=============================================

Introduction

Volatility is the heartbeat of financial markets. For traders, the ability to predict volatility changes in trading is not just an edge—it can define profitability. Whether you are a quantitative analyst, a day trader, or an institutional investor, forecasting volatility helps optimize strategies, manage risks, and seize market opportunities.

This article provides a comprehensive exploration of how to predict volatility changes in trading, combining professional insights, mathematical models, real-world experiences, and the latest industry tools. We’ll analyze different methods, compare their strengths and weaknesses, and highlight which approaches suit various trading styles.

By the end, you will understand not only why volatility matters, but also how to measure, forecast, and trade around it effectively.

Understanding Volatility in Trading

What is Volatility?

Volatility measures the degree of price fluctuation in a financial instrument over a period of time. High volatility means large price swings, while low volatility indicates stable movement.

Volatility is typically expressed in annualized percentage terms, often derived from:

- Historical Volatility (HV): Based on past price data.

- Implied Volatility (IV): Derived from options pricing models like Black-Scholes.

Why Predicting Volatility is Important

Accurately predicting volatility allows traders to:

- Adjust position sizing for better risk management.

- Time entry and exit points around high- or low-volatility phases.

- Design volatility-based strategies, such as straddles or mean-reversion trades.

- Hedge portfolios against unexpected market swings.

This connects directly with why is volatility important in quantitative trading? since quant models rely heavily on accurate volatility forecasts to simulate returns and optimize strategy robustness.

Methods to Predict Volatility Changes

1. Statistical Models (Historical Volatility, GARCH)

Historical volatility (HV) uses standard deviation of past returns. More advanced models like GARCH (Generalized Autoregressive Conditional Heteroskedasticity) adaptively forecast volatility by considering past variances and clustering effects.

Pros:

- Easy to calculate.

- Widely accepted in academia and institutions.

- GARCH captures volatility clustering (common in financial markets).

Cons:

- Historical volatility assumes the past reflects the future.

- GARCH requires parameter estimation and may lag sudden shifts.

Best Use Case: Swing traders and portfolio managers who need a medium-term volatility forecast.

2. Market-Implied Volatility (Options Market Data)

Options markets offer a forward-looking estimate of volatility, known as implied volatility (IV). Popular indexes like the VIX (Volatility Index) derive from options pricing.

Pros:

- Reflects real market expectations.

- Useful for hedging and volatility arbitrage.

Cons:

- Skewed by market sentiment and demand/supply imbalances.

- Limited for assets without liquid options markets.

Best Use Case: Institutional traders and hedge funds using volatility spreads, straddles, or hedging portfolios.

3. Machine Learning and AI Models

Machine learning models (e.g., LSTMs, Random Forests, Gradient Boosting) can detect non-linear volatility patterns using price, volume, macroeconomic, and sentiment data.

Pros:

- Handles complex datasets beyond price history.

- Adapts quickly to changing conditions.

Cons:

- Requires large datasets and strong computational power.

- Potential overfitting without robust validation.

Best Use Case: Quantitative funds and advanced algorithmic traders seeking predictive edges.

4. Technical Indicators and Real-Time Signals

Indicators such as:

- ATR (Average True Range) – Measures intraday volatility.

- Bollinger Bands – Show price deviation from moving averages.

- Volatility Breakouts – Identify sudden spikes.

Pros:

- Simple, intuitive for traders.

- Useful for intraday and retail traders.

Cons:

- Often lagging indicators.

- Less reliable during black swan events.

Best Use Case: Day traders and short-term scalpers.

Comparing Volatility Prediction Methods

| Method | Complexity | Cost | Data Required | Accuracy | Best For |

|---|---|---|---|---|---|

| Historical Volatility | Low | Low | Price Data | Moderate | Swing traders, portfolio managers |

| GARCH Models | Medium | Low | Price + Variance Data | High | Professional quantitative traders |

| Implied Volatility (Options) | Medium | Medium | Options Market Data | High | Institutional investors, hedgers |

| Machine Learning Forecasts | High | High | Multi-Source Big Data | Very High | Quant funds, AI-driven strategies |

| Technical Indicators | Low | Low | Real-Time Price Data | Moderate | Retail day traders, beginners |

From professional experience, a hybrid approach often works best. For example, machine learning models incorporating both GARCH signals and implied volatility data provide robust forecasts.

Industry Trends in Volatility Prediction

Rise of AI and Alternative Data

Professional traders now use alternative datasets—social media sentiment, news feeds, blockchain metrics—to anticipate volatility shifts before they appear in price data.

Volatility Forecasting for Crypto Markets

Crypto markets have no central volatility index like the VIX, so traders rely on customized models. This makes understanding where to find volatility data for quantitative trading particularly crucial for crypto-focused quants.

Integration with Risk Management

Asset managers now apply volatility control methods—adjusting exposure dynamically as volatility changes—to stabilize portfolio performance.

Visual Insights

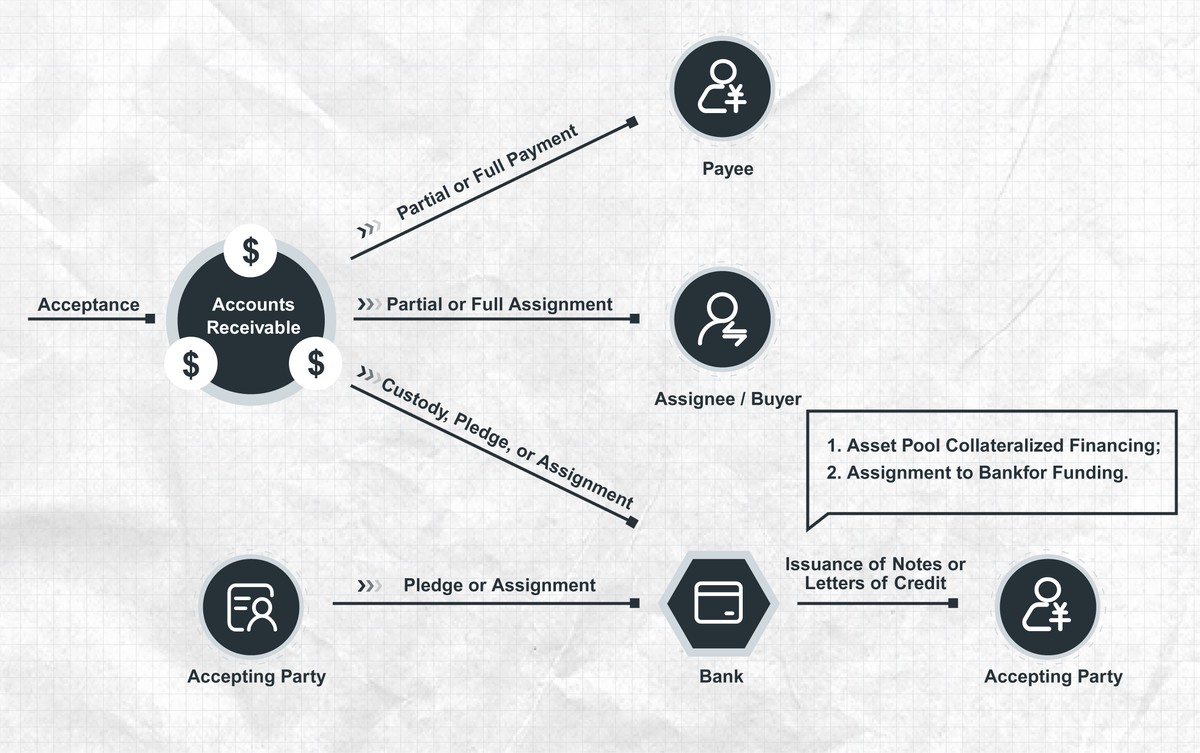

Comparison of volatility forecasting methods, including statistical, implied, and AI-driven models.

FAQ: How to Predict Volatility Changes in Trading?

1. What is the most reliable way to predict volatility?

There’s no single best method. For traditional markets, implied volatility provides forward-looking insights. For illiquid or emerging assets (like crypto), a combination of GARCH models and real-time sentiment analysis is more effective.

2. How can beginners start analyzing volatility?

Start with ATR and Bollinger Bands for real-time analysis, then gradually learn about statistical models like HV and GARCH. Online resources and trading platforms also offer tools for easy calculations.

3. Can volatility predictions completely eliminate risk?

No. Even the most advanced volatility models cannot account for black swan events like geopolitical crises or flash crashes. Volatility prediction is about risk management, not eliminating uncertainty.

Conclusion: The Professional Edge in Volatility Prediction

Predicting volatility changes in trading is a blend of science, art, and experience. From statistical models to AI-driven algorithms, traders now have powerful tools at their disposal.

For beginners, mastering technical indicators and historical volatility is a practical start. For professionals, integrating implied volatility and machine learning forecasts offers a deeper edge.

In practice, the most effective traders apply multiple approaches simultaneously, cross-validating signals from price, derivatives, and alternative data sources.

If you found this guide helpful, share it with your trading community, leave a comment below, and start a discussion on your favorite methods to predict volatility shifts.

Would you like me to expand this article into a step-by-step volatility prediction framework (with formulas, coding snippets, and backtesting workflows) so traders can directly apply it?

0 Comments

Leave a Comment