=========================================

Introduction

Momentum is one of the most powerful forces in financial markets. Traders, quants, and long-term investors alike often ask: how to identify momentum in market trends effectively? Momentum reflects the strength of a price move, indicating whether a trend is likely to continue or fade. It is not just about spotting rising prices but also measuring the speed and persistence of those moves.

In this guide, we will explore multiple methods for identifying momentum, compare their strengths and weaknesses, integrate practical experiences, and highlight why momentum is important in quant trading. By the end, you will have a clear roadmap for using momentum as part of your trading system, whether you are a beginner or a seasoned quantitative trader.

Understanding Market Momentum

What is Market Momentum?

Market momentum refers to the rate of change of an asset’s price, often linked to market psychology. When traders buy aggressively, prices rise rapidly, and vice versa when sellers dominate.

Why Momentum Matters

- Helps traders identify entry and exit points

- Provides a foundation for trend-following strategies

- Serves as a risk management tool in volatile markets

Core Methods to Identify Momentum in Market Trends

1. Moving Averages (MA) and Crossovers

One of the simplest ways to measure momentum is through moving averages.

- Simple Moving Average (SMA): Smooths price over a set period.

- Exponential Moving Average (EMA): Places more weight on recent data, capturing momentum shifts faster.

Example: A short-term EMA crossing above a long-term EMA often signals strong bullish momentum.

Pros:

- Easy to understand and implement

- Works well for trend-following strategies

Cons:

- Lagging indicator, may miss early momentum shifts

- Generates false signals in sideways markets

2. Relative Strength Index (RSI)

The RSI measures the speed and magnitude of price changes, oscillating between 0 and 100.

- RSI above 70: Overbought (possible trend reversal)

- RSI below 30: Oversold (potential rebound)

Pros:

- Useful for detecting overextended moves

- Widely adopted and reliable

Cons:

- Can remain overbought/oversold for extended periods during strong trends

- Best used in combination with other indicators

3. Moving Average Convergence Divergence (MACD)

The MACD compares two EMAs and adds a signal line to detect momentum shifts.

- MACD line above signal line: Positive momentum

- MACD line below signal line: Negative momentum

Pros:

- Captures both trend direction and strength

- Effective across multiple timeframes

Cons:

- Slightly lagging, may miss sharp reversals

- Requires interpretation skills to avoid false signals

4. Volume Analysis

Volume confirms price momentum. If price moves upward with rising volume, momentum is strong.

- Volume Spikes: Signal strong institutional activity

- Divergence between price and volume: Indicates weakening momentum

Pros:

- Adds credibility to price moves

- Useful for filtering false breakouts

Cons:

- Requires careful context interpretation

- Volume data may vary across exchanges

5. Price Action and Chart Patterns

Momentum can also be identified by direct observation of price charts.

- Breakouts from consolidation zones

- Continuation patterns like flags and pennants

- Momentum candlesticks (large-bodied candles)

Pros:

- Real-time, no indicator lag

- Can be adapted across markets

Cons:

- Requires significant experience

- Subjective interpretation

Comparing Momentum Identification Methods

| Method | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Moving Averages | Simple, trend-following | Lagging | Medium/long-term trades |

| RSI | Detects extremes | May mislead in strong trends | Swing trading |

| MACD | Combines trend + momentum | Slight lag | Cross-timeframe analysis |

| Volume Analysis | Confirms moves | Exchange-dependent | Breakout trades |

| Price Action Patterns | Immediate signals | Subjective | Short-term trading |

Advanced Approaches for Quantitative Traders

Momentum is more than just indicators—it’s the foundation of quantitative finance strategies. Understanding how does momentum affect quantitative trading helps in designing robust systems.

1. Statistical Momentum Models

Quantitative researchers measure returns over fixed lookback periods (e.g., 3 months, 6 months) and build models to predict future returns.

2. Factor Investing with Momentum

Hedge funds often include momentum as a factor alongside value, size, and volatility to balance portfolios.

3. Machine Learning and Momentum Signals

With modern computing power, AI models now detect non-linear momentum patterns, combining technical indicators with sentiment and macro data.

Practical Insights from Experience

From years of observing markets, one truth stands out: momentum often persists longer than traders expect. Many retail traders exit too early, fearing reversals, while professionals ride the trend longer.

For example, combining RSI with volume often yields strong signals:

- RSI above 70 with rising volume = powerful bullish momentum

- RSI falling below 30 with high sell volume = strong bearish momentum

Additionally, if you’re asking where to find momentum trading strategies, the best sources are not only trading books but also quant research papers and academic journals, which offer statistically validated strategies.

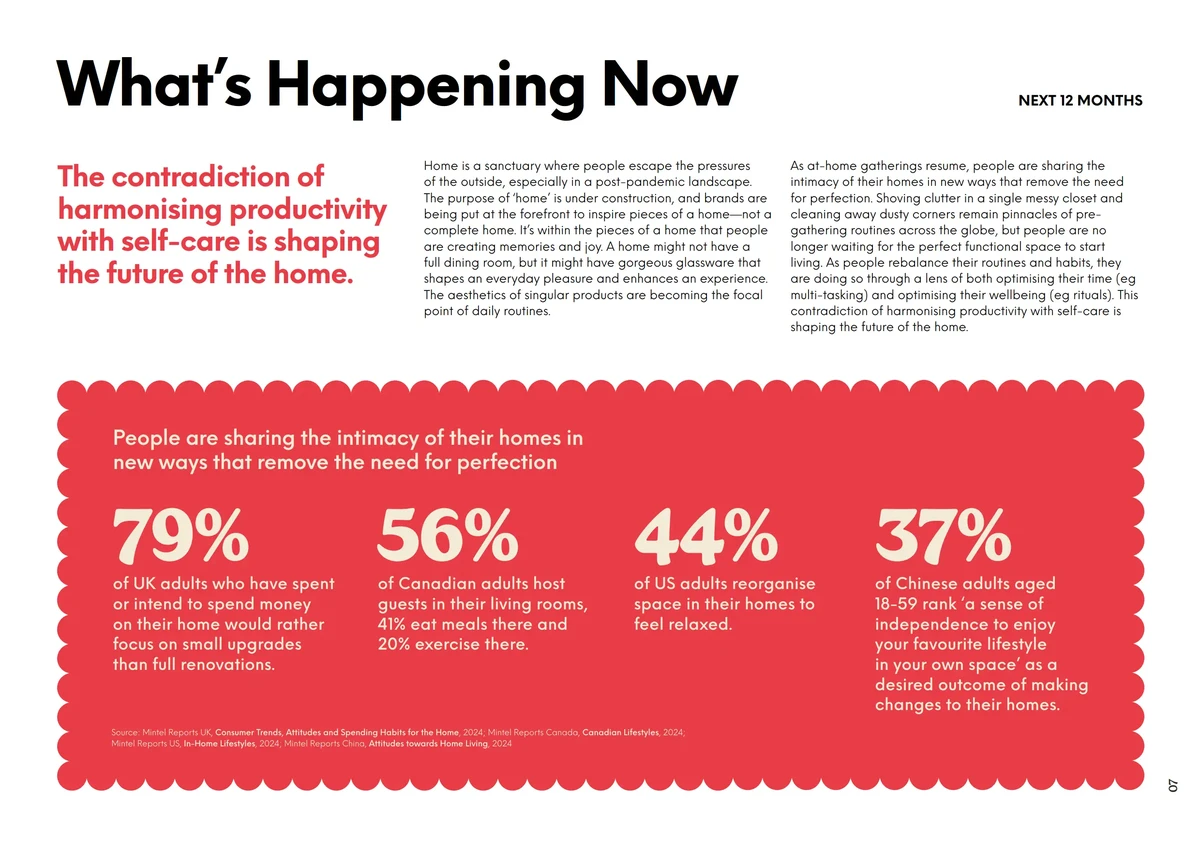

Image Example: Momentum Indicators in Action

Momentum indicators working together: RSI shows overbought/oversold levels, while MACD confirms directional momentum.

Best Practices for Identifying Market Momentum

- Use Multiple Indicators – Combine RSI, MACD, and volume for confirmation.

- Backtest Strategies – Always validate indicators across historical data before live trading.

- Adapt to Market Conditions – Momentum works best in trending markets; avoid overusing in choppy conditions.

- Incorporate Risk Management – Always set stop-loss levels, as momentum signals can fail.

- Blend Fundamentals with Technicals – For long-term investing, combine momentum analysis with earnings growth or macroeconomic data.

FAQ: How to Identify Momentum in Market Trends

1. What is the best momentum indicator for beginners?

The RSI is the easiest to understand and apply. It quickly shows whether an asset is overbought or oversold, making it ideal for beginners who want a straightforward entry into momentum trading.

2. Can momentum strategies work in all markets?

Momentum works best in trending markets such as equities, commodities, and cryptocurrencies. In sideways markets, momentum indicators often generate false signals, so combining them with range-bound strategies is recommended.

3. How can I apply momentum in quantitative finance?

In quant trading, momentum is used as a predictive factor. By ranking assets based on their past returns, quants build long-short portfolios, betting on winners to keep winning and losers to keep losing. This demonstrates why momentum strategies are effective in institutional finance.

Conclusion

Identifying momentum in market trends is both an art and a science. From moving averages and RSI to advanced statistical models, there are multiple ways to detect momentum. The most effective strategy often blends different indicators and confirms signals with volume and price action.

Whether you are a retail trader or a quantitative analyst, mastering momentum analysis gives you a competitive edge.

🔥 If you found this guide useful, share it with your trading community, comment below with your favorite momentum indicator, and help others learn how to identify momentum in market trends effectively.

Would you like me to create a step-by-step visual workflow (diagram in Markdown) showing how a trader should confirm momentum before entering a trade? It could make the content even more actionable.

0 Comments

Leave a Comment