===========================================

High-frequency trading (HFT) has revolutionized the financial markets by enabling traders to execute large volumes of orders within fractions of a second. This strategy relies heavily on sophisticated algorithms and cutting-edge technology to capitalize on minute price movements that would otherwise go unnoticed in traditional trading. In this article, we will explore effective high-frequency trading strategies, delve into the mechanics behind them, compare their strengths and weaknesses, and provide actionable insights for traders looking to optimize their HFT strategies.

Understanding High-Frequency Trading (HFT)

Before diving into the strategies, it is essential to understand the core mechanics of high-frequency trading. HFT leverages ultra-low-latency trading algorithms to execute orders at extremely high speeds. Traders use algorithms to analyze market data, identify trading opportunities, and execute orders within microseconds or milliseconds.

Key Elements of High-Frequency Trading:

- Algorithms: The heart of HFT, these computational models determine the best trading strategies based on data analysis.

- Low Latency: Speed is crucial in HFT. Traders rely on high-speed networks and co-located servers to minimize the time delay between order placement and execution.

- Market Data: Real-time data is critical for HFT. Traders analyze large volumes of data to detect trends, market inefficiencies, or arbitrage opportunities.

HFT is particularly prevalent in equities, commodities, and forex markets, where traders exploit inefficiencies in pricing over extremely short timeframes.

Effective High-Frequency Trading Strategies

In the fast-paced world of high-frequency trading, several strategies have been developed to capitalize on short-term price movements and market inefficiencies. Below are two of the most widely used and effective HFT strategies:

1. Market Making

Market making involves providing liquidity to the market by continuously buying and selling financial instruments at competitive prices. Market makers profit from the bid-ask spread—the difference between the price at which they buy (bid) and the price at which they sell (ask).

How Market Making Works:

- Placing Orders: The market maker places buy orders at lower prices and sell orders at higher prices. These orders are continuously updated to reflect the current market conditions.

- Profit from Spreads: The market maker earns a profit from the difference between the buy and sell prices, even though each individual trade is small.

- High Volume: The strategy works on high trading volume, with the market maker executing hundreds or even thousands of trades each day.

Advantages of Market Making:

- Constant Profit Potential: Market makers profit consistently from bid-ask spreads, which can be predictable over time.

- Liquidity Provision: Market makers help maintain liquidity in the markets, which can reduce price volatility and ensure smoother market operations.

Disadvantages of Market Making:

- Exposure to Risk: If the market moves rapidly in one direction, market makers can accumulate positions that are difficult to exit profitably.

- Low Margins: The profit from individual trades is small, meaning that success depends on executing a large number of trades at high frequency.

2. Statistical Arbitrage (StatArb)

Statistical arbitrage is another powerful HFT strategy, which uses mathematical models to exploit pricing inefficiencies between related financial instruments. The strategy relies on the assumption that the prices of these instruments will converge over time.

How Statistical Arbitrage Works:

- Pairs Trading: A common form of StatArb involves identifying pairs of correlated assets (e.g., two stocks in the same industry). When the price difference between them widens beyond a certain threshold, a trade is triggered to buy the underperforming asset and short the outperforming one.

- Mean Reversion: StatArb strategies often assume that the prices of related assets will revert to their historical correlation levels, creating an opportunity for profit when deviations occur.

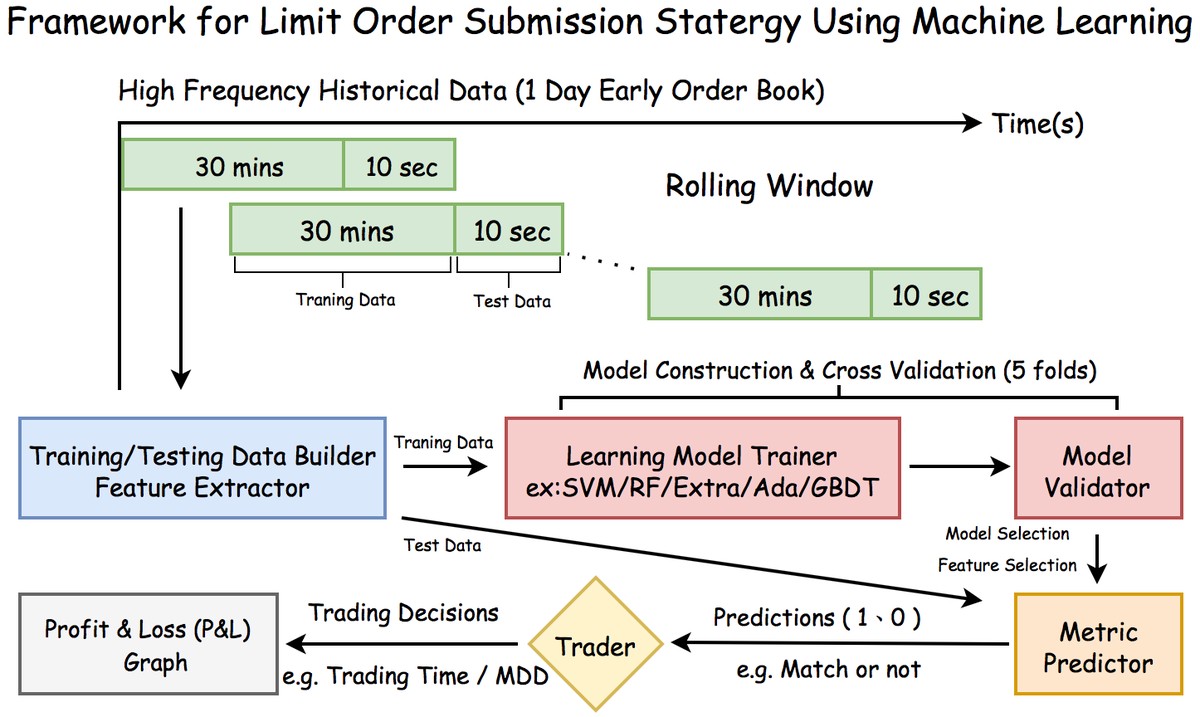

- Machine Learning Models: Advanced machine learning algorithms are increasingly being used in StatArb to identify patterns and predict future price movements.

Advantages of Statistical Arbitrage:

- Minimal Market Directional Risk: Since StatArb relies on price discrepancies between related assets, the strategy is largely neutral with respect to overall market movements.

- Diversification: StatArb strategies can be applied across multiple asset classes, including stocks, options, and futures, providing diversification benefits.

Disadvantages of Statistical Arbitrage:

- Complexity: Developing and maintaining a successful StatArb strategy requires sophisticated models, significant computational resources, and access to large datasets.

- Competition: As more traders implement statistical arbitrage, the profitability of the strategy diminishes, leading to smaller opportunities for profit.

Comparing High-Frequency Trading Strategies

While both Market Making and Statistical Arbitrage are highly effective strategies in high-frequency trading, each has distinct advantages and limitations. Let’s break down the differences between them.

| Strategy | Market Making | Statistical Arbitrage |

|---|---|---|

| Profit Mechanism | Bid-ask spread | Price convergence between related assets |

| Risk Exposure | High exposure to market movements | Low exposure to market directional risk |

| Complexity | Moderate | High—requires advanced mathematical models |

| Capital Requirement | High—requires liquidity to provide orders | High—needs computational resources for modeling |

| Market Dependency | Works best in liquid markets | Works in markets with correlated assets |

In conclusion, Market Making is ideal for traders looking for consistent, low-risk profits in highly liquid markets, while Statistical Arbitrage is better suited for those who can manage the complexities of mathematical modeling and machine learning to exploit pricing inefficiencies in related assets.

How to Start High-Frequency Trading

For traders interested in getting started with high-frequency trading, here are a few steps:

1. Understanding the Basics

Learn about the foundational concepts of high-frequency trading, including market microstructure, algorithmic trading, and latency optimization. Reading books, attending webinars, and taking courses are great ways to build your knowledge.

2. Choosing a Platform

Selecting the right high-frequency trading platform is crucial. Look for platforms with ultra-low latency, high-order execution speeds, and access to multiple markets. Popular platforms include QuantConnect, MetaTrader, and custom-developed systems.

3. Developing or Customizing Algorithms

Whether you are implementing a market-making strategy or statistical arbitrage, it is essential to develop efficient algorithms. You can either build your own algorithms or modify existing ones to suit your trading style. Programming languages such as Python, C++, and R are often used for HFT.

4. Testing and Optimization

Before deploying your strategies in live markets, backtest them using historical data to ensure they are profitable under various market conditions. After backtesting, optimize your models to reduce latency and improve execution speeds.

FAQ: High-Frequency Trading

1. How does high-frequency trading work?

High-frequency trading works by using algorithms to analyze market data and place large volumes of orders at extremely high speeds. The goal is to exploit very short-term price inefficiencies, executing trades within milliseconds to capitalize on these opportunities.

2. Why is high-frequency trading popular?

High-frequency trading is popular because it enables traders to profit from very small price movements that occur within fractions of a second. By leveraging speed, large volumes, and complex algorithms, traders can generate significant returns in highly liquid markets.

3. How is high-frequency trading profitable?

High-frequency trading is profitable due to its ability to exploit small price discrepancies over a high number of trades. Traders earn profits by executing thousands of orders within seconds and capturing small spreads or price movements that aggregate into substantial profits.

Conclusion

Effective high-frequency trading strategies are not only about speed, but also about precision and understanding the market’s microstructure. Market Making and Statistical Arbitrage are two of the most widely employed strategies in the HFT space, each with its own set of strengths and challenges. By continuously refining algorithms, optimizing execution speeds, and managing risk, traders can harness the power of high-frequency trading to gain an edge in the competitive financial markets.

If you found this article helpful, don’t forget to share it with your network and leave a comment below! We’d love to hear your thoughts on the strategies discussed.

0 Comments

Leave a Comment