=========================================================================================

In the world of finance, few metrics are as critical as drawdown. For financial analysts, understanding drawdowns is essential for evaluating investment performance, assessing risk, and building resilient portfolios. This comprehensive guide explores drawdown insights for financial analysts, providing deep knowledge on how to measure, interpret, and manage drawdowns effectively.

By combining academic theory, industry practices, and personal experience, this article will give analysts the tools they need to incorporate drawdown analysis into their professional workflows.

What Is Drawdown and Why Does It Matter?

Drawdown is the peak-to-trough decline during a specific investment period, expressed as a percentage. It is one of the most direct measures of downside risk.

For financial analysts, drawdown provides a more practical risk metric than volatility because it reflects real investor pain. While volatility measures variability, drawdown highlights capital erosion and recovery time, which are critical for long-term investment strategies.

- Maximum Drawdown (MDD): The worst peak-to-trough decline observed in a portfolio.

- Average Drawdown: The mean of multiple drawdown events.

- Drawdown Duration: The length of time required to recover from a drawdown.

Understanding drawdown allows analysts to assess resilience, risk tolerance, and the realistic behavior of portfolios under stress.

Why Drawdown Insights Are Crucial for Financial Analysts

Capital Preservation

Drawdowns directly impact capital. Large drawdowns require disproportionately high returns to recover. For instance, a 50% drawdown requires a 100% gain just to break even.

Investor Psychology

Clients rarely leave a portfolio due to volatility, but they often withdraw funds during prolonged or deep drawdowns. Analysts must be able to explain and mitigate such risks.

Risk-Adjusted Performance

Metrics like the Sharpe ratio only partially capture risk. Drawdown metrics complement these by highlighting worst-case scenarios.

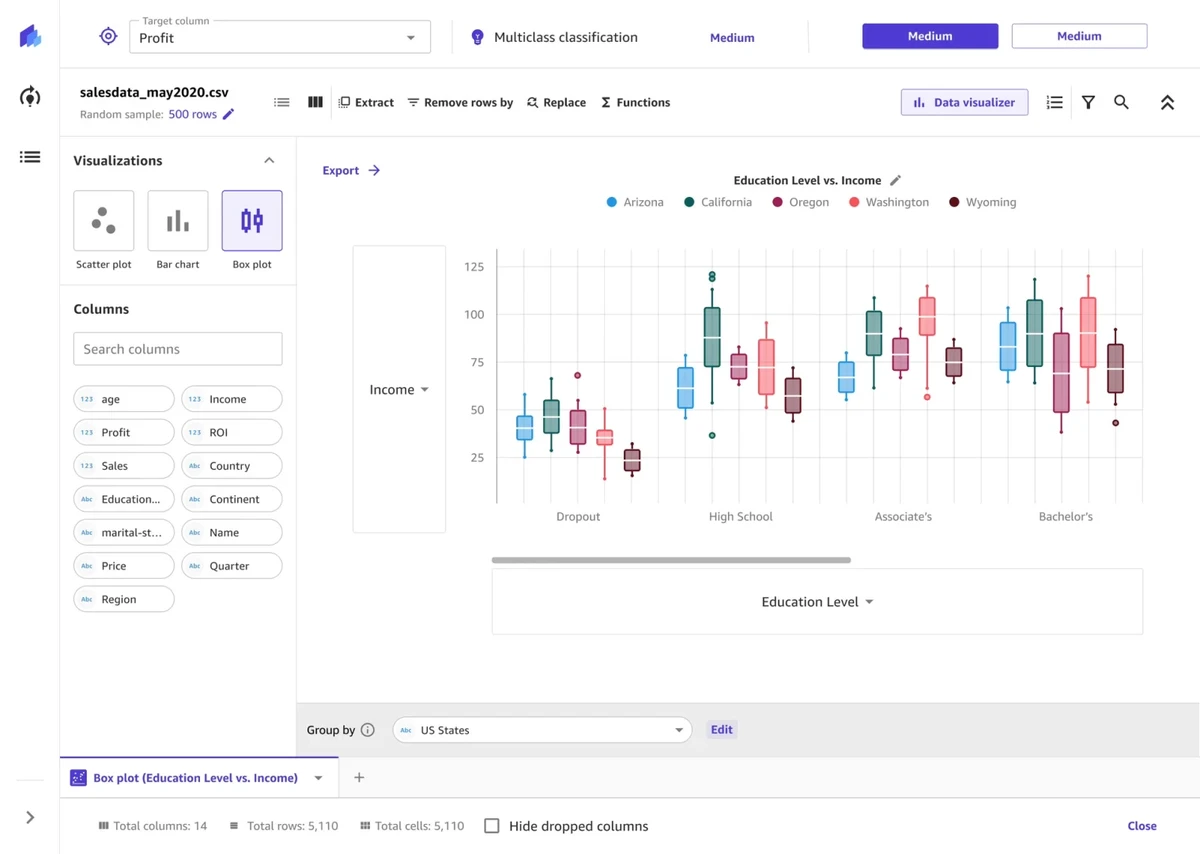

Visualization of maximum drawdown during a portfolio’s lifecycle

Methods of Analyzing Drawdown

Method 1: Historical Simulation

This approach uses past market data to simulate portfolio performance and measure drawdowns.

- Pros: Simple to implement; relies on real-world market conditions.

- Cons: Past performance may not reflect future risks; ignores unprecedented scenarios.

Method 2: Monte Carlo Simulation

Monte Carlo methods generate thousands of simulated return paths based on statistical assumptions. Analysts can then estimate potential drawdowns under various market conditions.

- Pros: Captures a wide range of possible outcomes; useful for stress testing.

- Cons: Requires strong assumptions about distributions; may mislead if models are poorly specified.

Recommendation

For practical use, a combination of historical simulation and Monte Carlo analysis offers the most balanced insight. Historical data grounds the analysis, while simulations expand the horizon of possible risks.

How Drawdown Affects Investment Strategies

Drawdowns play a decisive role in portfolio design and strategy evaluation.

Momentum-Based Strategies

Momentum portfolios often perform well in bull markets but are vulnerable to sudden reversals. Analysts must monitor drawdowns to avoid excessive risk exposure.

Value-Based Strategies

Value strategies typically endure smaller drawdowns but may face prolonged underperformance, increasing drawdown duration.

Impact on Risk-Adjusted Returns

Drawdowns directly affect compound returns. Long or deep drawdowns reduce the compounding effect, making risk management essential.

For analysts, understanding how drawdown affects trading strategy is key to advising clients and adjusting allocation models effectively.

Drawdown Management Strategies

Strategy 1: Diversification

By allocating across uncorrelated assets, analysts can reduce portfolio drawdown severity. Diversification spreads risk across asset classes, geographies, and sectors.

- Pros: Proven method for smoothing returns.

- Cons: Less effective during systemic crises when correlations converge.

Strategy 2: Dynamic Hedging

Using options, futures, or volatility products to hedge downside risk can mitigate drawdowns.

- Pros: Provides protection during market stress.

- Cons: Expensive; hedges can erode long-term returns if overused.

Strategy 3: Risk Parity Allocation

Balancing risk contribution across asset classes reduces the likelihood of concentrated drawdowns.

- Pros: Creates more stable return streams.

- Cons: May underperform in strong equity bull markets.

Recommended Approach

A hybrid model works best: combine diversification with selective hedging and dynamic rebalancing. This balances cost efficiency with effective protection.

Diversification reduces drawdown risk by lowering correlation between assets

Tools and Techniques for Drawdown Analysis

Financial analysts should integrate drawdown analytics into their daily toolkit.

- Risk Management Software: Bloomberg, FactSet, and Barra provide robust drawdown modules.

- Quant Platforms: Python with libraries like

pandasandpyfolioallows custom drawdown analysis.

- Real-Time Monitoring: Some firms use dashboards with real-time drawdown monitoring software to prevent excessive losses.

Additionally, analysts should be aware of where to find drawdown statistics from reliable data providers for comparative benchmarks.

Drawdown Insights for Different Types of Analysts

Institutional Analysts

Focus on long-term drawdown resilience, ensuring pension funds and endowments survive market crises.

Hedge Fund Analysts

Prioritize minimizing drawdowns to retain investor confidence and prevent redemptions.

Retail Financial Advisors

Educate clients on drawdown risks and set realistic expectations. Incorporating drawdown tips for beginner traders can build trust and prevent panic selling.

Frequently Asked Questions (FAQ)

1. How do financial analysts calculate drawdown effectively?

Analysts typically use portfolio time series data to calculate peak-to-trough declines. Tools like Excel, R, or Python can automate this. For advanced cases, Monte Carlo simulations are applied to model future drawdowns.

2. What causes drawdown in markets?

Drawdowns stem from multiple factors:

- Market corrections and crashes

- Strategy overfitting to historical data

- High leverage amplifying small losses

- Systemic events that drive asset correlations higher

3. How can financial analysts reduce drawdown risk in portfolios?

- Apply diversification across uncorrelated assets

- Use stop-loss rules or position sizing

- Incorporate hedging instruments like options

- Monitor real-time portfolio risk exposure and adjust dynamically

Conclusion

For financial analysts, drawdown insights are not just theoretical—they are practical tools for managing risk, preserving capital, and guiding investment decisions. By combining historical analysis, simulations, diversification, and hedging, analysts can better control downside risk and improve long-term performance.

Whether advising institutional clients or retail investors, mastering drawdown analysis is a cornerstone of professional credibility and success.

What are your thoughts on drawdown management? Share your experiences in the comments below, and don’t forget to share this article with colleagues who want to strengthen their risk management expertise.

0 Comments

Leave a Comment