===========================================

Forecasting lies at the heart of successful trading. Whether in equities, forex, commodities, or digital assets, traders rely on predictive models to anticipate price movements, manage risks, and optimize returns. With the rise of advanced data analytics, machine learning, and algorithmic platforms, there is now a wide array of forecasting software for trading. This comprehensive article delivers a detailed forecasting software comparison for trading, evaluates strategies, and recommends the most effective approaches based on accuracy, usability, and cost.

Why Forecasting Matters in Trading

The Role of Forecasting

Forecasting allows traders to transform raw market data into actionable insights. By analyzing past price action, macroeconomic indicators, and order flow, forecasting software generates signals that inform buy, sell, or hold decisions.

Why Is Forecasting Important in Trading Strategies

Traders who rely solely on intuition risk emotional decision-making. Forecasting models introduce discipline, consistency, and statistical validation. Incorporating forecasting into trading strategies reduces uncertainty and enhances long-term performance.

Categories of Forecasting Software

1. Statistical Forecasting Tools

These focus on time-series models such as ARIMA, GARCH, and exponential smoothing.

- Pros: Transparent, mathematically grounded, relatively lightweight.

- Cons: Struggle with highly non-linear or regime-shifting markets.

2. Machine Learning Platforms

These use algorithms such as Random Forests, XGBoost, and deep learning to predict price movements.

- Pros: High adaptability, capable of uncovering complex patterns.

- Cons: Require large datasets and strong computational power.

3. Integrated Trading Platforms

Many broker platforms (e.g., MetaTrader, NinjaTrader, TradeStation) provide built-in forecasting indicators alongside execution features.

- Pros: Seamless execution + forecasting in one environment.

- Cons: Less customizable for advanced research.

Comparing Leading Forecasting Software

MATLAB & R for Quantitative Forecasting

- Strengths: Excellent for advanced statistical modeling and quantitative research.

- Limitations: Steeper learning curve; requires coding expertise.

- Best For: Academics, quantitative analysts, data scientists.

Python Ecosystem (TensorFlow, Scikit-learn, Prophet)

- Strengths: Free, flexible, with powerful libraries for forecasting.

- Limitations: Requires strong programming skills; setup can be complex.

- Best For: Algorithmic traders, professional quants, developers.

MetaTrader 5

- Strengths: User-friendly, built-in indicators, supports custom Expert Advisors (EAs).

- Limitations: Limited deep-learning forecasting capabilities.

- Best For: Beginner to intermediate retail traders.

NinjaTrader

- Strengths: Strong charting, simulation, and backtesting tools.

- Limitations: Paid add-ons may be required for advanced forecasting.

- Best For: Active futures and forex traders.

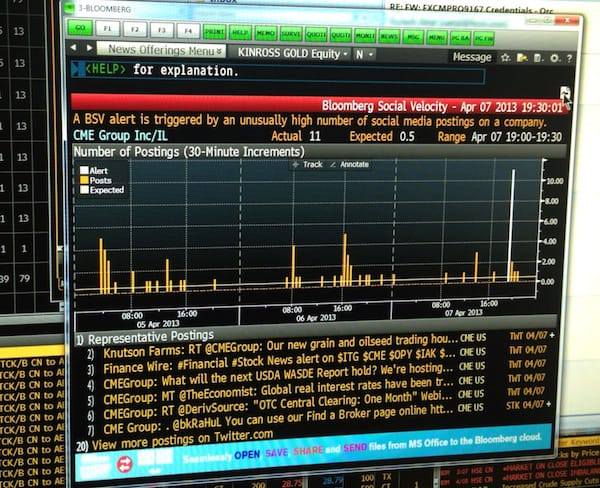

Bloomberg Terminal & Refinitiv Eikon

- Strengths: Institutional-grade data, advanced forecasting analytics, real-time feeds.

- Limitations: Extremely expensive subscriptions.

- Best For: Hedge funds, investment banks, and financial advisors.

Forecasting Approaches in Practice

Method 1: Time-Series Models (ARIMA/GARCH)

These rely on historical price series to project future trends.

- Pros: Highly interpretable, robust in stable market conditions.

- Cons: Struggles with sudden volatility spikes.

Method 2: Machine Learning Models (Neural Networks, Gradient Boosting)

These analyze non-linear dependencies, sentiment data, and alternative datasets.

- Pros: Better performance in fast-moving and complex markets.

- Cons: Risk of overfitting; opaque decision-making (“black box”).

Recommendation: A hybrid strategy that combines statistical baselines (for interpretability) with machine learning overlays (for adaptability) delivers the strongest results.

Forecasting Accuracy: Key Performance Metrics

- Mean Absolute Error (MAE) – measures prediction accuracy in raw terms.

- Root Mean Square Error (RMSE) – penalizes larger forecast errors more heavily.

- Directional Accuracy (DA) – percentage of correct up/down movement predictions.

- Sharpe Ratio of Forecast-Driven Strategy – evaluates profitability relative to risk.

Understanding forecasting performance metrics in trading ensures traders can objectively assess which software truly adds value.

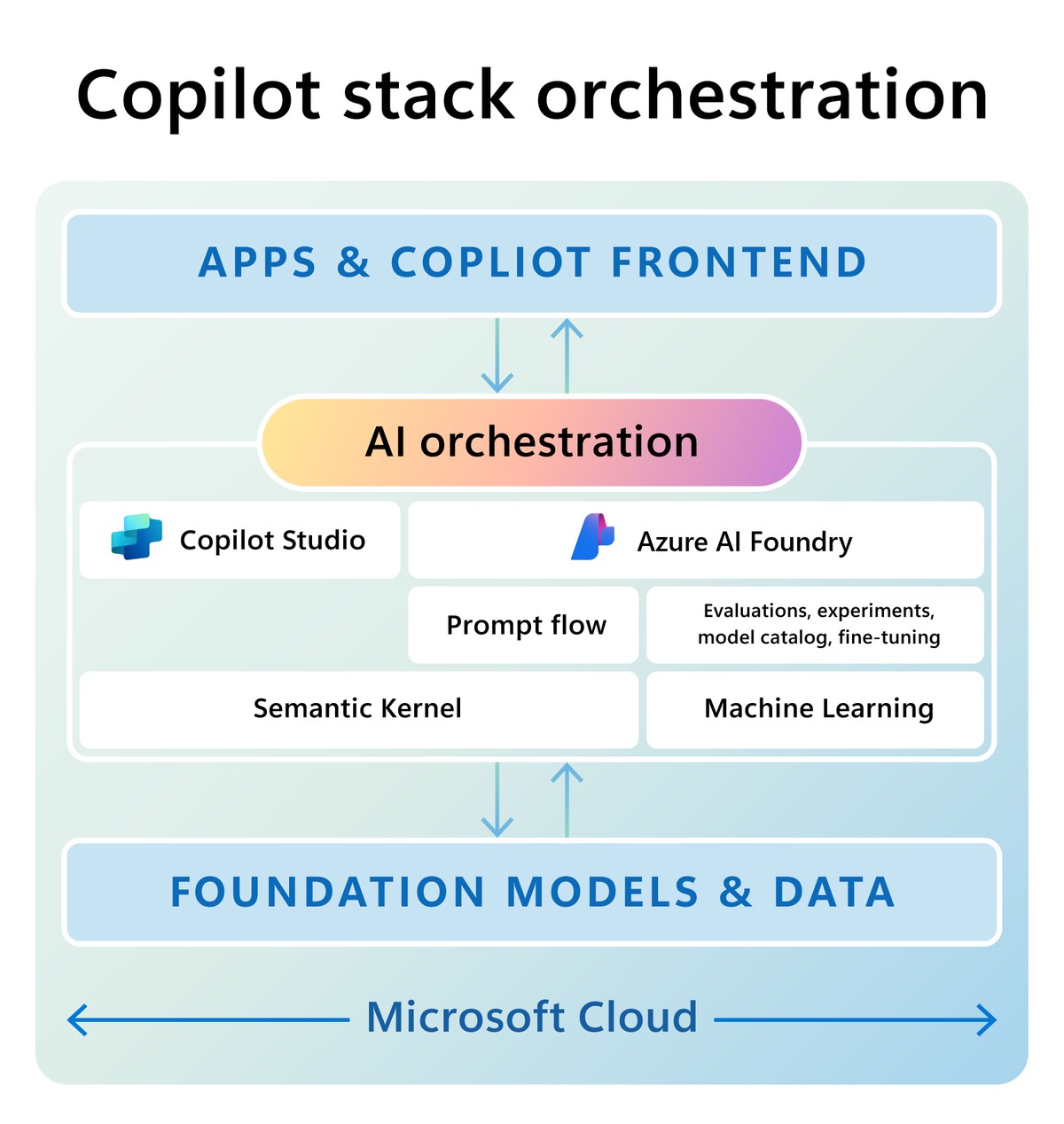

Visual Comparison

Comparison framework showing accuracy, usability, and cost dimensions for trading forecasting tools.

Data and Forecasting

Where to Find Forecasting Data for Trading

Reliable data is essential for accurate forecasts. Traders can source data from:

- Broker feeds (MetaTrader, Interactive Brokers)

- Institutional providers (Bloomberg, Refinitiv)

- Open datasets (Yahoo Finance, Quandl, Kaggle)

Without robust datasets, even the most advanced forecasting software will fail.

Practical Case Study

A medium-sized hedge fund compared Prophet (Python) vs ARIMA ® for commodity price forecasting.

- ARIMA provided stable forecasts for long-term trend detection.

- Prophet adapted quickly to seasonality and short-term volatility.

The fund ultimately deployed a dual-system forecasting framework, using ARIMA for baseline modeling and Prophet for dynamic adjustments.

Common Pitfalls in Forecasting Software Use

- Overfitting Models – Over-optimized parameters fail in live markets.

- Ignoring Market Regimes – Models trained in bullish phases may collapse in bearish shifts.

- Lack of Risk Management – Even accurate forecasts fail without proper stop-loss and position sizing.

FAQ: Forecasting Software for Trading

1. How do I choose the best forecasting software for trading?

Consider your goals, budget, and technical skills. Retail traders may prefer MetaTrader, while professional quants benefit from Python or MATLAB. Institutional traders rely on Bloomberg for real-time forecasting.

2. Can forecasting software guarantee profits?

No. Forecasts improve probability but cannot eliminate uncertainty. The effectiveness depends on integration with a solid trading plan, risk controls, and continuous model updates.

3. How can I improve forecasting accuracy?

Diversify models, use ensemble methods, include alternative data (sentiment, macroeconomic indicators), and constantly recalibrate your system. This aligns with strategies under how to improve forecasting accuracy in trading, ensuring adaptability.

Conclusion

This forecasting software comparison for trading reveals that there is no universal best tool—only the right tool for the right trader.

- Retail beginners: MetaTrader or NinjaTrader.

- Quant professionals: Python, R, or MATLAB.

- Institutions: Bloomberg Terminal or Refinitiv.

By understanding the trade-offs between statistical transparency and machine learning adaptability, traders can build stronger forecasting frameworks.

If you found this guide insightful, share it with your network, leave a comment with your favorite forecasting tools, and let’s build a smarter trading community together.

Do you want me to also create a comparison matrix infographic ranking the top forecasting tools (MetaTrader, Python, R, Bloomberg, etc.) across cost, ease-of-use, and accuracy?

0 Comments

Leave a Comment