=================================================================================

Introduction

Backtesting is the backbone of quantitative and algorithmic trading. It allows traders to simulate how a strategy would have performed historically before risking capital in live markets. However, the accuracy of backtesting determines whether those results are meaningful or misleading. Traders often overestimate profitability because of poor data quality, unrealistic assumptions, or methodological flaws.

This article provides a comprehensive guide on how to improve backtesting accuracy by exploring best practices, common pitfalls, and advanced optimization methods. We’ll analyze multiple approaches, compare their pros and cons, and provide actionable advice grounded in both professional practice and the latest industry trends.

By the end, you’ll have a clear roadmap to building reliable backtests that not only look good on paper but also translate into real-world performance.

Why Backtesting Accuracy Matters

Accurate backtesting is essential because:

- Prevents overfitting – Avoids strategies that only work in hindsight.

- Builds confidence – Gives traders conviction to execute trades under pressure.

- Improves capital allocation – Helps assess risk-adjusted returns.

- Guides optimization – Identifies which parameters truly impact performance.

If accuracy is compromised, backtesting can become dangerous—providing false assurance that leads to unexpected drawdowns when strategies are deployed. This is why understanding why backtesting is important in finance is a foundation for every trader, whether retail or institutional.

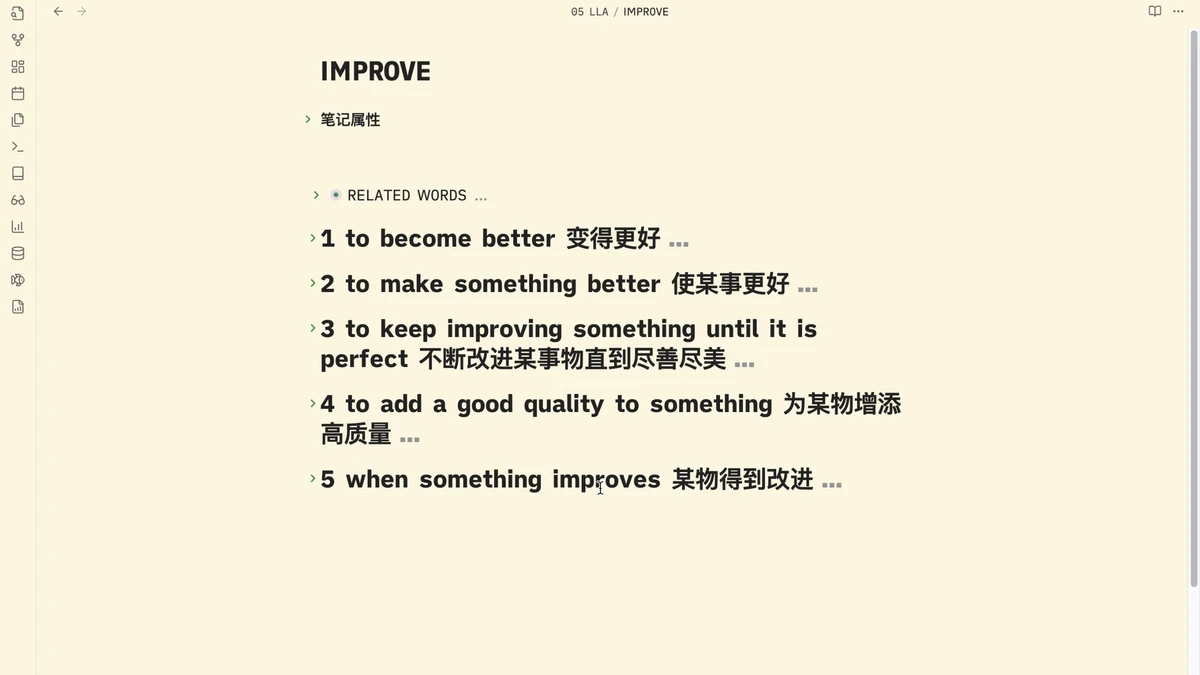

A structured workflow for improving backtesting accuracy

Common Issues That Reduce Backtesting Accuracy

1. Survivorship Bias

Using only current assets (stocks, ETFs) and ignoring those that were delisted inflates performance unrealistically.

2. Look-Ahead Bias

Accidentally using data that would not have been available at the time of trading leads to overly optimistic results.

3. Poor Data Quality

Missing ticks, incorrect pricing, or adjusted-for-dividend errors can drastically alter outcomes.

4. Ignoring Transaction Costs

Failing to include commissions, spreads, and slippage can turn profitable strategies into unprofitable ones.

5. Overfitting Parameters

Over-optimizing based on historical data creates a fragile strategy that fails in live conditions.

How to Improve Backtesting Accuracy

1. Use High-Quality Historical Data

Accurate data is the foundation of reliable backtests. Choose providers offering tick-level or minute-level data with adjustments for corporate actions.

Pros:

- Captures realistic price action

- Minimizes errors caused by missing values

Cons:

- More expensive

- Computationally intensive

Personal insight: In my experience, upgrading from daily to intraday data significantly improved the predictive power of short-term strategies.

2. Incorporate Transaction Costs and Slippage

Model all realistic costs, including:

- Broker commissions

- Bid-ask spreads

- Market impact for large orders

This avoids unrealistic profit margins.

Pros: Reflects real-world performance

Cons: More complex modeling required

3. Apply Walk-Forward Testing

Walk-forward testing divides historical data into in-sample (for optimization) and out-of-sample (for testing). This mimics real-world conditions by preventing look-ahead bias.

Pros:

- Reduces overfitting

- Provides robust validation

Cons:

- Requires more computational effort

4. Run Monte Carlo Simulations

Instead of relying on a single equity curve, Monte Carlo resamples returns to test strategy robustness under different market conditions.

Pros:

- Exposes potential drawdowns

- Stress-tests strategy reliability

Cons:

- Results may be harder to interpret

5. Multi-Market and Multi-Timeframe Testing

Test strategies across multiple assets and timeframes. A truly robust strategy should not rely on a single market.

Pros:

- Improves generalization

- Identifies hidden weaknesses

Cons:

- Longer testing process

6. Avoid Overfitting with Fewer Parameters

Simplicity often outperforms complexity. Strategies with fewer moving parts are easier to replicate and less prone to curve fitting.

Pro tip: If you must optimize, use walk-forward optimization and test out-of-sample performance before deploying.

Backtesting framework highlighting best practices

Comparing Two Backtesting Accuracy Improvement Methods

Walk-Forward Testing vs. Monte Carlo Simulation

| Factor | Walk-Forward Testing | Monte Carlo Simulation |

|---|---|---|

| Focus | Preventing overfitting and look-ahead bias | Stress-testing randomness and drawdowns |

| Pros | Replicates real-world trading decisions | Provides statistical confidence intervals |

| Cons | Computationally demanding | Results harder for beginners to interpret |

| Best Use Case | Parameter optimization and model validation | Robustness testing for live-deployed systems |

Recommendation: Use walk-forward testing for validation and Monte Carlo for robustness. Combining both gives the most accurate picture.

Advanced Trends in Improving Backtesting Accuracy

- AI-driven backtesting – Machine learning models can adaptively adjust strategies but risk overfitting.

- Event-driven simulation – Instead of bar-by-bar, models simulate actual order execution in real time.

- Cloud-based platforms – Institutions now rely on distributed computing for faster, large-scale backtesting.

For those just starting, exploring how to backtest with Python provides a flexible and scalable way to implement advanced techniques while still controlling accuracy.

Personal Advice from Experience

Early in my career, I tested a moving average crossover system on daily stock data. The results were spectacular—until live trading began. Ignoring transaction costs and using only surviving stocks caused a 25% drawdown. After upgrading to cleaner data, including realistic costs, and applying walk-forward testing, performance stabilized into a sustainable strategy.

FAQ: How to Improve Backtesting Accuracy

1. Why do most backtests fail in live trading?

Backtests often fail because of overfitting, ignoring transaction costs, or using biased data. Real markets behave more chaotically than historical patterns suggest.

2. How can I validate whether my backtest is reliable?

Use out-of-sample testing, Monte Carlo simulations, and test strategies across multiple assets and timeframes. A robust strategy should perform consistently under varied conditions.

3. What data should I use for accurate backtesting?

High-quality tick or minute data from reliable providers is best. Ensure it includes corporate actions, dividends, and adjustments to avoid survivorship bias.

4. Is Python suitable for professional backtesting?

Yes, Python is widely used by professionals. With libraries like Backtrader, Zipline, and QuantConnect, it supports high-accuracy backtesting and realistic order simulations.

Conclusion

Improving backtesting accuracy is not about finding the perfect curve-fit—it’s about creating realistic, robust, and repeatable strategies. By addressing biases, modeling transaction costs, applying walk-forward testing, and validating with Monte Carlo simulations, traders can bridge the gap between historical performance and live execution.

Accurate backtesting is your safety net in trading—protecting you from false confidence and helping you make smarter, data-driven decisions.

👉 What’s your go-to method for improving backtesting accuracy? Share your thoughts in the comments.

👉 If you found this guide helpful, share it with fellow traders to promote better trading practices.

Would you like me to also create a downloadable backtesting checklist (PDF) summarizing these accuracy-improving steps so traders can follow it step by step?

0 Comments

Leave a Comment