=================================================

In the world of quantitative trading, speed, efficiency, and precision define success. Among all programming languages, C++ stands out as the gold standard for building high-performance trading systems. Whether it’s for developing execution algorithms, backtesting frameworks, or ultra-low latency strategies, C++ provides unmatched advantages in performance-critical environments. This article explores how C++ improves quantitative trading performance, compares it with other programming languages, highlights real-world strategies, and gives insights from practical experience.

Introduction to C++ in Quantitative Trading

Why C++ Matters in Financial Markets

Quantitative trading depends on processing vast amounts of financial data and executing trades in fractions of a millisecond. C++ is widely chosen because of its:

- Speed and low latency: Direct memory management and compiled code make it faster than Python, Java, or C#.

- Reliability: Used for mission-critical systems like exchanges and broker APIs.

- Control: Offers deep system-level access to optimize hardware utilization.

For traders, hedge funds, and financial institutions, C++ is not just a choice—it’s a competitive advantage.

C++ enables low-latency execution critical for high-frequency trading

Core Advantages of C++ for Quantitative Trading

1. Ultra-Low Latency Execution

Trading systems written in C++ often achieve nanosecond-level latency, which is critical in high-frequency trading (HFT) where microseconds decide profitability. For example, in equities and FX markets, being 0.1 milliseconds faster can mean capturing spreads before compe*****s.

2. High Throughput for Market Data Processing

C++ applications efficiently handle millions of ticks per second, parsing order books, price feeds, and depth-of-market data without bottlenecks.

3. Deterministic Performance

Unlike garbage-collected languages such as Java, C++ provides deterministic performance without unpredictable pauses, which is crucial for risk management and execution.

4. Extensive Libraries and Frameworks

Developers can integrate advanced quantitative models, numerical libraries, and trading APIs with C++ for a complete trading solution.

How C++ Improves Quantitative Trading Performance

Faster Order Execution

C++ minimizes execution delays by interfacing directly with exchange gateways, reducing network and processing overhead.

Optimized Backtesting

Quantitative researchers can simulate years of trading data at lightning speed, enabling faster strategy iteration.

Real-Time Risk Management

C++ risk engines calculate VaR (Value at Risk), stress tests, and margin requirements instantly, helping traders avoid catastrophic losses.

Hardware-Level Optimization

By leveraging multi-threading, SIMD instructions, and GPU acceleration, C++ trading systems maximize performance across CPUs and GPUs.

Comparing C++ with Other Languages

| Language | Pros | Cons | Use Case |

|---|---|---|---|

| C++ | Fastest execution, deterministic latency, hardware control | Complex to develop, steep learning curve | HFT, real-time trading engines |

| Python | Easy to prototype, rich libraries | Slower execution, dependent on wrappers | Research, signal generation |

| Java/C# | Balanced performance, easier memory management | Less control, garbage collection pauses | Mid-frequency trading, analytics |

While Python dominates research and prototyping, C++ remains the backbone for production trading systems where execution speed is non-negotiable.

Python accelerates research, but C++ dominates execution and infrastructure

Strategies Powered by C++

1. High-Frequency Trading (HFT) Strategies

C++ is the language of choice for HFT, enabling traders to execute market-making, arbitrage, and latency-sensitive strategies.

- Pros: Ultra-fast execution, direct exchange connectivity.

- Cons: Requires expensive infrastructure and expertise.

2. Execution Algorithms and Smart Order Routing

C++ powers algorithms like VWAP, TWAP, and implementation shortfall, efficiently routing trades across multiple venues.

- Pros: Reduces costs and slippage.

- Cons: Complex to design and test.

3. Quantitative Risk Management

Risk models built in C++ run simulations in real time, protecting portfolios against adverse price movements.

Methods to Boost Performance with C++

Multi-threading and Concurrency

By using C++’s threading libraries, trading systems can handle multiple tasks simultaneously, such as data parsing, risk evaluation, and execution.

Memory Optimization

Manual memory management reduces latency spikes, ensuring consistent trade execution speeds.

Code Profiling and Optimization

Learning how to optimize C++ code for trading systems allows developers to minimize bottlenecks and enhance throughput under real-time stress.

Practical Experience: Lessons Learned

From my own experience in developing trading systems:

- Prototype in Python, deploy in C++: This combination balances flexibility and speed.

- Focus on latency bottlenecks: Network I/O and order routing often matter more than raw computation.

- Test in live-like environments: Simulation doesn’t capture all exchange-specific nuances.

This hybrid approach saves development time while ensuring production-ready performance.

Optimization techniques in C++ reduce latency and maximize system throughput

Future Trends in C++ for Quantitative Trading

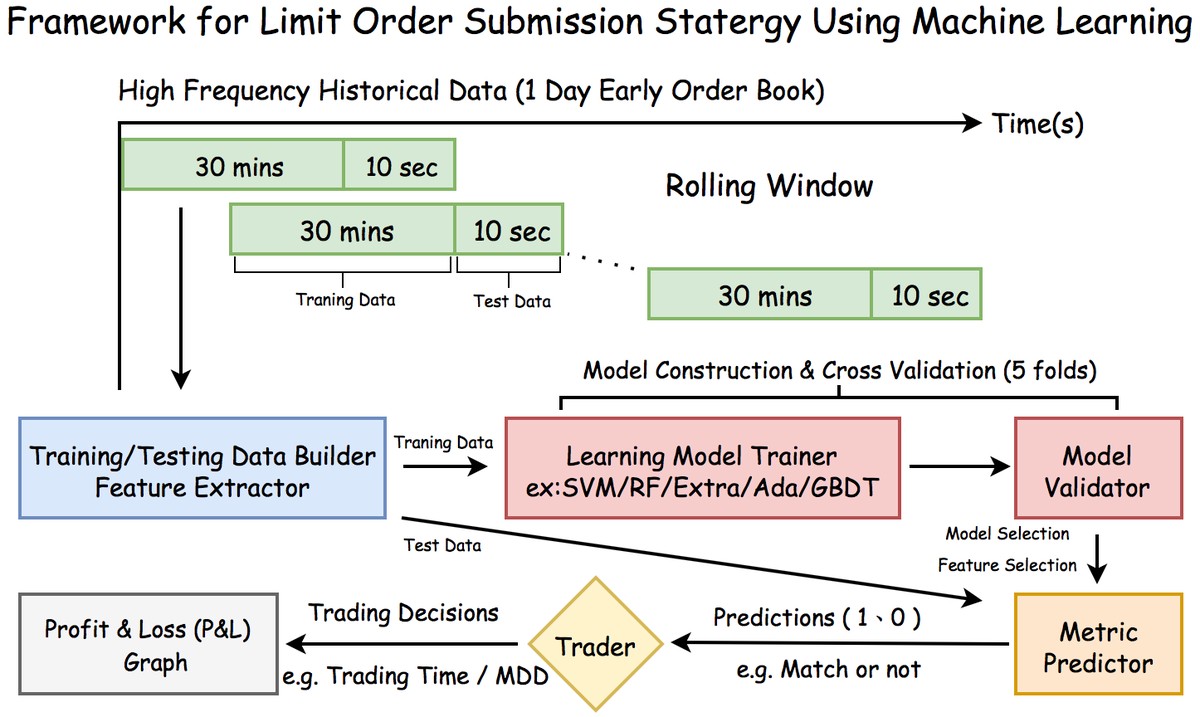

- AI and Machine Learning Integration: While models may be trained in Python, deployment in C++ ensures speed.

- GPU Acceleration: CUDA with C++ enhances backtesting and simulation performance.

- Hybrid Systems: Increasingly, quant firms adopt Python for research and C++ for live trading.

The future clearly points to C++ maintaining its dominance in performance-critical trading environments.

FAQ: How C++ Improves Quantitative Trading Performance

1. Why is C++ preferred for high-frequency trading?

C++ provides ultra-low latency and deterministic execution, making it ideal for strategies where microseconds define profitability. Its ability to directly manage memory and hardware resources ensures maximum efficiency.

2. Can beginners use C++ for quantitative trading?

Yes, but it has a steep learning curve. Beginners should start with smaller projects, leveraging resources like How to use C++ for quantitative trading, before building advanced systems. Pairing C++ with Python can help balance learning speed and system performance.

3. How can I optimize C++ trading systems for better results?

Key techniques include:

- Using lock-free data structures for concurrency.

- Profiling code to identify performance bottlenecks.

- Leveraging SIMD and GPU acceleration.

- Minimizing unnecessary abstractions in critical code paths.

Final Thoughts

C++ continues to improve quantitative trading performance by offering speed, control, and scalability unmatched by other programming languages. While Python and other languages enhance research productivity, C++ ensures strategies are executed in real-time with minimal latency.

For traders, developers, and institutions, investing in C++ expertise is not optional—it’s essential. The combination of Python for research and C++ for deployment is emerging as the most effective approach for today’s trading landscape.

If this article helped you understand the role of C++ in trading, share it with your peers and leave a comment: Do you prefer building your trading systems entirely in C++, or do you combine it with Python for research flexibility?

0 Comments

Leave a Comment