=============================================

Leverage is one of the most powerful tools available to investors. For experienced traders and institutional investors, leverage can multiply opportunities across asset classes, improve capital efficiency, and optimize portfolio performance. However, it also carries significant risks if not applied with discipline. This comprehensive guide explores leverage strategies for experienced investors, compares methods, provides practical examples, and integrates current industry trends to help advanced market participants make informed decisions.

Understanding Leverage in Advanced Investing

Leverage allows investors to amplify exposure to assets using borrowed funds or derivatives. For professionals, it’s not only about magnifying returns but also about capital allocation efficiency, hedging, and strategic diversification.

Why Experienced Investors Use Leverage

- Capital Optimization: Control larger positions while freeing up capital for other investments.

- Risk Hedging: Offset exposure using derivatives or short positions.

- Performance Enhancement: Leverage allows for higher returns on correctly timed trades.

- Portfolio Structuring: Combine leverage with traditional and alternative assets for better Sharpe ratios.

Leverage is central to hedge funds, proprietary trading desks, and advanced retail investors. But the key is knowing how leverage affects trading strategies in both bull and bear markets.

Step-by-Step Framework for Implementing Leverage Strategies

Step 1: Define Investment Goals

Before selecting a strategy, align leverage with goals—whether it’s alpha generation, income enhancement, or risk-adjusted performance.

Step 2: Assess Risk Appetite

High leverage may be unsuitable for long-term institutional mandates. Experienced investors often perform a risk assessment for leverage trading using Value-at-Risk (VaR) or stress testing.

Step 3: Choose the Right Leverage Vehicle

Leverage can be obtained through:

- Margin trading.

- Futures and options.

- ETFs with embedded leverage.

- Structured products.

Step 4: Apply Proper Risk Controls

- Use stop-loss orders and portfolio hedges.

- Limit leverage exposure to a percentage of capital.

- Run scenario analysis before executing trades.

Advanced Leverage Strategies

1. Portfolio Margining with Derivatives

How It Works:

Portfolio margining uses futures, swaps, and options to optimize capital. For example, an investor long equities might use futures leverage to replicate exposure while deploying freed-up capital into bonds or commodities.

Pros:

- Efficient capital use.

- Flexible across multiple asset classes.

- Professional-level risk modeling available.

Cons:

- Requires sophisticated analytics software.

- Complexity increases operational risks.

2. Leveraged ETF Strategies

How It Works:

Leveraged ETFs provide 2x or 3x exposure to indices like S&P 500 or NASDAQ. These instruments are ideal for tactical trades rather than long-term holds due to daily compounding effects.

Pros:

- Easy access for institutions and advanced retail investors.

- No need to manage margin accounts directly.

- Transparent pricing.

Cons:

- Compounding decay over long periods.

- Not suitable for passive investors.

3. Hedged Leverage Strategy

How It Works:

Combine long leverage with hedges, such as shorting correlated assets or buying protective options. Example: long NASDAQ futures with leveraged exposure, hedged with volatility index (VIX) calls.

Pros:

- Risk-adjusted performance improvement.

- Reduces tail risk in volatile markets.

Cons:

- Hedging reduces net returns.

- Requires active monitoring and cost management.

4. Structured Products with Embedded Leverage

How It Works:

Banks and brokers issue structured notes that provide leveraged exposure with downside buffers.

Pros:

- Tailored to institutional needs.

- Combines leverage with risk mitigation.

Cons:

- Illiquidity risk.

- Counterparty exposure.

Comparing Leverage Strategies

| Strategy | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Portfolio Margining | Hedge funds, prop desks | Capital efficiency, cross-asset use | High complexity, operational risk |

| Leveraged ETFs | Tactical institutional investors | Easy access, transparent | Compounding decay, short-term only |

| Hedged Leverage Strategy | Risk-aware advanced investors | Balances risk/reward | Lower net gains, higher costs |

| Structured Products | Institutions, UHNW investors | Customized leverage & risk control | Counterparty and liquidity risks |

Recommendation: For most experienced investors, portfolio margining combined with hedging techniques offers the most sustainable long-term benefits. Leveraged ETFs should remain tactical instruments, while structured products are ideal for specific mandates.

Industry Trends in Leverage Strategies

- Rise of Quantitative Models: Institutional investors increasingly rely on leverage optimization algorithms.

- Leverage Analytics Software: More firms adopt where to find leverage tools for trading platforms that provide real-time leverage metrics and stress simulations.

- Regulatory Oversight: Post-2008 reforms demand stricter margin requirements, pushing investors toward safer structured leverage.

- Integration with AI: AI-driven trading systems assess how to mitigate leverage risks in trading by automatically adjusting exposure.

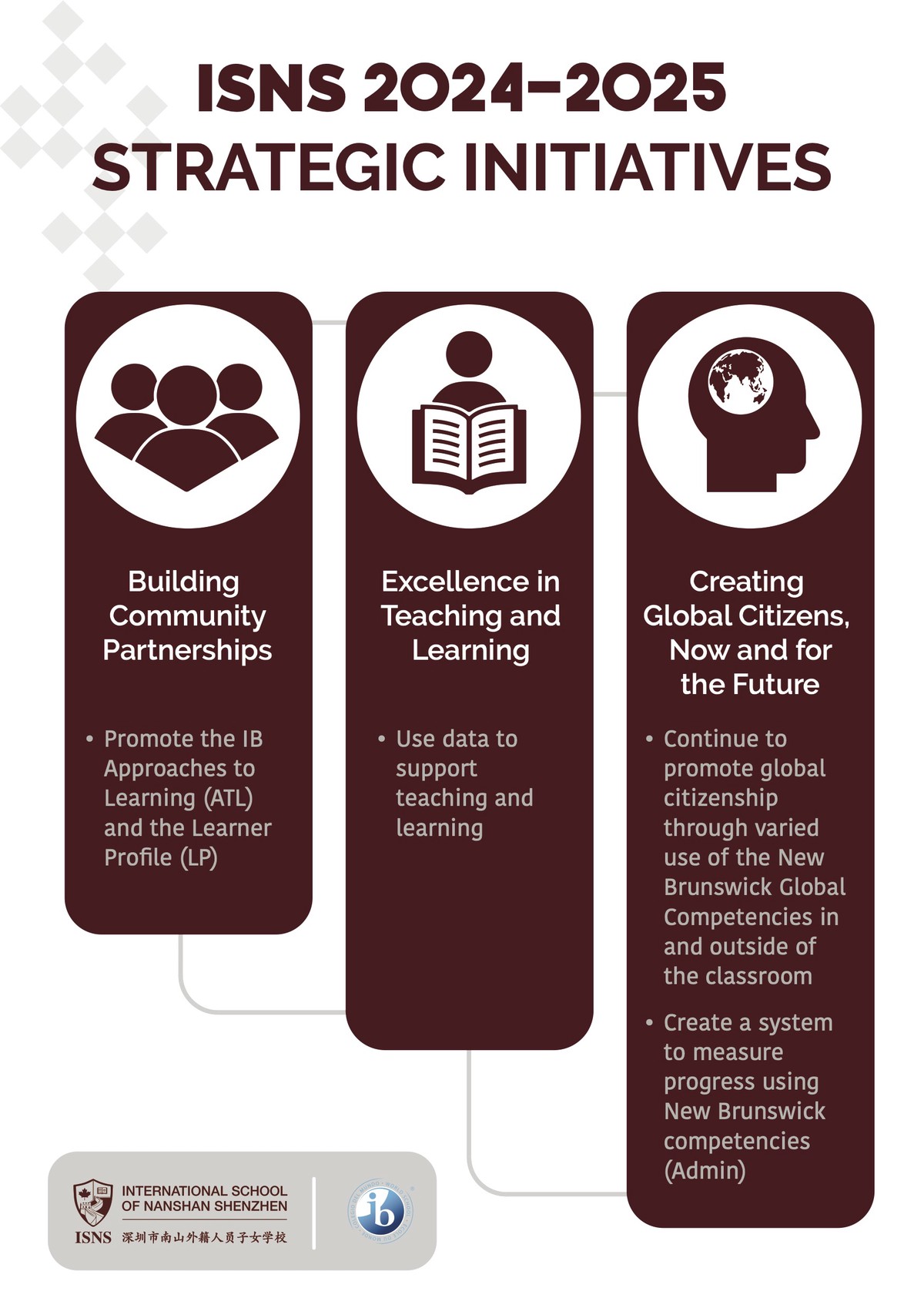

Visual Insights

Breakdown of leverage use in institutional portfolios versus retail markets.

Personal Experience: Lessons Learned

During my early years managing leveraged equity strategies, I underestimated funding costs on overnight futures positions. This reduced returns significantly, despite correct market predictions. Lesson: Always factor in hidden costs such as funding rates, commissions, and slippage when applying leverage.

Similarly, in hedge fund consulting, I observed clients who failed to use hedged leverage strategies during volatile markets like 2020 COVID crashes. Those with hedges preserved capital, while unhedged leveraged funds collapsed. This reinforces that risk-adjusted leverage always outperforms raw leverage.

FAQ: Leverage Strategies for Experienced Investors

1. What leverage ratio is best for advanced investors?

There’s no one-size-fits-all answer. Institutional investors often use 2x–5x portfolio leverage, while hedge funds may tactically increase exposure to 10x in specific trades. Anything higher is generally unsustainable for long-term strategies.

2. How can leverage improve portfolio management?

Leverage allows investors to balance different asset classes without overcommitting capital. For example, using leverage in equities while allocating freed-up cash to fixed income improves diversification and risk-adjusted returns.

3. How do experienced investors mitigate leverage risks?

They use a combination of stop-loss rules, hedging with options, and risk analytics software. Advanced investors also integrate leverage into broader portfolio strategies, ensuring no single leveraged trade can collapse the portfolio.

Conclusion: Building Smarter Leverage Strategies

Leverage, when applied correctly, transforms good investment strategies into exceptional ones. For experienced investors, it is less about speculation and more about precision, capital efficiency, and risk-adjusted performance.

From portfolio margining to hedged leverage techniques, strategies must align with goals, risk appetite, and market conditions. As tools like AI-driven risk systems and leverage analytics evolve, investors have more control than ever before.

If you found this guide insightful, share it with your network, comment with your preferred leverage approach, and help foster a smarter investing community built on knowledge and disciplined strategy.

0 Comments

Leave a Comment