====================================================

In the world of quantitative trading, the ability to predict market movements accurately is crucial for success. Traders rely on sophisticated models and forecasting techniques to make informed decisions and manage risks. In this article, we will explore the development of forecasting plans in quantitative trading, offering a detailed overview of the best strategies, methods, and tools to enhance forecasting accuracy. We will also delve into industry trends, compare different approaches, and discuss how to implement forecasting in trading strategies effectively.

Understanding Forecasting in Quantitative Trading

Quantitative trading involves using mathematical models, algorithms, and statistical methods to identify profitable trading opportunities. At the heart of these strategies lies forecasting, which aims to predict future market prices, trends, and volatility. Forecasting in this context is not just about making random predictions; it involves using historical data, market behavior, and computational techniques to forecast price movements and optimize trading decisions.

Key Components of Forecasting in Trading

Forecasting in trading typically relies on several core components:

- Data: Historical data, market trends, and financial indicators provide the foundation for any forecasting model.

- Models: Various statistical and machine learning models, such as ARIMA, GARCH, and LSTM, are commonly used for predicting market movements.

- Execution: The ability to implement and execute trades based on forecasted data, ensuring the model’s accuracy translates into real-time profit.

In quantitative trading, the forecasting plan needs to align with the overall trading strategy, ensuring the model’s predictions influence buy and sell decisions effectively.

Methods and Strategies for Forecasting in Quantitative Trading

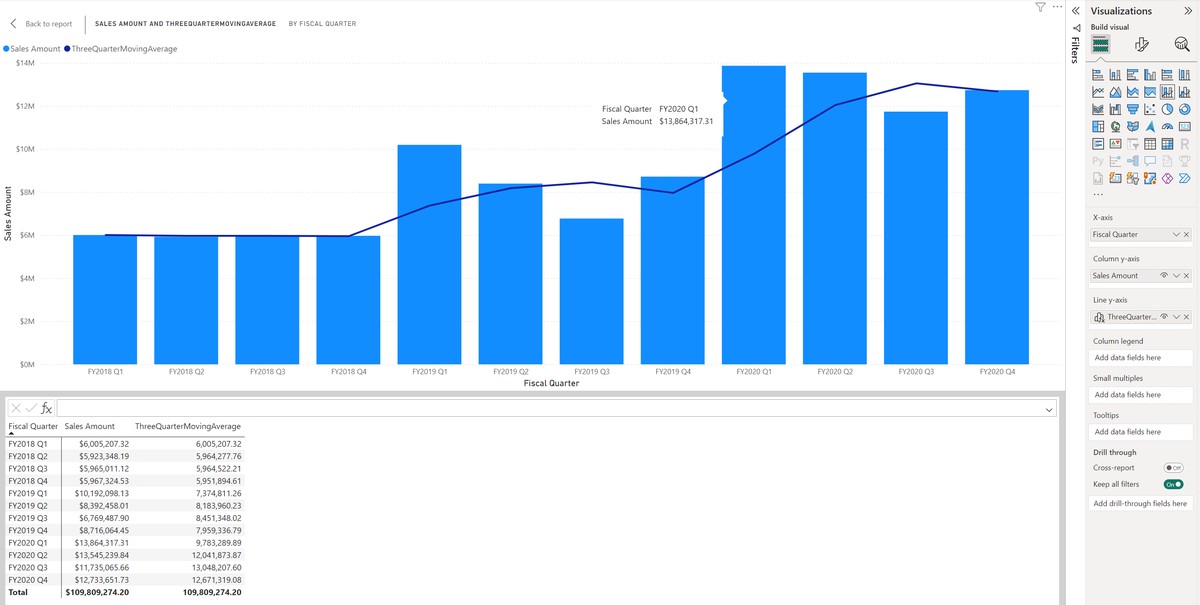

1. Time Series Forecasting Models

Time series forecasting is one of the most widely used methods in quantitative trading. It involves analyzing historical price data to predict future values. The key advantage of time series forecasting is its reliance on the assumption that past market behavior can provide insights into future trends.

Popular Time Series Models:

- ARIMA (Auto-Regressive Integrated Moving Average): ARIMA models are well-suited for forecasting data that shows patterns over time, particularly in markets with trends or seasonal behaviors.

- Exponential Smoothing (ETS): This method applies a weighted moving average approach, giving more weight to recent data points to forecast future values.

- GARCH (Generalized Autoregressive Conditional Heteroskedasticity): GARCH models are often used for forecasting volatility, which is a critical component of many trading strategies.

While these models have proven effective in many scenarios, they come with certain limitations. Time series models can struggle with capturing non-linear relationships or sudden market shifts caused by unforeseen events, such as geopolitical crises.

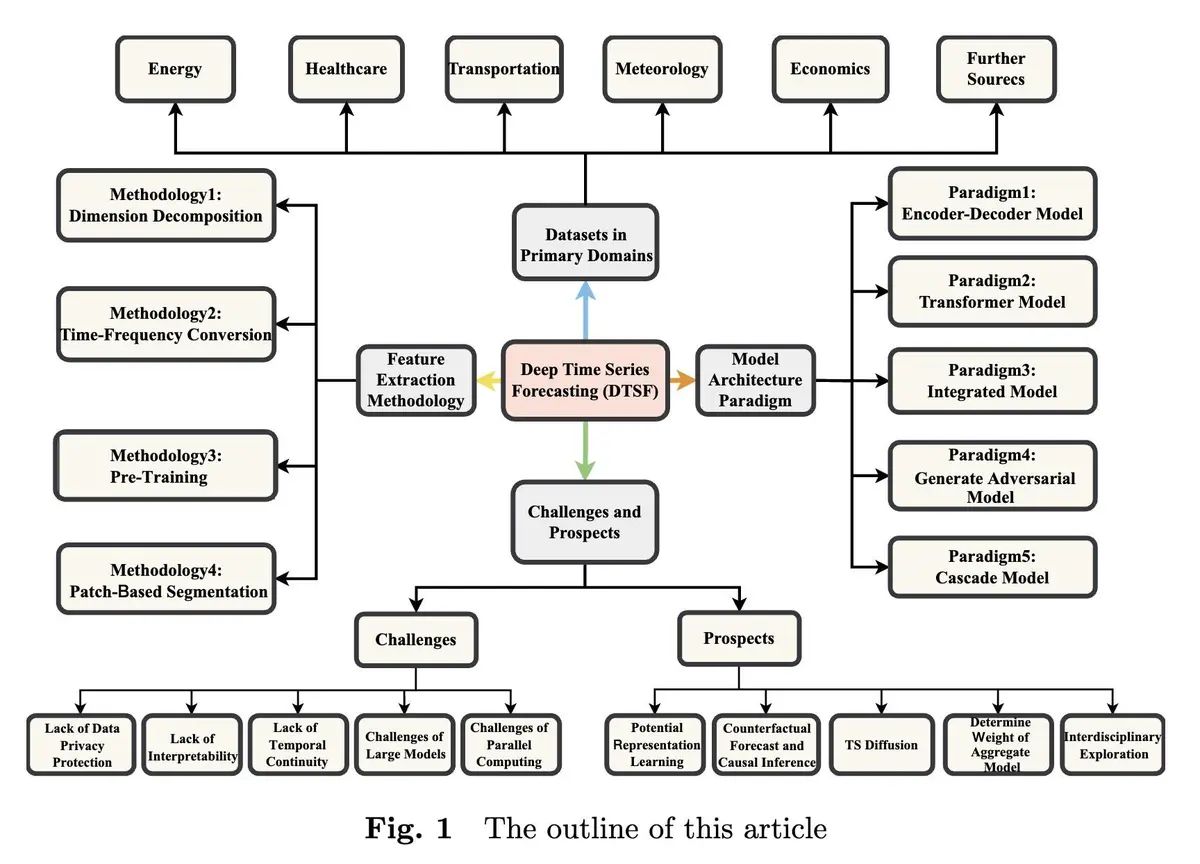

2. Machine Learning and Deep Learning Techniques

In recent years, machine learning (ML) and deep learning (DL) techniques have gained significant traction in quantitative trading due to their ability to handle large datasets and learn complex patterns that traditional statistical models might miss.

Key ML and DL Methods:

- Random Forest: This ensemble method combines multiple decision trees to improve forecasting accuracy, especially in non-linear environments.

- Support Vector Machines (SVM): SVM models work well in high-dimensional spaces, making them ideal for handling complex relationships in market data.

- Long Short-Term Memory (LSTM): LSTM networks, a type of recurrent neural network, excel at processing time-dependent data and are particularly effective in forecasting market trends.

Machine learning models are highly flexible and can improve their performance over time through training with fresh data. However, these models require significant computational resources and careful tuning to avoid overfitting.

Comparison of Time Series and Machine Learning Approaches

| Aspect | Time Series Models | Machine Learning Models |

|---|---|---|

| Data Requirements | Requires historical data with temporal dependencies | Can handle large, complex datasets |

| Computational Complexity | Lower; can be executed on standard systems | Higher; requires substantial computing power |

| Flexibility | Limited to patterns and trends in time-series data | Highly flexible, can capture complex non-linear relationships |

| Accuracy | Good for stable, trend-based data | Superior for volatile or non-linear data |

Best Practices for Developing a Forecasting Plan

When developing a forecasting plan in quantitative trading, several best practices can help optimize the accuracy and performance of your models.

1. Data Quality and Preparation

Accurate forecasting begins with high-quality data. In quantitative trading, this means ensuring that your historical data is clean, well-organized, and relevant to the market conditions you are predicting. Moreover, it’s crucial to preprocess the data by handling missing values, removing outliers, and normalizing the data to ensure the models work effectively.

2. Model Selection and Tuning

The choice of model plays a significant role in forecasting success. Traders should start with simpler models and gradually increase complexity based on their understanding of the data. Tuning model parameters, such as learning rate, regularization terms, and time window length, is essential to improving performance.

3. Testing and Validation

No model is perfect, which is why backtesting is a crucial step. This involves testing the model’s performance using historical data to evaluate how well the forecasted values align with actual market performance. Cross-validation and walk-forward analysis are common techniques used to validate forecasting models.

How to Use Forecasting in Quantitative Trading

Forecasting is the backbone of many quantitative trading strategies. By understanding the future market trends and movements, traders can make informed decisions on when to buy, sell, or hold assets.

For example, time series forecasting might predict that a particular stock will rise in value in the next week based on past trends. Machine learning models might identify specific patterns in market sentiment or macroeconomic indicators that suggest an upcoming downturn in the market.

These predictions guide traders in executing trades that maximize profit while minimizing risk, as they are armed with actionable insights from their forecasting models.

FAQ: Frequently Asked Questions

1. How can I improve the accuracy of my forecasting models in quantitative trading?

Improving forecasting accuracy involves several key steps:

- Use high-quality, relevant data: The better the data quality, the more accurate your predictions will be.

- Model tuning: Regularly tweak your models’ parameters to improve performance.

- Ensemble methods: Combine different models (e.g., ARIMA and machine learning) to improve accuracy by leveraging their individual strengths.

- Data augmentation: Consider incorporating additional data sources, such as sentiment analysis or macroeconomic indicators, to enhance model accuracy.

2. What are the main challenges in quantitative trading forecasting?

Quantitative trading forecasting faces several challenges:

- Data quality: Inaccurate or incomplete data can lead to flawed predictions.

- Model complexity: Highly complex models are prone to overfitting, making them less generalizable.

- Market volatility: Forecasting models often struggle to predict sudden market shifts caused by unforeseen events, such as economic crises or natural disasters.

3. Where can I learn more about forecasting techniques for trading?

For those interested in learning more about forecasting techniques in trading, there are several resources available:

- Online courses: Websites like Coursera, Udemy, and edX offer comprehensive courses on forecasting techniques, machine learning for trading, and quantitative finance.

- Books: Consider reading books like “Quantitative Financial Analytics” or “Advances in Financial Machine Learning” for in-depth knowledge on forecasting methods in trading.

- Forums and Communities: Join quantitative finance communities such as QuantNet or Elite Trader to exchange ideas and gain insights from professionals in the field.

Conclusion

Developing a robust forecasting plan is essential for anyone serious about quantitative trading. Whether using time series models, machine learning techniques, or a hybrid approach, it’s important to continually refine your methods based on the latest data and trends. By carefully selecting models, fine-tuning parameters, and validating results, traders can develop reliable forecasting systems that help predict market movements with greater accuracy.

The ultimate goal of a forecasting plan is to improve trading performance by reducing risks and maximizing returns. As the field of quantitative trading evolves, so too will the forecasting techniques, making it an exciting and dynamic area to explore. Don’t forget to share your thoughts and experiences in the comments below, and feel free to share this article with others who may benefit from it!

By mastering forecasting in quantitative trading, traders can better navigate the complexities of the financial markets and make more informed, data-driven decisions.

0 Comments

Leave a Comment