=========================================

Introduction

Professional traders face a complex challenge: achieving consistent returns while minimizing exposure to unpredictable market events. In this environment, hedge strategies for professional traders serve as a critical toolkit. These strategies are not about eliminating risk entirely—rather, they aim to control risk, preserve capital, and enhance performance stability.

In this article, we will explore the principles of hedging, compare different hedge strategies, and analyze their advantages and disadvantages. Drawing on both professional experience and modern financial research, we will show how traders can select, implement, and refine hedge techniques. Along the way, we will integrate insights from current industry practices and quantitative approaches.

What Is Hedging in Professional Trading?

Definition

Hedging is the practice of entering into financial positions that offset potential losses in a portfolio. Traders use derivatives, options, futures, and other instruments to manage exposure to equities, bonds, currencies, or commodities.

Importance for Professional Traders

- Capital Preservation: Reduces the probability of catastrophic losses.

- Return Stabilization: Creates smoother equity curves, important for attracting institutional investors.

- Risk Management: Provides tools to handle volatility and geopolitical shocks.

Professional traders often focus on how to hedge against market volatility because volatility directly influences portfolio drawdowns and investor confidence.

Core Hedge Strategies for Professionals

1. Options-Based Hedging

Options are among the most versatile instruments for hedging. Traders often buy put options to protect against downside risk or sell covered calls to generate income while hedging long positions.

Advantages:

- Flexibility in designing payoff structures.

- Limited downside risk when purchasing options.

- Can be tailored to specific risk profiles.

Disadvantages:

- Time decay erodes option value.

- Costs can accumulate if hedging frequently.

2. Futures and Forward Contracts

Professional traders often use futures contracts to hedge against movements in commodities, interest rates, or currencies. For example, a portfolio heavily exposed to oil prices may use crude oil futures to reduce risk.

Advantages:

- Deep liquidity in major markets.

- Standardized contracts simplify execution.

- Effective for large institutional hedges.

Disadvantages:

- No flexibility once the contract is locked in.

- Margin requirements can tie up capital.

3. Cross-Asset Hedging

Cross-asset hedging involves using a correlated asset class to mitigate risk. For example, equity traders might hedge with gold or Treasury bonds during uncertain macroeconomic conditions.

Advantages:

- Diversification beyond the asset class being traded.

- Potential for asymmetric risk reduction.

Disadvantages:

- Correlations are not always stable.

- Requires constant monitoring and recalibration.

4. Quantitative Hedging Models

Modern professional traders employ algorithmic and quantitative approaches, such as hedge ratio optimization and statistical arbitrage models. Understanding what is hedge ratio in trading helps quantify the exact amount of exposure that needs to be hedged.

Advantages:

- Data-driven precision in execution.

- Can adjust dynamically to market conditions.

Disadvantages:

- Requires strong technical expertise.

- Dependence on data accuracy and system reliability.

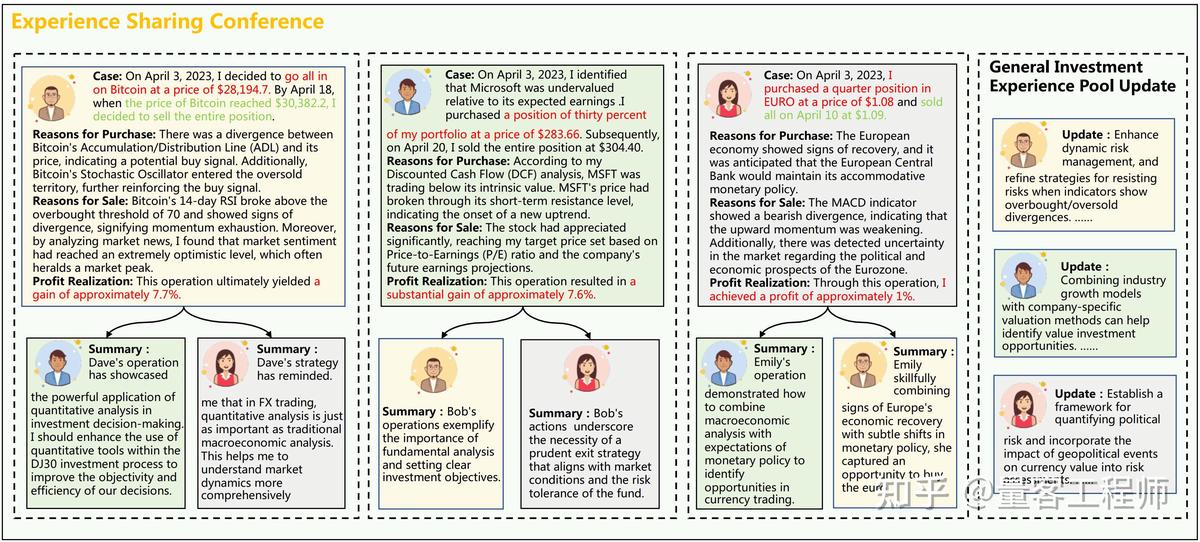

Visual: Hedge Strategy Comparison

A side-by-side analysis of popular hedge strategies, highlighting strengths and weaknesses for professional traders.

Evaluating Hedge Effectiveness

Key Metrics

- Hedge Ratio: Measures the portion of exposure covered by a hedge.

- Hedge Effectiveness: Evaluates how much volatility or risk reduction is achieved.

- Drawdown Control: Analyzes performance during market stress.

Professional traders consistently monitor how to assess hedge performance to refine their strategies.

Real-World Applications of Hedge Strategies

Case Study 1: Equity Portfolio Hedge with Options

A professional fund manager buys S&P 500 puts to protect against systemic risk. While premiums reduce net returns, the hedge provides insurance during a market crash.

Case Study 2: Commodity Hedge Using Futures

An energy trading desk hedges exposure to oil price declines with crude oil futures. This hedge ensures stable revenue forecasting for clients exposed to oil markets.

Case Study 3: Cross-Currency Hedge

A global macro fund hedges U.S. dollar exposure by shorting USD/JPY futures, balancing risks from foreign investment flows.

Visual: Hedge in Action

A properly implemented hedge significantly reduces portfolio volatility, even if returns are slightly reduced.

Advanced Hedge Approaches for Professionals

Dynamic Hedging

Instead of static hedges, dynamic strategies adjust hedge ratios based on market conditions. For example, volatility-targeted hedging adjusts exposure when implied volatility changes.

Tail Risk Hedging

Tail risk hedges are designed for extreme market events. This may involve deep out-of-the-money options or complex derivative structures.

Volatility Hedging

Professional traders use volatility products such as VIX futures and options to hedge against sudden market turbulence.

Common Mistakes Professionals Avoid

- Over-Hedging: Too much hedging can erode profits.

- Ignoring Costs: Option premiums and futures margins reduce performance.

- Assuming Correlations Are Fixed: Asset relationships often change under stress.

Education and Continuous Improvement

Professional traders continually refine their hedge strategies by researching new models, attending advanced workshops, and analyzing hedge fund reports. For those looking to deepen their skills, understanding where to learn hedge strategies is essential. Online platforms, institutional courses, and quant-driven hedge fund research provide valuable insights.

Visual: Hedge Framework for Professional Traders

A framework showing how professional traders select and implement hedge strategies step by step.

FAQ: Hedge Strategies for Professional Traders

1. What is the most effective hedge strategy for professionals?

It depends on portfolio composition. Options-based hedging is highly flexible, but futures are more efficient for large, standardized exposures. Professionals often combine multiple strategies for maximum effectiveness.

2. How do professional traders measure hedge success?

They use metrics such as hedge ratio, volatility reduction, and Sharpe ratio improvement. The key is not eliminating risk but optimizing the balance between protection and performance.

3. Are hedges always necessary for professional traders?

Not always. Some strategies, like momentum or arbitrage, inherently reduce risk. However, in volatile or uncertain markets, hedges are invaluable for protecting capital and stabilizing returns.

Conclusion

Hedging is an essential discipline for professional traders seeking to balance risk and return. From options-based approaches to quantitative hedging models, the choice depends on portfolio size, asset exposure, and risk tolerance. The most effective professionals treat hedging not as a one-time tactic but as an ongoing process of refinement and adaptation.

Whether you are managing an institutional portfolio or trading on a professional desk, mastering hedge strategies for professional traders ensures resilience in an unpredictable market landscape.

📢 What hedge strategies have you found most effective in your trading practice? Share your thoughts and pass this article to colleagues who can benefit from advanced hedging insights!

0 Comments

Leave a Comment