==============================================================================

Factor models are powerful tools used in quantitative trading, investment strategies, and risk management. They help traders, investors, and financial analysts understand the underlying drivers of asset returns by identifying and quantifying the factors that influence price movements. This comprehensive factor model tutorial will explore the core principles, methods of building factor models, their applications, and practical implementation tips for experienced professionals.

What is a Factor Model?

Definition of Factor Models

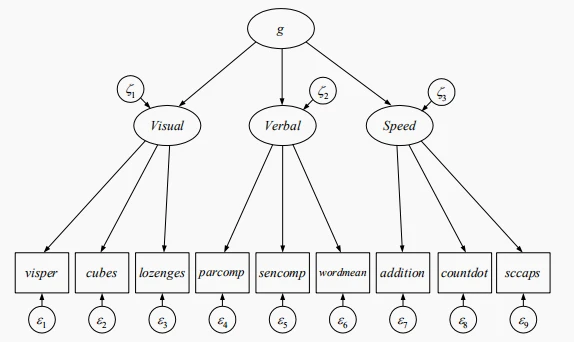

A factor model is a statistical model used to describe the return of an asset or a portfolio as a function of various factors that drive those returns. These factors are typically market-wide variables such as interest rates, inflation, or industry-specific variables that influence the asset’s price.

In essence, factor models decompose the return of a financial asset into common risk factors and idiosyncratic risks (specific to that asset), which helps investors and analysts predict and analyze future price movements.

Types of Factor Models

There are two primary types of factor models:

Single-Factor Model: This type involves using one factor to explain asset returns, like the Capital Asset Pricing Model (CAPM), which uses the market return as the sole factor.

Multi-Factor Models: These involve multiple factors and are more widely used in modern quantitative trading. The most common multi-factor models include:

- Fama-French Three-Factor Model: Incorporates factors like market return, company size (SMB), and value (HML).

- Carhart Four-Factor Model: Adds a momentum factor (MOM) to the Fama-French model.

- Arbitrage Pricing Theory (APT): A more flexible model that can incorporate any number of factors, offering a broader framework for asset pricing.

- Fama-French Three-Factor Model: Incorporates factors like market return, company size (SMB), and value (HML).

Why Use Factor Models in Trading?

Factor models are vital tools for understanding asset returns, making informed investment decisions, and managing risks. Below are the key reasons factor models are widely used in trading:

1. Identifying Key Drivers of Asset Returns

Factor models help identify the key drivers behind an asset’s return. By understanding what factors influence returns, traders can make better predictions about future price movements and improve their trading strategies.

2. Diversifying and Risk Management

Factor models allow traders to identify and mitigate specific risks that could impact asset returns. For example, by understanding the exposure to market risk (the “market factor”), traders can adjust their portfolios to be less sensitive to market-wide movements.

3. Enhancing Portfolio Construction

Factor models are essential for portfolio optimization and construction. By understanding the contribution of each factor to portfolio returns, traders can build portfolios that maximize expected returns for a given level of risk.

Building a Factor Model

Creating a factor model involves several key steps. Below, we’ll walk through the process of building a basic factor model.

1. Define the Dependent Variable (Asset Returns)

The first step is to define the asset or portfolio whose returns you want to model. This could be a single stock, a portfolio of stocks, or an index.

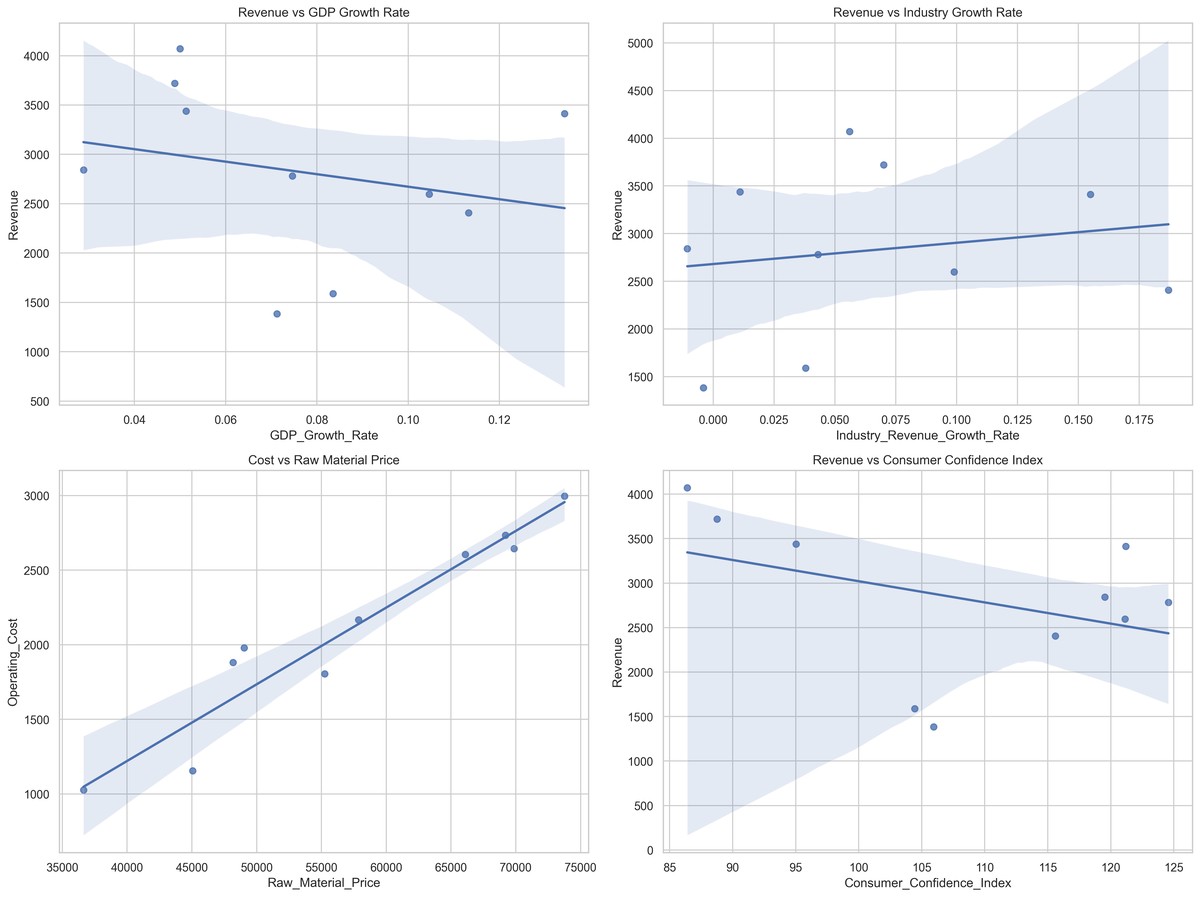

2. Select the Factors

Next, choose the factors that you believe explain the returns of the asset. These could be broad market indices, interest rates, inflation rates, or any other variables that might influence asset prices.

3. Collect Historical Data

Gather historical data for both the asset returns and the factors you’ve selected. This data should cover a sufficiently long period to capture market trends and fluctuations.

4. Estimate Factor Sensitivities

Using statistical techniques like regression analysis, estimate how sensitive the asset is to each of the chosen factors. This process involves estimating the factor loadings, which tell you how much each factor contributes to the asset’s return.

5. Model Evaluation

Once the model is built, evaluate its performance by comparing predicted returns to actual returns. Use statistical tests such as R-squared and t-statistics to assess the model’s accuracy.

Types of Factor Models for Different Applications

Factor models can be applied in different ways, depending on the objective. Let’s explore two main strategies.

1. Factor Models for Risk Management

In risk management, factor models are used to quantify the exposure of a portfolio to various risk factors. For instance, if a trader’s portfolio is highly exposed to the market factor, they might hedge against market downturns using derivatives like options or futures.

How Factor Models Help in Risk Management:

- Stress Testing: Factor models help traders understand how their portfolios will perform under different market conditions.

- Factor Exposure: Identifying and managing exposure to different risk factors ensures that traders are not overly reliant on a single factor.

2. Factor Models for Predictive Analytics

Factor models can also be used to predict asset returns by analyzing historical data. Traders can apply the model to identify profitable trades by predicting which factors will influence asset prices.

How Factor Models Help in Predictive Trading:

- Factor Timing: Predict when specific factors will have a larger impact on asset returns, and make trades accordingly.

- Outperformance: Factor models help identify assets that are likely to outperform based on their factor exposures.

Comparing Factor Models: Advantages and Disadvantages

Factor models provide powerful insights, but they also have limitations. Below, we compare the advantages and disadvantages of using factor models in trading.

| Aspect | Factor Models for Risk Management | Factor Models for Predictive Analytics |

|---|---|---|

| Strength | Helps reduce overall portfolio risk. | Can identify profitable trades by predicting returns. |

| Complexity | Relatively simple to implement with basic factors. | Requires advanced statistical techniques for accurate predictions. |

| Time Horizon | Best suited for long-term risk management. | More effective for short-term and medium-term predictions. |

| Data Requirements | Requires historical market data and volatility measures. | Requires detailed historical data and factor backtesting. |

| Model Stability | Highly stable with lower risk of overfitting. | May suffer from overfitting and poor prediction accuracy in volatile markets. |

How to Optimize Factor Models

Optimizing factor models is essential to improve their accuracy and robustness. Below are a few strategies for model optimization:

1. Factor Selection

Choosing the right factors is critical to the model’s success. Always consider economic, financial, and market conditions when selecting factors. Using a wide range of diverse factors can improve the model’s robustness.

2. Regular Model Updates

Markets are dynamic, and so are the factors that drive asset returns. It’s essential to regularly update your factor model to incorporate new information and market trends.

3. Use of Machine Learning Techniques

To improve model predictions, machine learning techniques like Lasso regression or Random Forests can be used. These techniques help automate the factor selection process and can improve the accuracy of predictions.

Frequently Asked Questions (FAQ)

1. How do I evaluate the performance of a factor model?

Evaluating a factor model involves assessing its accuracy and predictive power. Use metrics such as R-squared, Mean Absolute Error (MAE), or the Sharpe ratio to determine how well the model performs in predicting asset returns.

2. Why should I use multi-factor models instead of single-factor models?

Multi-factor models provide a more comprehensive view of asset returns. By considering multiple factors, these models account for a variety of influences on asset prices, making them more accurate and adaptable to market conditions than single-factor models.

3. How can factor models be used to predict market movements?

Factor models help predict market movements by analyzing the relationship between various factors (like interest rates or inflation) and asset returns. By forecasting how these factors will evolve, traders can anticipate changes in market conditions and adjust their strategies accordingly.

Conclusion

Factor models are essential tools for traders, investors, and financial analysts who seek to understand and predict asset returns. Whether you are managing risk or trying to optimize trading strategies, factor models offer valuable insights. By understanding the key elements of factor models and applying advanced techniques, traders can refine their strategies, minimize risk, and maximize returns.

If you found this tutorial helpful, share it with others and leave a comment or question below to further discuss how factor models can be applied in your trading strategies.

For further reading on factor models, check out:

0 Comments

Leave a Comment