=======================================

Introduction

In the world of algorithmic and systematic trading, backtesting a quantitative strategy is the foundation of developing a profitable trading system. Backtesting enables traders, portfolio managers, and quantitative analysts to evaluate a strategy’s effectiveness using historical data before deploying it in live markets.

However, backtesting is not simply a matter of running code against old price data. To achieve robust, reliable, and realistic results, traders must understand how to structure tests, account for risks like overfitting, and interpret performance metrics.

In this comprehensive guide, we’ll walk through how to backtest a quantitative strategy, explore different methodologies, highlight common pitfalls, and provide actionable insights based on professional experience and industry best practices.

What is Backtesting in Quantitative Trading?

Definition

Backtesting is the process of applying a trading strategy to historical market data to determine how it would have performed in the past. This includes simulating trades, calculating profits and losses, and measuring risk-adjusted returns.

Why Backtesting is Important

- Validation: Confirms whether a strategy has predictive power or is just random noise.

- Risk Assessment: Identifies drawdowns and tail risks before live trading.

- Optimization: Helps refine parameters and execution rules.

- Confidence Building: Provides psychological reassurance to traders before committing capital.

Backtesting is not about predicting the future—it’s about learning whether a strategy has a statistically valid edge that could persist.

Core Steps in Backtesting a Quantitative Strategy

1. Define the Strategy

A strategy should have clear entry and exit rules. For example:

- Entry: Buy when the 50-day moving average crosses above the 200-day moving average.

- Exit: Sell when the reverse happens or after a fixed holding period.

2. Select Historical Data

- Type of Data: Price, volume, corporate actions, interest rates, or alternative datasets.

- Quality: Clean, adjusted for dividends/splits, and without survivorship bias.

- Frequency: Intraday, daily, weekly, depending on the strategy.

3. Simulate Trades

Execute the strategy step by step on the dataset, accounting for order execution rules and transaction costs.

4. Measure Performance Metrics

- CAGR (Compound Annual Growth Rate)

- Sharpe Ratio

- Sortino Ratio

- Maximum Drawdown

- Win Rate vs. Loss Rate

- Profit Factor

5. Validate and Stress-Test

Test under different market regimes (bull, bear, sideways) and across multiple assets to ensure robustness.

Two Common Backtesting Approaches

Method 1: Historical Simulation

Description

This approach directly applies a strategy to historical price data to simulate how it would have performed.

Advantages

- Simple and intuitive.

- Provides clear performance results using real past data.

- Easy to implement for most trading strategies.

Limitations

- Assumes that past conditions will repeat in the future.

- Susceptible to overfitting if parameters are excessively optimized.

- Does not account for structural market changes (regulations, liquidity shifts).

Best Use Case

Suitable for trend-following or mean-reversion strategies in liquid markets with stable characteristics.

Method 2: Monte Carlo Simulation

Description

Monte Carlo backtesting generates thousands of random simulations of trade sequences, volatility conditions, or execution slippage to test how a strategy might perform under uncertainty.

Advantages

- Models randomness and risk more realistically.

- Stress-tests strategies against extreme market conditions.

- Provides probability distributions of outcomes instead of a single performance curve.

Limitations

- More complex to implement and computationally intensive.

- Requires careful assumptions about distributions and market conditions.

Best Use Case

Useful for hedge funds, portfolio managers, and systematic traders who want to understand tail risks and drawdown probabilities before scaling capital.

Comparative Analysis: Historical Simulation vs. Monte Carlo

| Factor | Historical Simulation | Monte Carlo Simulation |

|---|---|---|

| Complexity | Low | High |

| Realism | Moderate | Strong |

| Computational Cost | Low | High |

| Stress Testing Ability | Weak | Strong |

| Use Case | Basic validation | Advanced risk analysis |

The best practice is often to combine both approaches: start with historical simulation for baseline validation, then use Monte Carlo to evaluate robustness under stress scenarios.

Key Considerations in Backtesting

Avoiding Overfitting

Overfitting happens when a strategy is excessively tailored to historical data, making it fail in real markets. Use out-of-sample testing and walk-forward analysis to minimize this risk.

Accounting for Transaction Costs

Ignoring spreads, commissions, and slippage leads to overly optimistic results. Hedge funds often simulate realistic execution costs to ensure accuracy.

Data Biases

- Survivorship Bias: Using only stocks that survived to the present day.

- Look-Ahead Bias: Using information not available at the time of trade.

- Selection Bias: Choosing data periods that favor the strategy.

Market Regime Sensitivity

Backtests must be validated across different market conditions, such as the 2008 financial crisis or the 2020 pandemic crash.

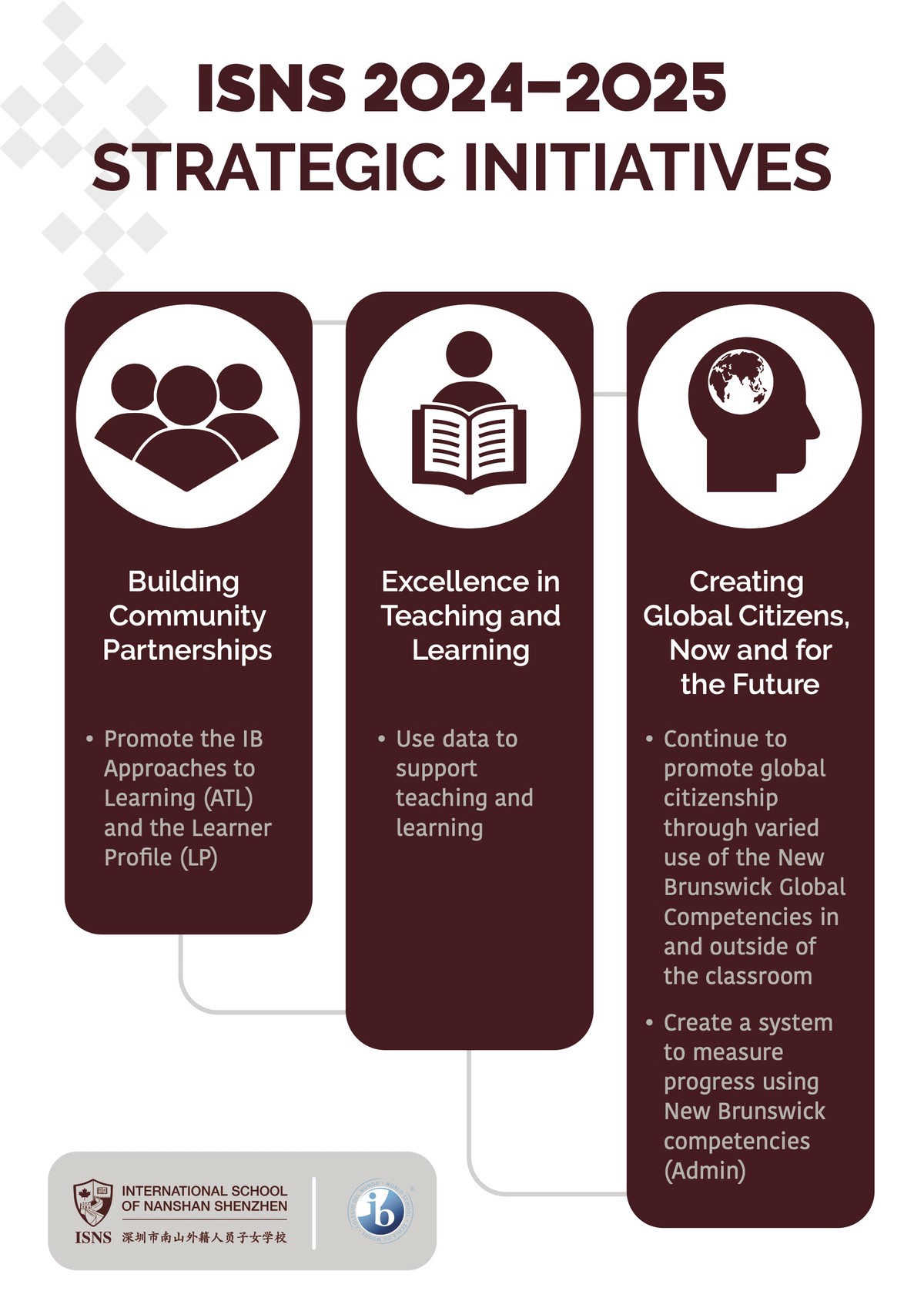

Visual Representation

Backtesting workflow for quantitative strategies: from data preparation to performance validation

Industry Trends in Backtesting

Cloud-Based Backtesting Platforms

Many hedge funds and retail quants now use platforms like QuantConnect and Backtrader that allow large-scale, cloud-powered backtests.

AI Integration

Machine learning is increasingly used to refine strategies and reduce overfitting.

Real-Time Paper Trading

Before going live, traders often run strategies in simulated real-time to validate performance outside of historical data.

Internal References

Before performing a backtest, it’s crucial to know how to develop a quantitative trading strategy that has clear, testable rules. Similarly, traders should understand why quantitative strategy fails in practice—often due to poor backtesting practices such as ignoring transaction costs or failing to test across regimes.

FAQs

1. How much historical data do I need to backtest a strategy?

It depends on the strategy’s timeframe. For daily or weekly strategies, 10–20 years of data is ideal. For high-frequency intraday strategies, even one year of tick data can be sufficient if it captures different volatility regimes.

2. How do I know if my backtest results are reliable?

Reliability comes from using out-of-sample testing, walk-forward validation, and testing across multiple assets. If performance metrics remain consistent, the results are more trustworthy.

3. Can backtesting guarantee future profits?

No. Backtesting provides insights into past performance and statistical robustness, but live trading involves slippage, market impact, and behavioral challenges that cannot be fully captured by backtests.

Conclusion

Knowing how to backtest a quantitative strategy effectively is one of the most critical skills for traders, quants, and portfolio managers. A well-designed backtest reveals both the strengths and weaknesses of a strategy, helping investors make informed decisions before committing real capital.

The optimal approach often involves combining historical simulation for baseline testing with Monte Carlo analysis for stress testing. By avoiding pitfalls like overfitting and survivorship bias, traders can ensure their strategies are both realistic and robust.

If this guide gave you new insights, please share it with fellow traders, comment below with your own backtesting experiences, and join the conversation. By learning from each other, we can improve the quality and reliability of quantitative strategies across the industry.

0 Comments

Leave a Comment