===============================================

Quantitative trading has revolutionized the financial markets by leveraging mathematical models, data-driven strategies, and advanced technology to make trading decisions. However, knowing how to execute successful quantitative trading requires more than just coding a strategy—it involves careful planning, backtesting, risk management, and flawless trade execution. In this comprehensive guide, we will explore proven methods, compare execution strategies, and provide actionable insights to help traders maximize their performance.

Understanding Quantitative Trading

Quantitative trading, often called “quant trading,” is the process of using mathematical and statistical models to identify trading opportunities. Unlike discretionary trading, which relies on human judgment, quant trading leverages algorithms to execute trades systematically.

Core Components of Quantitative Trading

- Data Collection & Cleaning: Reliable data is the foundation of every quant strategy. Without accurate data, models may produce misleading signals.

- Model Development: Traders use statistical analysis, machine learning, or econometric models to identify patterns in historical data.

- Backtesting: Testing a strategy against past data to evaluate its performance before applying it in live markets.

- Execution: Deploying the strategy in real-time with minimal slippage and transaction costs.

- Risk Management: Limiting exposure to drawdowns through position sizing, stop-losses, and diversification.

Execution is often the most underestimated element. Even the best models fail if orders are not executed efficiently.

Why Execution Matters in Quantitative Trading

The ability to execute trades quickly and at favorable prices determines whether a strategy is profitable. Poor execution can result in slippage, missed opportunities, and higher transaction costs. According to industry studies, execution efficiency can impact returns by up to 30% in high-frequency or algorithmic trading strategies.

For this reason, why execution is crucial in quantitative trading? is a core question every quant should ask. Execution bridges the gap between a profitable backtest and real-world performance.

Two Primary Execution Approaches in Quant Trading

To succeed, traders must choose the right execution model. Below, we compare two of the most widely used approaches:

1. Direct Market Access (DMA) Execution

DMA gives traders direct control over order placement, bypassing broker intervention.

Advantages:

- Faster execution speed

- Greater transparency of order books

- Reduced dependency on intermediaries

Disadvantages:

- Higher infrastructure costs

- Requires advanced technical expertise

- Potential exposure to market microstructure risks

DMA is often favored in high-frequency trading (HFT) or professional trading firms where execution speed is critical.

2. Broker-Assisted Algorithmic Execution

In this approach, brokers provide execution algorithms (VWAP, TWAP, POV, etc.) to manage order placement.

Advantages:

- Lower infrastructure cost

- Access to broker’s liquidity pools

- Reduced market impact through sophisticated algorithms

Disadvantages:

- Less control over order routing

- Possible hidden broker fees

- Execution speed may lag behind DMA

This method is suitable for institutional investors and retail quants who prioritize cost-efficiency and market access over raw execution speed.

Best Practices for Successful Quantitative Execution

Optimize Execution Speed

Milliseconds matter in quant trading. Leveraging colocation services and low-latency APIs can drastically reduce execution delays. Traders often ask: how to improve execution speed in trading? The answer lies in optimizing network connections, choosing the right brokers, and streamlining code.

Minimize Slippage

Slippage occurs when a trade is executed at a worse price than intended. Using limit orders, smart order routing, and adaptive algorithms can help mitigate slippage.

Monitor Execution Quality

Tracking metrics such as implementation shortfall, fill ratios, and average execution cost ensures continuous improvement. Many firms use execution analysis dashboards for real-time performance evaluation.

Integrate Execution with Strategy

Strategies must align with execution capabilities. For example, a high-frequency scalping strategy is ineffective without ultra-fast execution systems. Conversely, long-term trend-following strategies can tolerate slower execution.

Practical Example: Execution in Volatile Markets

Let’s consider a quant strategy designed for earnings season. Markets often become highly volatile, leading to wider bid-ask spreads and sudden price gaps.

- Using DMA execution, the strategy might place rapid-fire orders across multiple exchanges to capture arbitrage opportunities.

- Using broker algorithms, the trader could rely on VWAP execution to gradually fill large orders without revealing their full position.

Choosing the right execution model can mean the difference between profit and loss during volatile events.

Incorporating Execution into Quant Workflows

Step 1: Backtest with Execution Costs

Include realistic transaction fees, spreads, and slippage models in your backtests. This avoids overestimating performance.

Step 2: Stress-Test Execution Models

Simulate different market conditions (high volatility, illiquidity, flash crashes) to see how execution holds up.

Step 3: Continuous Refinement

Execution models should evolve with market changes. Regularly update routing strategies, API integrations, and performance benchmarks.

Recommended Execution Strategy

For most traders, a hybrid execution model works best:

- Use broker-assisted algorithms for large institutional orders to minimize market impact.

- Deploy DMA execution for strategies requiring ultra-low latency.

This balanced approach ensures efficiency, flexibility, and scalability.

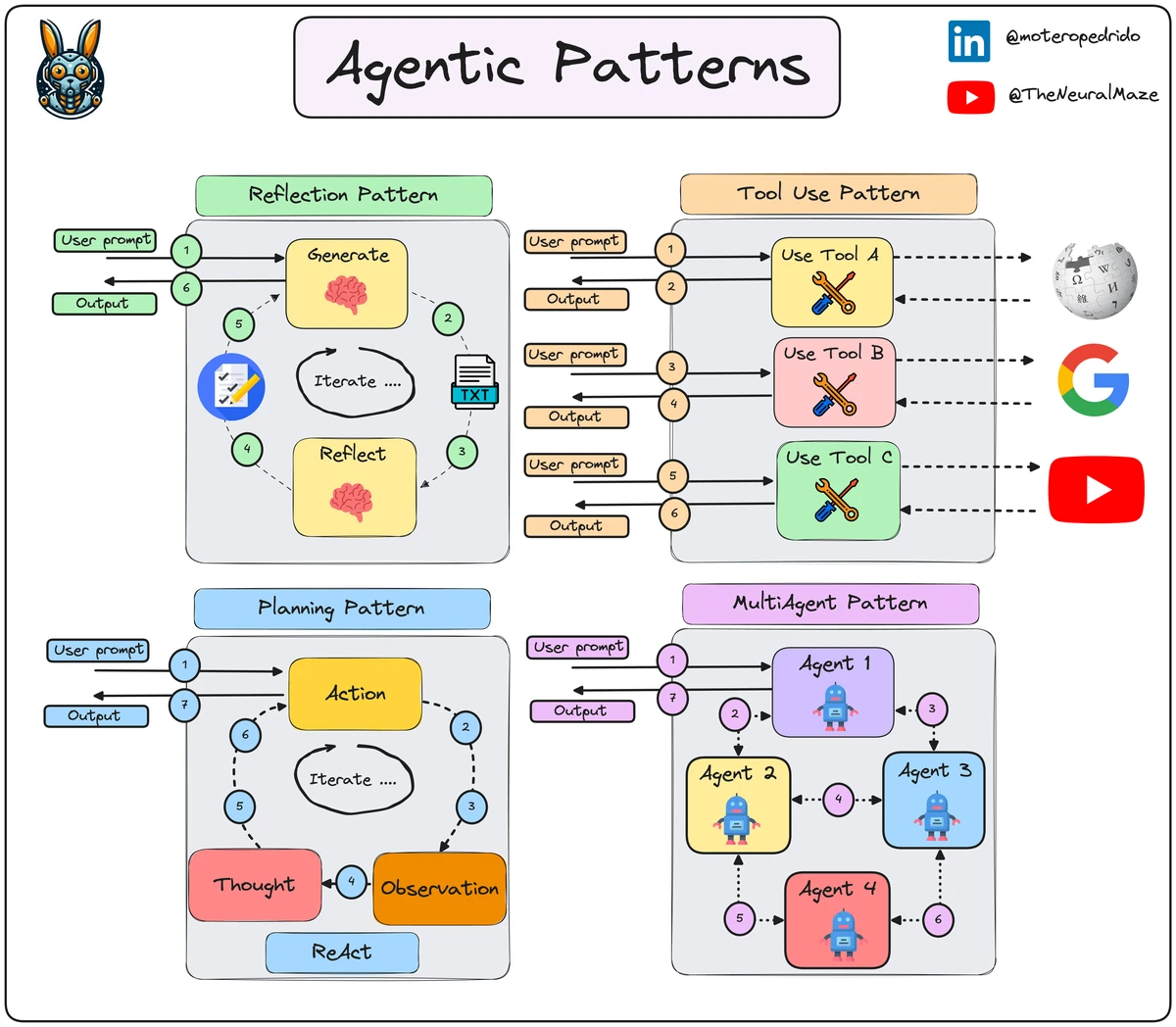

Visual Example: Execution Flow in Quant Trading

Execution workflow in quantitative trading

FAQ: Successful Quantitative Trading Execution

1. How does execution affect trading outcomes?

Execution directly impacts profitability. A poorly executed trade may result in higher costs, slippage, or even missed opportunities, turning a profitable model into a losing one.

2. What are the best execution practices for institutional traders?

Institutional traders should combine broker algorithms with real-time execution analytics. Custom order types, liquidity pools, and dark pool access are often key to reducing market impact.

3. How can retail traders improve execution?

Retail traders can improve execution by choosing brokers with fast APIs, minimizing order delays, and using smart order types. Retail-friendly execution solutions are increasingly available in modern platforms.

Conclusion: Mastering Quantitative Trading Execution

Executing successful quantitative trading strategies requires more than building sophisticated models. The execution layer—order speed, cost minimization, and strategy alignment—is where theory meets reality. Whether you’re a retail quant or an institutional player, adopting a disciplined execution framework is essential for long-term success.

If you found this guide insightful, share it with your trading community, leave a comment with your execution challenges, and join the conversation. The more we exchange experiences, the more effective our quant trading execution will become.

0 Comments

Leave a Comment