====================================================================

Derivatives trading has long been a cornerstone of financial markets, providing investors and institutions with tools to hedge risks, speculate on future price movements, and enhance investment strategies. However, along with these opportunities comes a significant amount of risk. Effective risk management is critical to ensure that traders and investors do not face catastrophic losses. In this article, we will explore various derivatives trading risk management solutions, examine different strategies, and provide insights into how they can be effectively applied in today’s complex financial markets.

Understanding Derivatives and Their Role in Trading

What Are Derivatives?

Derivatives are financial contracts whose value is derived from the price of an underlying asset, such as stocks, bonds, commodities, or indices. Common derivatives include options, futures, swaps, and forwards. Traders use derivatives for various purposes, including speculation, arbitrage, and hedging.

The Importance of Derivatives in Trading

Derivatives play an important role in financial markets by allowing traders to take on exposure to an asset without owning it. This enables both individuals and institutions to manage risks associated with fluctuating prices of assets. Moreover, derivatives provide a way to leverage positions, offering the potential for higher returns—but also increasing exposure to potential losses.

Risks Associated with Derivatives Trading

While derivatives can be a powerful tool for risk management and speculative profit, they also carry inherent risks. These include:

- Market Risk: The risk of price fluctuations in the underlying asset that can lead to significant losses.

- Liquidity Risk: The risk of being unable to buy or sell derivatives positions quickly at a fair market price.

- Credit Risk: The risk that a counterparty may default on their obligations.

- Operational Risk: The risk of errors or inefficiencies in the execution or settlement of derivative transactions.

It is essential to implement robust risk management solutions to mitigate these risks and protect the capital invested in derivatives.

Key Risk Management Solutions in Derivatives Trading

1. Hedging Strategies

Hedging is one of the most common risk management techniques in derivatives trading. It involves taking an opposite position in a related asset to offset potential losses in the original investment.

How Hedging Works in Derivatives

Hedging with derivatives typically involves using options or futures contracts. For example:

- Futures Contracts: A trader holding a position in an underlying asset may use a futures contract to lock in a price at which they can sell the asset in the future, effectively mitigating the risk of adverse price movements.

- Options Contracts: A trader can buy put options as a form of insurance against price drops in the underlying asset, ensuring that they can sell at a predetermined price even if market prices fall.

Advantages of Hedging

- Risk Mitigation: Hedging helps to reduce the exposure to price volatility and market risk.

- Flexibility: With options, traders can limit losses while maintaining the potential for gains.

Disadvantages of Hedging

- Cost of Hedging: The premiums on options contracts and the margin requirements for futures can reduce overall profitability.

- Complexity: Hedging requires a deep understanding of the markets and the instruments being used, which may lead to costly mistakes if misused.

2. Position Sizing and Leverage Management

Another key aspect of risk management in derivatives trading is controlling position size and the amount of leverage employed.

Position Sizing

Position sizing involves determining how much capital to allocate to each trade. A common rule of thumb in risk management is to never risk more than 1-2% of your total capital on any single trade. By limiting the amount of capital exposed to a single trade, traders can reduce the risk of catastrophic losses.

Leverage Management

Leverage allows traders to control a larger position with a smaller capital outlay, amplifying both potential profits and losses. While leverage can be beneficial, it also increases the risk of a trade, as losses can exceed the initial margin deposit.

Effective Position Sizing Strategies

- Fixed Fractional Model: A strategy where traders risk a fixed percentage of their capital on each trade.

- Kelly Criterion: A formula that helps traders determine the optimal amount of capital to risk based on their edge and probability of success.

Advantages of Position Sizing and Leverage Management

- Controlled Risk: By adjusting position sizes and leverage, traders can limit exposure to significant losses.

- Maximized Profits: Proper leverage management allows traders to amplify their profits while managing risk effectively.

Disadvantages of Position Sizing and Leverage Management

- Limited Returns: A conservative approach to position sizing may limit potential profits.

- Complex Calculations: Determining optimal position size requires careful analysis and understanding of market conditions.

3. Stress Testing and Scenario Analysis

Stress testing and scenario analysis involve simulating extreme market conditions to evaluate the potential impact of adverse events on a derivatives portfolio.

How Stress Testing Works

Stress testing involves creating hypothetical scenarios where market conditions shift dramatically—such as a sharp decline in asset prices or an interest rate shock—and assessing the impact on a derivatives position.

Benefits of Stress Testing

- Anticipating Market Shocks: Stress testing helps identify vulnerabilities in a portfolio, allowing traders to take preventative measures.

- Improved Decision-Making: It provides insights into how the portfolio might perform under extreme conditions.

Limitations of Stress Testing

- Unrealistic Assumptions: Stress tests may rely on unrealistic assumptions, which can lead to inaccurate predictions of risk.

- Complexity: It requires access to sophisticated modeling tools and data, which may not be available to all traders.

4. Using Diversification to Spread Risk

Diversification involves spreading investments across different asset classes, sectors, or regions to reduce the risk associated with any single investment.

How Diversification Works in Derivatives

In derivatives trading, diversification can be achieved by holding a mix of futures or options contracts across different underlying assets. By not relying on a single asset, traders can reduce their exposure to idiosyncratic risks.

Benefits of Diversification

- Reduced Risk: Diversification helps smooth out the volatility of a portfolio by offsetting losses in one asset with gains in another.

- Improved Risk-Return Profile: By holding a diversified set of assets, traders can enhance their risk-adjusted returns.

Disadvantages of Diversification

- Diluted Returns: Diversification can sometimes lead to smaller profits if some positions are underperforming.

- Over-Diversification: Excessive diversification may lead to inefficient portfolios with poor performance.

Frequently Asked Questions (FAQ)

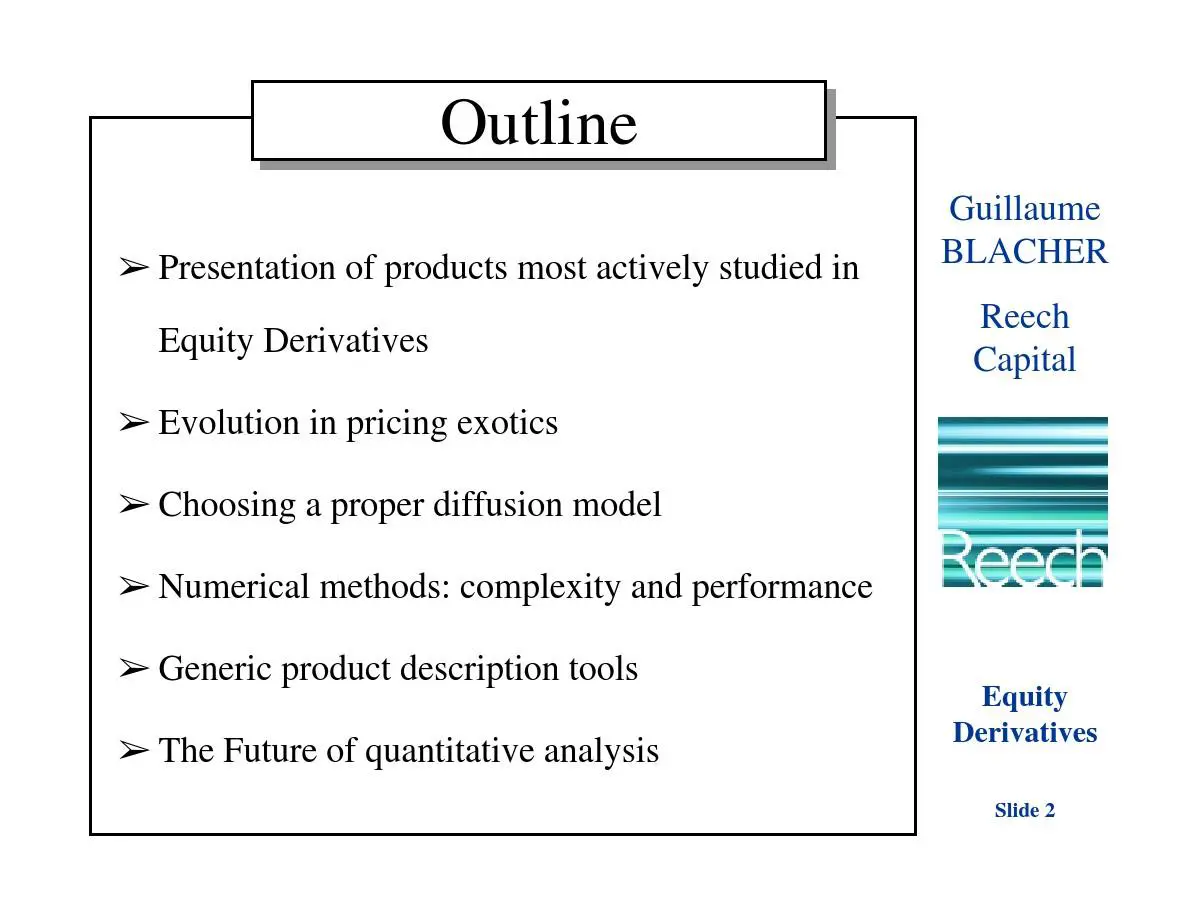

1. How do derivatives work in quantitative trading?

In quantitative trading, derivatives are used to manage risks, arbitrage price discrepancies, and speculate on market movements. Mathematical models and algorithms are employed to predict the behavior of derivatives and identify profitable opportunities. For example, quantitative traders might use options pricing models (like Black-Scholes) to calculate the theoretical value of options and hedge portfolios effectively.

2. How can I learn about derivatives trading for risk management?

There are several resources available for learning about derivatives trading and risk management. You can start with online courses offered by platforms like Coursera, edX, or the CFA Institute. Books such as “Options, Futures, and Other Derivatives” by John Hull provide an in-depth understanding of derivatives and risk management strategies. Additionally, practical experience through paper trading or simulation platforms can enhance your understanding.

3. Why is stress testing important for managing derivatives risk?

Stress testing helps traders and institutions assess the impact of extreme market events on their portfolios. It allows for proactive risk management by identifying vulnerabilities before they result in significant losses. By simulating worst-case scenarios, traders can develop strategies to mitigate these risks, such as adjusting positions or diversifying holdings.

Conclusion

Derivatives trading offers substantial opportunities but comes with significant risks. Implementing effective risk management solutions, such as hedging strategies, position sizing, stress testing, and diversification, is essential to mitigating potential losses. By carefully managing risk, traders can navigate the complexities of the derivatives market and enhance their potential for success.

Encourage Social Sharing

If you found this article helpful, feel free to share it with fellow traders or financial enthusiasts! Share your thoughts and experiences with derivatives trading risk management in the comments below.

0 Comments

Leave a Comment