=============================================

In the world of investing, forecasting is one of the most valuable tools for making informed decisions. Whether it’s predicting stock prices, market trends, or economic shifts, accurate forecasts can significantly enhance an investor’s ability to minimize risk and maximize returns. For experienced investors, understanding advanced forecasting methods is essential to stay ahead in a highly competitive environment.

In this article, we’ll explore several forecasting methods that experienced investors use to make strategic decisions. We’ll compare their strengths and weaknesses, and delve into practical insights on how you can implement these strategies to improve your investment performance.

Why is Forecasting Important for Experienced Investors?

Forecasting is the art and science of predicting future events based on historical data, statistical analysis, and trends. For seasoned investors, it’s not just about predicting the future but also understanding the dynamics of markets, economies, and assets.

Some of the key reasons experienced investors rely on forecasting include:

- Informed Decision Making: By analyzing trends and patterns, investors can make more informed decisions, especially when considering buying or selling assets.

- Risk Management: Forecasting helps investors anticipate market volatility and potential risks, allowing them to adjust their portfolios accordingly.

- Improved Return on Investment (ROI): With accurate forecasts, investors can optimize their strategies, increasing the likelihood of higher returns.

Forecasting Methods for Experienced Investors

Now let’s dive into two commonly used forecasting methods for experienced investors, exploring how they work and the potential benefits they offer.

1. Time Series Forecasting

Time Series Forecasting is one of the most popular methods for predicting future data points based on past data. It involves analyzing historical data to detect trends, seasonality, and cyclical patterns, which can then be extrapolated into the future.

How It Works:

- Data Collection: Time series data is collected over consistent intervals (e.g., daily stock prices, monthly sales figures).

- Trend Identification: Statistical models like Autoregressive Integrated Moving Average (ARIMA) or Exponential Smoothing are used to identify trends, seasonality, and noise in the data.

- Forecasting: After analyzing past data, predictions are made for future time points.

Pros:

- Proven Track Record: Time series forecasting is widely used in the financial industry for market predictions, making it a reliable method.

- Quantitative and Data-Driven: This method removes human emotion from the decision-making process, relying purely on historical data.

Cons:

- Requires Large Data Sets: The accuracy of time series forecasting increases with the availability of vast amounts of historical data, which might not always be accessible.

- Sensitive to Outliers: Unusual data points or anomalies can distort the model’s predictions.

Example:

Using platforms like MetaTrader or RStudio, experienced investors can apply time series models to predict stock prices, commodity trends, or interest rates.

2. Machine Learning (ML) Models

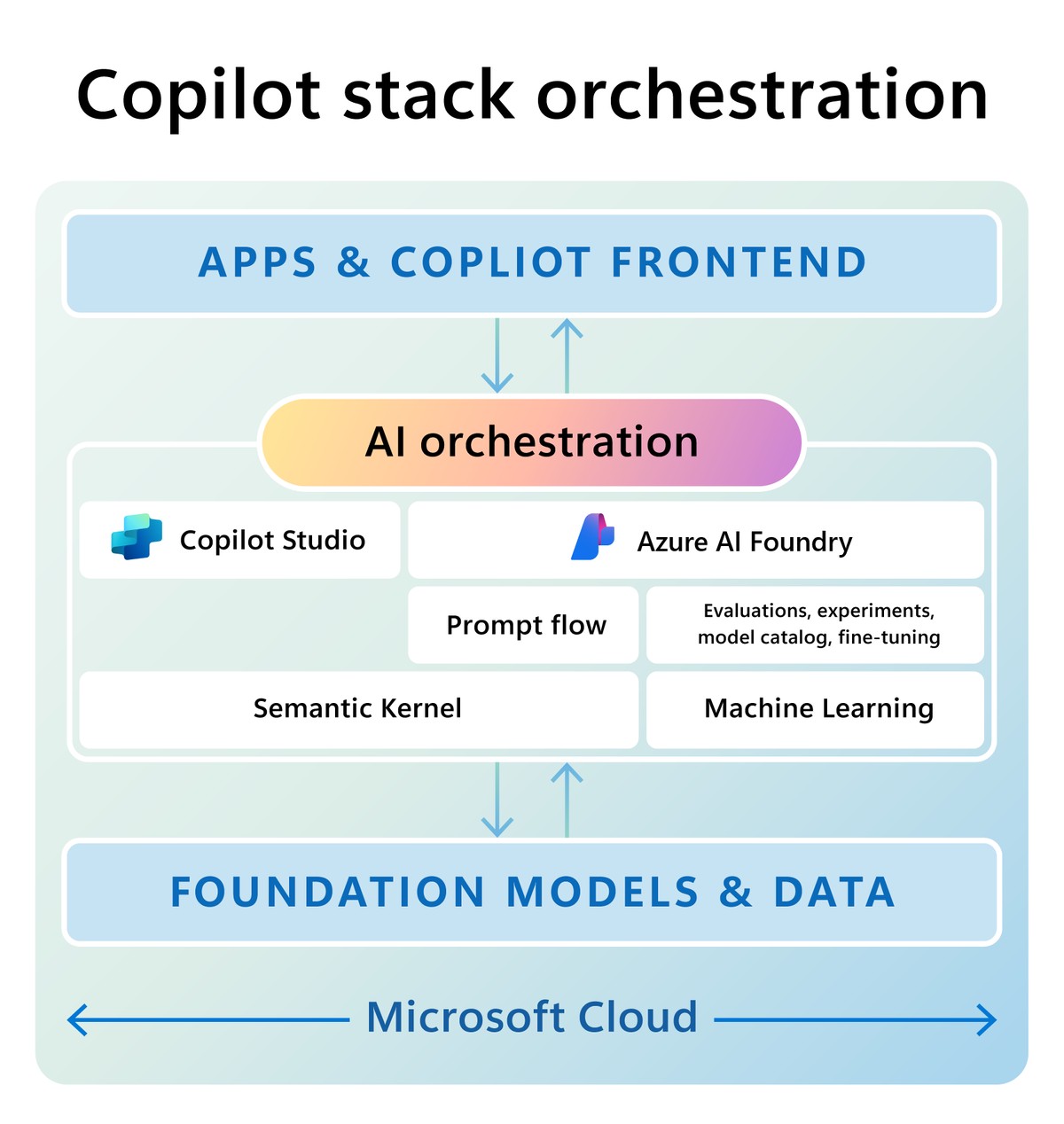

Machine learning (ML) is revolutionizing forecasting by enabling systems to learn from data and improve their predictions over time without explicit programming. ML-based forecasting models are increasingly used by experienced investors to gain deeper insights into complex financial markets.

How It Works:

- Data Input: Machine learning algorithms use large datasets, including not just historical prices, but also economic indicators, social media sentiment, and other factors.

- Model Training: The system learns from the data using algorithms like Random Forest, Support Vector Machines (SVM), and Neural Networks to make predictions.

- Continuous Learning: These models continuously adapt and evolve by learning from new data as it becomes available.

Pros:

- Handling Complexity: Machine learning models can handle massive datasets with a complexity far beyond traditional statistical methods.

- Improved Accuracy Over Time: As the model trains on more data, its ability to predict future events becomes more accurate.

Cons:

- Data Intensity: Machine learning models require vast amounts of high-quality data to be effective.

- Overfitting Risk: If not carefully monitored, the model might overfit the data, meaning it works well on historical data but fails to generalize to future data.

Example:

Experienced investors may use Python libraries such as TensorFlow or Scikit-learn to build predictive models that can forecast asset prices, market trends, or even cryptocurrency valuations.

How to Improve Forecasting Accuracy

Achieving accurate forecasts is crucial for long-term success in investing. While no forecasting method is foolproof, there are several steps investors can take to improve the accuracy of their predictions.

1. Combining Multiple Forecasting Methods

Rather than relying on a single forecasting method, many experienced investors use a combination of time series forecasting and machine learning models. This hybrid approach allows for a more comprehensive understanding of the market by leveraging the strengths of different models.

2. Incorporating Fundamental Analysis

While forecasting methods primarily focus on quantitative data, fundamental analysis (such as analyzing a company’s financial health, management, and industry trends) can enhance the accuracy of predictions. By combining forecasting methods with fundamental insights, investors can develop a more holistic view of the market.

3. Regular Model Evaluation and Adjustment

Markets evolve over time, and so should forecasting models. Regular evaluation and adjustment of the models based on new data can improve their performance and help prevent them from becoming outdated.

4. Risk Management and Diversification

Even with the best forecasting models, no prediction is guaranteed. By incorporating sound risk management strategies and diversifying portfolios, investors can reduce the impact of inaccurate forecasts on their overall performance.

FAQ: Common Questions About Forecasting for Experienced Investors

1. What is the best forecasting method for predicting stock prices?

The best forecasting method depends on the trader’s objectives and data availability. Time series forecasting is excellent for analyzing price trends based on historical data, while machine learning models can provide more complex insights, especially when other factors (such as economic indicators or social sentiment) are considered.

2. How accurate are machine learning models for forecasting?

The accuracy of machine learning models can be high, but they require high-quality and large datasets to be effective. Overfitting can occur if the model is not carefully tuned, so it’s important to regularly evaluate and adjust these models.

3. Can forecasting models predict market crashes?

Forecasting models can provide insights into market trends and risks, but predicting market crashes with absolute certainty is extremely difficult. However, incorporating risk management strategies, such as stop-loss orders and diversification, can help investors mitigate potential losses during volatile periods.

Conclusion

Forecasting methods are invaluable tools for experienced investors looking to navigate the complexities of the financial markets. Whether using time series forecasting or machine learning models, investors can gain actionable insights that guide their investment decisions. By leveraging these methods and combining them with sound risk management strategies, investors can improve their accuracy and maximize their returns.

As financial markets evolve, so too should forecasting methods. Continuous learning, experimentation, and adaptation are essential to remaining competitive in the ever-changing world of investing. Whether you’re a quantitative analyst, hedge fund manager, or individual investor, mastering these forecasting techniques can help you stay ahead of the curve.

Feel free to share your thoughts or ask questions in the comments below! Would you like to learn more about a specific forecasting method?

0 Comments

Leave a Comment