=======================================

High-frequency trading (HFT) has become one of the most advanced and lucrative strategies in the world of finance. By leveraging cutting-edge technologies and algorithms, traders can execute thousands of trades per second, capitalizing on minute price discrepancies in the market. In this article, we will delve into innovative high-frequency trading ideas that can help traders gain an edge, explore new strategies, and optimize their trading performance.

Understanding High-Frequency Trading (HFT)

High-frequency trading is a form of algorithmic trading where computers use algorithms to analyze market data and execute trades at extremely high speeds. The goal is to exploit very small price movements in a short time frame. HFT strategies rely heavily on technology, quantitative models, and market microstructure to gain a competitive advantage.

Key Features of High-Frequency Trading

- Speed: Trades are executed in milliseconds, or even microseconds.

- Liquidity Provision: HFT firms often provide liquidity to the markets, helping to narrow bid-ask spreads.

- Algorithmic Execution: Algorithms analyze vast amounts of data in real-time, executing trades based on predefined criteria.

- Market Making: HFT firms can act as market makers, buying and selling assets to facilitate smoother market operations.

Innovative High-Frequency Trading Ideas

As the competition in high-frequency trading intensifies, it’s crucial to stay ahead of the curve. Below are some innovative ideas and strategies that can enhance high-frequency trading performance.

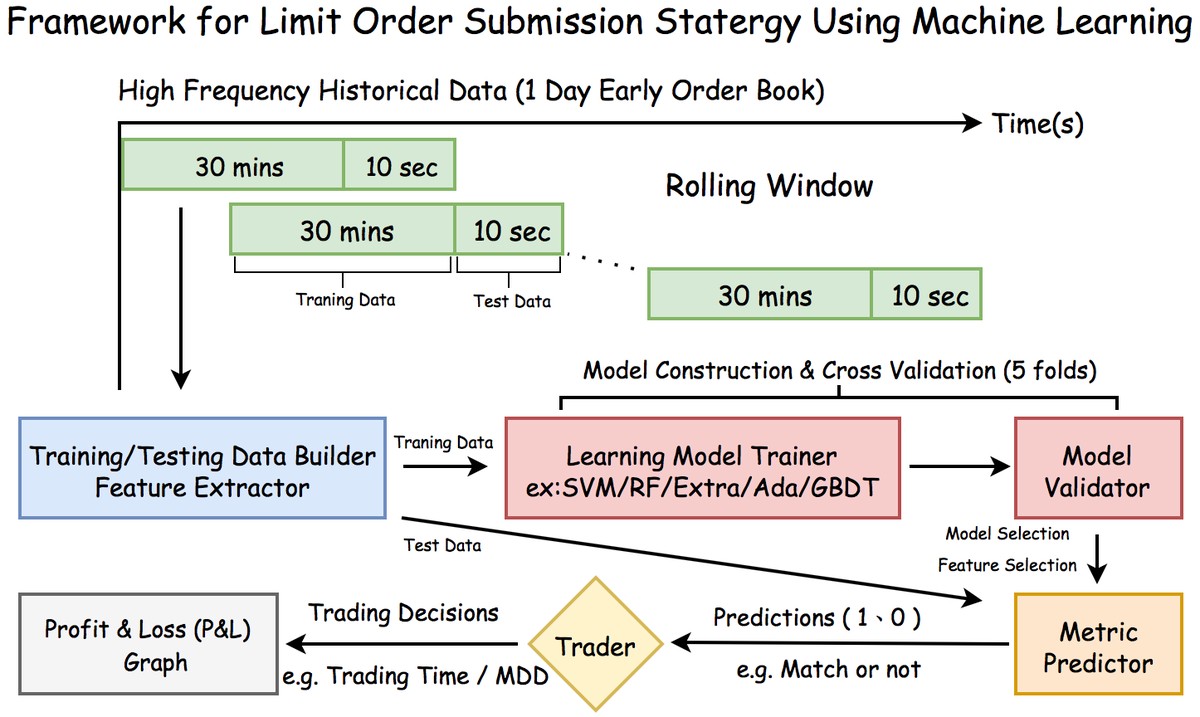

1. Machine Learning for Predictive Analytics

Machine learning (ML) is rapidly transforming the landscape of high-frequency trading. By incorporating predictive models, traders can forecast price movements, detect patterns, and improve trade execution strategies. Machine learning models can learn from historical data and adapt to changing market conditions, providing traders with a dynamic approach to trading.

How Machine Learning Enhances HFT:

- Algorithm Optimization: ML algorithms can optimize HFT strategies by analyzing vast amounts of data and refining execution algorithms.

- Pattern Recognition: ML models can identify recurring patterns in the market, which can be leveraged to predict short-term price movements.

- Anomaly Detection: Machine learning can detect anomalies in price movements or trading volume, which may indicate potential opportunities for arbitrage or trend-following.

While ML can significantly enhance HFT, it requires robust data pipelines, computational power, and expertise in both financial markets and machine learning techniques.

2. Latency Arbitrage Strategies

Latency arbitrage takes advantage of the time difference between the moment a price change occurs in one market and when it is reflected in another. This delay can be as small as milliseconds, but it provides HFT traders with the opportunity to capitalize on price discrepancies before others in the market can react.

Key Latency Arbitrage Techniques:

- Cross-Exchange Arbitrage: Exploiting price discrepancies between two or more exchanges.

- Latency Sniping: Using high-speed connections to detect small price differences caused by latency and execute trades before the market adjusts.

- Dark Pool Arbitrage: Exploiting price differences between public exchanges and dark pools (private exchanges) by leveraging faster data feeds.

Latency arbitrage requires cutting-edge technology and a deep understanding of market infrastructure. It’s essential to have access to the fastest possible network infrastructure and co-location services to gain a competitive advantage.

3. Market Microstructure Research for Edge Development

Understanding market microstructure—the way markets operate and how trades are processed—can provide HFT firms with valuable insights into how to design more effective trading strategies. Market microstructure research focuses on understanding order book dynamics, liquidity, price discovery, and the behavior of market participants.

How Market Microstructure Research Helps:

- Identifying Liquidity Gaps: By understanding order flow, traders can identify liquidity gaps and place trades to capture price movements before other traders can react.

- Optimizing Order Types: Different order types, such as limit orders, market orders, and iceberg orders, behave differently depending on the market microstructure. Understanding how they interact can give traders a tactical advantage.

- Slippage Minimization: Market microstructure research helps reduce slippage by determining optimal order placement strategies and execution times.

Implementing market microstructure insights into HFT can lead to better trade execution, reduced costs, and more profitable strategies.

4. Co-Location and Proximity Hosting

In high-frequency trading, the speed of execution is paramount. One of the ways to gain a competitive edge is through co-location, where a trader places their servers in the same data centers as the exchanges’ systems. This reduces the physical distance between the trader and the exchange, significantly cutting down on latency.

Benefits of Co-Location:

- Reduced Latency: By minimizing the time it takes for data to travel between the trader’s system and the exchange, co-location enables faster order execution.

- Access to Real-Time Data: Traders can access the exchange’s real-time data feeds directly, allowing for quicker reaction times.

- Improved Trade Execution: With reduced latency, HFT firms can execute more trades in less time, increasing the probability of profitable outcomes.

However, co-location comes with significant infrastructure and maintenance costs, which may only be viable for institutional traders.

5. Quantum Computing for High-Speed Trading

While still in its early stages, quantum computing promises to revolutionize high-frequency trading by processing data at speeds far exceeding current classical computing capabilities. Quantum algorithms can analyze massive datasets, optimize trading strategies, and make predictions in fractions of a second.

Potential of Quantum Computing in HFT:

- Parallel Processing: Quantum computers can process a multitude of potential outcomes simultaneously, making it easier to model complex market dynamics.

- Advanced Optimization: Quantum algorithms can be used to optimize portfolios, detect arbitrage opportunities, and execute trades with incredible speed and accuracy.

- Improved Risk Management: Quantum computing could enable more sophisticated risk management techniques by simulating various market conditions and assessing potential risks.

While quantum computing is still in the development phase, it represents a potential game-changer in the world of high-frequency trading.

Comparing HFT Strategies

1. Machine Learning vs. Latency Arbitrage

- Machine Learning offers predictive power and adaptability, making it suitable for market forecasting and anomaly detection. However, it requires substantial computational power and expertise.

- Latency Arbitrage is more focused on exploiting short-term price discrepancies between markets. It requires ultra-fast connections and co-location but does not rely on complex algorithms like machine learning.

2. Market Microstructure Research vs. Co-Location

- Market Microstructure Research provides deep insights into market behavior, allowing traders to optimize order execution. However, it requires continuous research and analysis.

- Co-Location ensures that trades are executed as quickly as possible, reducing latency. However, it requires significant investment in infrastructure and access to high-speed networks.

3. Quantum Computing in HFT

While quantum computing is still in its infancy, its potential for transforming HFT strategies is immense. Unlike classical methods, quantum computing could handle complex market conditions at previously unattainable speeds. However, it requires specialized knowledge and hardware that may not be widely available for the near future.

FAQ: Innovative High-Frequency Trading Ideas

1. How can I start implementing machine learning in high-frequency trading?

To start implementing machine learning, first focus on learning data science and algorithmic trading fundamentals. Then, explore libraries such as Python’s Scikit-learn or TensorFlow to build and test machine learning models. Experiment with predictive models and backtest them against historical data.

2. What is the importance of co-location in high-frequency trading?

Co-location is crucial in HFT as it reduces latency by placing your trading servers close to the exchange’s infrastructure. This minimizes the time it takes to send and receive market data, allowing traders to execute orders faster and gain a competitive advantage.

3. Can quantum computing revolutionize high-frequency trading?

Quantum computing holds significant potential for HFT, particularly in optimization and risk management. It can process vast amounts of data quickly and simulate complex market scenarios. However, it is still in its early stages, and it may take several years before it is practical for mainstream use.

Conclusion

High-frequency trading continues to evolve with technological advancements such as machine learning, quantum computing, and co-location. By incorporating innovative strategies and tools into your trading operations, you can enhance your ability to execute trades efficiently, reduce risks, and capitalize on market opportunities. Whether you’re exploring predictive analytics or optimizing order execution with market microstructure insights, staying ahead of the curve is essential for success in the competitive world of high-frequency trading.

Share your thoughts or experiences in the comments, and feel free to pass this article along to other traders looking to sharpen their HFT strategies!

0 Comments

Leave a Comment