==================================================

Volatility plays a crucial role in quantitative trading, affecting asset pricing, risk management, and the performance of various trading strategies. Understanding how to measure volatility is fundamental for developing effective trading models. In this article, we will explore several methods for measuring volatility, compare them based on their strengths and weaknesses, and provide recommendations for traders to select the best approach for their strategies.

What is Volatility in Quantitative Trading?

1. Defining Volatility

Volatility is the degree of variation in the price of an asset over time. In quantitative trading, volatility serves as a critical measure of risk and market uncertainty. Higher volatility indicates that the asset’s price is more likely to change dramatically, while lower volatility suggests more stable price movements. Volatility can be measured using different approaches, each offering unique insights into market conditions.

2. Why Volatility Matters in Quantitative Trading

In quantitative trading, volatility is integral to portfolio management, risk control, and market timing. Traders rely on volatility to:

- Predict market behavior: Understanding volatility helps traders anticipate price swings and optimize entry and exit points.

- Manage risk: By assessing volatility, traders can decide how much risk to take on and adjust their positions accordingly.

- Enhance strategy development: Volatility is often used to create volatility-adjusted returns and optimize trading algorithms.

Key Methods for Measuring Volatility

1. Historical Volatility

Historical volatility (HV) is a statistical measure that calculates the standard deviation of an asset’s returns over a specific period in the past. It’s one of the simplest and most commonly used volatility measures.

How It Works

Historical volatility is calculated by measuring the variance of daily returns over a given time window (e.g., 30 days, 60 days). The formula for historical volatility is:

HV=1N−1∑t=1N(Rt−R‾)2\text{HV} = \sqrt{\frac{1}{N-1} \sum_{t=1}^{N} (R_t - \overline{R})^2}HV=N−11t=1∑N(Rt−R)2

Where:

- RtR_tRt is the return at time ttt,

- R‾\overline{R}R is the average return,

- NNN is the number of observations.

Advantages of Historical Volatility

- Simplicity: The method is straightforward to compute using readily available price data.

- Widely Accepted: It is a standard measure used by traders and analysts.

Disadvantages of Historical Volatility

- Lagging Indicator: Since it only looks at past data, it may not accurately predict future volatility, especially during significant market shifts.

- Assumes Normal Distribution: The method assumes that returns follow a normal distribution, which may not always be the case.

When to Use

- When historical data is available, and the market has not experienced significant structural changes.

- For long-term strategies that rely on past market behavior.

2. Implied Volatility

Implied volatility (IV) is a forward-looking measure derived from the pricing of options. It represents the market’s expectations of future volatility, as reflected in the options prices.

How It Works

Implied volatility is calculated using options pricing models like the Black-Scholes model, which takes into account the current price of the asset, the strike price, the time to expiration, and the risk-free interest rate. IV is derived by solving for volatility in the model that matches the market price of an option.

Advantages of Implied Volatility

- Predictive Power: IV reflects market expectations and can be a leading indicator of future volatility.

- Real-Time Data: Since it’s derived from live market data, IV provides real-time insight into market sentiment and expectations.

Disadvantages of Implied Volatility

- Options Market Dependency: IV is only available for assets with an active options market.

- Market Sentiment: It can be influenced by factors other than price volatility, such as liquidity or supply and demand for options.

When to Use

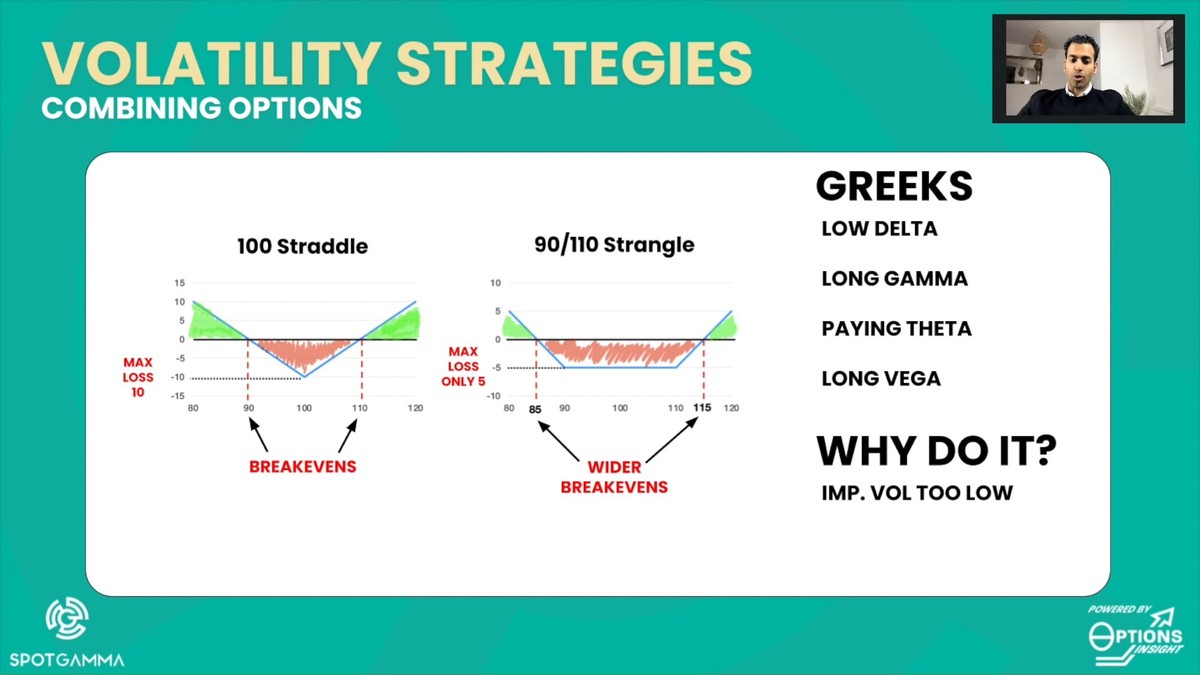

- In strategies involving options, such as volatility arbitrage or straddle strategies.

- When the trader needs to anticipate how market participants expect volatility to behave in the future.

3. Average True Range (ATR)

The Average True Range (ATR) measures volatility based on the range between the high and low prices of an asset over a set period. Unlike historical volatility, ATR does not focus on price returns but instead looks at the asset’s price movement within each period.

How It Works

ATR is calculated as the moving average of the true range over a specified number of periods, typically 14 days. The true range is the greatest of the following:

- The current high minus the current low,

- The absolute value of the current high minus the previous close,

- The absolute value of the current low minus the previous close.

Advantages of ATR

- No Assumptions About Distribution: ATR does not assume normal distribution of returns and is based on actual price movements.

- Versatile: It can be used for both intraday and longer-term analysis.

Disadvantages of ATR

- Lagging Indicator: Like historical volatility, ATR is based on past data and can miss sudden shifts in market conditions.

- No Predictive Value: ATR does not forecast future volatility; it only measures past price movements.

When to Use

- For analyzing the risk of individual positions and setting stop-loss orders.

- In volatility-based trading strategies like trend following or breakout strategies.

4. Volatility Index (VIX)

The Volatility Index (VIX), often referred to as the “fear gauge,” measures the market’s expectation of future volatility based on S&P 500 options prices. It is a popular measure of implied volatility in the broader market.

How It Works

The VIX index calculates the 30-day expected volatility of the S&P 500 based on option prices. A higher VIX indicates greater expected volatility, while a lower VIX signals a period of relative calm.

Advantages of VIX

- Market Sentiment Indicator: VIX provides a snapshot of overall market sentiment and investor fear.

- Widely Used: As a benchmark for market volatility, the VIX is commonly used in various strategies, from hedging to trading volatility itself.

Disadvantages of VIX

- Broad Market Focus: VIX represents overall market volatility and may not capture volatility in specific assets or sectors.

- Indirect Measurement: The VIX is based on options prices, which can be influenced by factors other than volatility.

When to Use

- For portfolio hedging, especially in times of heightened market uncertainty.

- As an indicator for assessing the broader market’s volatility environment.

Volatility Measurement in Practice

1. When to Use Each Method

- Historical Volatility: Best for long-term trend analysis, risk management, and backtesting of strategies based on past market data.

- Implied Volatility: Ideal for options-based strategies and forecasting future market conditions.

- ATR: Useful for managing individual trade risks and determining appropriate position sizes.

- VIX: Suitable for gauging overall market conditions and assessing broad market risk.

2. Combining Methods for a Comprehensive Approach

To achieve a well-rounded understanding of volatility, many traders use a combination of these methods. For instance, you could use implied volatility to forecast market expectations and complement it with historical volatility for a robust risk assessment. ATR can be used to evaluate individual trades, while VIX helps to assess overall market sentiment.

Frequently Asked Questions (FAQ)

1. How do I know which volatility measure to use for my strategy?

The choice of volatility measure depends on your trading goals and the instruments you use. For options traders, implied volatility is critical, while historical volatility works best for traders focusing on past price movements. ATR is valuable for those managing risk on individual trades, and the VIX is best for assessing market-wide sentiment.

2. Can implied volatility predict future market crashes?

Implied volatility can provide insights into market sentiment and investor expectations, but it is not a direct predictor of market crashes. However, a significant increase in the VIX often signals heightened market fear, which can precede larger market moves.

3. How do I calculate historical volatility in real-time?

To calculate historical volatility in real-time, you can use platforms that provide access to live price data and offer built-in volatility calculators. Alternatively, you can manually calculate the standard deviation of price returns over a specified period, such as 30 days, using Excel or Python.

Conclusion

Measuring volatility is essential for quantitative traders aiming to manage risk and optimize their strategies. By understanding and applying different volatility measures—such as historical volatility, implied volatility, ATR, and the VIX—traders can gain valuable insights into market conditions and make more informed decisions.

Each volatility measure has its strengths and weaknesses, and the best approach often involves combining multiple methods to create a comprehensive volatility strategy. By integrating these techniques into your trading plan, you can improve your risk management, enhance your strategies, and navigate the complexities of quantitative trading with greater confidence.

If you have any further questions or thoughts on volatility measurement, feel free to leave a comment below and share this article with fellow traders!

0 Comments

Leave a Comment