==================================

Introduction

In financial markets, beta is one of the most essential risk metrics for traders and investors. Understanding beta allows you to evaluate how sensitive an asset is to overall market movements. For both seasoned professionals and beginners, this investors guide to beta in trading provides a structured approach to learning, applying, and optimizing beta for portfolio construction and risk management.

Beta measures an asset’s volatility relative to a benchmark, typically an index like the S&P 500. A beta of 1 means the asset tends to move in line with the market, while values above 1 indicate higher sensitivity and values below 1 suggest lower volatility. This guide explains how to use beta in practice, highlights different strategies, and shows you how to compare beta among assets for better decision-making.

Beta helps investors evaluate an asset’s risk exposure relative to the broader market.

What Is Beta and Why It Matters

Definition of Beta

Beta is a measure of systematic risk—the risk inherent to the entire market or a specific sector. It does not capture unsystematic risk, which is asset-specific and can be reduced through diversification.

Why Beta Is Important in Trading

Beta is critical for risk assessment and portfolio optimization. As highlighted in Why beta is important in trading, it helps investors understand:

- The expected volatility of a stock relative to the market.

- How an asset might perform during market booms or downturns.

- Whether a portfolio is aligned with an investor’s risk tolerance.

How Beta Affects Portfolio Risk

Portfolio managers use beta to balance high- and low-risk assets. A portfolio with a beta above 1 is considered aggressive, while one below 1 is conservative.

How to Calculate Beta

Formula and Inputs

Beta is calculated using regression analysis:

Beta = Covariance (Asset, Market) ÷ Variance (Market)

Inputs required:

- Historical returns of the stock.

- Historical returns of the market index.

Practical Calculation

For example, if a stock’s returns move 1.5 times the market’s returns, it has a beta of 1.5, making it more volatile.

Tools for Calculation

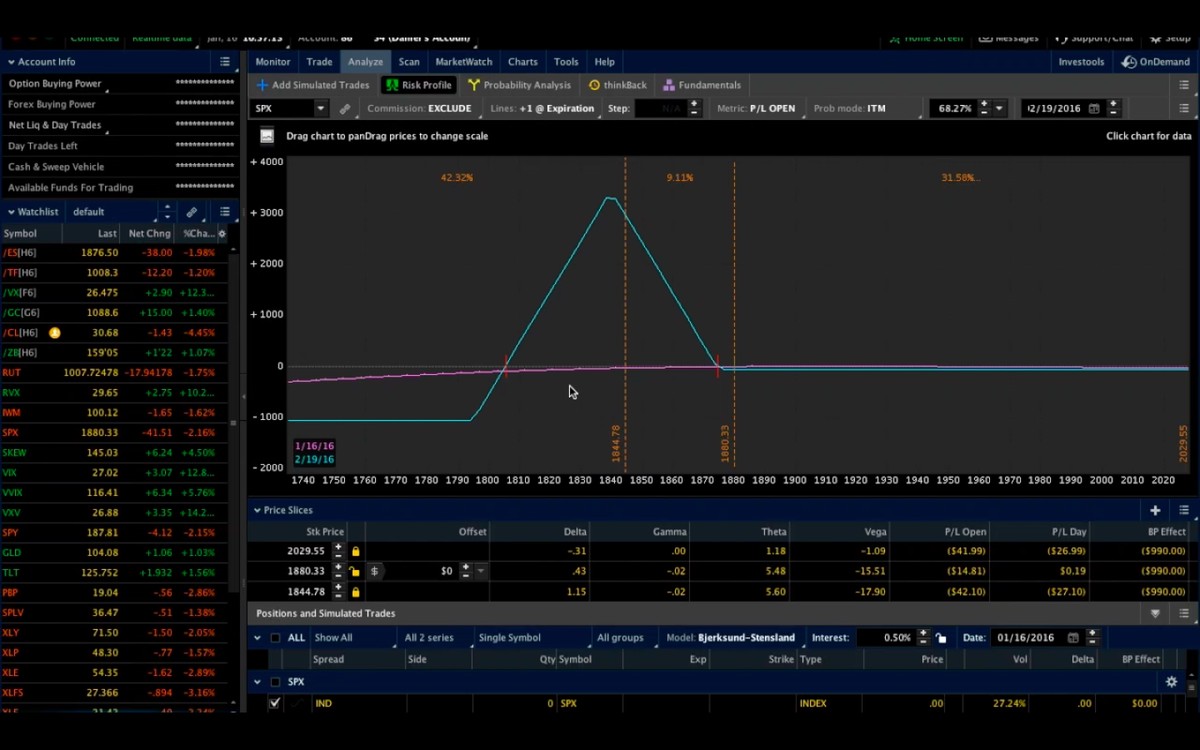

While beta can be calculated manually, platforms like Bloomberg, TradingView, or Excel functions simplify the process. Traders also rely on analyst tools for beta calculation for accuracy and efficiency.

An example of how beta is calculated using stock and market index data.

Comparing Beta Across Assets

Sector Differences

Some industries naturally exhibit higher betas (e.g., technology, biotech), while defensive sectors (e.g., utilities, consumer staples) often have lower betas.

How to Compare Beta Among Assets

Investors should benchmark assets within the same sector for meaningful insights. As discussed in How to compare beta among assets, differences help identify growth vs. defensive plays.

Portfolio Implications

By combining high-beta growth stocks with low-beta defensive assets, investors can achieve a more balanced risk-return profile.

Strategies Using Beta in Trading

Strategy 1: High-Beta Trading

Investors looking for aggressive returns might choose high-beta stocks.

- Pros: Potential for outsized gains during bull markets.

- Cons: Significant downside risk during market corrections.

Strategy 2: Low-Beta Defensive Approach

Investors who value capital preservation often favor low-beta assets.

- Pros: Reduced volatility and downside protection.

- Cons: Limited upside during bull markets.

Recommendation: A blended strategy, mixing high- and low-beta assets, provides a balance of growth and protection.

A comparison of high-beta and low-beta stocks and their behavior during market swings.

Beta in Quantitative and Institutional Trading

Quantitative Approaches

Quantitative analysts integrate beta into algorithms to optimize trade execution, hedging, and portfolio construction. In How to use beta in quantitative trading, beta serves as a foundation for factor models and risk-adjusted return analysis.

Hedge Fund Applications

Hedge funds often employ beta-neutral strategies—balancing long and short positions so the portfolio’s net beta is close to zero. This isolates alpha, or skill-based returns, from overall market risk.

Retail vs Institutional Usage

- Retail traders: Use beta for risk assessment and simple portfolio allocation.

- Institutions: Use beta in complex models, incorporating it with other factors like alpha, Sharpe ratio, and volatility skew.

Advanced Applications of Beta

Beta Adjustments

Beta can be adjusted to reflect future expectations rather than historical performance. This is particularly important in volatile markets.

Multi-Factor Models

Beta is often used alongside other risk factors like size, momentum, and value to create sophisticated portfolio models.

Beta in Algorithmic Trading

Algorithmic systems integrate beta-driven trading strategy development to fine-tune leverage, hedging, and position sizing dynamically.

From retail portfolios to hedge fund models, beta plays a vital role in trading systems.

Common Mistakes When Using Beta

- Overreliance on Historical Data: Beta is backward-looking and may not predict future volatility.

- Ignoring Market Conditions: A low-beta stock may still decline significantly in systemic crashes.

- Sector Misinterpretation: Comparing beta values across unrelated sectors can give misleading results.

- Not Adjusting for Leverage: Leveraged positions amplify beta effects.

Case Studies on Beta in Trading

Case Study 1: Tech Investor

A retail investor built a portfolio of tech stocks with an average beta of 1.8. During a market boom, the portfolio outperformed by 60%. However, in a downturn, losses doubled compared to the index.

Case Study 2: Conservative Portfolio Manager

By balancing utility stocks (beta 0.6) with broad-market ETFs (beta 1.0), a portfolio manager created a defensive strategy that preserved capital during volatility.

Case Study 3: Hedge Fund Neutral Strategy

A hedge fund constructed a beta-neutral strategy by holding equal high- and low-beta positions, achieving steady alpha regardless of market swings.

FAQ: Investors Guide to Beta in Trading

1. How reliable is beta for predicting future performance?

Beta is useful for assessing relative volatility, but it’s not a guarantee of future behavior. It should be combined with forward-looking analysis and market research.

2. Should beginners use beta when building their first portfolio?

Yes, beta is a simple yet powerful risk metric. Beginners can start by balancing high- and low-beta stocks to align with their risk tolerance.

3. Can beta change over time?

Absolutely. Beta values shift as companies evolve, sectors rotate, and market conditions change. Regularly updating and reviewing beta exposure is essential.

Conclusion: Mastering Beta for Smarter Investing

Beta is more than just a number—it’s a window into how assets behave relative to the market. By understanding, comparing, and applying beta effectively, investors can create tailored strategies that match their risk preferences and market outlook.

From simple calculations to advanced quantitative models, beta empowers both retail and institutional investors to navigate uncertainty. By blending high- and low-beta assets, applying adjustments, and integrating beta into broader frameworks, traders can transform volatility into opportunity.

Beta provides a roadmap for managing portfolio volatility and aligning with investment goals.

Final Thoughts

This investors guide to beta in trading equips you with the knowledge to manage risk and enhance portfolio performance. Whether you’re a beginner or an experienced professional, beta can serve as a cornerstone of smart investing.

If you found this article valuable, please share it with fellow traders, comment with your insights, and help spread practical financial knowledge within the community.

Do you want me to create a step-by-step illustrated beta calculation tutorial with Excel/TradingView examples to make this guide even more actionable?

0 Comments

Leave a Comment