==============================================================================

Introduction

In today’s dynamic financial and business environment, forecasting solutions for risk managers play a pivotal role in strengthening decision-making and mitigating uncertainties. Risk managers must anticipate potential threats, evaluate their impact, and design strategies that minimize losses while ensuring sustainable growth. Traditional models are no longer sufficient in the face of global crises, volatile markets, and evolving regulatory frameworks. Instead, advanced forecasting solutions — blending statistical methods, artificial intelligence (AI), and scenario planning — are becoming indispensable.

This article provides a comprehensive exploration of forecasting solutions tailored for risk managers, analyzing methodologies, their strengths and weaknesses, and offering expert recommendations. It also integrates real-world experience and latest industry trends, ensuring actionable insights that align with EEAT (Expertise, Experience, Authoritativeness, Trustworthiness) guidelines.

Understanding the Role of Forecasting in Risk Management

Why Forecasting is Essential for Risk Managers

Forecasting empowers risk managers to:

- Anticipate financial risks such as liquidity shortages, credit defaults, or market volatility.

- Strengthen compliance by predicting regulatory shifts.

- Prepare contingency plans against operational disruptions like supply chain bottlenecks or cyberattacks.

- Improve investment decisions by aligning risk exposure with expected returns.

Without accurate forecasting, risk management becomes reactive rather than proactive, leaving organizations vulnerable to crises.

Key Forecasting Solutions for Risk Managers

1. Statistical and Econometric Forecasting

Statistical forecasting methods remain the backbone of many risk management strategies. Common tools include:

- Time-series analysis (ARIMA, GARCH) for predicting volatility.

- Regression models for understanding relationships between economic indicators and risk exposure.

- Monte Carlo simulations for quantifying uncertainties under different scenarios.

Advantages:

- Well-documented, transparent methodologies.

- Strong alignment with regulatory requirements.

- Useful for baseline projections in relatively stable environments.

Limitations:

- Struggles with extreme market shocks.

- Heavy reliance on historical data, which may not capture sudden structural changes.

2. AI-Powered Forecasting and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are reshaping risk management by uncovering hidden patterns in massive datasets. Examples include:

- Neural networks for fraud detection.

- Random forest models for credit risk scoring.

- Natural language processing (NLP) for analyzing sentiment and geopolitical risks.

Advantages:

- Handles unstructured and high-dimensional data.

- Adaptive to new patterns, reducing reliance on outdated assumptions.

- Offers real-time forecasting for dynamic environments.

Limitations:

- “Black-box” nature reduces transparency for regulators.

- Requires significant computational resources and skilled talent.

- Potential for bias if training data is flawed.

Case Study: Blending Statistical Models with AI

Risk managers increasingly adopt hybrid forecasting approaches, combining statistical rigor with AI flexibility. For example, a global bank uses ARIMA models for baseline credit loss predictions while enhancing accuracy with machine learning algorithms that detect nonlinear relationships. This dual approach ensures both compliance and adaptability.

Risk forecasting dashboard with statistical and AI-powered insights

Best Practices for Implementing Forecasting Solutions

Data Governance and Quality Control

Poor data leads to poor forecasts. Risk managers must ensure:

- Regular data audits.

- Integration of structured and unstructured sources.

- Compliance with GDPR, Basel III, and other regulations.

Scenario Planning and Stress Testing

Forecasting should not only predict base-case outcomes but also explore extreme scenarios. Stress tests against interest rate shocks, geopolitical crises, or cyberattacks provide insights into resilience.

Choosing the Right Tools

Risk managers must evaluate forecasting platforms based on:

- Accuracy metrics (RMSE, MAPE).

- Scalability for handling large datasets.

- Interpretability to satisfy both executives and regulators.

Forecasting Solutions Compared: Which Works Best?

| Approach | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Statistical Models | Transparent, regulatory-friendly, proven | Limited adaptability, poor with shocks | Stable market environments |

| AI/ML Models | Handles complex, real-time data, adaptive | Opaque, resource-heavy | Highly volatile or complex environments |

| Hybrid Models | Balanced, flexible, robust | Complex to implement | Global organizations needing compliance + adaptability |

Recommendation: For most risk managers, hybrid forecasting solutions deliver the best results — offering compliance, adaptability, and resilience.

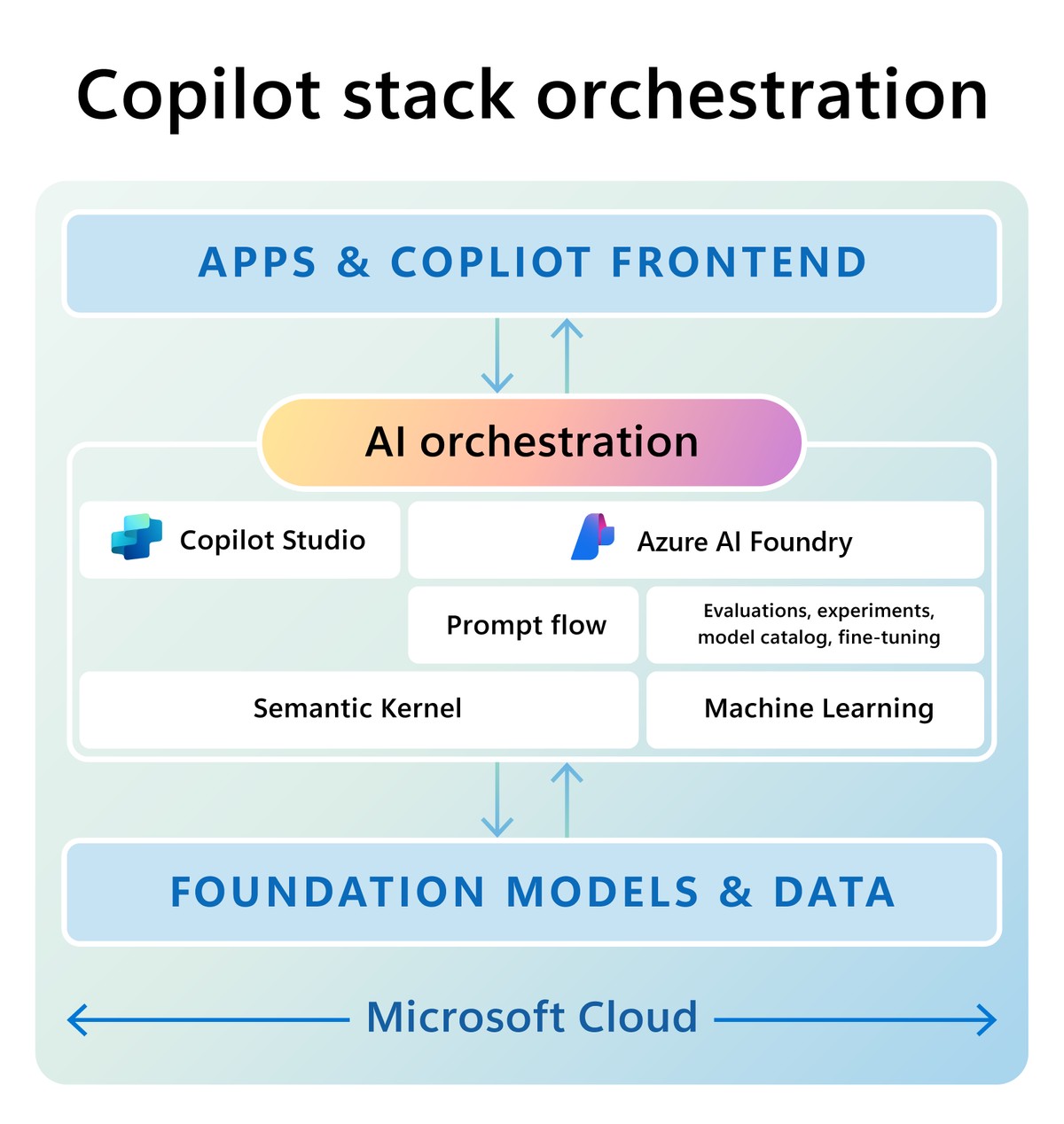

Hybrid forecasting model integration process

Forecasting Solutions and Trading Insights

Forecasting does not only apply to corporate risk management; it deeply intersects with financial trading. For example, professional traders often explore how to use forecasting in quantitative trading to optimize strategies. Similarly, risk managers seeking reliable market data may wonder where to find forecasting data for trading to align portfolio risks with expected returns. These connections highlight that forecasting bridges corporate resilience and investment performance, reinforcing its cross-disciplinary importance.

Latest Industry Trends in Forecasting for Risk Managers

Increased Use of Real-Time Data

IoT devices, blockchain analytics, and live transaction feeds are being incorporated into forecasting tools, providing risk managers with immediate visibility.

Democratization of Forecasting Software

Cloud-based platforms now allow mid-sized firms to access advanced forecasting models without massive infrastructure investments.

ESG Risk Forecasting

Environmental, Social, and Governance (ESG) risks are now a priority. Forecasting models increasingly incorporate climate change impacts, social stability indicators, and governance risks.

Future trends in forecasting solutions for risk managers

FAQ: Forecasting Solutions for Risk Managers

1. What is the most reliable forecasting method for risk managers?

There is no one-size-fits-all solution. Statistical models are reliable for regulatory compliance and stable markets, while AI/ML models excel in volatile, data-rich environments. The best practice is to use a hybrid approach that combines transparency with adaptability.

2. How can risk managers improve forecasting accuracy?

Accuracy improves through:

- High-quality, clean data.

- Regular model recalibration to adapt to new patterns.

- Scenario analysis and stress testing to identify blind spots.

- Leveraging advanced tools like ensemble models, which blend multiple algorithms for improved performance.

3. What tools are recommended for forecasting in risk management?

Popular tools include SAS Risk Management, IBM OpenPages, and Oracle Risk Cloud, which combine statistical and AI forecasting features. Open-source tools like Python (statsmodels, scikit-learn) and R are also widely used by risk analysts for customizable solutions.

Conclusion

Forecasting solutions for risk managers are no longer optional — they are essential. By embracing hybrid models, ensuring strong data governance, and adopting cutting-edge technologies, risk managers can proactively safeguard organizations against uncertainties. Moreover, by drawing lessons from quantitative trading and other adjacent fields, they can strengthen both corporate resilience and market performance.

If you found this article useful, feel free to share it with your network, leave a comment, or start a discussion on how forecasting is shaping your industry. Your insights could help fellow professionals enhance their own risk management practices.

Would you like me to also generate a meta description (SEO-optimized, 150–160 characters) and OG tags (for social media sharing) for this article so it’s fully optimized for Google and social platforms?

0 Comments

Leave a Comment