============================================

Introduction

In modern financial markets, uncertainty is inevitable. From sudden geopolitical events to shifts in interest rates and inflation, financial analysts face growing pressure to protect portfolios against downside risks. One of the most effective approaches is hedge risk assessment, a structured process that identifies, evaluates, and mitigates potential risks through hedging instruments and strategies.

This article serves as a comprehensive hedge risk assessment for financial analysts, integrating industry best practices, real-world applications, and proven methodologies. By the end, you’ll understand how to conduct a structured hedge risk assessment, compare alternative approaches, and apply practical insights to strengthen portfolio resilience.

What Is Hedge Risk Assessment?

Definition

Hedge risk assessment is the process of evaluating a portfolio’s exposure to risks and determining how hedging strategies (such as derivatives, options, futures, and swaps) can be used to minimize losses without excessively limiting upside potential.

Why It Matters for Financial Analysts

- Portfolio protection: Safeguards investments against adverse market moves.

- Regulatory compliance: Institutions require structured risk assessments to meet international standards.

- Strategic insights: Improves capital allocation and enhances trading decisions.

This underscores why hedge is important in trading: it transforms uncertainty into manageable risk rather than leaving portfolios vulnerable.

Core Principles of Hedge Risk Assessment

1. Identifying Risk Exposures

Analysts must map out risks such as interest rate risk, credit risk, currency risk, equity volatility, and liquidity constraints.

2. Quantifying Risk Impact

Techniques such as Value-at-Risk (VaR), Conditional VaR, and stress testing quantify potential losses under different scenarios.

3. Selecting Hedging Instruments

Options, futures, ETFs, and swaps each serve distinct hedging functions. Choosing the right tool requires understanding portfolio composition.

4. Measuring Hedge Effectiveness

The process doesn’t stop at execution. Analysts must evaluate what is hedge effectiveness in trading by comparing hedged vs. unhedged performance across market cycles.

Common Hedge Risk Assessment Methods

Method 1: Value-at-Risk (VaR) Analysis

VaR estimates the maximum potential loss of a portfolio within a given confidence interval (e.g., 95%) over a specific time horizon.

Advantages:

- Widely used in institutions.

- Provides quantifiable risk thresholds.

Disadvantages:

- Does not capture extreme tail risks.

- Assumes historical data patterns will repeat.

Method 2: Scenario and Stress Testing

Stress testing simulates extreme market events (e.g., 2008 financial crisis) to assess portfolio vulnerability.

Advantages:

- Captures “black swan” risks.

- Enhances decision-making under uncertainty.

Disadvantages:

- Requires assumptions that may not match reality.

- Complex for large portfolios.

Method Comparison and Best Practice

- VaR is best for day-to-day monitoring.

- Stress testing is critical for crisis preparedness.

- Recommended approach: Use both methods in tandem to capture normal and extreme risk environments.

Real-World Hedge Risk Assessment Example

Consider a multinational corporation with heavy foreign currency exposure. Analysts apply:

- VaR analysis to measure typical FX fluctuations.

- Stress tests to model sudden currency devaluation.

- Hedging instruments like currency futures and swaps to reduce volatility.

By combining quantitative analysis with practical hedging, the company reduces earnings volatility while maintaining competitiveness.

Visual Insights

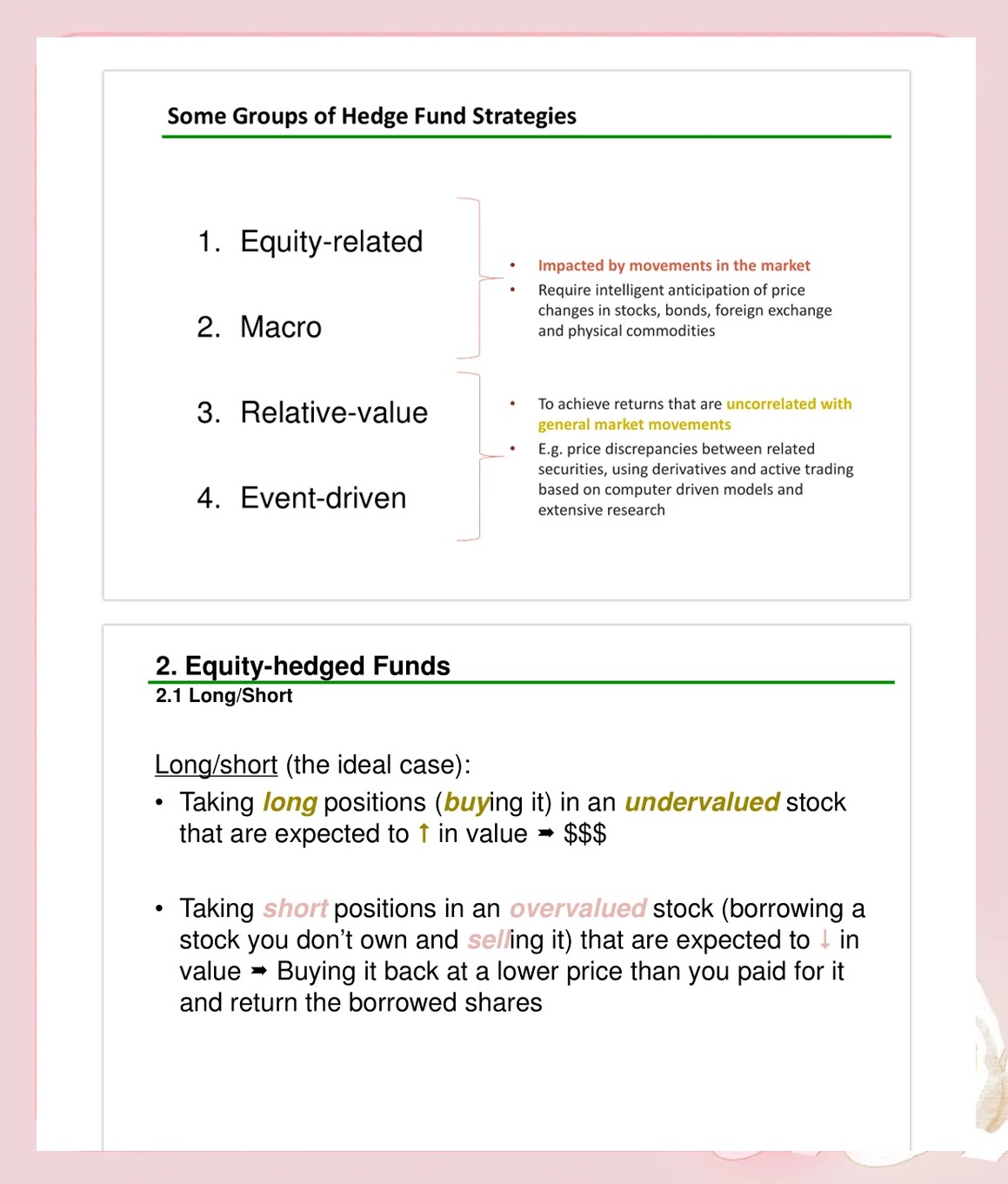

Hedge Risk Assessment Process

Key Hedging Strategies for Risk Mitigation

Strategy 1: Options-Based Hedging

Options give the right but not obligation to buy/sell assets at a set price. This flexibility makes them effective against volatility.

Pros:

- Protects downside while allowing upside gains.

- Useful in unpredictable markets.

Cons:

- Options premiums can be costly.

- Requires expertise in pricing and timing.

Strategy 2: Futures Contracts

Futures lock in a price for buying/selling at a future date, protecting against unfavorable price movements.

Pros:

- Cost-effective hedging tool.

- Highly liquid markets.

Cons:

- Eliminates both downside risk and upside potential.

- Margin requirements can tie up capital.

Strategy Comparison

- Options: Best for volatile markets where upside potential is valuable.

- Futures: Best for stable exposures where predictability is preferred.

Recommendation: Use a blended strategy—options for volatility hedging and futures for predictable cash flow exposures.

Integrating Hedge Risk Assessment with Portfolio Management

Hedge risk assessment is not a one-off exercise but part of continuous hedge portfolio management tips for experts. Successful analysts integrate it into:

- Asset allocation models.

- Dynamic rebalancing strategies.

- Performance attribution analysis.

By embedding hedging insights into portfolio management, analysts enhance resilience without compromising growth.

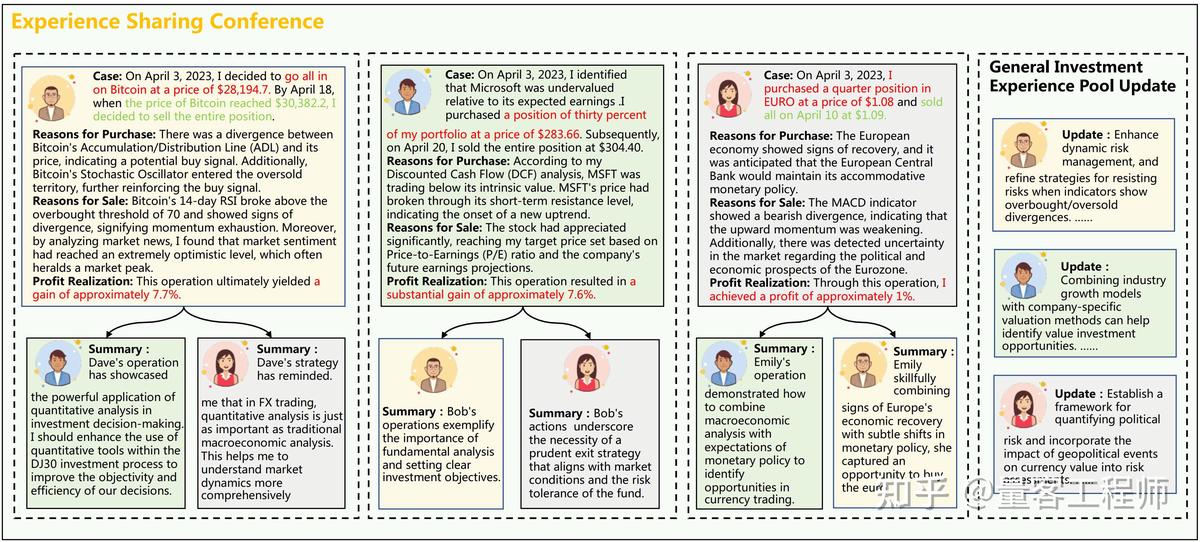

Visual Insights

Hedging Tools Comparison

Industry Trends in Hedge Risk Assessment

AI and Machine Learning

Algorithms are increasingly applied to predict hedge effectiveness and optimize hedging ratios.

ESG and Sustainable Hedging

Risk assessments now consider environmental, social, and governance (ESG) factors, especially for institutional investors.

Digital Assets and Crypto Hedging

With rising crypto adoption, financial analysts explore new ways of hedging against market volatility in digital assets.

This evolution connects directly with how to hedge against market volatility, especially as asset classes diversify.

FAQ: Hedge Risk Assessment for Financial Analysts

1. How do I know if my hedge strategy is effective?

You must measure hedge effectiveness by comparing the variance of returns in hedged vs. unhedged portfolios. If hedging significantly reduces volatility without eroding returns, it’s effective.

2. What is the biggest mistake analysts make in hedge risk assessment?

Over-hedging. Many analysts hedge excessively, which protects against losses but also erases potential gains. A balanced approach with calculated hedge ratios is key.

3. Which hedge risk assessment method should beginners start with?

Beginners should start with scenario analysis because it’s intuitive. Once familiar with data-driven models, they can adopt VaR and advanced quantitative methods.

Conclusion

Hedge risk assessment is no longer optional—it is essential for financial analysts tasked with managing modern portfolios. By applying methods like VaR and stress testing, leveraging tools such as options and futures, and continuously measuring hedge effectiveness, analysts can build portfolios that withstand uncertainty.

This hedge risk assessment for financial analysts has shown both practical strategies and advanced techniques, offering a roadmap for building resilience in volatile markets.

If you found this guide helpful, share it with colleagues, comment with your favorite hedge strategy, and keep the conversation going—because in finance, shared insights are the best hedge against ignorance.

Would you like me to also prepare a step-by-step hedge risk assessment checklist (PDF) so financial analysts can apply these methods directly in their workflow?

0 Comments

Leave a Comment