===========================================================

Introduction

Value at Risk (VaR) is one of the most widely used risk management tools in modern finance and trading. Whether you are a hedge fund manager, institutional investor, or quantitative trader, understanding how does VaR work in quantitative trading is essential for effective decision-making. VaR provides a statistical estimate of the maximum potential loss within a given confidence interval over a specific time horizon.

In this article, we will explore the mechanics of VaR, compare different calculation methods, analyze its benefits and drawbacks, and share how it can be integrated into quantitative strategies. By the end, you will have a complete understanding of VaR’s role in quantitative trading and risk management.

What is Value at Risk (VaR)?

Definition of VaR

Value at Risk (VaR) is a quantitative measure that estimates the maximum expected loss of a portfolio under normal market conditions over a specific period of time, with a given confidence level. For example, a one-day 95% VaR of \(1 million means that there is a 95% probability the portfolio will not lose more than \)1 million in a single day.

Why is VaR Popular in Quantitative Trading?

- Standardization: VaR offers a standardized risk metric across asset classes.

- Regulatory use: Banks and hedge funds use VaR reports for compliance purposes.

- Strategic insights: Traders use it to balance leverage, position sizing, and portfolio optimization.

Core Components of VaR

1. Confidence Level

VaR is commonly calculated at 95% or 99% confidence intervals. The higher the confidence, the more conservative the estimate.

2. Time Horizon

VaR can be measured daily, weekly, or monthly. For day traders, short-term VaR is essential, while institutional investors often prefer 10-day or monthly VaR horizons.

3. Loss Estimate

The numerical outcome of VaR represents the maximum loss expected, not the average loss. This distinction is critical for traders who need to prepare for extreme events.

How Does VaR Work in Quantitative Trading?

Portfolio-Level Risk Management

Quantitative traders use VaR to assess the overall exposure of a trading book. Instead of relying solely on volatility or historical drawdowns, VaR integrates both probability and magnitude of losses.

Integration into Algorithmic Trading

When developing trading algorithms, VaR can serve as a risk filter. For example, if an algorithm predicts potential returns that are outweighed by the VaR-based risk estimate, the trade may be rejected.

Example:

- Portfolio size: $50 million

- 1-day 99% VaR = \(2 million

This means that, on average, only 1 out of 100 trading days would likely result in a loss greater than \)2 million.

Methods of Calculating VaR

1. Historical Simulation

This method uses historical price data to simulate portfolio returns and determine the percentile cutoff.

Pros:

- Simple to implement.

- No distribution assumptions.

Cons:

- Assumes the past will repeat.

- May underestimate extreme risks.

2. Variance-Covariance (Parametric) Method

This approach assumes asset returns are normally distributed, calculating risk using mean, variance, and covariance.

Pros:

- Fast computation.

- Easy integration into large portfolios.

Cons:

- Normal distribution assumption often fails in real markets.

- Underestimates fat-tail risks.

3. Monte Carlo Simulation

A more advanced approach that simulates thousands of random price paths based on statistical models.

Pros:

- Highly flexible.

- Can incorporate non-linear instruments like options.

Cons:

- Computationally intensive.

- Requires strong modeling expertise.

Comparing Methods: Which is Best for Quantitative Traders?

| Method | Accuracy | Complexity | Best For |

|---|---|---|---|

| Historical Simulation | Moderate | Low | Retail & small funds |

| Variance-Covariance | Low to Moderate | Low | Institutions with liquid assets |

| Monte Carlo | High | High | Hedge funds, complex portfolios |

From personal experience, Monte Carlo is the most powerful in complex, derivative-heavy portfolios, while Historical Simulation suffices for simpler trading systems. However, many quantitative funds use a hybrid approach to balance accuracy and speed.

Where to Apply VaR in Quantitative Finance

Quantitative traders apply VaR at different stages:

- Position sizing: Ensuring no single trade risks more than a predefined VaR threshold.

- Portfolio allocation: Comparing multiple strategies and choosing the one with better return-to-VaR ratios.

- Stress testing: Complementing VaR with scenario analysis to capture tail risks.

This aligns with why is VaR important in risk management: it provides a foundation for systematic and scalable risk controls across diverse strategies.

Strengths and Weaknesses of VaR

Strengths

- Universal risk measure across asset classes.

- Recognized by regulators and financial institutions.

- Easy to communicate to investors and stakeholders.

Weaknesses

- Ignores tail risk beyond the confidence level.

- Relies heavily on assumptions (normal distribution, stable volatility).

- Can give a false sense of security during market crises.

Best Practices for Using VaR in Quantitative Trading

1. Combine VaR with Stress Testing

VaR alone cannot capture extreme market shocks. Complement it with scenario analysis and stress tests.

2. Recalibrate Regularly

Markets evolve rapidly; therefore, recalculating VaR frequently ensures models remain relevant.

3. Use Multiple Confidence Levels

Comparing 95% vs. 99% VaR helps traders assess both moderate and severe risk scenarios.

Industry Trends in VaR for Quantitative Trading

- Machine learning integration: ML models are being used to enhance VaR predictions.

- Real-time risk dashboards: Institutional traders are moving towards intraday VaR recalculations.

- ES (Expected Shortfall) adoption: Regulators are pushing towards Expected Shortfall, which complements VaR by capturing tail losses.

FAQ: Common Questions About VaR in Quantitative Trading

1. How accurate is VaR in predicting real losses?

VaR provides a probabilistic estimate, not a guarantee. While it is effective under normal conditions, it may underestimate extreme market crashes. Traders should combine VaR with stress testing and scenario analysis for better accuracy.

2. Should retail traders use VaR?

Yes, but with caution. While VaR can help retail traders understand portfolio risk, it requires reliable data and correct assumptions. For beginners, historical simulation is the easiest method.

3. How often should VaR be recalculated?

The frequency depends on trading style. Day traders may recalculate VaR daily or intraday, while long-term investors can use weekly or monthly recalibrations. However, during high-volatility markets, more frequent updates are recommended.

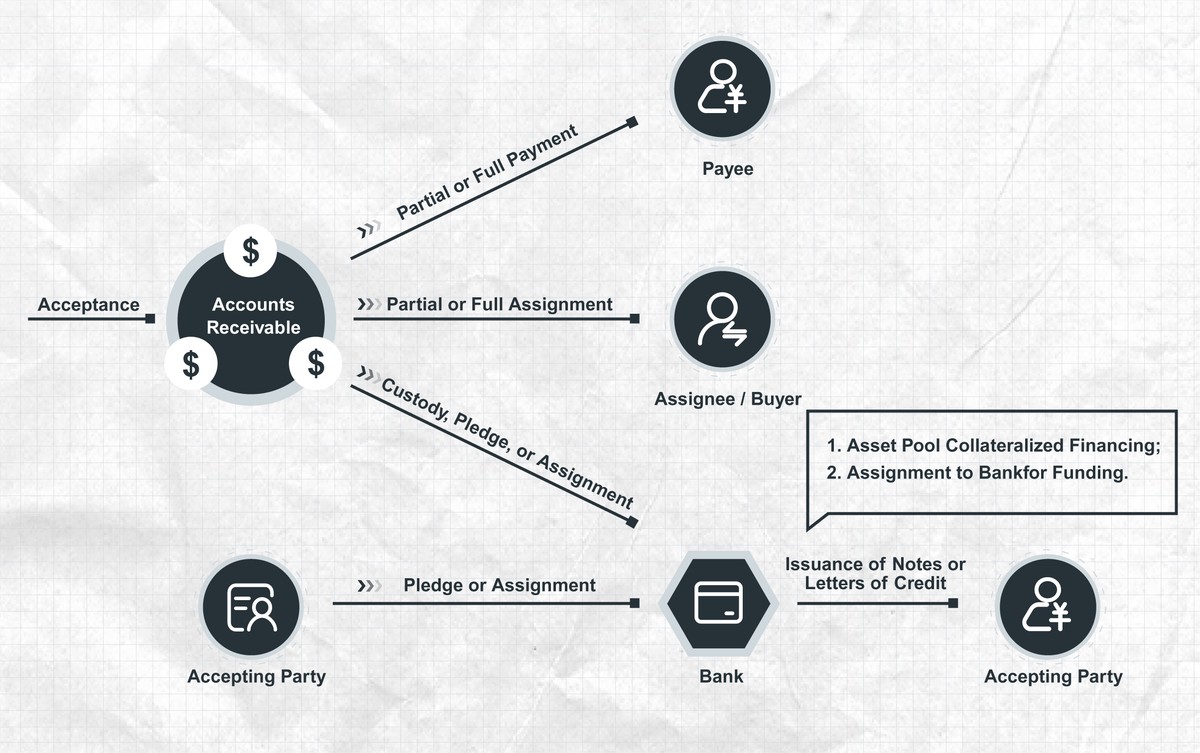

Visual Examples

VaR calculation methods compared: Historical, Parametric, Monte Carlo

VaR as part of risk management framework in trading portfolios

Conclusion

So, how does VaR work in quantitative trading? It functions as a statistical safeguard, helping traders estimate potential portfolio losses and control exposure. By applying methods such as Historical Simulation, Variance-Covariance, and Monte Carlo, traders can integrate VaR into portfolio optimization and trading algorithms.

While VaR is not without limitations, its role in modern finance is undeniable. For best results, quantitative traders should use VaR alongside stress testing, recalibration, and other advanced risk metrics.

If you found this guide helpful, share it with your network of traders and risk managers. Let’s keep the conversation going—drop a comment below on how you use VaR in your own trading strategies.

0 Comments

Leave a Comment