=====================================

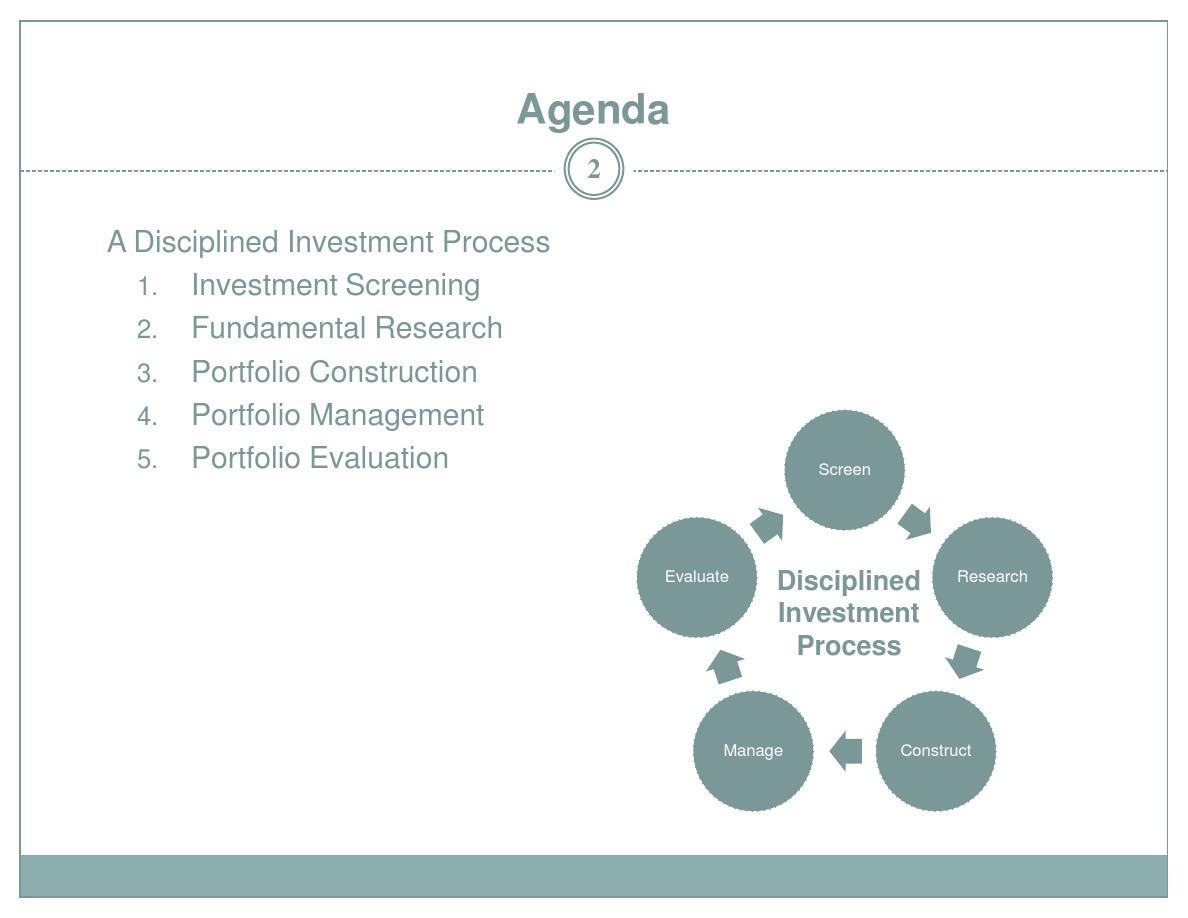

Introduction

Understanding how to evaluate portfolio performance is critical for investors, fund managers, and financial analysts. A portfolio’s performance goes beyond just returns—it must be measured against risks, diversification, benchmarks, and alignment with investor goals. In today’s financial world, where quantitative strategies, AI-driven analytics, and global diversification trends are reshaping investment practices, the ability to measure performance effectively is more important than ever.

This article explores professional methods for portfolio evaluation, compares different strategies, and provides actionable guidance on implementing the best practices. Drawing on both personal experience and industry insights, it will walk you through the most widely used performance metrics, their pros and cons, and how modern investors can integrate advanced tools to achieve reliable results.

Why Evaluating Portfolio Performance Matters

Beyond Returns

It’s tempting to look at absolute returns as the primary measure of success. However, returns alone don’t tell the full story. A portfolio with high returns but excessive risk exposure may not serve long-term goals.

Accountability and Strategy Validation

Performance evaluation allows investors to validate whether their chosen investment strategy—whether passive index tracking or quantitative portfolio management solutions—is achieving its objectives.

Continuous Improvement

Evaluation is not a one-time activity. Markets change, risk factors evolve, and investor objectives shift. Proper assessment helps in adjusting strategies, rebalancing assets, and adopting innovations.

Key Metrics in Portfolio Performance Evaluation

1. Absolute Return

The simplest metric: how much profit or loss the portfolio generated. While straightforward, it doesn’t account for market conditions or risk taken.

2. Relative Return

Compares performance against a benchmark index (e.g., S&P 500). This shows whether the portfolio outperformed or underperformed the market.

3. Risk-Adjusted Metrics

- Sharpe Ratio: Measures return per unit of risk.

- Sortino Ratio: Focuses only on downside volatility.

- Information Ratio: Evaluates performance relative to a benchmark with risk taken into account.

4. Alpha and Beta

- Alpha: The excess return above market expectation.

- Beta: The portfolio’s sensitivity to market movements.

5. Drawdown Analysis

Shows the peak-to-trough decline, helping investors assess the severity of potential losses.

Key metrics for evaluating portfolio performance

Two Major Approaches to Portfolio Performance Evaluation

Method 1: Benchmark Comparison

How It Works

This approach compares portfolio performance against a benchmark, such as a stock index or a custom benchmark designed for the portfolio’s objectives.

Pros

- Easy to interpret.

- Helps investors understand relative performance.

- Widely accepted in the industry.

Cons

- May not fully capture portfolio uniqueness.

- Benchmarks may not reflect specific goals or risks.

Method 2: Risk-Adjusted Analysis

How It Works

Evaluates performance by considering both return and the risk taken to achieve it. Tools like the Sharpe ratio or drawdown analysis are commonly applied.

Pros

- Offers a realistic assessment of performance quality.

- Helps investors identify if higher returns come from excessive risk-taking.

- Especially useful for quantitative trading portfolios for millennials or other demographics seeking tailored solutions.

Cons

- Requires statistical expertise.

- May vary depending on the risk model used.

Personal Experience: Balancing Both Approaches

As someone who has managed portfolios for both individual investors and institutions, I’ve seen the limitations of relying solely on benchmarks or risk-adjusted metrics. A hybrid approach works best: use benchmarks for market-relative insights and risk-adjusted ratios for deeper risk-return evaluation.

For example, one client’s portfolio consistently outperformed the S&P 500, but when risk-adjusted metrics were applied, the performance was revealed to be overly dependent on high-volatility assets. This insight helped shift the allocation toward a more sustainable balance.

Advanced Tools and Modern Trends in Portfolio Evaluation

Portfolio Analytics Software

Modern investors leverage AI-driven tools for real-time insights. Popular portfolio analysis software reviews highlight platforms offering data visualization, scenario testing, and predictive analytics.

ESG Performance Evaluation

With environmental, social, and governance (ESG) investing becoming mainstream, performance evaluation now extends beyond financial returns to sustainability metrics.

Factor-Based Evaluation

Quantitative investors increasingly assess portfolios based on exposure to factors like momentum, value, or low volatility.

Comparing Approaches: Which Is Best?

- For Individual Investors: Benchmark comparison provides simplicity and clarity.

- For Professionals and Institutions: Risk-adjusted metrics combined with software-driven analytics offer depth and precision.

- Best Practice: A blended evaluation method ensures a balanced perspective.

Modern portfolio evaluation with analytics software

Practical Recommendations

- Set Clear Objectives – Define what “success” means: outperforming a benchmark, minimizing drawdowns, or achieving stable income.

- Use Multiple Metrics – Don’t rely on just one measure; combine return, risk, and benchmark comparisons.

- Leverage Technology – Adopt modern tools to enhance analysis and reporting.

- Rebalance Periodically – Regular evaluation helps determine when to rebalance, reinforcing why rebalancing a portfolio is essential.

- Incorporate Diversification – Effective performance evaluation must always consider why is portfolio diversification important in reducing systemic risks.

FAQs

1. What is the most reliable metric for portfolio performance?

There isn’t a single “most reliable” metric. The Sharpe ratio is popular for risk-adjusted evaluation, while benchmark comparison is widely used for simplicity. A combination of metrics provides the most comprehensive insight.

2. How often should I evaluate my portfolio performance?

Professionals typically review performance quarterly, but in volatile markets, monthly evaluation may be warranted. Long-term investors can review semi-annually, provided their strategy is stable.

3. Can technology replace human judgment in portfolio evaluation?

Technology enhances evaluation with real-time data and predictive models, but human judgment is still essential for interpreting context, goals, and market nuances.

Conclusion

Learning how to evaluate portfolio performance is an essential skill for every investor, whether managing a personal portfolio or overseeing institutional funds. By applying a mix of benchmark comparison, risk-adjusted metrics, and modern tools, investors can gain a holistic view of their portfolio’s effectiveness.

Performance evaluation is not about chasing short-term gains—it’s about ensuring alignment with long-term objectives, managing risks effectively, and continuously improving strategies.

Call to Action

Have you tried different methods to evaluate your portfolio? Share your experiences in the comments below, and don’t forget to share this article with fellow investors who want to strengthen their performance evaluation practices.

Portfolio managers analyzing performance data

0 Comments

Leave a Comment