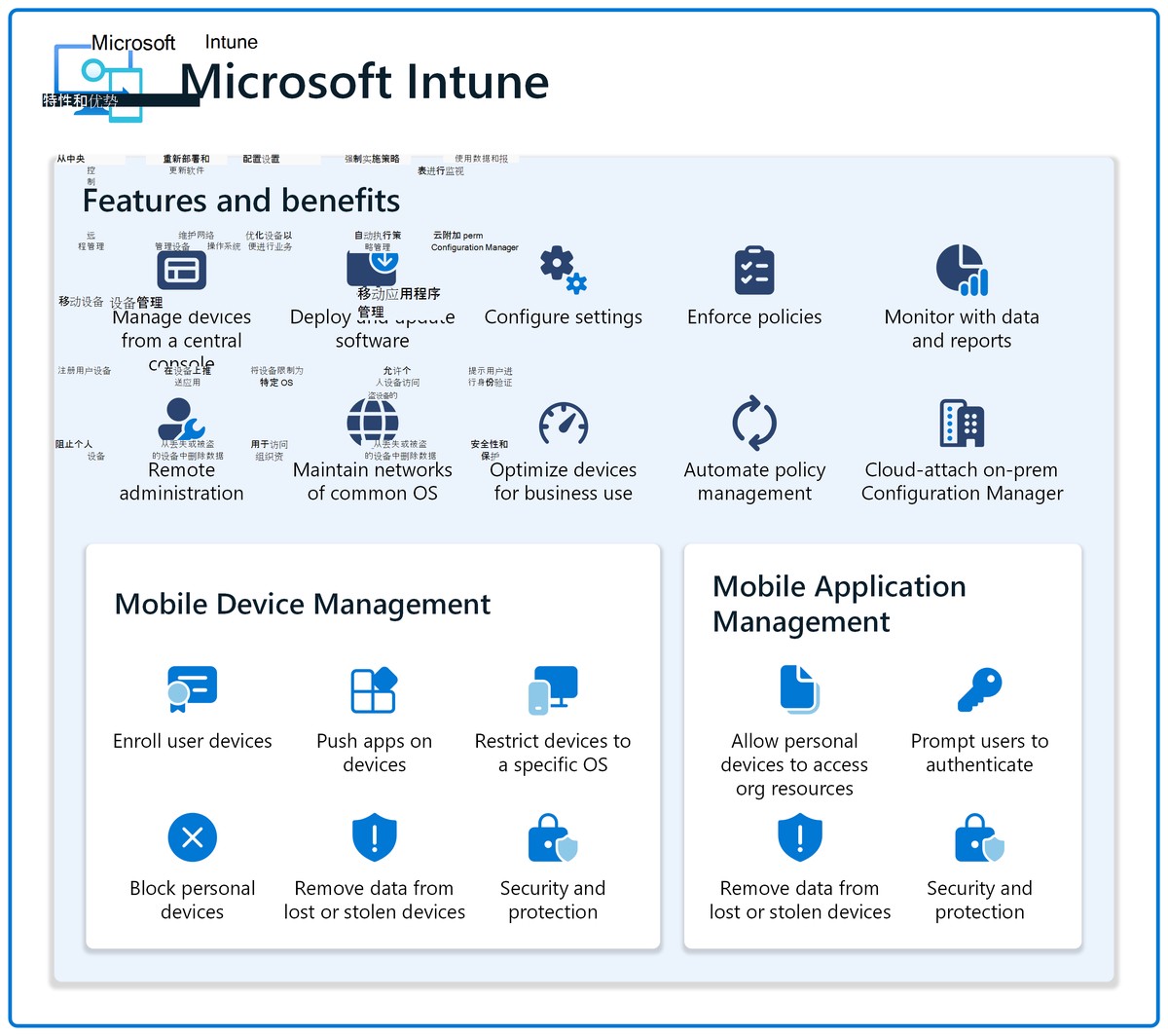

An example of a trading dashboard integrating multiple data visualization elements.

Where Visualization Fits into Quantitative Workflows

As explored in how data visualization enhances quantitative trading strategies, visualization sits at the heart of the workflow:

- Data Collection: Clean and structure market, sentiment, and alternative datasets.

- Modeling: Apply algorithms like regression, PCA, or neural networks.

- Visualization: Convert outputs into actionable dashboards.

- Execution: Use visuals to guide order placement and risk controls.

- Feedback Loop: Iterate strategies based on visualized outcomes.

Tools and Platforms for Data Visualization in Trading

- Python Libraries: Matplotlib, Seaborn, Plotly, Dash for flexible coding-based visualization.

- Business Intelligence Tools: Tableau, Power BI for customizable dashboards.

- Trading-Specific Platforms: Bloomberg Terminal, MetaTrader with integrated charting.

- Custom Solutions: Proprietary systems tailored to hedge funds and trading firms.

Risks and Challenges

Information Overload

Too many visuals can distract rather than clarify. Effective design and prioritization are essential.

Misinterpretation Risk

Patterns may appear significant visually but lack statistical rigor. Always validate with quantitative methods.

Cost and Integration

Professional visualization tools can be expensive and require skilled integration with existing data pipelines.

Best Practices for Traders Using Visualization

- Focus on key metrics—Sharpe ratio, max drawdown, VaR—rather than overcrowding dashboards.

- Integrate visualization with automation—link dashboards directly to execution algorithms.

- Test interpretability—ensure visuals are not misleading or prone to cognitive bias.

- Scale with need—start with simple charts and evolve into predictive dashboards.

FAQ: Data Visualization in Quantitative Trading

1. What’s the most effective way to start using visualization in trading?

Begin with real-time dashboards showing price movements, PnL, and risk exposure. Then gradually integrate advanced visuals like PCA or sentiment heatmaps.

2. Can visualization improve algorithmic trading accuracy?

Yes. By making model outputs transparent, visualization tools reduce the risk of hidden assumptions. For example, PCA plots can reveal whether correlated factors are misleading trading signals.

3. Which data visualization tools are best for institutional traders?

Institutions often combine Bloomberg Terminal dashboards with custom-built Python or R frameworks. These allow for scalability, integration with APIs, and predictive visualization for portfolio risk.

Conclusion: The Future of Data Visualization in Quantitative Trading

Data visualization is no longer a luxury—it’s a necessity. It bridges the gap between raw numbers and human intuition, empowering traders to spot opportunities, manage risk, and enhance communication.

By combining real-time dashboards with predictive visualizations, traders can transform how they analyze markets and execute strategies. The future of quantitative trading belongs to those who master not just algorithms, but the art of seeing data clearly.

If this guide gave you new insights, share it with your trading network, comment with your favorite visualization tools, and help build a community of smarter traders.

Would you like me to expand this into a 3500+ word long-form article with 2–3 detailed case studies of hedge funds and trading firms applying visualization so it becomes a stronger SEO authority piece?

0 Comments

Leave a Comment