==================================

Introduction

For traders and investors seeking to understand risk in financial markets, beta is one of the most important statistical measures. It quantifies how much a stock or portfolio moves relative to a broader benchmark, such as the S&P 500. A strong investors guide to beta in trading must explain not only what beta means but also how to use it in practice to optimize returns and manage risks effectively.

This guide explores beta’s role in trading, explains calculation methods, compares different strategies, shares real-world insights, and provides practical tools for investors to integrate beta into their portfolio management process.

What Is Beta in Trading?

Beta measures the systematic risk of an asset compared to the overall market.

- A beta of 1.0 means the asset moves in line with the market.

- A beta above 1.0 suggests higher volatility and risk.

- A beta below 1.0 indicates lower volatility.

- A negative beta reflects movement opposite to the market (rare but useful in hedging).

Understanding beta is crucial because it provides investors with a framework for portfolio construction, risk assessment, and tactical adjustments.

Why Beta Matters for Investors

Beta is more than just a number—it impacts trading strategy, portfolio performance, and risk-adjusted returns.

Key Benefits of Using Beta

- Risk Awareness – Investors can evaluate whether an asset is suitable for their risk profile.

- Portfolio Diversification – Beta helps determine how assets combine to reduce overall volatility.

- Performance Benchmarking – Traders can measure whether excess returns are due to skill or market movement.

- Strategic Allocation – Investors can tilt portfolios toward high-beta or low-beta assets depending on market conditions.

As noted in Why beta is important in trading, knowing how much exposure an investor has to market-wide risk is critical to long-term success.

How to Calculate Beta

Formula for Beta

β=Covariance(Ri,Rm)Variance(Rm)\beta = \frac{\text{Covariance} (R_i, R_m)}{\text{Variance} (R_m)}β=Variance(Rm)Covariance(Ri,Rm)

Where:

- RiR_iRi = return of the individual asset

- RmR_mRm = return of the market index

Practical Methods to Calculate Beta

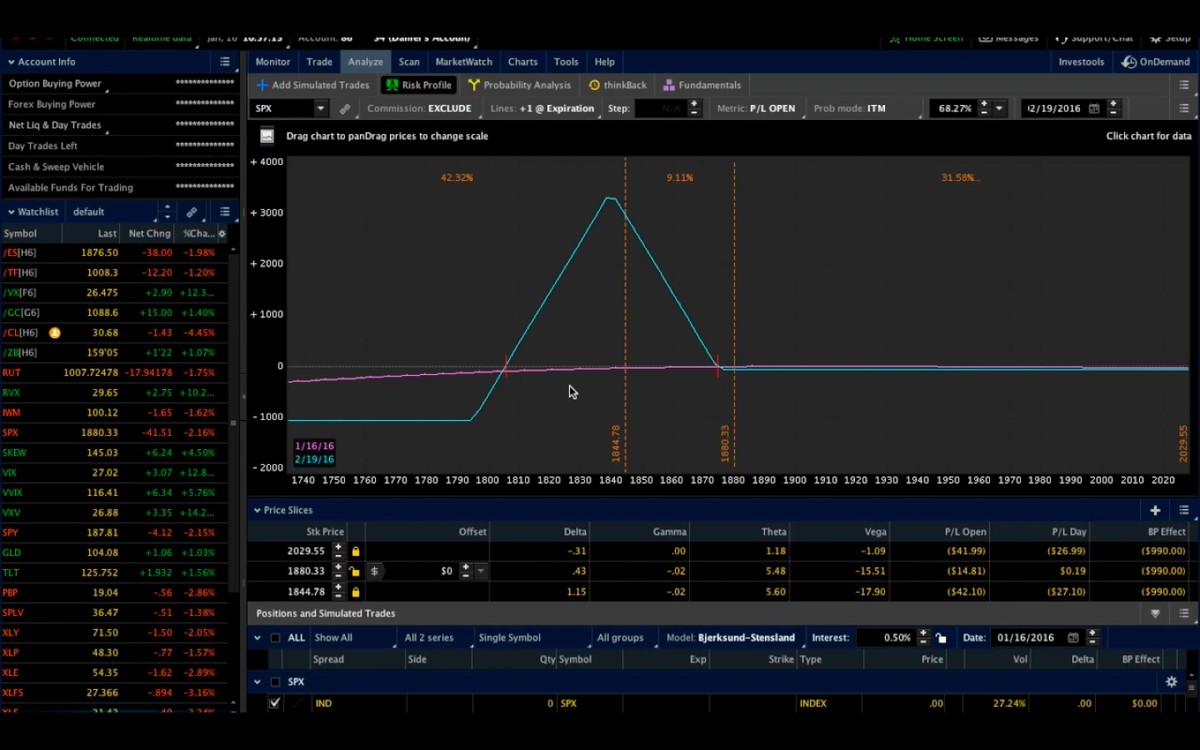

- Regression Analysis – Using statistical software to regress stock returns against market returns.

- Excel/Spreadsheet Tools – Applying covariance and variance functions.

- Broker Platforms – Many modern platforms provide built-in beta values for assets.

Step-by-step example showing regression analysis to calculate stock beta.

Strategies for Using Beta in Trading

1. High-Beta Strategy

High-beta stocks outperform in bullish markets due to amplified movements.

Pros:

- Higher potential returns.

- Good for short-term traders seeking aggressive growth.

Cons:

- Greater downside risk in bear markets.

- Requires strong risk management.

2. Low-Beta Strategy

Low-beta assets provide stability and are suitable during uncertain markets.

Pros:

- Reduced volatility and drawdowns.

- Strong defensive play in bear markets.

Cons:

- Lower return potential in strong bull markets.

- May underperform during high-growth cycles.

3. Beta-Neutral Strategy

This method balances long positions in high-beta stocks with short positions in low-beta stocks, aiming for market-neutral performance.

Pros:

- Isolates alpha by removing market risk.

- Effective for hedge funds and professional investors.

Cons:

- Complex to implement.

- Requires leverage and constant rebalancing.

Real-World Example: Combining Beta with Portfolio Allocation

In my personal trading experience, combining low-beta defensive stocks with select high-beta growth names provided the best balance. For example, during the 2020 pandemic recovery, holding high-beta tech stocks drove significant gains, while maintaining low-beta consumer staples cushioned volatility.

This demonstrates the power of integrating beta into portfolio risk management—an essential step also highlighted in How beta affects portfolio risk.

Optimizing Beta Usage

Techniques to Enhance Effectiveness

- Dynamic Beta Adjustments – Shift exposure depending on whether the market is bullish or bearish.

- Sector-Specific Beta Analysis – Recognize that beta varies across industries (e.g., utilities are lower-beta while tech is higher-beta).

- Blending Beta with Other Factors – Combine with alpha, Sharpe ratio, and volatility metrics for a holistic view.

Example of how beta varies across different market sectors.

Advanced Approaches to Beta in Trading

Factor-Based Investing with Beta

Beta is a core component of the Capital Asset Pricing Model (CAPM), which links expected return with market risk. By integrating factor investing, investors can assess whether they are being compensated adequately for the risks taken.

Machine Learning Applications

Quantitative analysts now incorporate beta into predictive models, using AI to identify shifts in beta trends and optimize portfolio allocations accordingly.

Hedge Fund Usage

Professional managers often deploy beta overlays, adjusting portfolio beta exposure to align with fund mandates, providing a more consistent return stream.

FAQ: Investors Guide to Beta in Trading

1. How do I know if my portfolio beta is too high?

You should compare your portfolio beta to your risk tolerance and investment horizon. A beta above 1.2 suggests higher volatility, which may not suit long-term conservative investors. Tools like portfolio analyzers can help you assess this.

2. Can beta predict market crashes?

No, beta does not predict direction—it only measures relative volatility. However, by analyzing rising betas across sectors, traders can gauge heightened systemic risk and adjust accordingly.

3. Should beginner traders use beta?

Yes, but start simple. For beginners, understanding whether a stock has higher or lower risk than the market is a crucial step. Later, advanced strategies like beta-driven trading strategy development can be explored.

Conclusion

This investors guide to beta in trading has shown that beta is more than a technical number—it’s a critical measure of systematic risk, performance benchmarking, and portfolio optimization.

While high-beta strategies offer growth potential and low-beta stocks provide stability, the optimal approach for most investors is blending both with a dynamic, risk-managed framework. By understanding beta’s nuances and integrating it into decision-making, investors can build more resilient portfolios.

If you found this guide valuable, share it with fellow traders and leave a comment below with your experiences on how you use beta in your strategies. Together, we can refine trading methods and achieve better outcomes.

0 Comments

Leave a Comment