========================================

Quantitative trading has transformed the way markets are analyzed and traded. By leveraging data, algorithms, and mathematical models, quantitative trading enables traders to make informed decisions with a level of precision and speed that would be impossible for human traders to achieve manually. But how do quantitative trading models work, and what are the best methods for building and optimizing them?

In this article, we will explore the core principles behind quantitative trading models, their functionality, the various types of models used, and how they are applied to different markets such as stocks, forex, and cryptocurrencies. We will also look at practical examples, compare popular strategies, and provide insights on how to improve these models for better performance.

What Are Quantitative Trading Models?

Quantitative trading models are mathematical frameworks used to identify profitable opportunities in financial markets. These models rely on historical data and a set of algorithms to predict future price movements, trends, and patterns. By analyzing a wide range of data, from market prices and trading volumes to macroeconomic indicators and sentiment data, these models help traders make data-driven decisions.

Core Components of Quantitative Trading Models

- Data Input: Quantitative models rely heavily on historical and real-time data. The quality and type of data are crucial to the model’s success. Data can include price history, trading volumes, order book data, and fundamental or technical indicators.

- Algorithms: The core of any quantitative model is the algorithm that processes the data. These algorithms can range from simple statistical methods (e.g., moving averages) to complex machine learning models (e.g., neural networks).

- Optimization: Once a model is created, it is continuously optimized to improve its accuracy and predictive power. This is done through processes like backtesting and performance evaluation.

- Execution: Quantitative trading models also include the execution component, where trades are automatically placed based on the model’s predictions, often in milliseconds.

How Do Quantitative Models Work in Different Markets?

Quantitative trading models are versatile and can be applied to different markets, each with its unique dynamics. Let’s explore how these models work in some of the major trading markets:

Quantitative Models in Stock Markets

Stock trading is one of the most common areas where quantitative models are used. These models analyze a range of factors, such as historical stock prices, corporate earnings, and macroeconomic indicators, to predict stock price movements.

Key Strategies in Stock Market Quantitative Trading:

- Mean Reversion: This strategy is based on the idea that stock prices tend to revert to their mean or average value over time. Models that use this strategy will buy stocks that are underperforming and sell stocks that are overperforming.

- Trend Following: These models attempt to predict and follow trends in stock prices. By analyzing price momentum, moving averages, and other technical indicators, these models can make buy or sell decisions based on ongoing market trends.

Quantitative Models in Forex Trading

The foreign exchange (forex) market, with its 24-hour trading cycle, presents unique challenges and opportunities for quantitative trading. Forex models typically rely on macroeconomic data, interest rates, and geopolitical events to predict currency price movements.

Key Strategies in Forex Quantitative Trading:

- Carry Trade Strategies: This strategy exploits differences in interest rates between two currencies. Traders use quantitative models to predict which currency pairs are likely to offer the highest return based on the interest rate differential.

- Statistical Arbitrage: In the forex market, statistical arbitrage involves identifying short-term mispricings between currency pairs and executing trades to capitalize on these inefficiencies.

Quantitative Models in Cryptocurrency Trading

Cryptocurrency markets are known for their volatility, offering unique opportunities for quantitative traders. Models that work in the crypto market focus on analyzing blockchain data, transaction volumes, and market sentiment.

Key Strategies in Cryptocurrency Quantitative Trading:

- Momentum-Based Strategies: Cryptocurrency models often use momentum strategies, which analyze the price momentum of digital assets to predict future price trends.

- Arbitrage: Due to the fragmented nature of cryptocurrency exchanges, arbitrage opportunities arise when the same asset is priced differently across platforms. Quantitative models can quickly identify and exploit these price discrepancies.

Popular Quantitative Trading Models and Their Applications

1. Mean Reversion Models

Mean reversion is a widely used strategy in quantitative trading. It assumes that asset prices will revert to their historical average or mean over time. This strategy can be applied across various markets, including stocks, forex, and cryptocurrencies.

How it Works:

The model identifies when an asset’s price deviates significantly from its historical mean and predicts that the price will eventually revert back. This model can be executed using simple statistical techniques like the Z-Score or Moving Averages.

Pros:

- Simple to implement and understand.

- Can be highly effective in low-volatility markets.

Cons:

- May fail in trending markets where prices do not revert to the mean.

- Requires regular recalibration to avoid overfitting.

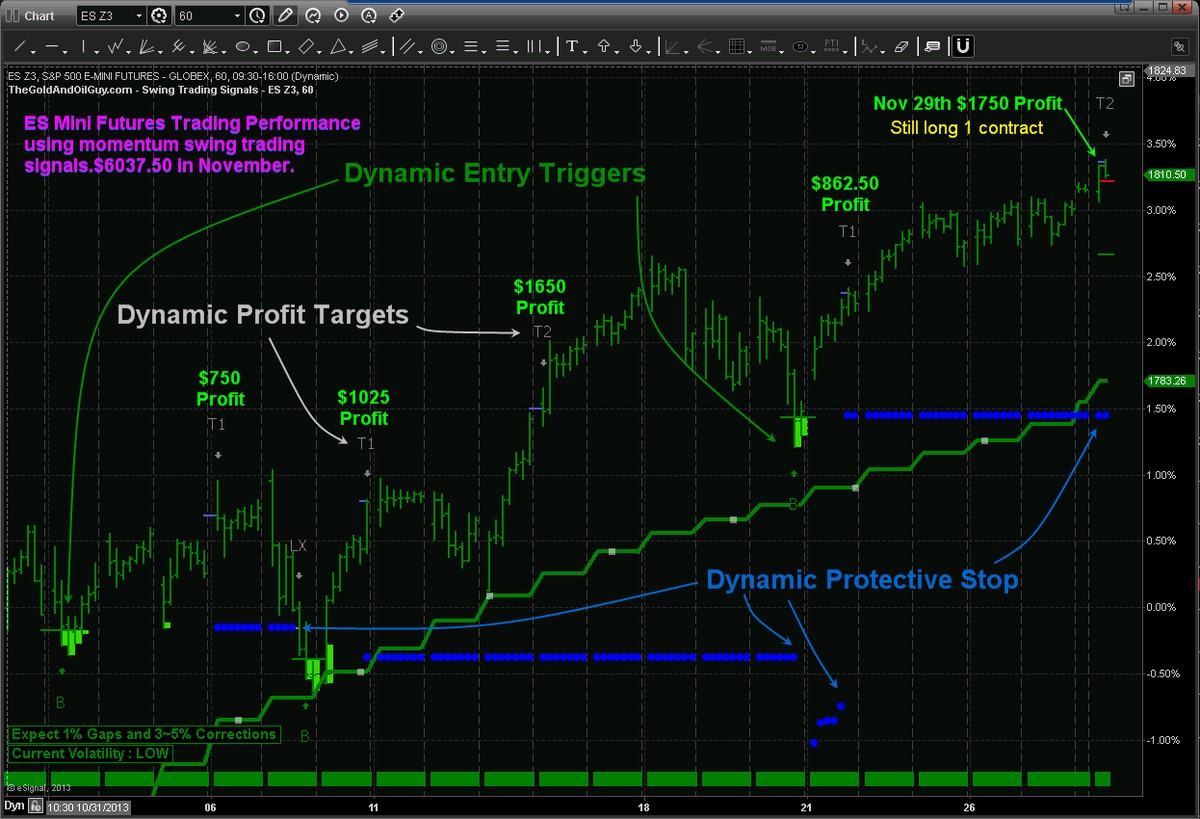

2. Trend Following Models

Trend following models aim to capitalize on price movements in the same direction. The primary goal is to enter a position when a trend is established and exit when the trend shows signs of reversal.

How it Works:

These models rely on technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). The model will generate buy signals when the price is trending upwards and sell signals when the price is trending downwards.

Pros:

- Highly effective in trending markets.

- Can capture large price movements.

Cons:

- May result in significant losses if the trend reverses abruptly.

- Not effective in sideways or choppy markets.

3. Machine Learning-Based Models

With the advancement of artificial intelligence (AI) and machine learning, many quantitative traders now use ML-based models to improve their trading strategies. These models can learn from historical data and adapt to new patterns in the market.

How it Works:

Machine learning algorithms, such as Random Forest, Neural Networks, and Support Vector Machines (SVMs), are used to process large datasets and make predictions about future price movements. These models can identify complex, nonlinear relationships between different market factors.

Pros:

- Can adapt to changing market conditions.

- Effective at capturing complex patterns that traditional models may miss.

Cons:

- Requires significant computational resources.

- Can be prone to overfitting if not properly tuned.

How to Build and Optimize a Quantitative Trading Model

Building a quantitative trading model involves several key steps. Let’s break down the process:

Step 1: Data Collection and Cleaning

The first step in building a quantitative model is gathering historical market data. This data could include price, volume, volatility, economic indicators, and other relevant variables. The quality of the data is crucial—erroneous or incomplete data can lead to poor model performance.

Step 2: Model Selection and Algorithm Development

Once the data is collected, the next step is to select a model and develop the underlying algorithms. Depending on your strategy, you might choose from models like linear regression, time series analysis, or machine learning models.

Step 3: Backtesting the Model

After building the model, it is essential to test it using historical data. Backtesting allows you to evaluate how the model would have performed in past market conditions. It’s a crucial step for understanding the model’s strengths and weaknesses.

Step 4: Optimization

Once you have a working model, the next step is optimization. This involves adjusting model parameters (e.g., time periods for moving averages or other technical indicators) to improve its performance. You should also use out-of-sample data to validate the model and prevent overfitting.

Frequently Asked Questions (FAQs)

1. How do I choose the right quantitative trading model?

Choosing the right quantitative trading model depends on your trading goals, risk tolerance, and the market you are trading in. For example, mean reversion models work well in stable, low-volatility markets, while trend-following models are better suited for volatile markets. Consider starting with simpler models and gradually progressing to more complex machine learning-based models as you gain experience.

2. Why do some quantitative trading models fail?

Quantitative trading models can fail due to several reasons:

- Overfitting: If the model is overly complex and tailored to historical data, it may perform poorly when applied to new, unseen data.

- Lack of adaptation: Models that don’t adapt to changing market conditions may become obsolete over time.

- Poor data quality: Inaccurate or insufficient data can skew the model’s predictions, leading to bad trades.

3. How do I improve the performance of my quantitative trading model?

To improve your model’s performance:

- Use more relevant features: Incorporate additional data sources such as sentiment analysis, news sentiment, or fundamental analysis.

- Regularly update the model: As markets evolve, it’s essential to retrain your model using the latest data.

- Optimize parameters: Fine-tune the model’s parameters to avoid overfitting and improve generalization to new data.

Conclusion

Quantitative trading models are indispensable tools in modern financial markets. Whether you’re trading stocks, forex, or cryptocurrencies, these models help you make data-driven decisions with high precision and speed. By understanding how these models work, the different strategies involved, and how to build and optimize them, you can enhance your trading performance. Whether you’re a beginner or an experienced trader, mastering quantitative trading is essential for staying competitive in today’s fast-paced markets.

0 Comments

Leave a Comment