==========================================

Managing drawdown is one of the most critical aspects of building and sustaining a profitable trading strategy. While many traders focus on returns, ignoring drawdown can destroy capital, confidence, and long-term viability. In this comprehensive guide, we will explore how drawdown affects trading strategy, compare different approaches to managing it, and provide actionable methods to reduce risk.

Understanding Drawdown in Trading

What Is Drawdown?

Drawdown is the decline from a portfolio’s peak to its trough during a specific period, expressed as a percentage. For example, if your trading account rises to \(100,000 and then falls to \)80,000, the drawdown is 20%.

This measure highlights the risk side of performance, showing how much a trader could lose before recovering.

Types of Drawdowns

- Absolute Drawdown – The difference between the initial deposit and the lowest point below it.

- Maximum Drawdown (MDD) – The largest peak-to-trough drop in equity over a trading period.

- Relative Drawdown – A dynamic measure, expressed as a percentage of equity.

These distinctions matter because professional traders, hedge funds, and institutions often track maximum drawdown as a key performance risk indicator.

How Drawdown Impacts Trading Strategy

1. Psychological Effects on Traders

Drawdowns are not just numbers—they influence decision-making. Large drawdowns can:

- Create fear and hesitation to follow strategies.

- Cause traders to abandon profitable systems prematurely.

- Lead to revenge trading and overleveraging.

Maintaining emotional discipline is harder when your portfolio has declined 30% compared to 5–10%.

2. Risk-Adjusted Performance

High drawdowns distort performance metrics. A system with 100% return and 50% drawdown is riskier than one with 40% return and 10% drawdown. Investors and institutions often prefer strategies with lower drawdowns, even if returns are slightly smaller.

This is why drawdown is as important as return when analyzing trading performance.

3. Capital Recovery Challenges

Recovering from drawdown requires disproportionate returns. For example:

- A 20% loss requires a 25% gain to recover.

- A 50% loss requires a 100% gain.

This exponential recovery problem makes controlling drawdown a survival necessity.

Methods to Manage Drawdown in Trading Strategies

Method 1: Position Sizing and Risk Control

One effective way to limit drawdown is to adjust position size relative to volatility and account equity.

- Fixed Fractional Position Sizing: Risking a fixed % (e.g., 1–2%) of account equity per trade.

- Volatility-Based Sizing: Allocating smaller positions in highly volatile markets.

- Dynamic Leverage Adjustments: Reducing exposure during high-risk conditions.

Pros:

- Simple to implement.

- Scales naturally with account growth.

- Protects against catastrophic losses.

Cons:

- May reduce short-term gains.

- Requires discipline to stick with risk limits.

Method 2: Portfolio Diversification Across Assets

Diversifying across asset classes (stocks, futures, forex, crypto) and strategies (trend-following, mean reversion, statistical arbitrage) reduces drawdown probability.

- Non-Correlated Assets: Holding instruments that move differently (e.g., equities vs. bonds).

- Multi-Strategy Models: Combining long-term and short-term signals.

- Geographic Diversification: Exposure to global markets to avoid local shocks.

Pros:

- Smooths equity curve.

- Reduces portfolio-level drawdown.

- Increases strategy resilience.

Cons:

- Requires more capital.

- Complex to manage and monitor correlations.

Comparing the Two Approaches

- Risk Control (Method 1) works best for retail traders or small funds with limited capital. It is straightforward and protects individual trades.

- Diversification (Method 2) is optimal for institutional investors who can deploy capital across multiple strategies. It reduces systemic drawdown risk but requires infrastructure.

👉 Best Practice: Use both methods together—strict position sizing rules with diversification across instruments and time horizons.

Real-World Application of Drawdown Management

Hedge funds and professional trading desks often track real-time drawdown monitoring software to enforce risk limits. For instance, funds may impose a maximum daily drawdown cap of 3%—if breached, trading stops automatically.

Retail traders can apply similar safeguards using broker settings or algorithmic stop-loss rules. To explore more detail on how to calculate drawdown in quantitative trading, check specialized resources that guide on mathematical and software-based approaches.

Similarly, understanding why drawdown is important in trading helps retail and institutional participants prioritize capital protection before chasing returns.

Case Study: Two Traders, Two Outcomes

- Trader A grows his account by 80% in a year but suffers a 40% maximum drawdown. He eventually quits after failing to recover from one large losing streak.

- Trader B grows his account by 35% in the same period but keeps drawdown below 8%. Over five years, his capital compounds significantly due to consistency and lower recovery requirements.

📊 The lesson: Steady, low-drawdown growth beats explosive but unstable returns.

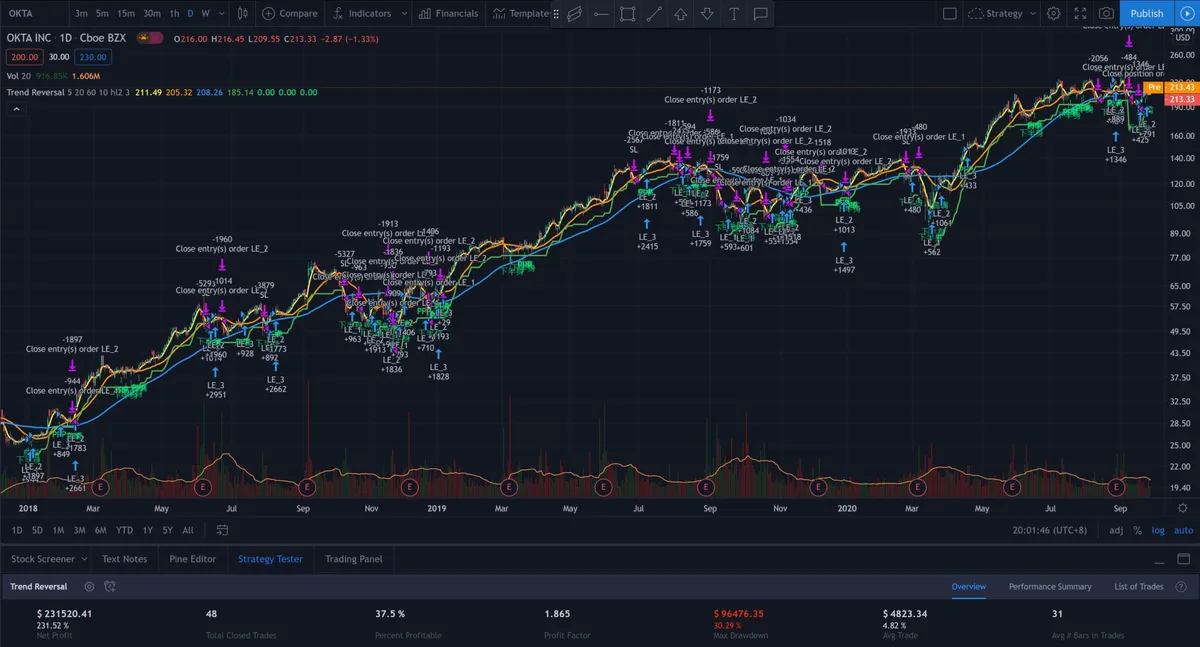

Visual Example of Drawdown Impact

Drawdown recovery requirements increase exponentially, making risk control crucial.

FAQ: Common Questions About Drawdown in Trading

1. How much drawdown is acceptable in trading?

Acceptable drawdown depends on strategy type and risk tolerance. For retail traders, keeping drawdown under 10–15% is ideal. Hedge funds may tolerate up to 20%, but anything above that risks investor redemptions.

2. Can a high-return strategy justify high drawdowns?

Not necessarily. High drawdowns often signal unstable strategies. Even if returns are attractive, investor confidence and long-term sustainability decline when drawdowns exceed 30–40%.

3. What is the fastest way to recover from a drawdown?

The fastest recovery comes from reducing position size, maintaining discipline, and sticking with a proven system rather than chasing losses. Adding diversification or pausing during volatile market conditions can also accelerate recovery.

Conclusion: Why Managing Drawdown Defines Trading Success

Drawdown is more than a risk metric—it shapes trader psychology, portfolio growth, and long-term survival. By applying position sizing controls and diversified strategies, traders can minimize drawdowns and enhance sustainable profitability.

The goal is not to avoid drawdowns entirely (they are inevitable) but to manage them intelligently. In trading, success belongs not to those who avoid losses but to those who recover quickly and protect capital.

💡 Now it’s your turn: How do you handle drawdowns in your trading? Share your strategies, comment below, and don’t forget to share this article with fellow traders who value risk management.

0 Comments

Leave a Comment