=========================================================

Introduction: Why Backtesting Matters in Trading

Backtesting is a cornerstone of quantitative trading and algorithmic strategy development. It allows traders to simulate strategies using historical data to evaluate their performance before risking real capital. For traders wondering how to backtest with Python, the language offers an unmatched ecosystem of libraries, tools, and community resources, making it the preferred choice for both beginners and professionals.

In this guide, we will cover the fundamentals of backtesting, explore multiple approaches, compare their pros and cons, and provide actionable insights on building robust trading strategies with Python. We will also integrate practical advice, industry best practices, and frequently asked questions to help you avoid common pitfalls and achieve consistent results.

What Is Backtesting?

The Core Concept

Backtesting is the process of applying a trading strategy to historical data to assess how it would have performed. The goal is to test profitability, risk, and robustness without exposing actual money.

Why Backtesting Is Crucial

- Risk Management: Prevents traders from running strategies blindly.

- Optimization: Helps refine entry/exit signals, stop-losses, and risk controls.

- Validation: Confirms whether a strategy aligns with real-world market dynamics.

Common Mistakes to Avoid

- Overfitting: Designing a strategy that only works on past data.

- Ignoring Costs: Failing to account for slippage, commissions, or liquidity.

- Data Snooping: Using too many parameters until something “fits.”

Why Use Python for Backtesting?

Python dominates quantitative finance because of its flexibility, simplicity, and extensive libraries. Compared to Excel, R, or MATLAB, Python strikes the best balance between ease of use, scalability, and community support.

- Pandas and NumPy make handling time-series data straightforward.

- Libraries like Backtrader, Zipline, and PyAlgoTrade offer out-of-the-box backtesting frameworks.

- Machine learning and statistical tools can be integrated seamlessly.

This is why Python is also the go-to language when exploring how Python improves trading strategies and enhancing performance through automation.

Setting Up Your Python Environment for Backtesting

Essential Libraries

- Pandas: Data handling.

- NumPy: Numerical computation.

- Matplotlib/Seaborn: Visualization.

- Backtrader or Zipline: Full backtesting engines.

- TA-Lib or pandas-ta: Technical indicators.

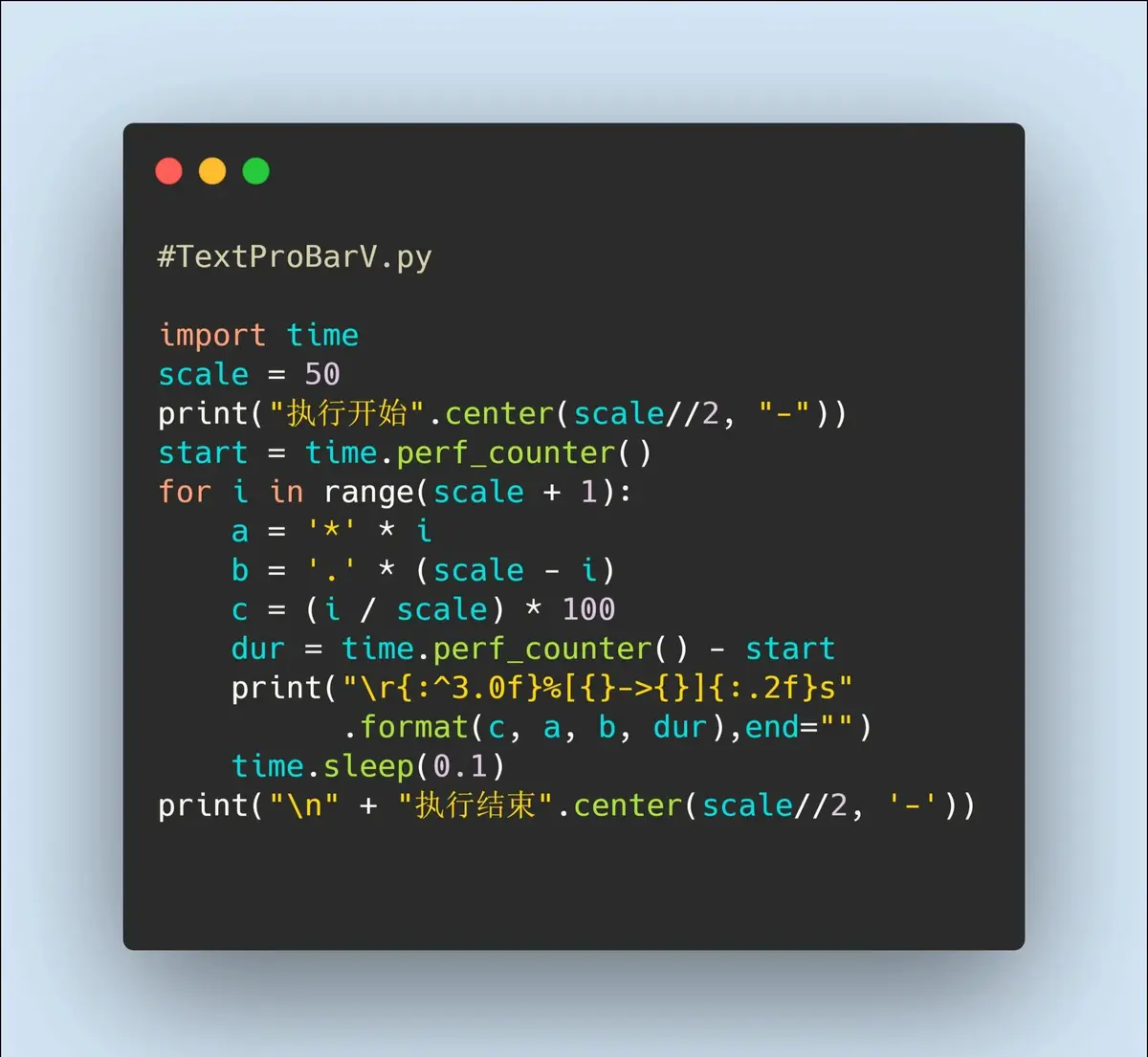

Example Environment Setup

bash

Copy code

pip install pandas numpy matplotlib backtrader pandas-ta

With this setup, you can easily load financial datasets, apply trading logic, and visualize performance.

0 Comments

Leave a Comment