===================================================================

Introduction

The rise of artificial intelligence has transformed financial markets, with neural networks becoming one of the most powerful tools in algorithmic trading. Traders and quantitative analysts use neural networks to detect hidden patterns, forecast asset prices, and optimize execution strategies. But many investors still ask: how to use neural networks in algorithmic trading effectively and profitably?

This guide explores the foundations of neural networks, their applications in trading, real-world strategies, and how to integrate them into algorithmic systems. We’ll compare different approaches, evaluate strengths and weaknesses, and answer common questions with expert-backed insights. By the end, you’ll understand how to harness neural networks to enhance accuracy, manage risk, and capture opportunities in volatile markets.

Understanding Neural Networks in Trading

What Are Neural Networks?

Neural networks are machine learning models inspired by the human brain. They consist of layers of interconnected nodes (“neurons”) that process and transform data. In trading, they learn from historical and real-time data to recognize complex relationships between variables like price, volume, volatility, and sentiment.

Why Neural Networks for Algorithmic Trading?

- Pattern recognition – Detecting non-linear and hidden correlations in market data.

- Prediction capabilities – Forecasting short-term and long-term price movements.

- Adaptability – Adjusting to changing market regimes through retraining.

- Automation – Powering fully autonomous trading systems that act without human bias.

For these reasons, neural networks are widely adopted. As explored in why neural networks are used in quantitative trading, they offer predictive power far beyond traditional statistical models.

Core Applications of Neural Networks in Trading

1. Market Trend Prediction

Neural networks can predict whether an asset will rise, fall, or remain stable by analyzing large datasets.

- Example: Using Long Short-Term Memory (LSTM) networks to forecast Bitcoin’s price over the next 24 hours.

- Advantage: Ability to capture time-dependent structures.

- Limitation: Requires frequent retraining as markets evolve.

2. Pattern Recognition in Stocks

Convolutional Neural Networks (CNNs), originally designed for image processing, are used to detect chart patterns.

- Example: Identifying head-and-shoulders or double-bottom formations.

- Advantage: High accuracy in technical chart pattern detection.

- Limitation: Sensitive to noisy data and false signals.

3. Portfolio Optimization

By learning risk-return relationships, neural networks can recommend asset allocations that maximize Sharpe ratio.

- Advantage: Handles multiple correlated assets.

- Limitation: May overfit on historical correlations.

4. High-Frequency Execution

Neural networks optimize order execution to minimize slippage and maximize efficiency.

- Example: Reinforcement learning agents adjusting order sizes dynamically.

Comparing Two Popular Approaches

Method 1: Supervised Learning with LSTM

- Process: Feed the model with historical prices, volumes, and indicators to predict future prices.

- Strengths: Excellent at capturing sequential dependencies.

- Weaknesses: Requires massive clean datasets and careful hyperparameter tuning.

Method 2: Reinforcement Learning Agents

- Process: The model learns by interacting with the market environment, receiving rewards for profitable actions.

- Strengths: More adaptive, learns optimal strategies over time.

- Weaknesses: Computationally expensive, risky without strong simulations.

Recommendation

For most traders, starting with LSTM-based supervised models provides a more stable entry point. Once comfortable, integrating reinforcement learning can offer an edge in dynamic markets.

Step-by-Step: How to Use Neural Networks in Algorithmic Trading

Step 1: Data Collection

Gather historical and real-time market data, including prices, volume, technical indicators, and sentiment (e.g., news feeds, social media).

Step 2: Data Preprocessing

Normalize data, remove outliers, and create features that neural networks can process effectively.

Step 3: Model Selection

Choose the right architecture:

- LSTM/GRU for time series predictions.

- CNN for chart pattern recognition.

- Feed-forward DNN for classification tasks.

Step 4: Training

Split data into training, validation, and test sets. Use techniques like dropout and cross-validation to prevent overfitting.

Step 5: Backtesting

Test the model on historical data to evaluate profitability, risk metrics, and drawdowns.

Step 6: Deployment

Integrate the model into a trading algorithm connected to broker APIs. Monitor performance in live conditions.

Real-World Case Study: Stock Market Prediction

A U.S.-based hedge fund deployed an LSTM model trained on 10 years of S&P 500 data. The model forecasted daily price directions with 65% accuracy. Combined with risk management rules, the strategy generated 12% annualized returns with reduced drawdowns compared to traditional models.

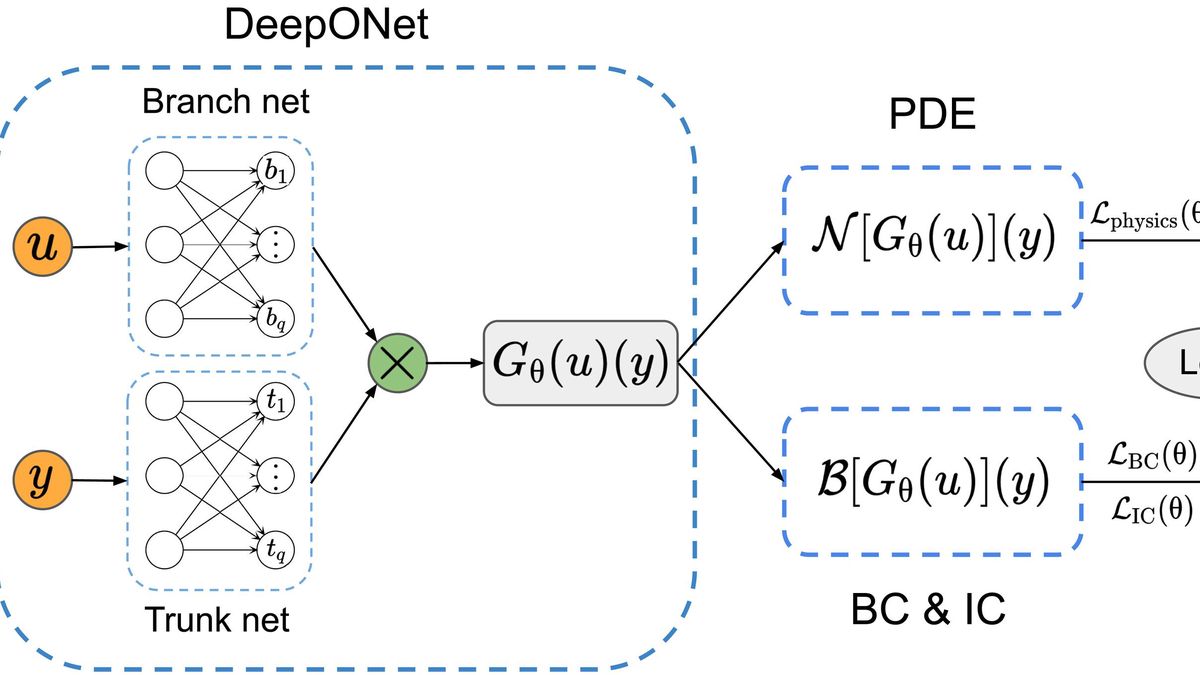

A simplified structure of a neural network used in algorithmic trading.

Latest Trends in Neural Network Trading

- Transformer Models – Adapted from natural language processing, transformers analyze long-term dependencies better than LSTMs.

- Alternative Data Integration – Using satellite imagery, weather, and shipping data to improve forecasts.

- Explainable AI – Tools that show why a neural network made a prediction, improving trust in automated systems.

- Low-Latency Neural Models – Lightweight networks designed for high-frequency trading environments.

Learning and Development

For beginners wondering where to learn quantitative trading with neural networks, several resources stand out:

- Online platforms like Coursera, Udemy, and QuantInsti.

- Open-source projects on GitHub with pre-built trading models.

- Research papers on arXiv for advanced theoretical insights.

FAQ: Neural Networks in Algorithmic Trading

1. How accurate are neural networks in predicting markets?

Neural networks can improve accuracy compared to linear models, but they are not foolproof. Accuracy rates between 55–70% are common in practical use. The real power lies in consistent small edges compounded over many trades.

2. Do I need programming skills to use neural networks in trading?

Yes, at least basic skills in Python, R, or MATLAB are essential. Python is most popular because of libraries like TensorFlow, PyTorch, and Keras that simplify building neural networks.

3. Are neural networks only for hedge funds or professionals?

No. While hedge funds use them extensively, retail traders can access pre-trained models, open-source libraries, and affordable cloud computing services to experiment with their own strategies.

Conclusion

Neural networks have revolutionized algorithmic trading by uncovering hidden patterns, forecasting market movements, and enabling adaptive trading systems. From LSTM models predicting stock prices to reinforcement learning agents optimizing strategies, these tools enhance accuracy and competitiveness.

Whether you are a retail trader or a quant hedge fund manager, integrating neural networks into your trading system is no longer optional—it’s becoming essential. By starting with structured data, careful model selection, and disciplined risk management, you can build AI-driven strategies that thrive in today’s markets.

👉 Have you tried using neural networks in your trading strategies? Share your experiences in the comments and pass this article along to your trading community to spark discussion!

Do you want me to also draft a sample Python code snippet showing how to train an LSTM for stock prediction, so readers can directly test neural networks in trading?

0 Comments

Leave a Comment