==========================================================================

Introduction

In today’s fast-evolving financial landscape, machine learning solutions for portfolio management have become a cornerstone for institutional investors, hedge funds, and even advanced retail traders. By leveraging data-driven algorithms, machine learning (ML) enables investors to analyze massive datasets, uncover hidden patterns, optimize asset allocation, and manage risks in ways that traditional financial models often cannot achieve.

This guide explores how machine learning can be effectively applied to portfolio management. We’ll cover key ML methods, compare different strategies, evaluate their strengths and weaknesses, and highlight best practices for implementation. By the end, you’ll understand not only how to integrate ML into your portfolio strategies but also how it enhances decision-making and risk-adjusted returns.

Why Machine Learning Matters in Portfolio Management

Shifting from Traditional Models

Conventional portfolio management relies on models such as the Capital Asset Pricing Model (CAPM) and Modern Portfolio Theory (MPT). While these frameworks provide a foundation, they struggle with real-world complexity—nonlinear correlations, regime shifts, and unpredictable black swan events.

Machine learning introduces flexibility by detecting nonlinear relationships in data, adapting to market changes, and continuously improving performance through training.

Key Benefits

- Predictive Power – Algorithms can forecast asset prices, volatility, and correlations more accurately.

- Adaptive Risk Management – Dynamic models help rebalance portfolios in real time.

- Efficiency – Automated systems reduce human biases and manual workload.

- Scalability – ML can handle thousands of assets across asset classes simultaneously.

Machine learning workflow applied to portfolio management: from data collection to model deployment.

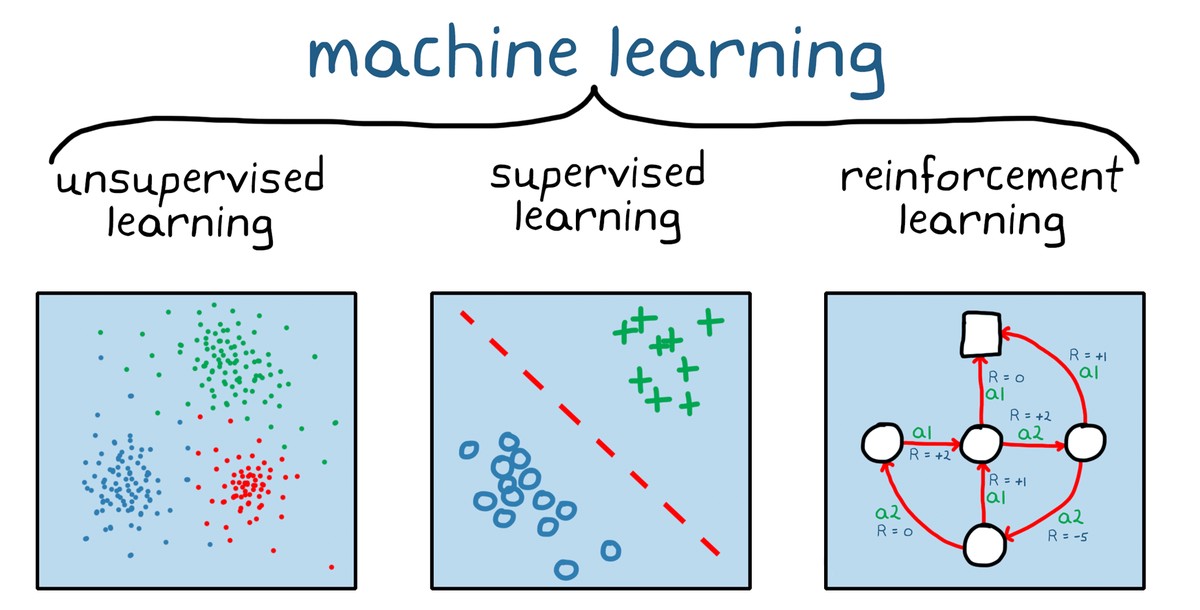

Core Machine Learning Strategies in Portfolio Management

1. Supervised Learning Models

Supervised learning algorithms are widely used for return prediction and asset classification. Models such as Random Forests, Gradient Boosting, and Neural Networks can be trained on labeled financial data (historical prices, macroeconomic indicators, sentiment scores).

- Use case: Predicting short-term returns of equities to optimize allocation.

- Advantage: High accuracy when trained on quality datasets.

- Disadvantage: Requires continuous retraining to avoid overfitting.

2. Reinforcement Learning (RL) for Dynamic Allocation

Reinforcement learning allows algorithms to learn by interacting with the market environment, making sequential decisions that maximize long-term rewards. In portfolio management, RL agents optimize allocations dynamically, considering transaction costs and risk constraints.

- Use case: Automated rebalancing of multi-asset portfolios.

- Advantage: Adapts well to changing market regimes.

- Disadvantage: Computationally intensive and data-hungry.

3. Unsupervised Learning for Risk Clustering

Unsupervised learning models like K-means, PCA, and Hierarchical Clustering help in identifying hidden structures in market data. They are particularly effective in risk clustering and factor analysis.

- Use case: Grouping assets by volatility or factor exposure to diversify effectively.

- Advantage: Reduces concentration risks and uncovers diversification opportunities.

- Disadvantage: Does not directly predict returns.

Comparing Two Key Approaches: Predictive Models vs. Reinforcement Learning

| Feature | Predictive Models (Supervised Learning) | Reinforcement Learning |

|---|---|---|

| Goal | Predict future returns/volatility | Optimize allocation over time |

| Strengths | High predictive accuracy, well-documented methods | Adaptive, robust to regime shifts |

| Weaknesses | Risk of overfitting, sensitive to data quality | Requires vast amounts of data, complex to implement |

| Best For | Short-term return prediction and stock selection | Dynamic asset allocation and long-term optimization |

Recommendation:

For institutions starting with machine learning solutions for portfolio management, a hybrid approach works best—using supervised learning for predictive insights and reinforcement learning for allocation decisions.

Practical Implementation of ML in Portfolio Management

Data Requirements

- Market Data: Price, volume, volatility

- Macroeconomic Data: Interest rates, GDP growth, inflation

- Alternative Data: Sentiment analysis from news and social media, ESG metrics

Model Deployment Steps

- Data Collection & Cleaning – Ensure accuracy and reduce noise.

- Feature Engineering – Extract relevant predictors like moving averages, volatility clusters.

- Model Training – Apply supervised or reinforcement learning frameworks.

- Backtesting – Validate models with historical data.

- Live Testing – Deploy in real-world conditions with capital constraints.

Risk Management with Machine Learning

Volatility Forecasting

ML models such as LSTM (Long Short-Term Memory networks) can forecast volatility more effectively than GARCH models, helping in position sizing.

Stress Testing

Machine learning can simulate market shocks using scenario analysis to evaluate portfolio resilience.

Automated Stop-Loss Systems

Reinforcement learning can adjust stop-loss levels dynamically, balancing drawdown control with performance.

AI-enhanced risk management: adaptive rebalancing and volatility forecasting in action.

Industry Trends in Machine Learning for Portfolio Management

- Explainable AI (XAI): Investors demand transparency in ML models to comply with regulatory standards.

- Integration with ESG: ML helps quantify and integrate environmental, social, and governance factors.

- Cloud-based ML platforms: Lower barriers for institutions to deploy advanced ML models at scale.

- Hybrid Models: Combining statistical finance models with ML for more robust performance.

For those exploring deeper applications, you can study how to use machine learning in quantitative trading, which complements portfolio management by extending predictive analytics to trading execution.

Best Practices and Recommendations

- Start Small: Deploy ML models in a sandbox environment before scaling.

- Human Oversight: Machine learning enhances, not replaces, portfolio managers.

- Continuous Monitoring: Retrain models regularly to adapt to new data.

- Cross-Validation: Prevent overfitting by using multiple validation datasets.

This aligns with the growing recognition of why machine learning in quantitative analysis is important—not only for improving performance but also for institutional credibility.

FAQs

1. How do machine learning solutions improve portfolio performance?

ML improves portfolio performance by predicting returns, identifying risk clusters, and dynamically rebalancing allocations. Unlike static models, ML adapts to changing market conditions and integrates diverse data sources for more informed decisions.

2. Are machine learning models reliable during market crises?

Machine learning can perform well in crises if trained on diverse datasets that include stress periods. Reinforcement learning models are particularly resilient since they optimize for long-term rewards, but no model is immune to black swan events.

3. What skills are needed to implement ML in portfolio management?

A mix of financial expertise (risk management, asset pricing), data science skills (Python, R, SQL), and ML frameworks knowledge (TensorFlow, PyTorch) is essential. Many firms build cross-disciplinary teams of quants, analysts, and engineers.

Conclusion

Machine learning solutions for portfolio management are revolutionizing how investors optimize returns and control risks. From predictive models that forecast returns to reinforcement learning algorithms that rebalance portfolios dynamically, ML provides powerful tools for modern asset managers.

By combining financial expertise with cutting-edge AI techniques, institutions and sophisticated investors can achieve better diversification, enhanced risk-adjusted returns, and more adaptive strategies.

The future of portfolio management is undeniably data-driven—and machine learning is at its core.

💬 Your turn:

Have you experimented with machine learning in your investment strategy? Share your experiences in the comments below and forward this guide to colleagues or peers interested in AI-driven portfolio management.

0 Comments

Leave a Comment