=====================================================================

Volatility is a crucial aspect of quantitative trading. Understanding how volatility behaves and how to measure it can make or break a trading strategy. Whether you’re a novice or an experienced trader, knowing how to implement volatility testing in quantitative markets can enhance your trading decisions. In this guide, we’ll explore two of the most effective methods for volatility testing in quantitative markets, their advantages and disadvantages, and recommend the best approach based on current industry trends and personal experience.

- Introduction to Volatility in Quantitative Trading

—————————————————–

Volatility, simply put, refers to the degree of variation in a financial instrument’s price over time. In the context of quantitative markets, volatility is a key parameter that impacts asset pricing models, risk management strategies, and algorithmic trading systems. By measuring and testing volatility, traders can gain a better understanding of market dynamics and anticipate price movements.

1.1 What Is Volatility?

In quantitative trading, volatility often refers to the standard deviation of returns, which provides insights into the market’s risk level. High volatility indicates significant price fluctuations, while low volatility suggests more stable prices. For quantitative traders, volatility is both a risk factor and an opportunity, as it can signal market imbalances or opportunities for short-term profits.

1.2 Why Is Volatility Important?

Volatility plays a central role in shaping the behavior of various market participants. Traders, asset managers, and institutional investors all use volatility metrics to make informed decisions about their positions, risk exposure, and hedging strategies. Specifically, volatility has a direct impact on quantitative strategies as it informs models that rely on historical data, such as mean-reversion, momentum, and arbitrage models.

- Methods for Volatility Testing in Quantitative Markets

———————————————————

Testing volatility involves using historical data to model and predict future price fluctuations. There are several methods for conducting volatility testing in quantitative markets, each with its strengths and weaknesses. Here, we’ll discuss two commonly used methods: Historical Volatility (HV) and Implied Volatility (IV).

2.1 Historical Volatility (HV) Method

Historical volatility is calculated by analyzing past price movements of an asset. This method looks at the standard deviation of asset returns over a specified period to estimate the volatility for the future.

2.1.1 Advantages of Historical Volatility

- Simplicity: HV is relatively easy to compute and requires only historical price data, making it accessible for most traders.

- Straightforward Interpretation: It gives traders a clear view of how volatile an asset has been in the past, which can help them forecast future movements.

2.1.2 Disadvantages of Historical Volatility

- Lagging Indicator: Since HV is based on historical data, it may not fully reflect current market conditions. It could be outdated, especially in fast-moving markets.

- Lack of Forward-Looking Insights: HV does not take into account future events or market sentiment, which can drastically alter an asset’s volatility.

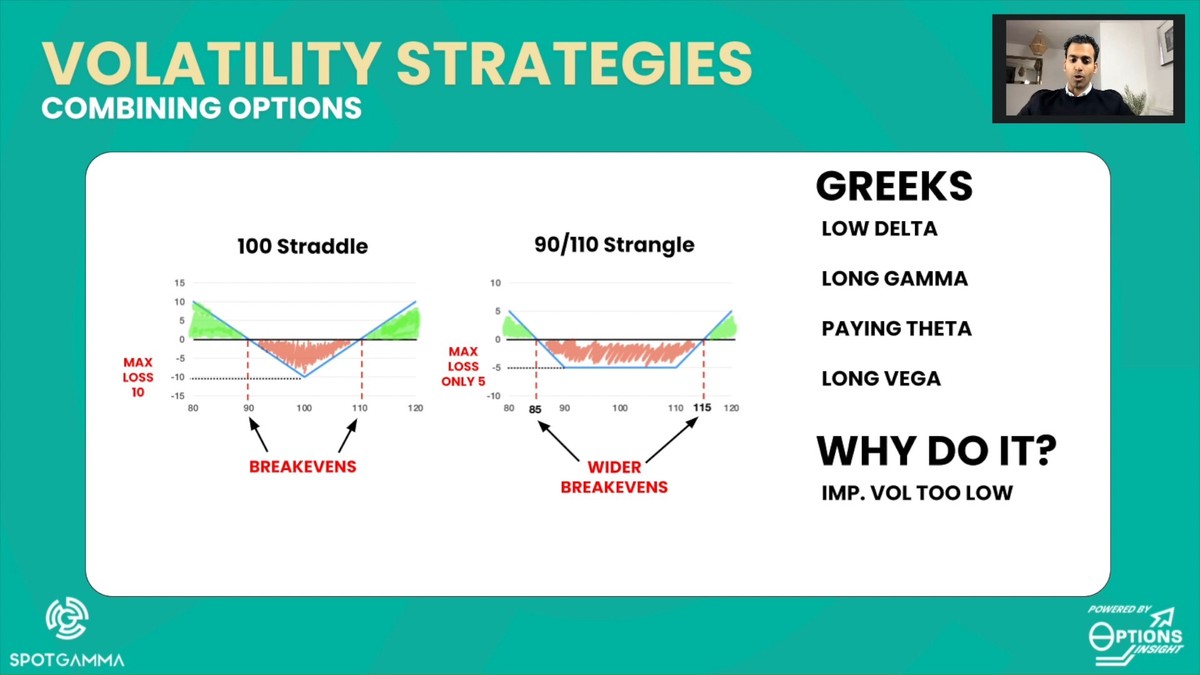

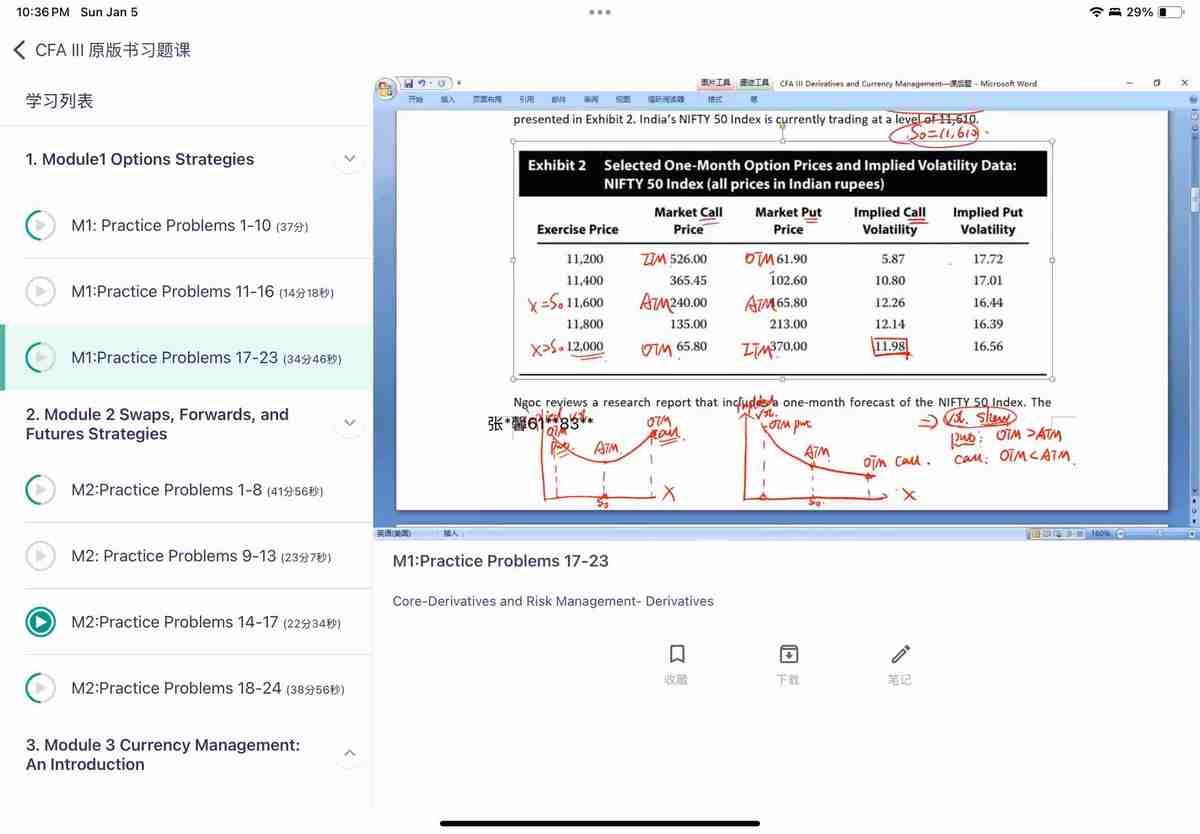

2.2 Implied Volatility (IV) Method

Implied volatility is derived from the pricing of options in the market. It reflects the market’s expectations of future volatility based on option prices. Traders can use implied volatility to gauge the market’s sentiment about the future direction of prices.

2.2.1 Advantages of Implied Volatility

- Forward-Looking: Unlike historical volatility, implied volatility reflects market expectations about future price movements.

- Market Sentiment: IV captures the market’s consensus about future volatility, providing insights into potential price swings.

2.2.2 Disadvantages of Implied Volatility

- Subject to Market Noise: IV can be influenced by market sentiment, news, and other external factors that may not necessarily be related to the asset’s fundamentals.

- Complexity: Calculating IV can be more complex than HV, as it requires option pricing models like Black-Scholes, which can be challenging for less-experienced traders.

- Comparison of Volatility Testing Methods

——————————————-

Both historical volatility and implied volatility are useful tools for testing volatility in quantitative markets. However, they offer different insights and serve different purposes. Let’s break down the key differences:

| Feature | Historical Volatility | Implied Volatility |

|---|---|---|

| Calculation Method | Based on past price data | Based on option prices |

| Forward-Looking | No | Yes |

| Complexity | Low | High |

| Sensitivity to Market Events | Low | High |

| Usefulness in Predicting Future Volatility | Moderate | High |

3.1 Which Method Is Best?

The best volatility testing method depends on your trading strategy and the type of market you are operating in. For short-term traders or those involved in options trading, implied volatility is often more relevant. However, for those focusing on longer-term strategies or risk management, historical volatility provides a solid base for making informed decisions.

- Practical Applications of Volatility Testing in Quantitative Trading

———————————————————————–

Incorporating volatility testing into your trading strategies can offer several benefits. Below are a few practical applications:

4.1 Portfolio Risk Management

Volatility testing is crucial for understanding how the risk profile of a portfolio changes over time. By testing volatility using both historical and implied measures, traders can better assess their risk exposure and adjust their portfolios accordingly. This is particularly important for risk-averse traders or those managing large institutional funds.

4.2 Option Pricing and Hedging Strategies

Implied volatility plays a significant role in option pricing. By analyzing IV, traders can identify whether options are overpriced or underpriced, and adjust their strategies to take advantage of these discrepancies. Additionally, volatility testing helps in creating hedging strategies that protect against sudden market movements.

4.3 Algorithmic Trading and Volatility Models

For quantitative traders using algorithmic strategies, volatility testing can enhance decision-making models. By integrating volatility measures into machine learning models or other algorithmic strategies, traders can better forecast price movements and make more accurate predictions. Volatility also plays a critical role in volatility forecasting models, which can guide traders in adjusting their positions dynamically.

- Frequently Asked Questions (FAQ)

———————————–

5.1 How Can I Integrate Volatility Testing into My Quantitative Trading Strategy?

To integrate volatility testing, start by incorporating volatility measures (such as HV or IV) into your risk management framework. You can use historical volatility to assess past price movements and apply implied volatility to forecast future trends. Combining both methods can give you a holistic view of potential price fluctuations, helping you manage risk and optimize returns.

5.2 Can Volatility Testing Help in Predicting Market Crashes?

While volatility testing can indicate periods of high risk or instability, predicting a market crash with precision is incredibly difficult. Implied volatility often spikes before major market downturns, but it’s not a guarantee of an imminent crash. Still, understanding volatility patterns can help traders prepare for extreme market conditions and adjust their strategies accordingly.

5.3 How Often Should I Conduct Volatility Testing?

The frequency of volatility testing depends on your trading horizon and strategy. Short-term traders may want to conduct volatility testing on a daily or weekly basis, while long-term investors may prefer monthly or quarterly evaluations. Ideally, volatility testing should be performed regularly, especially during times of market turbulence.

- Conclusion

————-

Volatility testing is a fundamental component of quantitative trading strategies. By understanding the nuances of both historical and implied volatility, traders can make informed decisions that better align with their risk tolerance and market conditions. While each volatility testing method has its strengths and weaknesses, a combination of both can provide a comprehensive view of market dynamics. By continually testing and refining your volatility models, you can improve your trading strategies and better navigate the complexities of the quantitative markets.

Feel free to share your thoughts or experiences with volatility testing in quantitative markets in the comments below, and don’t forget to share this article with your network!

Suggested Reading:

- How does volatility affect quantitative trading?

- Why is volatility important in quantitative trading?

0 Comments

Leave a Comment