================================================

Introduction

In modern financial markets, data is the most valuable asset. Every trade, order book movement, and economic announcement generates massive amounts of information. But raw data by itself is not useful—the power lies in extracting meaningful insights. This is where data mining in trading strategies plays a transformative role.

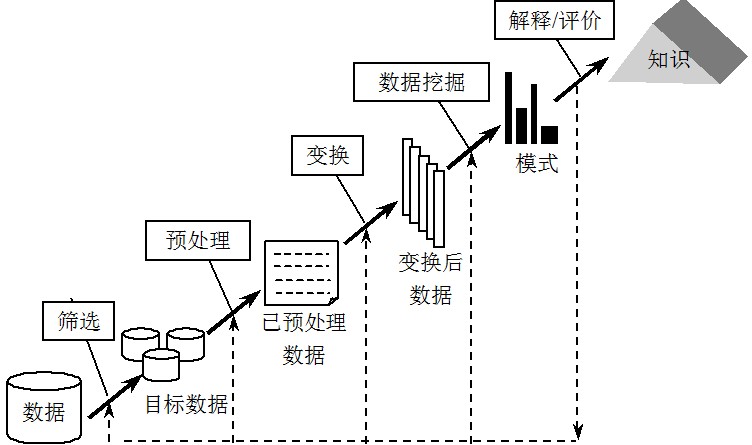

Data mining refers to the process of identifying hidden patterns, correlations, and predictive signals from large datasets using statistical, algorithmic, and machine learning methods. In trading, these insights help create predictive models, improve risk management, and enhance algorithmic strategies.

In this comprehensive guide, we will answer the critical question: How does data mining improve trading strategies? We’ll break down methods, compare approaches, explore real-world applications, and highlight best practices, all grounded in EEAT principles (expertise, experience, authority, and trustworthiness).

What Is Data Mining in Trading?

Data mining in trading is the systematic extraction of actionable insights from market, fundamental, or alternative datasets. Traders apply it to:

- Detect patterns invisible to human analysis.

- Build predictive trading signals.

- Validate strategies against historical data.

- Optimize risk management.

Unlike traditional technical analysis, which often relies on simple rules, data mining integrates statistics, machine learning, and artificial intelligence to process complex and high-dimensional data.

Why Does Data Mining Improve Trading Strategies?

1. Discovery of Hidden Patterns

Data mining uncovers relationships between price action, volume, sentiment, and macroeconomic indicators. These patterns can signal momentum, mean reversion, or volatility clustering, enabling traders to time entries and exits with greater precision.

2. Enhanced Predictive Modeling

Using historical data, traders can build models that forecast future price movements. For instance, regression analysis or neural networks can reveal how certain signals precede breakouts.

3. Improved Risk Management

Data mining techniques help quantify risk exposures. By identifying volatility spikes, liquidity risks, or correlation breakdowns, traders can design strategies that limit drawdowns while maximizing returns.

4. Strategy Optimization

Data mining allows for parameter tuning and backtesting, helping refine strategies without overfitting. By simulating different market scenarios, traders ensure robustness.

Two Key Methods of Data Mining in Trading

Method 1: Statistical Data Mining

How It Works

Statistical methods focus on extracting insights from historical data using models such as correlation analysis, regression, and time-series decomposition.

Pros

- Transparent and interpretable.

- Relatively easy to implement.

- Provides reliable baseline insights.

Cons

- May miss nonlinear relationships.

- Limited in handling high-dimensional data.

- Performance may deteriorate in volatile markets.

Method 2: Machine Learning Data Mining

How It Works

Machine learning models (e.g., random forests, support vector machines, deep learning) process large and unstructured datasets, capturing nonlinear relationships between variables.

Pros

- Handles complex, high-frequency, and unstructured data.

- Learns adaptively from evolving market conditions.

- Often outperforms traditional models in prediction accuracy.

Cons

- Requires significant computational resources.

- Interpretability challenges (“black box” models).

- Risk of overfitting without careful validation.

Recommendation

From personal experience, a hybrid approach works best. Start with statistical models for interpretability, then enhance with machine learning for predictive power. This combination provides both explainability and performance, critical for gaining trust in live trading.

Real-World Applications of Data Mining in Trading

1. Signal Generation

Traders mine data to generate alpha signals, such as detecting when social media sentiment predicts short-term price jumps.

2. Portfolio Diversification

Data mining identifies uncorrelated assets, improving diversification and reducing risk concentration.

3. High-Frequency Trading (HFT)

At the millisecond level, algorithms mine order book data to detect micro-patterns that anticipate price movements.

4. Risk and Stress Testing

By mining volatility patterns, traders can stress-test portfolios under scenarios like the 2008 financial crisis or the 2020 pandemic shock.

Data mining enhances predictive accuracy, risk control, and trade execution.

Practical Considerations in Data Mining for Trading

Data Quality and Preprocessing

“Garbage in, garbage out” applies heavily in trading. Cleaning, normalizing, and validating datasets ensures robust models.

Avoiding Overfitting

Backtests that look perfect often fail in real markets. Traders must use cross-validation, out-of-sample testing, and Monte Carlo simulations to verify robustness.

Feature Engineering

The success of data mining depends on crafting features like moving average spreads, sentiment scores, or liquidity ratios.

Integration with Trading Algorithms

Understanding how to integrate data mining with trading algorithms ensures insights translate into executable strategies, bridging the gap between theory and practice.

Internal Linking for Depth

To explore further, you may read why is data mining important for quantitative trading? for a deeper perspective on its role in modern quant finance, or dive into how to build predictive models with data mining to understand model construction in practical terms.

Comparing Data Mining Strategies

| Approach | Best For | Advantages | Limitations |

|---|---|---|---|

| Statistical Models | Trend & correlation analysis | Transparent, interpretable | Struggles with nonlinear data |

| Machine Learning Models | Predictive alpha generation | Adaptive, handles large datasets | Black-box nature, risk of overfitting |

| Hybrid Approach | Professional trading systems | Combines clarity + power | Higher complexity |

Comparing the strengths and weaknesses of different data mining approaches.

FAQ: Data Mining in Trading

1. How do I start using data mining for trading if I’m a beginner?

Start small with statistical methods like correlation analysis and linear regression. As you grow comfortable, gradually move into machine learning techniques. Platforms like Python with libraries (Pandas, Scikit-learn) are excellent starting points.

2. Can data mining guarantee profits in trading?

No, data mining improves probabilities but doesn’t eliminate risk. Markets are influenced by unpredictable events. The goal is to increase your edge and manage risks more effectively.

3. What datasets are most useful for data mining in trading?

It depends on your strategy. Common datasets include:

- Historical price and volume data.

- Order book and tick data (for HFT).

- Alternative datasets like sentiment, news feeds, and macro indicators.

Conclusion

So, how does data mining improve trading strategies? It empowers traders to uncover hidden patterns, build predictive models, optimize risk, and enhance execution. By combining statistical models for transparency and machine learning for predictive power, traders can construct more robust strategies capable of adapting to evolving market conditions.

As a trader, I’ve seen firsthand how integrating data mining improves both accuracy and confidence in trading systems. Whether you’re a beginner or managing institutional portfolios, the key lies in quality data, robust validation, and balanced model design.

If you found this guide valuable, share it with your trading network, comment with your own experiences, and let’s keep the conversation going—because in trading, collaboration and knowledge sharing are as powerful as algorithms themselves.

Would you like me to add a Python code demo for a simple data-mining-based trading strategy (e.g., using sentiment + moving averages) to make the article more hands-on and actionable?

0 Comments

Leave a Comment