=============================================

Machine learning has become a transformative force in modern finance. For aspiring traders, gaining a strong understanding of machine learning courses for aspiring traders is no longer optional—it is a necessity. Traders who can harness predictive algorithms, data-driven models, and AI-powered insights have a significant edge in today’s fast-paced financial markets. This comprehensive guide explores the best courses, strategies, and tools to help beginners and advanced learners alike master machine learning for trading success.

Introduction: Why Machine Learning Matters in Trading

Financial markets are inherently noisy and complex, making them difficult to predict using traditional methods alone. Machine learning (ML) helps traders by analyzing massive datasets, detecting hidden patterns, and improving decision-making through automation.

For aspiring traders, structured courses provide a learning path that covers both theory and hands-on applications. By enrolling in the right program, traders can learn how to use machine learning in quantitative trading effectively, bridging the gap between coding skills, financial knowledge, and market intuition.

Core Topics Covered in Machine Learning Courses for Traders

Most quality ML courses for traders emphasize a balance of theoretical foundation and practical application. Here are the essential components students can expect:

1. Data Preprocessing for Financial Markets

Financial data is messy—missing values, noise, and irregular time series are common. Courses typically start with data cleaning and feature engineering, ensuring reliable inputs for models.

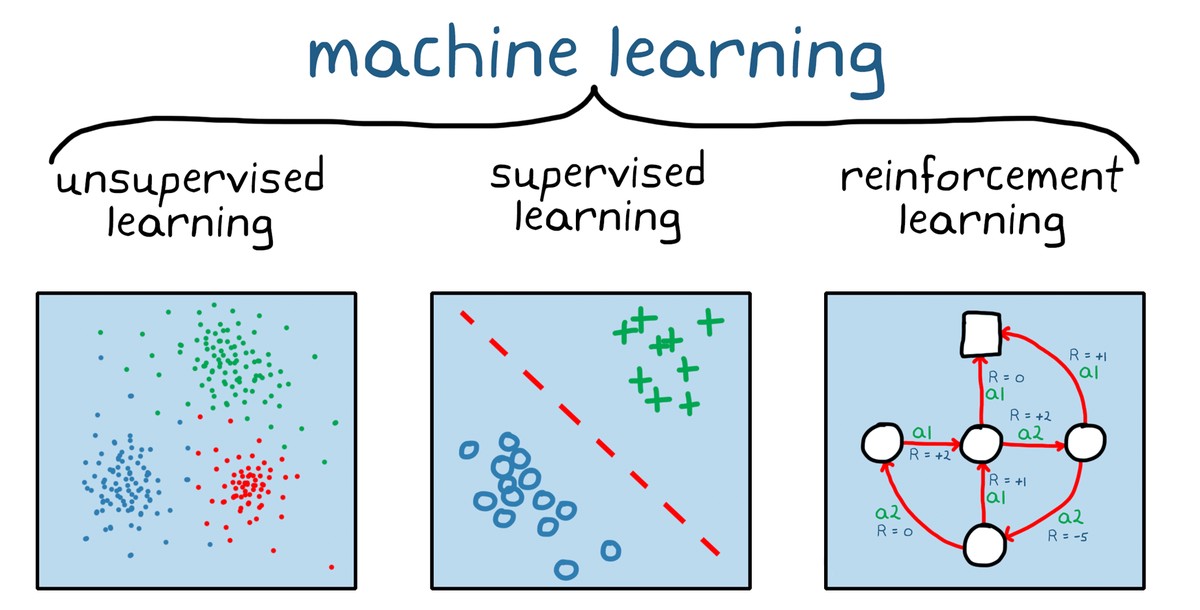

2. Supervised and Unsupervised Learning

- Supervised learning (regression, classification) helps predict stock price direction, volatility, or order flows.

- Unsupervised learning (clustering, PCA) aids in market regime detection and portfolio diversification.

3. Deep Learning Applications

Neural networks, particularly LSTMs and Transformers, are frequently used for time-series predictions. Advanced courses dive deep into architectures suited for financial modeling.

4. Backtesting and Validation

Courses stress robust backtesting to avoid overfitting. Learners practice applying models to historical market data to gauge real-world feasibility.

5. Risk and Portfolio Management

Machine learning is not just about predictions. Many courses highlight portfolio optimization, hedging, and machine learning solutions for portfolio management.

Recommended Machine Learning Courses for Aspiring Traders

Beginner-Level Programs

1. Coursera: Machine Learning for Trading by Georgia Tech

- Focuses on the basics of ML in finance.

- Introduces decision trees, random forests, and reinforcement learning.

- Hands-on projects with stock market datasets.

Pros: Ideal for beginners, industry recognition.

Cons: Limited coverage of deep learning.

2. Udemy: Python for Financial Analysis and Algorithmic Trading

- Covers Python basics, NumPy, pandas, and ML applications.

- Includes building backtesting frameworks.

Pros: Affordable, practical coding exercises.

Cons: More Python-focused than ML-focused.

Intermediate to Advanced Programs

1. QuantInsti: EPAT (Executive Programme in Algorithmic Trading)

- Comprehensive course covering ML, algorithmic trading, and financial engineering.

- Strong focus on practical algorithm deployment.

Pros: Industry-leading certification, strong alumni network.

Cons: Expensive, requires prior finance background.

2. MIT OpenCourseWare: Machine Learning for Trading

- A rigorous academic program.

- Focuses on statistical learning, reinforcement learning, and portfolio optimization.

Pros: Free access to world-class lectures.

Cons: Requires strong math/programming foundation.

Key areas where machine learning impacts trading: prediction, portfolio management, and risk analysis.

Methods and Strategies Taught in Machine Learning Courses

Strategy 1: Predictive Modeling for Asset Prices

Courses teach regression-based models and deep neural networks for predicting stock returns, volatility, and option pricing.

Advantages:

- Provides quantitative predictions.

- Can be tuned to short-term or long-term horizons.

Disadvantages:

- High risk of overfitting.

- Markets may react to unforeseen macro events outside the model’s scope.

Strategy 2: Reinforcement Learning for Trading Bots

Reinforcement learning (RL) is increasingly popular, enabling algorithms to learn optimal trading policies through trial and error.

Advantages:

- Adaptive to changing market conditions.

- Can simulate complex decision-making.

Disadvantages:

- Computationally expensive.

- Requires large datasets and simulation environments.

Comparison of Both Strategies

| Feature | Predictive Modeling | Reinforcement Learning |

|---|---|---|

| Complexity | Moderate | High |

| Market Adaptability | Limited | Strong |

| Data Requirements | Medium | Very High |

| Suitable For | Beginners/Students | Advanced practitioners |

For aspiring traders, predictive modeling offers a solid foundation, while RL strategies are best suited once coding, math, and finance fundamentals are strong.

Where to Apply Machine Learning in Quantitative Finance

Machine learning courses often include applied case studies showing where to apply machine learning in quantitative finance. Popular applications include:

- Portfolio optimization: balancing risk and return using ML-driven weights.

- Algorithmic trading: designing automated bots for intraday trading.

- Fraud detection: anomaly detection in transaction patterns.

- Sentiment analysis: analyzing news and social media for market sentiment shifts.

Tools and Frameworks Commonly Taught

- Python libraries: scikit-learn, TensorFlow, PyTorch.

- Data platforms: Bloomberg API, Quandl, Yahoo Finance.

- Backtesting tools: Zipline, Backtrader, QuantConnect.

These tools provide a practical environment for building, testing, and deploying ML-powered trading strategies.

Example roadmap: from basic Python to advanced ML models for trading.

Latest Trends in Machine Learning for Trading

- Transformer models in finance: Similar to ChatGPT’s backbone, transformers are being applied to financial time series.

- Explainable AI (XAI): Regulators demand transparency in ML decisions, leading to new explainable finance models.

- Hybrid models: Combining econometric models with ML techniques for robustness.

- Cloud-based ML trading systems: Scalable, low-cost infrastructure for aspiring traders.

Frequently Asked Questions (FAQ)

1. Do I need a math or finance background to start machine learning for trading?

Not necessarily. Many beginner-friendly courses start with Python basics and gradually introduce finance concepts. However, having a foundation in statistics, calculus, and financial markets will accelerate your progress.

2. Which is more important: coding skills or financial knowledge?

Both matter. Coding (Python, R, SQL) enables you to implement ML models, while financial knowledge ensures strategies align with market behavior. Successful traders balance both domains.

3. How long does it take to become proficient?

With consistent effort, a motivated student can become proficient in 6–12 months. Beginners should start with smaller ML models for trading, while advanced students can aim for reinforcement learning and deep learning systems.

Conclusion

Investing in the right machine learning courses for aspiring traders is one of the smartest decisions for anyone looking to build a career in quantitative finance or algorithmic trading. Courses not only teach the theory but also provide hands-on practice, bridging the gap between academics and real-world market execution.

Start small, build strong coding and data skills, and gradually explore advanced ML-driven strategies. With discipline, persistence, and continuous learning, aspiring traders can transform into successful quants.

If this guide gave you insights, please share it on social media, trading forums, or with fellow students. Comment below with your learning experiences or course recommendations—we’d love to hear your thoughts!

0 Comments

Leave a Comment