=========================================

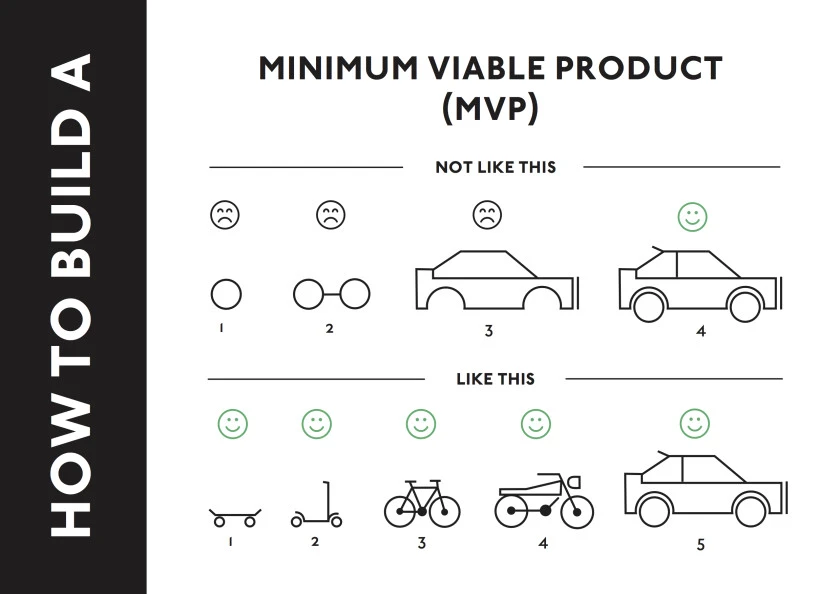

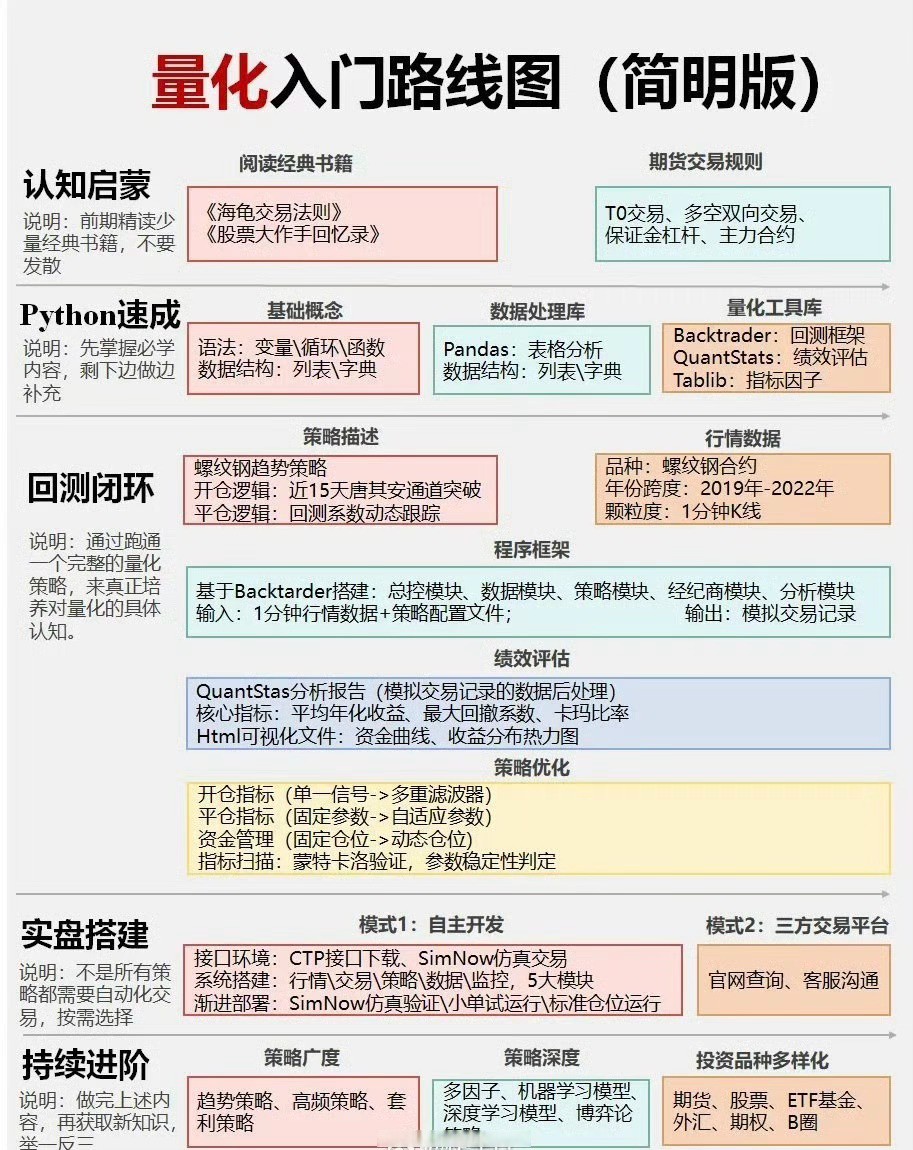

Quantitative trading models have become an essential tool for traders and investors looking to systematically analyze the markets and execute trades. These models use mathematical, statistical, and computational methods to identify patterns, forecast trends, and generate profitable trading strategies. Whether you are a beginner trying to understand the fundamentals or an experienced trader looking to refine your approach, building a solid quantitative trading model is key to success in today’s data-driven markets.

In this article, we will provide an in-depth guide on how to build a quantitative trading model, exploring various strategies, methodologies, and tools. We will also compare different techniques and offer expert advice on how to optimize your model for better performance.

What is a Quantitative Trading Model?

A quantitative trading model is a system that uses algorithms and mathematical formulas to predict market movements and execute trades. These models rely on large sets of historical data, statistical analysis, and computational power to make informed decisions, often without the need for human intervention.

Key Components of a Quantitative Trading Model:

- Data: The foundation of any quantitative model. This includes historical price data, trading volume, volatility, and macroeconomic indicators.

- Strategy: The trading logic or rules that the model will follow. This could be based on technical indicators, momentum, mean-reversion, or machine learning techniques.

- Execution: Once the model generates a trading signal, it must be executed. This involves sending orders to the market through an algorithmic trading system.

- Risk Management: Managing risk is essential to protect the portfolio. This could include stop-loss orders, portfolio diversification, and adjusting position sizes.

Step 1: Define Your Trading Strategy

The first step in building a quantitative trading model is to define a strategy. A strategy can be based on various factors such as technical analysis, fundamental analysis, or statistical arbitrage. It’s essential to choose a strategy that fits your risk profile, trading style, and the markets you plan to trade.

Types of Quantitative Trading Strategies:

- Trend Following: This strategy involves identifying and trading in the direction of the market trend. Common indicators include moving averages and momentum oscillators.

- Mean Reversion: This strategy is based on the idea that prices tend to revert to their historical mean. It’s often used in range-bound markets.

- Statistical Arbitrage: This strategy uses complex mathematical models to find price inefficiencies between related assets. It often involves high-frequency trading and requires significant computational resources.

- Machine Learning: Modern quantitative traders often employ machine learning algorithms to uncover patterns in the data that traditional statistical methods cannot identify.

Step 2: Gather and Prepare Data

Data is the backbone of any quantitative trading model. The accuracy and quality of your data will significantly impact your model’s performance. Here are some key types of data you will need:

Types of Data:

- Historical Price Data: The most commonly used data, including open, high, low, close prices (OHLC) and trading volume. This data is used for backtesting and creating indicators.

- Fundamental Data: Earnings reports, economic indicators, and company financials. This is often used in value-based trading strategies.

- Alternative Data: Social media sentiment, weather patterns, satellite imagery, and other non-traditional sources can provide valuable insights.

Once you have your data, you must clean and preprocess it. This involves handling missing values, adjusting for corporate actions (like stock splits), and normalizing the data to make it suitable for analysis.

Step 3: Build the Trading Algorithm

The next step is to translate your strategy into a mathematical algorithm. This is the core of the quantitative trading model. Depending on your strategy, the algorithm may use statistical methods, machine learning, or a combination of both.

Key Considerations for Building an Algorithm:

- Signal Generation: The algorithm must generate buy or sell signals based on specific criteria, such as a moving average crossover or a machine learning model’s prediction.

- Position Sizing: It is essential to decide how much capital to allocate for each trade. This can be based on the risk level of the trade, the market’s volatility, or other factors.

- Execution: The algorithm must send orders to the market, ensuring optimal entry and exit points while minimizing slippage and transaction costs.

Tools for Algorithm Development:

- Python: One of the most popular languages for quantitative trading due to its extensive libraries like NumPy, pandas, and scikit-learn.

- R: Known for its statistical capabilities and used heavily for data analysis and modeling.

- MATLAB: A high-level language often used for research and development of complex quantitative models.

- QuantConnect and Quantopian: These platforms provide cloud-based environments for developing and testing quantitative strategies.

Step 4: Backtest the Model

Backtesting is a critical step in the model-building process. It involves testing your algorithm on historical data to evaluate its performance. By doing this, you can identify issues such as overfitting, poor risk management, or an unsuitable strategy.

Backtesting Best Practices:

- Out-of-Sample Testing: Always keep a portion of your data aside to test the model after it’s developed, ensuring that it performs well on unseen data.

- Walk-Forward Analysis: This involves continuously retraining your model on new data as time progresses, which helps to maintain its robustness.

- Transaction Costs and Slippage: Ensure that your backtest accounts for real-world factors such as brokerage fees and slippage, which can significantly impact your strategy’s profitability.

Step 5: Implement Risk Management

Risk management is vital to ensure the longevity and profitability of your quantitative trading model. Without proper risk controls, even the best strategy can lead to significant losses.

Common Risk Management Techniques:

- Stop-Loss Orders: Automatically exit a position if the price moves against you by a certain amount.

- Position Sizing: Limit the size of each trade based on your risk tolerance or volatility of the asset.

- Diversification: Trade multiple assets to avoid putting all your capital into a single position.

Step 6: Evaluate and Optimize the Model

Once the backtesting is complete and the model is live, continuous evaluation and optimization are necessary. The market is constantly evolving, so periodic adjustments to your model may be required.

Metrics for Model Evaluation:

- Sharpe Ratio: Measures the risk-adjusted return of the model. A higher Sharpe ratio indicates better performance relative to risk.

- Maximum Drawdown: The largest peak-to-trough decline in the portfolio value. This measures the risk of significant loss.

- Profit Factor: The ratio of gross profits to gross losses. A higher profit factor indicates a more effective strategy.

FAQs: Quantitative Trading Models

1. How do I choose the best quantitative trading model?

Choosing the best model depends on your risk tolerance, trading style, and market conditions. For beginners, it’s advisable to start with simpler models such as moving average crossovers or mean reversion strategies. For more advanced traders, statistical arbitrage or machine learning models may offer higher returns, albeit with more complexity.

2. How do I backtest a quantitative trading model?

Backtesting involves running your model on historical data to simulate trades and evaluate performance. It’s important to use a separate testing set of data (out-of-sample testing) to prevent overfitting and ensure the strategy works on unseen data. Tools like Python, R, and platforms like QuantConnect can be used for backtesting.

3. Why do quantitative trading models fail?

Quantitative models can fail due to overfitting, poor data quality, or ignoring transaction costs. Models can also become obsolete if market conditions change significantly. It’s crucial to constantly monitor and update models to adapt to new data and evolving market dynamics.

Conclusion

Building a quantitative trading model involves several steps, including defining a strategy, gathering and preparing data, developing the algorithm, backtesting, and implementing risk management. By following a systematic approach and utilizing modern tools and techniques, traders can create models that are not only profitable but also robust and adaptive to market changes. Whether you’re just starting or refining an existing model, continuous learning and optimization are key to long-term success in quantitative trading.

Related Articles:

0 Comments

Leave a Comment