=============================================================

Understanding how to interpret correlation in quantitative stock selection is a cornerstone skill for traders, portfolio managers, and quantitative researchers. Correlation is more than just a statistical measure—it’s a tool to evaluate diversification, reduce portfolio risk, and uncover hidden market relationships. In quantitative strategies, interpreting correlation correctly can mean the difference between consistent alpha generation and devastating drawdowns.

This comprehensive guide will cover the meaning of correlation in stock selection, practical ways to use it, pitfalls to avoid, and expert insights. We will explore at least two different approaches—traditional correlation analysis vs. advanced machine learning-based techniques—and compare their strengths and weaknesses. By the end, you’ll have a professional-level understanding of correlation’s role in quantitative stock selection.

Understanding Correlation in Quantitative Stock Selection

What Is Correlation?

Correlation measures the statistical relationship between two variables, often expressed as a coefficient ranging from -1 to +1:

- +1 (Perfect Positive Correlation): Both assets move in the same direction consistently.

- -1 (Perfect Negative Correlation): Assets move in opposite directions.

- 0 (No Correlation): No linear relationship exists.

In quantitative stock selection, correlation is applied to identify stocks with similar or contrasting movements, helping traders manage risk and find opportunities.

Why Is Correlation Important?

Correlation matters because it directly impacts diversification and portfolio performance. A portfolio of highly correlated stocks may offer little risk reduction. On the other hand, a portfolio with low or negative correlations allows for better diversification and smoother returns.

This aligns with modern portfolio theory (MPT), where diversification through correlation analysis is central to risk-adjusted return optimization.

Methods to Interpret Correlation in Stock Selection

1. Traditional Correlation Matrix Analysis

A correlation matrix is one of the most common tools in quant trading. It visually displays correlations between multiple assets, usually in a heatmap format.

Advantages:

- Easy to compute using tools like Python’s

pandasor R.

- Effective for identifying clusters of similar stocks.

- Widely used by hedge funds and institutional traders.

- Easy to compute using tools like Python’s

Drawbacks:

- Captures only linear relationships.

- May miss non-linear dependencies.

- Can be misleading during market stress when correlations converge toward +1.

- Captures only linear relationships.

For traders asking “How does correlation affect quantitative trading?”, the answer lies here: it influences everything from pair trading setups to sector rotation strategies.

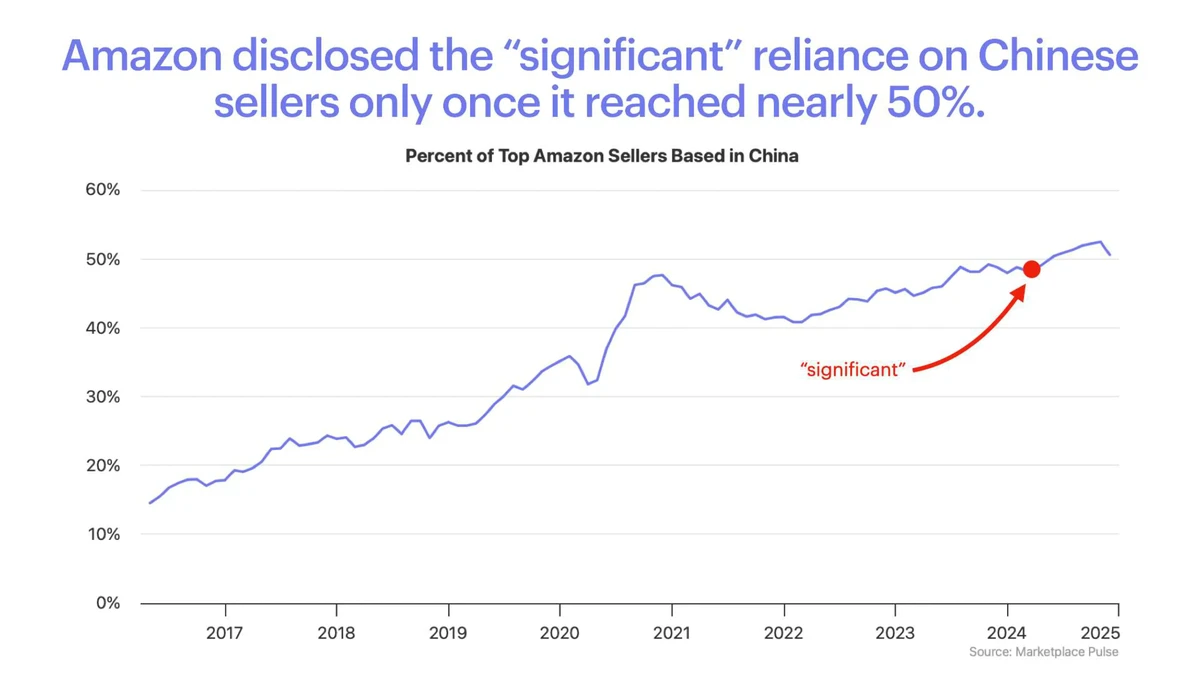

Correlation matrix heatmap in equity markets

2. Advanced Machine Learning Correlation Techniques

While traditional correlation matrices are valuable, advanced approaches such as copulas and non-linear correlation measures (e.g., distance correlation, mutual information) provide deeper insights.

Advantages:

- Capture complex, non-linear dependencies between stocks.

- Provide more robust insights during extreme market events.

- Useful in algorithmic trading systems and AI-driven strategies.

- Capture complex, non-linear dependencies between stocks.

Drawbacks:

- Require advanced computation and data science expertise.

- Less intuitive for manual interpretation.

- Risk of overfitting if not validated properly.

- Require advanced computation and data science expertise.

These methods are increasingly popular in quant hedge funds, particularly for correlation in quantitative trading for finance students who aim to explore cutting-edge approaches.

Practical Applications of Correlation in Stock Selection

1. Portfolio Diversification

By selecting stocks with low or negative correlations, traders can reduce portfolio volatility. For example, combining cyclical stocks with defensive ones often produces better risk-adjusted returns.

2. Pairs Trading

Correlation is the backbone of pairs trading, where traders long one stock and short another with high historical correlation, expecting mean reversion.

3. Sector and Factor Analysis

Quantitative analysts often use correlation to measure exposure to factors such as momentum, value, or growth, ensuring the portfolio doesn’t unintentionally overweight correlated factors.

4. Risk Management

Understanding correlation helps minimize tail risks. For instance, during the 2008 crisis, many traders learned that assets assumed to be uncorrelated suddenly converged. Hence, how to reduce correlation risk in quantitative portfolios remains a hot topic in institutional circles.

Comparing the Two Approaches

| Method | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Correlation Matrix | Easy, fast, intuitive | Limited to linear relationships | Quick scans of sector/market correlations |

| Advanced ML Correlation | Captures complex patterns, resilient | Requires expertise, risk of overfitting | Hedge funds, algorithmic strategies |

Recommendation: For beginner-to-intermediate traders, correlation matrices remain the best starting point due to simplicity. Advanced machine learning methods are ideal for professionals seeking alpha in complex markets.

FAQs on Interpreting Correlation in Quantitative Stock Selection

1. How do I calculate correlation in quantitative models?

You can calculate correlation using Pearson’s coefficient, Spearman’s rank, or advanced methods like distance correlation. Python (pandas, numpy) and R provide built-in functions, while machine learning libraries allow for deeper non-linear analysis.

2. Why does correlation matter in algorithmic trading?

In algorithmic trading, strategies often rely on identifying patterns between assets. Misinterpreting correlation can lead to overexposure or false diversification. Correctly interpreting correlation ensures balanced portfolio construction and reduces systemic risk.

3. How can I reduce correlation risk in my stock portfolio?

You can reduce correlation risk by:

- Diversifying across sectors, regions, and asset classes.

- Incorporating factors with low correlation to equities (e.g., commodities or bonds).

- Using rolling correlation windows instead of static historical values.

Final Thoughts

Interpreting correlation is not just about numbers—it’s about understanding relationships, market regimes, and portfolio dynamics. Whether you’re a beginner analyzing heatmaps or an expert applying machine learning copulas, mastering correlation ensures smarter stock selection.

The future of correlation analysis lies in integrating AI-driven insights with traditional statistical models. Traders who balance simplicity with advanced techniques will have a decisive edge.

If you found this article helpful, share it with colleagues, leave a comment with your experiences, and let’s keep the discussion alive. Together, we can refine the art of quantitative stock selection.

Would you like me to also create an SEO-optimized meta description and title tag for this article, so it’s ready for Google ranking?

0 Comments

Leave a Comment