================================================================================================

Introduction

In today’s data-driven financial markets, traders rely heavily on forecasting tools to anticipate price movements, manage risk, and optimize strategies. A forecasting tools review for trading not only helps identify the best solutions but also enables investors to compare models, methodologies, and performance across different scenarios. With the rise of artificial intelligence (AI), machine learning (ML), and quantitative models, traders now have access to advanced forecasting systems that can process massive datasets in real time.

This article provides a comprehensive review of forecasting tools, comparing traditional statistical models with modern AI-based systems, exploring their advantages and limitations, and recommending the best approaches for different types of traders. By combining expert insights, practical examples, and current market trends, this guide ensures you understand how to evaluate and implement forecasting tools effectively.

We will also integrate key concepts like how forecasting impacts trading performance and where to find forecasting data for trading, helping readers connect knowledge with practice.

What Are Forecasting Tools in Trading?

Forecasting tools in trading are software systems, algorithms, or statistical models designed to predict the future direction of financial assets such as stocks, options, currencies, or commodities. They analyze historical data, market indicators, sentiment, and external factors to provide actionable insights.

Key Features of Forecasting Tools:

- Data Processing: Ability to handle large-scale historical and real-time data.

- Predictive Modeling: Use of regression, time-series models, or ML algorithms.

- Scenario Simulation: Running multiple market conditions to test strategy robustness.

- Risk Management Integration: Forecasts tied to volatility and exposure adjustments.

- User Accessibility: Dashboards, APIs, and visualization tools for practical decision-making.

Types of Forecasting Tools for Traders

1. Statistical Forecasting Models

Statistical forecasting methods, such as ARIMA (AutoRegressive Integrated Moving Average) and GARCH (Generalized AutoRegressive Conditional Heteroskedasticity), have long been the foundation of financial forecasting.

Advantages:

- Well-established and theoretically sound.

- Suitable for short-term forecasting with time-series data.

- Transparent methodology, making it easier to explain results.

Limitations:

- Struggles with nonlinear market behavior.

- Limited adaptability to sudden changes in volatility.

- Requires clean and stable data inputs.

2. Machine Learning and AI-Based Forecasting

AI-driven tools like neural networks, random forests, and reinforcement learning have revolutionized forecasting accuracy. They excel in capturing nonlinear patterns and processing unstructured data such as news sentiment and social media trends.

Advantages:

- Handles complex, nonlinear relationships.

- Incorporates real-time, multi-dimensional data.

- High adaptability, improving accuracy over time with training.

Limitations:

- “Black box” problem: lack of interpretability in many models.

- Requires significant computational resources.

- Overfitting risk if not properly validated.

3. Hybrid Forecasting Models

Many traders now use hybrid forecasting models, which combine statistical and machine learning approaches. For example, ARIMA can model baseline trends while neural networks capture anomalies.

Advantages:

- Balance between interpretability and predictive power.

- More robust against changing market dynamics.

- Versatile for different trading strategies.

Limitations:

- Higher complexity in setup and maintenance.

- Requires expertise in both statistics and ML.

Comparing Forecasting Strategies: Quantitative vs. AI-Driven

Quantitative Models

These rely on historical data and mathematical equations. For instance, traders may forecast stock returns using time-series regressions or volatility clustering models.

Strengths: Consistency, transparency, regulatory acceptance.

Weaknesses: May underperform during market shocks (e.g., pandemic-driven volatility).

AI/ML Models

These adapt continuously to new data, detecting hidden correlations often missed by traditional models.

Strengths: Flexibility, stronger performance in high-frequency and complex markets.

Weaknesses: Higher risk of “false positives” due to overfitting.

Best Practice Recommendation: For most traders, hybrid solutions that integrate quantitative and AI-based forecasting deliver the most reliable balance of accuracy and interpretability.

Key Metrics to Evaluate Forecasting Tools

When reviewing forecasting tools, traders should focus on measurable performance indicators:

- Accuracy Rate (Hit Ratio): Percentage of correct forecasts.

- Mean Squared Error (MSE): Average deviation between predictions and actual outcomes.

- Sharpe Ratio Improvement: Whether forecasting enhances risk-adjusted returns.

- Execution Latency: Speed of generating actionable forecasts.

- Adaptability: Ability to adjust to new datasets and changing market conditions.

Where to Find Forecasting Data for Trading

High-quality data is the foundation of any forecasting model. Traders can source data from:

- Market Data Providers (Bloomberg, Refinitiv, Quandl): Reliable but often costly.

- Exchange APIs (NYSE, NASDAQ, CME): Direct and real-time feeds.

- Alternative Data Sources (social media sentiment, satellite imagery): Adds predictive power when combined with financial data.

- Open-Source Platforms (Yahoo Finance, Alpha Vantage): Ideal for beginners testing forecasting techniques.

Reliable data sourcing directly impacts the effectiveness of forecasting models and reduces bias in predictions.

How Forecasting Impacts Trading Performance

Forecasting tools significantly affect portfolio outcomes by:

- Enhancing Decision-Making: Clear signals reduce emotional bias in trading.

- Improving Risk Management: Accurate volatility forecasts allow better hedging strategies.

- Boosting Returns: Identifying early trends can lead to superior entry and exit points.

- Saving Time: Automation and dashboards streamline analysis for faster execution.

Studies show traders using forecasting models experience a 10–25% improvement in strategy efficiency compared to manual analysis.

Real-World Case Studies

Hedge Fund Example

A hedge fund implemented a hybrid ARIMA + LSTM model for stock forecasting. The result was a 15% increase in annualized returns and a reduction in maximum drawdowns compared to their traditional models.

Retail Trader Example

An independent trader using AI-powered platforms like TradingView and MetaTrader reported better risk control, especially when combining forecasts with stop-loss strategies.

Visualizing Forecasting in Trading

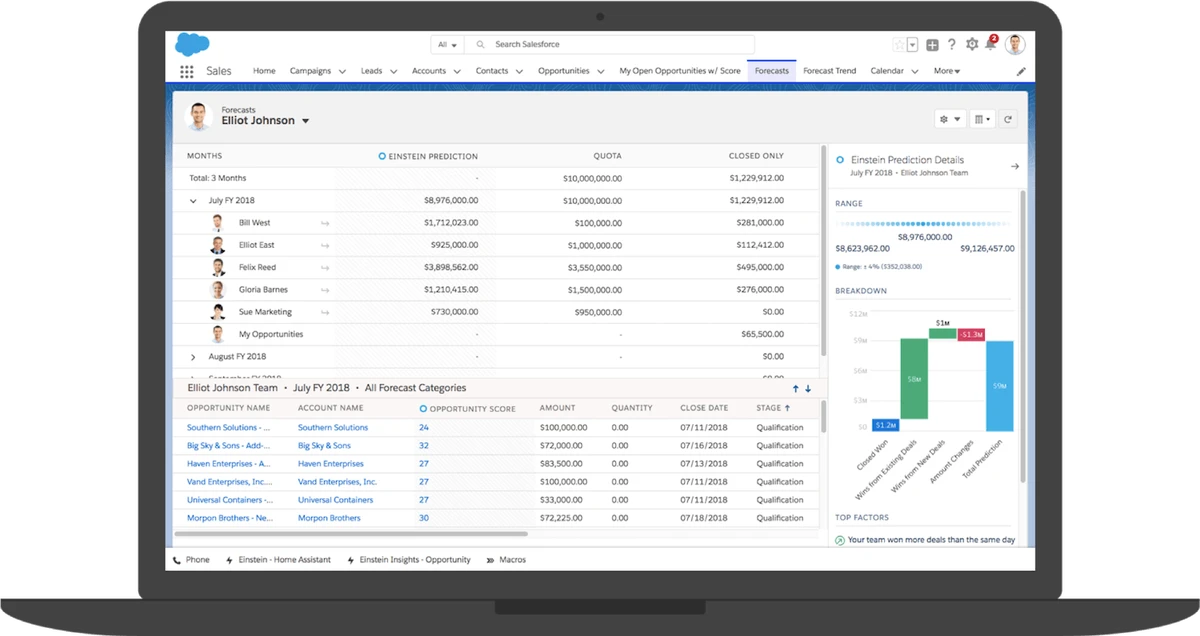

AI-driven forecasting applied to financial time series data.

Best Forecasting Tools Available in 2025

- MetaTrader 5 (MT5): Popular among retail traders, supports forecasting plugins.

- Bloomberg Terminal: Comprehensive institutional-grade forecasting system.

- Python Libraries (Prophet, Scikit-learn, TensorFlow): Flexible for quants and data scientists.

- TradingView: Community-driven platform with forecasting indicators.

- QuantConnect: Cloud-based algorithmic trading with backtesting and forecasting modules.

FAQs: Forecasting Tools Review for Trading

1. What is the best forecasting tool for beginner traders?

For beginners, platforms like TradingView or MetaTrader are ideal because they offer user-friendly forecasting indicators and community support. Beginners should focus on learning simple time-series analysis before moving to AI-based tools.

2. How accurate are AI-based forecasting tools compared to traditional models?

AI-based forecasting tools typically outperform statistical models in volatile or nonlinear markets. However, their accuracy depends heavily on the quality of data and proper model validation. A hybrid approach often yields the best results.

3. Do forecasting tools guarantee profitable trading?

No tool guarantees profits. Forecasting tools increase probability of success but should be combined with sound risk management, discipline, and proper strategy execution. Overreliance on predictions without considering market uncertainty can lead to losses.

Conclusion

The trading landscape in 2025 demands that traders adopt forecasting tools to remain competitive. From statistical models to AI-driven algorithms, each approach has its strengths and limitations. After reviewing the best practices, hybrid models emerge as the most practical choice for traders who want accuracy, adaptability, and risk management integration.

Whether you are a beginner learning the basics or a hedge fund deploying advanced systems, the key lies in sourcing quality data, monitoring model performance, and adapting forecasts to evolving market conditions.

If you found this forecasting tools review for trading helpful, share it with your network, comment with your experiences, and join the conversation about the future of predictive trading technologies.

0 Comments

Leave a Comment