====================================

Liquidity is the lifeblood of day trading. Without sufficient liquidity, traders face wider spreads, slippage, and increased trading costs, all of which can erode profitability. For those looking to master short-term trading, understanding and applying effective liquidity strategies for day traders is non-negotiable. This guide explores liquidity from multiple angles—its role, risks, strategies, and best practices—while combining real-world experience and modern industry trends.

What Is Liquidity and Why It Matters in Day Trading

Defining Liquidity in Trading

Liquidity refers to how quickly and efficiently an asset can be bought or sold without significantly impacting its price. In liquid markets like major forex pairs or large-cap stocks, traders can execute orders at or near the quoted price. In contrast, illiquid markets cause slippage, where trades fill at worse prices than expected.

Why Liquidity Is Critical for Day Traders

Day traders rely on tight spreads and fast order execution. Liquidity ensures that:

- Entry and exit are efficient — no waiting for counterparties.

- Costs remain low — narrow spreads mean smaller hidden costs.

- Volatility is manageable — deep order books absorb sudden flows.

This is why professionals stress that how to measure liquidity in quantitative trading is just as important as designing profitable strategies.

Key Indicators of Liquidity

Bid-Ask Spread

A narrow spread reflects higher liquidity, while a wide spread signals fewer participants.

Market Depth

Depth of the order book reveals how many buy and sell orders exist at various price levels.

Volume

Higher trading volume usually correlates with better liquidity.

Volatility

Excessive volatility can reduce effective liquidity by widening spreads and creating execution risk.

Liquidity Strategies for Day Traders

1. Focus on Highly Liquid Markets

The simplest liquidity strategy is to trade assets with naturally deep order books. Examples include:

- Major forex pairs (EUR/USD, USD/JPY).

- Large-cap stocks like Apple, Tesla, or Microsoft.

- Crypto assets such as BTC or ETH on leading exchanges.

Advantages:

- Low spreads and slippage.

- Reliable execution during most sessions.

Disadvantages:

- Highly competitive, as most day traders focus on the same assets.

2. Time-Based Liquidity Optimization

Liquidity is not static—it changes throughout the day.

- Opening hours: High liquidity due to institutional activity.

- Mid-session: Often quieter with reduced liquidity.

- Closing hours: Increased liquidity again as traders rebalance.

Day traders can design strategies that align entries and exits with periods of strong liquidity, reducing slippage and execution risk.

3. Liquidity-Driven Trade Sizing

A critical tactic is adjusting position size based on market depth.

- Deep liquidity markets: Larger orders can be placed without moving the market.

- Shallow liquidity markets: Smaller, incremental orders should be used to minimize price impact.

This ties directly to how to analyze liquidity risk in trading, since executing oversized orders in weak markets creates hidden losses.

4. Smart Order Routing and Execution Tools

Professional day traders use execution algorithms and routing systems that optimize trades across venues.

- VWAP (Volume-Weighted Average Price) execution breaks trades into smaller chunks, minimizing price impact.

- TWAP (Time-Weighted Average Price) execution spreads trades over time for reduced visibility.

Advantages:

- Lower market impact.

- Access to multiple liquidity pools.

Disadvantages:

- Requires advanced trading platforms and sometimes higher costs.

5. Liquidity Event Trading

Certain events create temporary liquidity surges—earnings reports, central bank announcements, or major economic releases. Skilled day traders position themselves to capture volatility during these events while relying on short-term liquidity bursts.

Advantages:

- Large profit opportunities in minutes.

- High trading volume ensures fast execution.

Disadvantages:

- Unpredictable volatility may cause rapid losses.

- Requires strict stop-losses and discipline.

Comparing Two Liquidity Approaches

Conservative Liquidity Focus

- Trade only top-tier assets with deep liquidity.

- Use narrow spreads and predictable execution.

- Lower risk of slippage, but reduced opportunities in niche markets.

Aggressive Liquidity Exploitation

- Trade illiquid or semi-liquid assets for higher volatility.

- Use smaller sizes and scaling methods.

- Higher profit potential, but increased slippage risk.

Best Approach:

For most day traders, a hybrid model works best: prioritize highly liquid assets but occasionally take calculated trades in moderately liquid instruments with proper risk controls.

Real-World Liquidity Tips for Day Traders

- Always check average daily volume before trading.

- Avoid trading during lunch hours when liquidity drops.

- Place limit orders instead of market orders in low-liquidity environments.

- Monitor order book imbalances for early signals of liquidity shifts.

- Keep a liquidity journal to record spreads, slippage, and execution quality.

Industry Trends in Liquidity for Day Traders

AI and Smart Liquidity Analysis

Machine learning models are increasingly used to forecast short-term liquidity based on order book microstructure.

Retail Access to Institutional Tools

Platforms now offer retail traders tools once reserved for institutions—dark pool access, smart routing, and real-time depth analytics.

Cross-Asset Liquidity Strategies

Day traders are exploring liquidity solutions for retail investors that span equities, forex, and crypto to diversify liquidity sources.

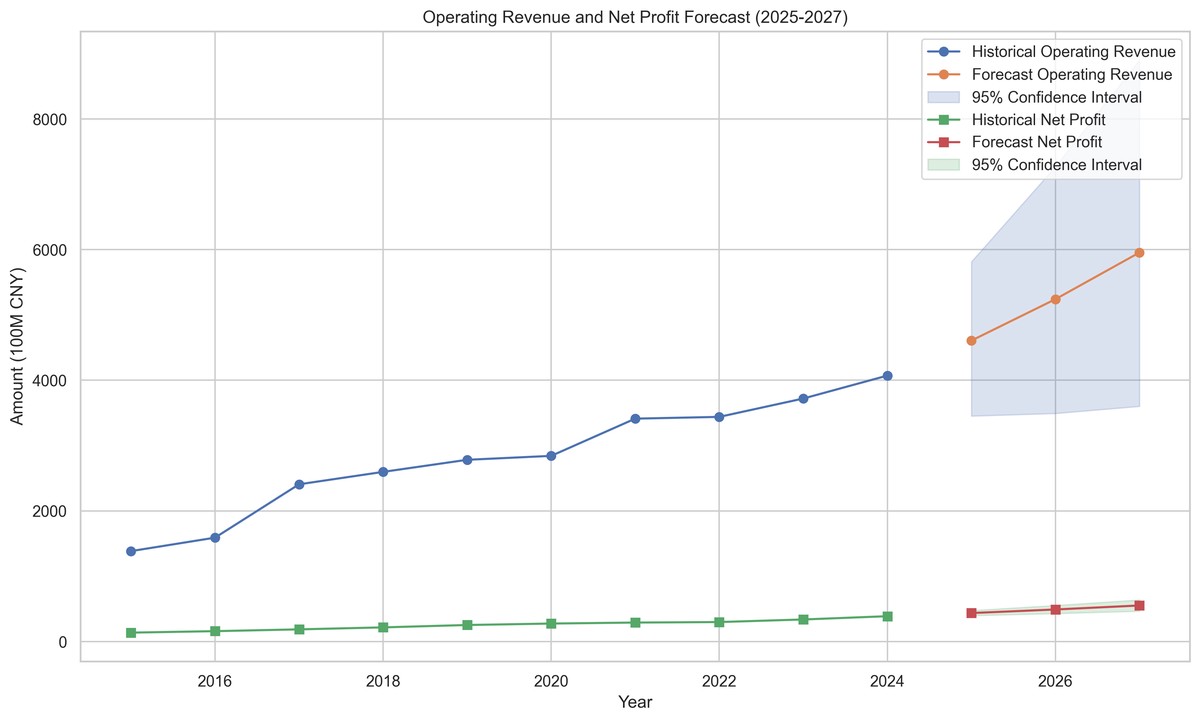

Example Visualization

Liquidity flow varies significantly by time of day and trading instrument

FAQs on Liquidity Strategies for Day Traders

1. How can I avoid slippage in day trading?

Slippage is best minimized by trading highly liquid assets, using limit orders, and aligning trades with peak liquidity hours. Advanced traders also use execution algorithms like VWAP or TWAP to split orders.

2. Should I trade illiquid stocks for bigger moves?

Illiquid stocks can provide large price swings, but they carry higher slippage and manipulation risk. Beginners should focus on liquid instruments before experimenting with less liquid ones.

3. How do I measure liquidity in real time?

Liquidity can be measured through bid-ask spreads, order book depth, and trading volume. Many platforms also provide liquidity heat maps and real-time depth charts to assist day traders.

Conclusion: Building Liquidity Awareness into Day Trading

Liquidity is not just a background condition—it’s a core driver of profitability in day trading. By mastering liquidity strategies for day traders, traders can reduce costs, improve execution, and gain a competitive edge.

From choosing liquid markets to using execution tools and timing trades wisely, liquidity-focused practices ensure that every trade is efficient and sustainable. For traders serious about long-term success, liquidity isn’t optional—it’s the foundation of every winning strategy.

If this article helped clarify liquidity strategies, share it with your trading community and comment below on your favorite method of managing liquidity. Together, we can build smarter, more efficient day trading practices.

Would you like me to also design a step-by-step liquidity improvement checklist (PDF/Excel) that day traders can download and apply directly in their daily routines?

0 Comments

Leave a Comment