==========================================================================================

Hedge funds have long been a cornerstone of institutional investment portfolios, known for their ability to generate alpha and manage risk in complex market conditions. Institutional investors, such as pension funds, endowments, and family offices, often turn to hedge fund strategies to diversify their holdings and enhance portfolio performance. In this article, we will explore some of the most effective hedge fund strategies for institutional investors, discussing their pros, cons, and best practices for implementation.

What are Hedge Fund Strategies?

Hedge fund strategies are diverse approaches employed by hedge fund managers to generate returns for their investors, often through advanced techniques and complex financial instruments. These strategies are designed to take advantage of market inefficiencies while managing risk, typically with the goal of generating positive returns regardless of market conditions.

Institutional investors are particularly drawn to hedge funds for their ability to:

- Diversify portfolios by including alternative assets

- Generate alpha, or returns above the market average

- Hedge against market volatility and systemic risk

- Protect downside risk while seeking outsize returns

Types of Hedge Fund Strategies

Hedge fund strategies vary widely, but some of the most common ones employed by institutional investors include:

- Long/Short Equity

- Global Macro

- Event-Driven Strategies

- Relative Value Arbitrage

- Quantitative Strategies

Long/Short Equity Strategy

What is Long/Short Equity?

The Long/Short Equity strategy involves buying (going long) securities that are expected to increase in value and selling (going short) securities expected to decrease. The goal is to profit from the difference in performance between the long and short positions. This strategy allows hedge funds to take advantage of both upward and downward price movements.

Advantages of Long/Short Equity:

- Market Neutrality: By balancing long and short positions, the strategy reduces exposure to overall market movements, which can be advantageous in volatile markets.

- Downside Protection: Short positions can provide a hedge against market downturns, making it appealing to institutional investors looking for risk management.

- Alpha Generation: Skilled managers can generate substantial returns by identifying under- or over-valued stocks.

Disadvantages of Long/Short Equity:

- High Costs: The strategy involves short selling, which can lead to borrowing costs and additional risks.

- Complexity: Requires sophisticated risk management and a deep understanding of the market to successfully balance long and short positions.

When to Use Long/Short Equity

This strategy is particularly useful when markets are expected to be volatile or when an investor wants to take advantage of market inefficiencies. Institutional investors often employ long/short equity as a way to hedge their equity exposure while still aiming for positive returns in both rising and falling markets.

Global Macro Strategy

What is the Global Macro Strategy?

Global macro strategies focus on making investment decisions based on the economic and political views of entire countries or regions. These strategies take positions in equity markets, bonds, commodities, currencies, and other assets based on anticipated macroeconomic trends, such as inflation, interest rates, or political events.

Advantages of Global Macro:

- Global Scope: Institutional investors can diversify across different asset classes and regions, reducing the impact of localized risks.

- Flexible Approach: This strategy allows investors to adapt quickly to changing macroeconomic conditions, providing flexibility and agility.

- Opportunities in All Markets: By focusing on broad economic trends, global macro strategies can generate returns in both bull and bear markets.

Disadvantages of Global Macro:

- High Risk: The strategy is heavily reliant on correct economic predictions, which can be difficult to make, leading to potential losses.

- Complex Analysis: A deep understanding of global economic trends is essential, making it a strategy that requires substantial research and expertise.

When to Use Global Macro

Global macro strategies are ideal for institutional investors who want to capitalize on large-scale economic shifts and global trends. These strategies can be particularly effective during times of economic upheaval or uncertainty, where significant changes in interest rates, currency values, or commodity prices are expected.

Event-Driven Strategies

What is an Event-Driven Strategy?

Event-driven strategies aim to profit from specific corporate events, such as mergers, acquisitions, bankruptcies, or restructurings. The goal is to identify inefficiencies or mispricings in the market related to these events and profit from them. Common event-driven strategies include merger arbitrage, distressed asset investing, and activist investing.

Advantages of Event-Driven Strategies:

- Specific Focus: By targeting specific events, this strategy provides a clear focus for decision-making.

- Alpha Generation: Successful event-driven investors can generate substantial alpha, particularly when corporate events result in market mispricing.

- Limited Market Exposure: Since these strategies focus on specific events, they can often reduce exposure to broader market risks.

Disadvantages of Event-Driven Strategies:

- Execution Risk: Events such as mergers or acquisitions may not go as planned, leading to losses.

- Capital Intensive: Some event-driven strategies, such as distressed asset investing, require significant capital and may have longer investment horizons.

When to Use Event-Driven Strategies

Event-driven strategies are best suited for institutional investors who have a long-term view and the expertise to assess corporate events. They are particularly valuable in periods of corporate consolidation or financial restructuring.

Quantitative Hedge Fund Strategies

What are Quantitative Hedge Fund Strategies?

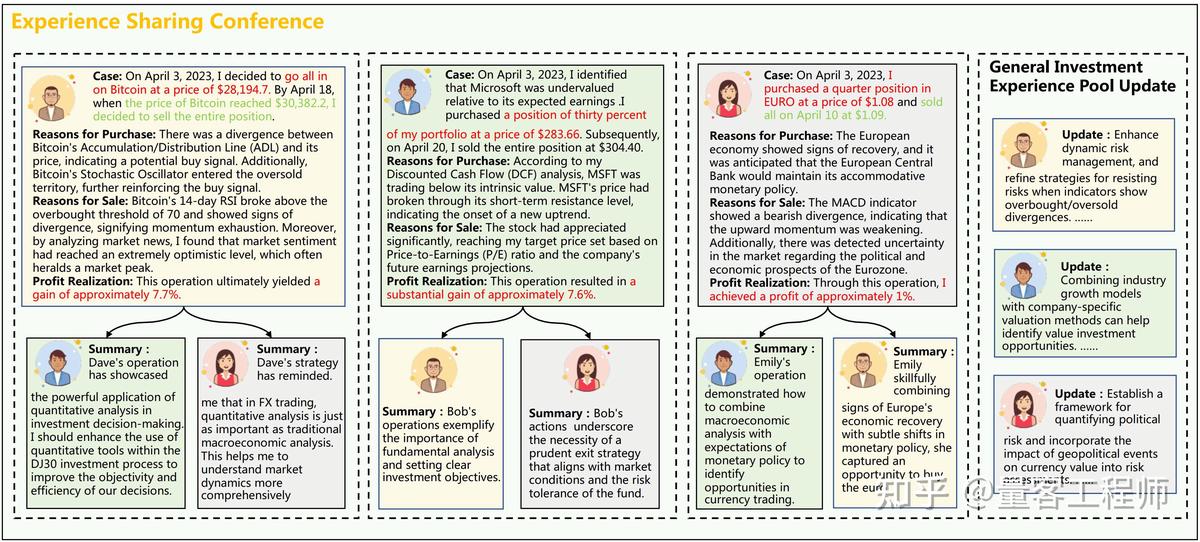

Quantitative strategies involve using mathematical models, algorithms, and data analysis to identify profitable trading opportunities. These strategies rely heavily on computer models and large data sets to forecast price movements and market trends. Quantitative strategies often include statistical arbitrage, high-frequency trading (HFT), and machine learning approaches.

Advantages of Quantitative Strategies:

- Data-Driven Decisions: Quantitative strategies rely on hard data and algorithms, minimizing the influence of human emotions in decision-making.

- Scalability: These strategies can be applied to a wide range of assets and markets, allowing institutional investors to scale their investments.

- Efficiency: With the right technology, quantitative strategies can process vast amounts of data quickly and identify patterns that might not be apparent to human traders.

Disadvantages of Quantitative Strategies:

- Overfitting Risk: Models can sometimes be overfitted to historical data, leading to poor performance in live markets.

- Technology Dependency: These strategies are heavily reliant on sophisticated algorithms and computing power, which can be expensive to develop and maintain.

When to Use Quantitative Strategies

Quantitative strategies are suitable for institutional investors looking for a systematic, data-driven approach to investing. They are particularly useful in liquid markets and can be applied across a wide range of assets, including equities, futures, and currencies.

Hedge Fund Strategy Comparison

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Long/Short Equity | Market neutrality, downside protection, alpha generation | High costs, complexity, requires skilled management |

| Global Macro | Global diversification, flexible approach, opportunities in all markets | High risk, complex analysis required |

| Event-Driven | Clear focus on specific events, limited market exposure, alpha generation | Execution risk, capital intensive |

| Quantitative | Data-driven, scalable, efficient, eliminates emotional bias | Overfitting risk, expensive technology |

FAQ: Common Questions on Hedge Fund Strategies

1. What is the best hedge fund strategy for institutional investors?

There is no one-size-fits-all approach, as the best strategy depends on the investor’s risk tolerance, time horizon, and market outlook. For example, long/short equity strategies are great for volatility, while global macro strategies are ideal for capitalizing on global economic trends.

2. How do quantitative strategies differ from traditional hedge fund strategies?

Quantitative strategies rely on data and algorithms to generate trades, whereas traditional strategies like long/short equity or event-driven investing are based on fundamental analysis or market events. Quantitative strategies are more systematic and scalable but are highly dependent on technology.

3. How can institutional investors assess the performance of a hedge fund?

Performance can be assessed through various metrics such as alpha, sharpe ratio, and maximum drawdown. Additionally, benchmark comparisons and evaluating risk-adjusted returns are important factors in assessing hedge fund performance.

Conclusion

Hedge fund strategies offer institutional investors a variety of ways to diversify their portfolios and manage risk. By carefully selecting strategies such as long/short equity, global macro, event-driven, and quantitative approaches, institutional investors can tailor their investments to market conditions and individual goals. Each strategy has its unique advantages and risks, and understanding these factors is crucial for maximizing returns and minimizing risks.

As market dynamics evolve, the key to successful hedge fund investing lies in selecting the right strategies, continuously monitoring performance, and adapting to changing market conditions.

0 Comments

Leave a Comment