=============================================

High-frequency trading (HFT) is a form of algorithmic trading that uses powerful computers and advanced mathematical models to execute thousands or even millions of trades within fractions of a second. These strategies are designed to capitalize on very small price movements, often measured in microseconds or milliseconds. With its massive scale, speed, and technical complexity, developing HFT models has become a competitive advantage for institutional traders. In this article, we’ll explore the key aspects of how to develop high-frequency trading models, focusing on the required technologies, strategies, and methods to build an efficient trading system.

Table of Contents

Understanding High-Frequency Trading

Key Components for Building High-Frequency Trading Models

- 1. Data Collection and Preprocessing

- 2. Algorithm Design

- 3. Hardware and Infrastructure

- 4. Risk Management

- 1. Data Collection and Preprocessing

Different Strategies in High-Frequency Trading

- 1. Market Making

- 2. Statistical Arbitrage

- 3. Event-Driven Strategies

- 1. Market Making

How to Optimize Your High-Frequency Trading Model

Risks and Challenges in High-Frequency Trading

Tools and Platforms for High-Frequency Trading

FAQ

Conclusion

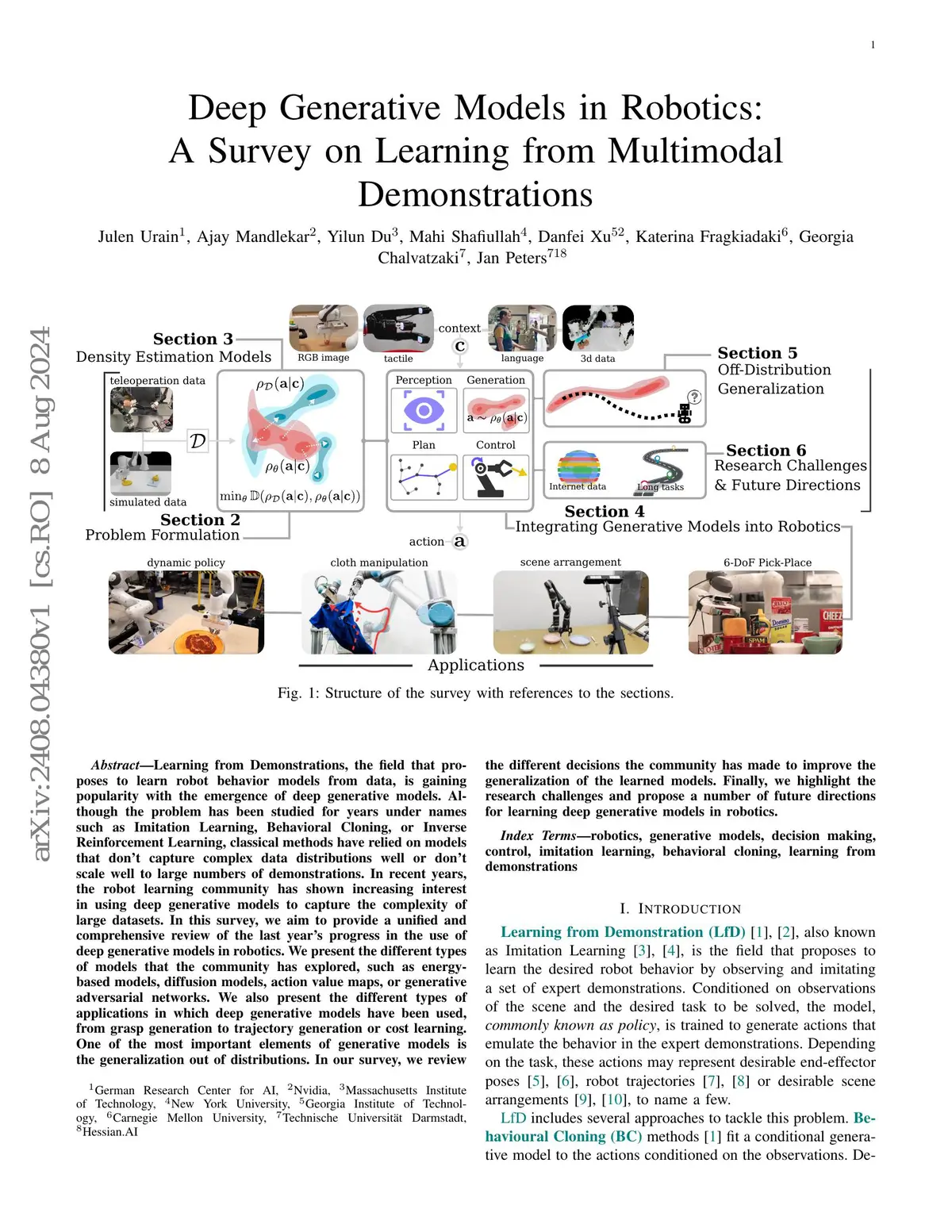

Understanding High-Frequency Trading

High-frequency trading is characterized by the use of sophisticated algorithms and high-speed data networks to make trades at extremely fast speeds. HFT algorithms rely on advanced mathematical models, historical data, and real-time market conditions to make decisions in milliseconds.

The Importance of Speed

Speed is a crucial factor in HFT. The goal is to capitalize on market inefficiencies that exist for only a fraction of a second, often taking advantage of tiny price discrepancies that the human eye or slower algorithms cannot detect. The effectiveness of HFT models is largely based on having access to the most accurate, up-to-date information, and executing trades faster than compe*****s.

Types of High-Frequency Trading

High-frequency trading includes several types of strategies:

- Market Making: Providing liquidity by quoting both buy and sell prices.

- Statistical Arbitrage: Using statistical models to predict price movements and exploit price inefficiencies.

- Event-Driven: Making trades based on real-time events like earnings reports, economic announcements, or geopolitical events.

Key Components for Building High-Frequency Trading Models

To build an effective high-frequency trading model, you must consider several key components: data collection, algorithm design, hardware infrastructure, and risk management.

1. Data Collection and Preprocessing

Data is the lifeblood of any HFT model. Real-time market data, including price feeds, bid-ask spreads, volume, and historical data, must be continuously monitored and processed. Accurate and low-latency data feeds are critical to the success of HFT strategies.

- Market Data: Consists of real-time data like price movements, order book depth, and recent trades.

- Tick Data: Includes every change in price, time-stamped, and can be used for high-precision backtesting.

- Alternative Data: Non-traditional data sources like social media sentiment, news feeds, and economic indicators.

Data preprocessing involves cleaning and transforming this data into a format that can be processed efficiently by algorithms, ensuring that models are not delayed by data noise.

2. Algorithm Design

The design of the algorithm is the most crucial step in high-frequency trading model development. The algorithm determines how data is processed, how trades are executed, and the logic behind trade decisions.

There are several types of algorithms used in HFT:

- Mean Reversion Algorithms: Based on the assumption that price will eventually return to its historical average.

- Trend-Following Algorithms: Designed to exploit market trends, either short-term or long-term.

- Arbitrage Algorithms: These algorithms exploit pricing discrepancies between different exchanges or related assets.

Backtesting is a critical process in algorithm design. Before deploying a model live, it should be tested using historical data to ensure that it behaves as expected under different market conditions.

3. Hardware and Infrastructure

Given the speed required for high-frequency trading, the hardware infrastructure is just as important as the algorithm. This involves optimizing both the physical servers and the network infrastructure to ensure minimal latency.

- Co-location: Placing your servers near exchange servers to reduce communication delay.

- FPGAs (Field-Programmable Gate Arrays): Specialized hardware used to speed up complex calculations.

- Low-Latency Networks: High-speed connections that allow algorithms to transmit data quickly.

Hardware optimization is a continuous process, and even slight improvements can lead to substantial gains in profitability.

4. Risk Management

High-frequency trading strategies are not immune to risks. In fact, the speed of execution and high-frequency nature of trading introduce additional risks, such as:

- Market Risk: Sudden market moves can trigger unexpected losses.

- Systematic Risk: Failures in the system can cause cascading effects across multiple trades.

- Liquidity Risk: HFT strategies depend on liquidity, and sudden market changes can leave positions illiquid.

To manage these risks, you need to implement robust stop-loss mechanisms, real-time monitoring, and fail-safe mechanisms that can halt trading in case of unexpected events.

Different Strategies in High-Frequency Trading

Here are some of the most commonly used high-frequency trading strategies:

1. Market Making

Market-making strategies involve continuously quoting both bid and ask prices for a given asset. The goal is to profit from the spread between buying and selling prices.

Advantages:

- Steady stream of income from bid-ask spreads.

- High liquidity provision.

Disadvantages:

- Exposed to market volatility and the risk of holding a position for too long.

2. Statistical Arbitrage

Statistical arbitrage relies on statistical models to predict future price movements based on historical data. These algorithms can detect short-term price discrepancies between related assets or markets and trade to profit from them.

Advantages:

- Can capitalize on small, short-term inefficiencies.

- Does not rely on market direction.

Disadvantages:

- Requires sophisticated statistical models.

- Exposed to model risk and overfitting.

3. Event-Driven Strategies

Event-driven strategies react to news, earnings reports, economic announcements, or other events that can affect asset prices. These models react to the event as it unfolds in real-time.

Advantages:

- Can exploit large price movements triggered by news events.

- Ability to adapt to changing market conditions.

Disadvantages:

- Requires a reliable news feed and fast processing.

- Prone to significant risks if the event is misinterpreted.

How to Optimize Your High-Frequency Trading Model

Optimization is key to success in high-frequency trading. Below are some of the ways to improve your models:

- Reduce Latency: Minimizing latency is essential for competitive advantage. Optimizing code, using co-location, and employing faster hardware can significantly reduce delays.

- Backtest Thoroughly: Test your strategy against a variety of market conditions to ensure robustness.

- Leverage Machine Learning: Incorporating machine learning can help your algorithm adapt to new market conditions and improve decision-making.

- Diversify: Use multiple strategies to diversify risk and reduce the impact of adverse market conditions.

Risks and Challenges in High-Frequency Trading

While high-frequency trading can be highly profitable, it also presents several challenges and risks, including:

- Market Impact: Large, rapid trades can disrupt market stability.

- Technological Failures: Even the smallest failure in the algorithm or hardware can lead to catastrophic losses.

- Regulatory Risks: Governments and regulatory bodies are increasingly focused on HFT practices, which could lead to increased scrutiny or restrictions.

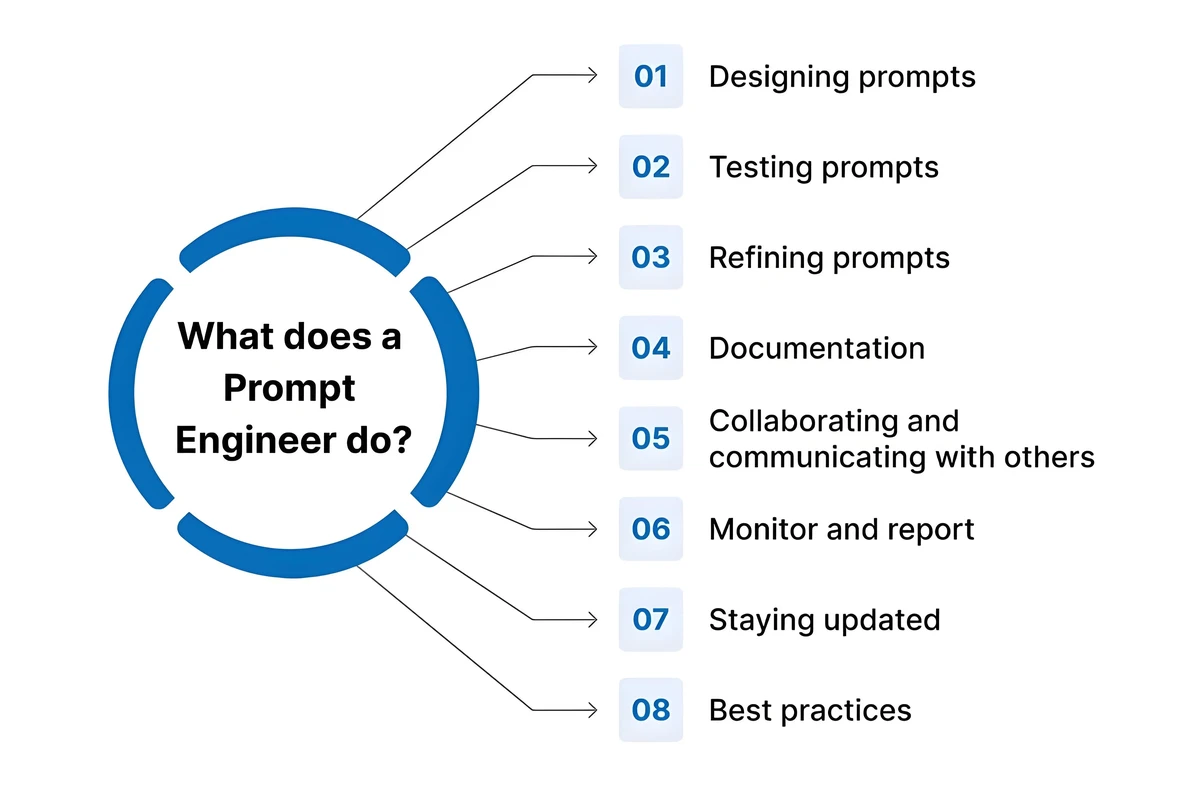

Tools and Platforms for High-Frequency Trading

To implement high-frequency trading successfully, you need reliable platforms and tools that support low-latency execution, backtesting, and data analysis.

- MetaTrader 5 (MT5): A widely used platform for algorithmic trading with extensive backtesting and automation features.

- QuantConnect: An open-source algorithmic trading platform that provides access to global markets and historical data.

- Interactive Brokers: A brokerage that offers low-latency execution for professional HFT traders.

FAQ

1. How does high-frequency trading work?

High-frequency trading involves the use of algorithms to execute trades at extremely high speeds. Traders use these algorithms to capitalize on small price discrepancies in the market, making thousands or millions of trades per day.

2. What strategies are used in high-frequency trading?

Common strategies in HFT include market-making, statistical arbitrage, and event-driven trading. Each strategy focuses on exploiting different market inefficiencies using real-time data and complex algorithms.

3. How can I reduce the risk in high-frequency trading?

Risk management in HFT involves using fail-safe mechanisms, implementing stop-loss strategies, reducing latency, and diversifying trading strategies. It’s crucial to backtest thoroughly and ensure that your infrastructure is optimized for speed and reliability.

Conclusion

Developing high-frequency trading models requires a combination of technical expertise, fast infrastructure, and a solid understanding of market dynamics. By focusing on key components such as

0 Comments

Leave a Comment