===================================================================

In the dynamic world of trading and investing, risk management is crucial. One of the most effective ways to protect your portfolio from market fluctuations is through hedging. However, with numerous hedge strategies available, selecting the best one for your unique situation can be challenging. This comprehensive guide will explore various hedge strategies, compare their advantages and disadvantages, and help you choose the best approach to safeguard your investments.

What is Hedging and Why is It Important?

Hedging refers to the practice of taking a position in a financial asset or instrument to offset potential losses in another investment. This strategy is designed to reduce risk exposure and provide a form of protection against unfavorable market movements. Whether you’re an institutional investor or a retail trader, hedging can be an essential tool in managing risk, especially in volatile markets.

The Importance of Hedging:

- Mitigates Risk: Hedging helps protect your portfolio from significant losses during market downturns.

- Stabilizes Returns: By balancing potential gains and losses, hedging strategies can lead to more stable returns over time.

- Enhances Portfolio Performance: Properly hedged portfolios can outperform non-hedged ones, especially in unpredictable markets.

- Reduces Volatility: It minimizes the impact of large price swings on your investments.

Different Types of Hedge Strategies

1. Options Hedging

Options hedging is one of the most popular techniques used by investors and traders to protect against downside risk. This strategy involves buying options contracts, such as put options, which give you the right to sell an asset at a predetermined price.

How It Works:

- Put Options: Investors purchase put options to lock in a price at which they can sell their assets. If the price of the underlying asset falls, the option increases in value, offsetting the losses in the asset itself.

- Call Options: Alternatively, call options can be used to protect against short positions. They allow investors to buy assets at a fixed price, potentially benefiting from upward price movements.

Advantages:

- Provides clear risk control with defined limits.

- Highly flexible and customizable.

- Can be used for both short-term and long-term hedging.

Disadvantages:

- Can be expensive, especially during high volatility periods.

- Requires a good understanding of options pricing and strategies.

- Might result in lower profits if the market does not move as expected.

Example of Strategy:

Suppose you hold 100 shares of a technology stock. To protect against a potential decline in its value, you buy one put option contract. If the stock price falls below the strike price, the put option allows you to sell at the pre-determined price, limiting your losses.

2. Futures Contracts

Futures contracts are another widely used hedge strategy, particularly in commodity and forex markets. These are agreements to buy or sell an asset at a specific price on a predetermined date.

How It Works:

- Long Futures Contracts: If you own an asset and expect its price to decline, you can sell futures contracts. If the asset’s price falls, the gains from the short futures position can offset the losses in the physical asset.

- Short Futures Contracts: On the other hand, if you’re short on an asset, you can hedge by purchasing futures contracts to lock in a selling price.

Advantages:

- Provides strong protection against significant price movements.

- Highly liquid, particularly in commodities and major currencies.

- Effective for long-term hedging needs.

Disadvantages:

- Futures contracts can be complex and require substantial capital.

- They may require margin calls if the market moves unfavorably.

- Limited flexibility compared to options.

Example of Strategy:

Imagine you’re a wheat farmer, and you’re concerned about a drop in wheat prices before your harvest. By selling wheat futures contracts, you lock in a selling price for your crop, ensuring a profit even if the market price falls.

3. Inverse ETFs (Exchange-Traded Funds)

Inverse ETFs are a popular hedging tool that moves in the opposite direction of a specific index or asset. These ETFs are designed to increase in value when the underlying asset or market declines.

How It Works:

- Short-Term Hedging: Inverse ETFs can be used for short-term hedging, as they are often designed to track daily price movements.

- No Margin Requirements: Unlike futures contracts, inverse ETFs do not require margin accounts and are accessible to individual investors.

Advantages:

- Easy to use and accessible for retail investors.

- No margin calls or complex strategies involved.

- Can be traded like any regular ETF on stock exchanges.

Disadvantages:

- Inverse ETFs can be volatile, especially in highly volatile markets.

- Not suitable for long-term hedging due to compounding effects over time.

- Often have higher expense ratios than traditional ETFs.

Example of Strategy:

An investor holding a diversified portfolio may use an inverse ETF that tracks the S&P 500 to hedge against a potential market downturn. If the market drops, the inverse ETF rises, helping offset the losses in the portfolio.

How to Choose the Best Hedge Strategy for Your Portfolio

Selecting the best hedge strategy depends on several factors, including your investment objectives, risk tolerance, and market conditions. Here’s how to make an informed decision:

1. Assess Your Risk Exposure

Before choosing a hedge strategy, evaluate your portfolio’s exposure to various risks, such as market downturns, interest rate changes, or commodity price fluctuations. The more volatile the asset, the higher the need for a hedge.

2. Understand Your Investment Horizon

- Short-Term Investments: For short-term investments, options and inverse ETFs may be more appropriate as they offer flexibility and immediate protection.

- Long-Term Investments: Futures contracts and options can provide more effective protection for long-term holdings by locking in prices and reducing risk exposure over an extended period.

3. Evaluate Costs and Complexity

- Options hedging can be costly, especially for retail investors, but it offers precise control over risk. In contrast, futures contracts are better for large-scale investors but require substantial capital and expertise.

- Inverse ETFs are easier to use but may not provide the same level of precision in risk management as futures or options.

4. Consider Market Conditions

During periods of high volatility, options hedging strategies can be more effective in providing short-term protection. However, in more stable market conditions, futures contracts or inverse ETFs may be better suited for protecting long-term investments.

5. Monitor Your Hedge Performance

Constantly evaluate the effectiveness of your hedge strategy. If market conditions change or if your risk exposure evolves, it might be necessary to adjust your hedging approach.

FAQ: Common Questions About Hedge Strategies

1. What is a hedge ratio in trading?

A hedge ratio refers to the proportion of the position being hedged to the size of the hedge. For example, if you’re holding 100 shares and want to hedge with 2 options contracts, the hedge ratio would be 2:100. This ratio helps determine how much of your position is protected.

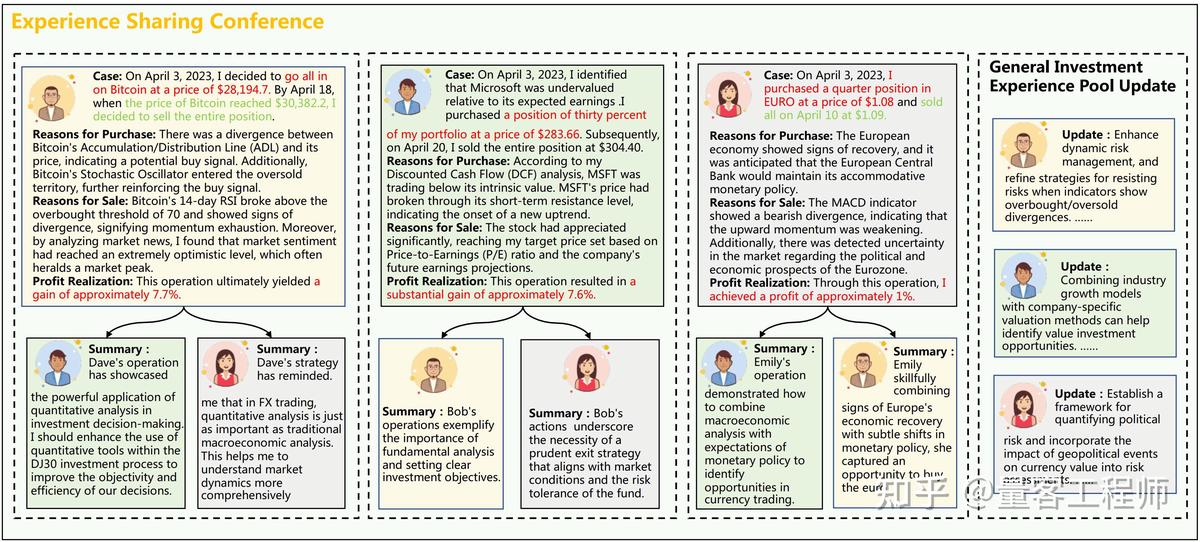

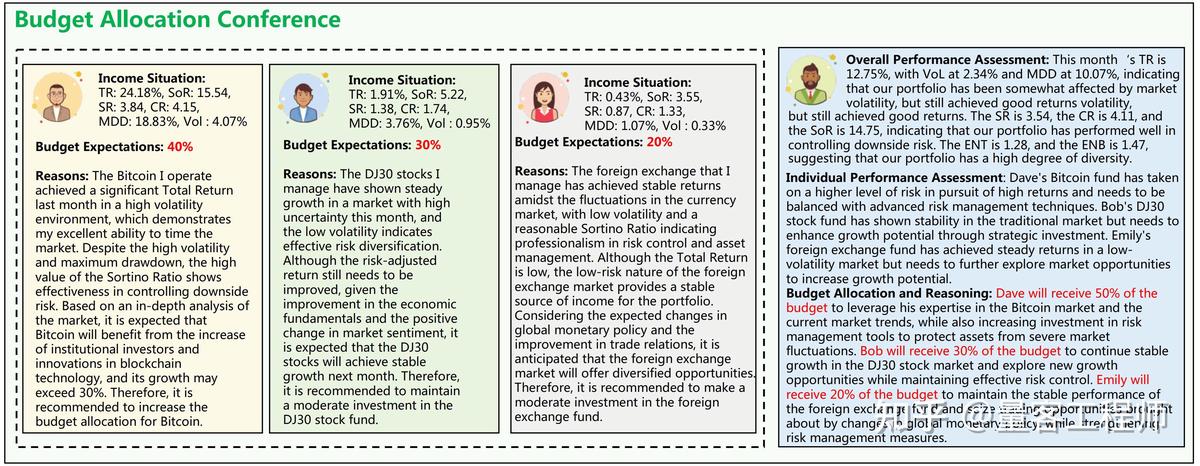

2. Why do hedge funds use quantitative trading strategies?

Hedge funds use quantitative trading strategies to identify profitable opportunities through statistical analysis. These strategies often involve hedging techniques to manage risk while optimizing returns. By leveraging algorithms and data, hedge funds can adapt their hedging strategies in real-time.

3. How do I assess hedge performance?

To assess hedge performance, track the hedged asset’s performance against the unhedged asset. If your hedge strategy is effective, it should reduce the volatility of your portfolio and minimize losses during market downturns.

Conclusion

Hedging is an essential aspect of managing risk in your investment portfolio, and choosing the best hedge strategy depends on your unique needs. Whether you opt for options hedging, futures contracts, or inverse ETFs, it’s important to assess your risk exposure, investment horizon, and market conditions to determine the most effective strategy.

By carefully selecting and monitoring your hedge, you can protect your investments from unexpected market movements and enhance your overall risk management framework.

0 Comments

Leave a Comment