===================================

Introduction

In the rapidly evolving landscape of finance, artificial intelligence, and quantitative research, black box models are becoming an integral part of decision-making. They refer to complex systems—often powered by machine learning or proprietary algorithms—where the internal logic is not fully transparent to the end-user. Understanding how to start using black box models is essential for traders, analysts, and portfolio managers who want to harness their power without falling prey to blind reliance.

This guide provides a comprehensive roadmap on the topic. We will explore definitions, use cases, benefits, risks, and step-by-step approaches to integrating black box models into practice. Additionally, we will compare different strategies, examine industry trends, and provide actionable insights for professionals at different stages.

What Are Black Box Models?

A black box model is an algorithm or computational framework where the input and output are visible, but the internal mechanics remain hidden. In practice, this means you can observe predictions or results without knowing exactly how the model arrived at them.

Examples of Black Box Models

- Neural Networks – Complex deep learning models that process high-dimensional data.

- Proprietary Trading Systems – Algorithms developed by hedge funds or investment banks.

- Reinforcement Learning Models – Systems that adapt and evolve based on trial-and-error strategies.

These models are especially common in finance, where predictive power is prioritized over interpretability.

Why Start Using Black Box Models?

Black box models are attractive because they often outperform traditional models when dealing with non-linear data, high-frequency inputs, and noisy environments.

Benefits

- Accuracy – High predictive power in trading, risk management, and asset allocation.

- Adaptability – Ability to learn patterns not captured by linear models.

- Speed – Suitable for high-frequency trading and real-time decision-making.

- Automation – Reduces manual oversight by integrating with trading platforms.

Risks

- Lack of transparency – Difficult to explain decisions to regulators or clients.

- Overfitting – Risk of models performing well in backtests but poorly in real markets.

- Operational dependency – Users may rely too heavily without understanding limitations.

Steps: How to Start Using Black Box Models

Step 1: Define Your Objective

Before adopting a black box model, clarify the problem you want to solve:

- Do you want to forecast asset prices?

- Are you focusing on risk management?

- Do you need execution optimization?

A defined objective ensures that the model is aligned with portfolio or trading goals.

Step 2: Choose the Right Platform

Many platforms provide access to ready-to-use black box systems. For instance, hedge funds and retail traders often explore where to find black box trading platforms with robust infrastructure, backtesting capabilities, and integration options.

Key factors to evaluate:

- Data compatibility (can it handle real-time feeds?)

- Execution speed (is it low-latency?)

- Scalability (can it grow with your needs?)

Step 3: Select the Model Type

Different black box models serve different purposes:

- Deep Learning Models – Best for large, unstructured datasets.

- Proprietary Systems – Pre-packaged trading solutions.

- Hybrid Models – Combine interpretable and black box approaches for balance.

Step 4: Backtesting and Validation

Before deploying live, run rigorous backtests across different market conditions. Evaluate:

- Sharpe ratio and drawdowns.

- Robustness across asset classes.

- Performance under stress scenarios.

Step 5: Integration into Workflows

Integration depends on user type:

- Traders – Link to execution systems for real-time trading.

- Portfolio Managers – Use models to guide asset allocation.

- Risk Managers – Deploy models for early warning systems.

Strategies for Using Black Box Models

Strategy 1: Proprietary Black Box Systems

Institutions often use proprietary algorithms for alpha generation. These are developed in-house and kept confidential to preserve competitive advantage.

Pros:

- Tailored to institutional needs.

- High secrecy, leading to reduced replication by compe*****s.

Cons:

- High cost of development.

- Requires large teams and infrastructure.

Strategy 2: Pre-Built Black Box Software

Retail traders often turn to black box trading for beginners, which provides off-the-shelf solutions. These are plug-and-play models that require minimal technical expertise.

Pros:

- Easy to implement.

- Affordable compared to in-house development.

Cons:

- Less customizable.

- Risk of vendor lock-in.

Strategy 3: Hybrid Explainable–Black Box Approach

Many professionals now combine explainable AI (XAI) with black box systems. This allows them to gain predictive strength while maintaining a degree of interpretability.

Pros:

- Regulatory compliance.

- Improved trust among clients.

Cons:

- Higher computational complexity.

- Slower deployment compared to fully black box.

Comparative Analysis of Strategies

| Strategy | Best Users | Strengths | Weaknesses |

|---|---|---|---|

| Proprietary Systems | Hedge funds, banks | Competitive advantage, alpha generation | High cost, secrecy required |

| Pre-Built Software | Retail, beginners | Easy, fast setup | Limited customization, vendor dependency |

| Hybrid Models | Institutions, advisors | Balanced transparency and performance | Complex, costly |

Recommendation: For most portfolio managers, hybrid approaches offer the best trade-off between predictive power and explainability.

Latest Industry Trends in Black Box Models

- Integration with DeFi platforms – Black box models now trade crypto assets on decentralized exchanges.

- Explainable AI overlays – Improving transparency while maintaining black box power.

- Edge computing – Running models closer to data sources for speed.

- Cloud-based deployment – Scalable access to advanced black box solutions.

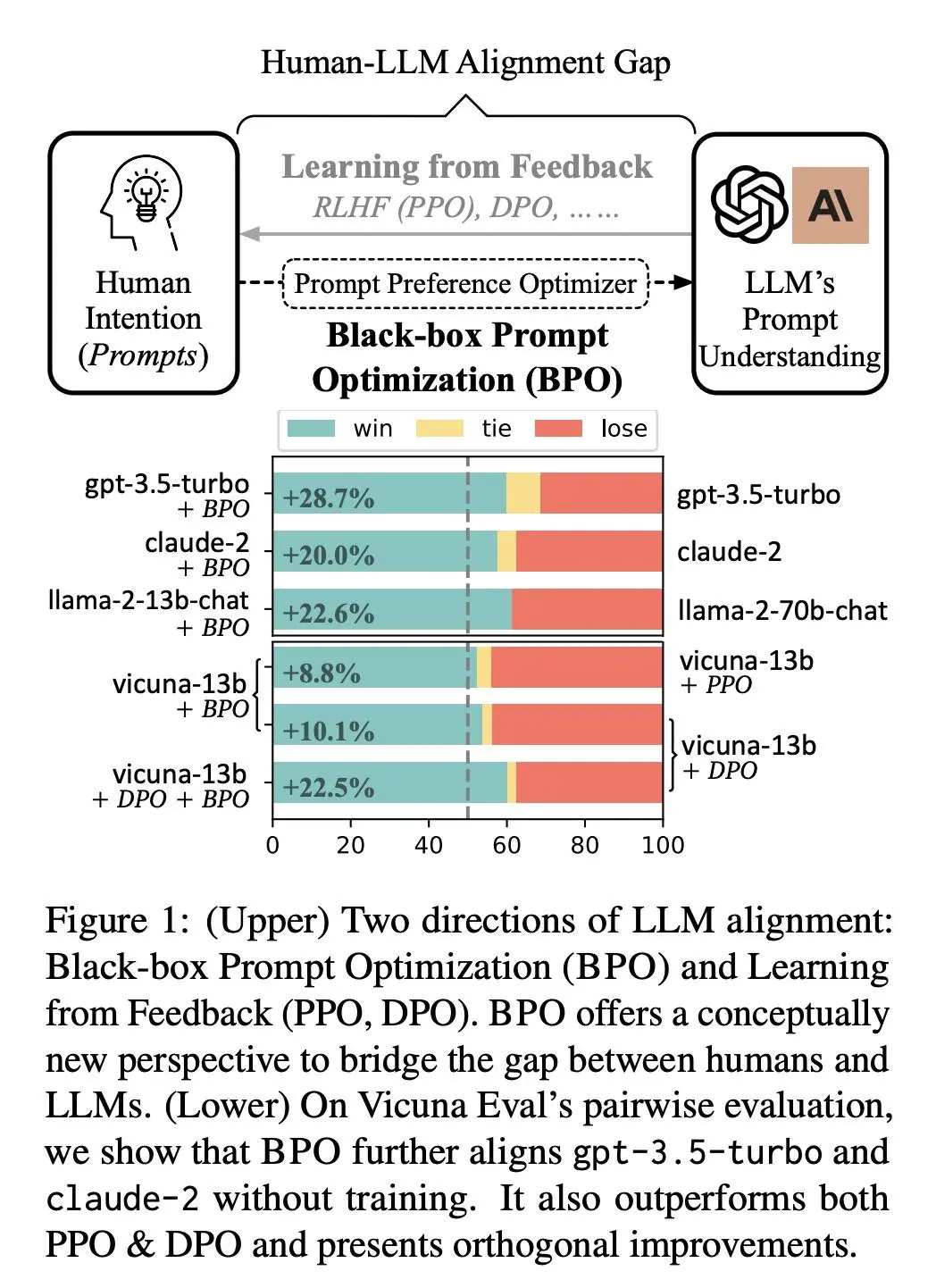

Visual Insight

Illustration of input-output flow in black box models

FAQs on Using Black Box Models

1. How do I know if a black box model is reliable?

Reliability comes from rigorous backtesting, stress testing, and cross-validation. A reliable model should perform consistently across multiple datasets and timeframes.

2. Should retail traders use black box systems?

Yes, but they should start small with pre-built platforms. This allows beginners to gain exposure without heavy investment in infrastructure.

3. How do black box algorithms work in trading?

They process market data, patterns, and signals through complex computations, generating buy/sell decisions without disclosing internal logic. These are widely discussed in resources like how black box algorithms work in trading for further study.

Conclusion

Understanding how to start using black box models is essential for modern traders and portfolio managers. From proprietary institutional systems to retail-friendly software, black box models open opportunities for enhanced performance, adaptability, and automation.

The best path forward is to combine predictive accuracy with explainability, ensuring compliance and trust while maintaining competitive performance.

💡 Found this guide useful? Share it with your network and leave a comment below: Do you prefer fully black box systems, or do you think hybrid models will dominate the future?

0 Comments

Leave a Comment