===============================================

Introduction

Liquidity is the lifeblood of algorithmic trading. Without sufficient liquidity, even the most sophisticated trading models can face slippage, execution delays, and unexpected losses. Knowing how to manage liquidity for algorithmic trading is a critical skill for both institutional traders and advanced retail quants. Effective liquidity management ensures smoother trade execution, reduced transaction costs, and minimized market impact—core objectives for any algorithmic strategy.

In this article, we will dive deep into the mechanics of liquidity in algorithmic trading, explore two primary strategies to manage liquidity, analyze their pros and cons, and provide actionable insights. We’ll also cover industry trends, personal insights from practical applications, and highlight how liquidity shapes the success of algorithmic models.

Understanding Liquidity in Algorithmic Trading

Definition of Liquidity

Liquidity refers to how easily an asset can be bought or sold without significantly impacting its price. In algorithmic trading, liquidity is not just about availability but about stability—whether a strategy can execute thousands of orders seamlessly without disrupting the market.

Key Metrics for Liquidity Measurement

- Bid-Ask Spread: Narrow spreads often indicate higher liquidity.

- Market Depth: Shows available volume at different price levels.

- Order Book Imbalance: Helps algorithms assess immediate market pressure.

- Trade Volume & Turnover: Indicators of how active a market is.

In practice, traders often integrate these factors into risk models. For instance, firms building quantitative liquidity strategy guides often analyze spreads, volatility, and execution costs together.

Why Liquidity Management Matters in Algo Trading

- Execution Efficiency – Liquidity directly influences fill rates. Poor liquidity means partial fills or delays.

- Slippage Reduction – High liquidity reduces price deviation between order placement and execution.

- Model Stability – Liquidity shocks can invalidate backtests and destabilize live strategies.

- Risk Mitigation – In volatile markets, liquidity can disappear quickly, leading to sudden exposure.

This is why many developers focus on how liquidity affects quantitative trading models when backtesting and optimizing algorithms.

Strategies for Managing Liquidity in Algorithmic Trading

1. Passive Liquidity Provision (Market Making)

How It Works

In this strategy, traders act as liquidity providers by placing limit orders on both sides of the order book. Market-making algorithms profit from the spread while contributing to market stability.

Advantages

- Generates consistent returns from spreads.

- Improves market depth, reducing slippage for other strategies.

- Offers rebates from exchanges that reward liquidity providers.

Disadvantages

- Exposure to adverse selection: when counterparties trade against you with better information.

- Requires sophisticated risk management to avoid holding unwanted inventory.

- High sensitivity to sudden volatility or liquidity shocks.

Use Case

Market-making strategies are popular among high-frequency trading firms that thrive in liquid markets like forex or large-cap equities.

2. Smart Order Routing (SOR) and Liquidity Aggregation

How It Works

Smart Order Routing distributes large orders across multiple venues to minimize market impact. Liquidity aggregation tools consolidate order books from different exchanges, ensuring that algorithms find the best execution price.

Advantages

- Reduces execution costs by splitting orders across venues.

- Minimizes visibility of large trades, avoiding front-running.

- Works well for large institutions trading across fragmented markets.

Disadvantages

- Higher infrastructure and data costs.

- Requires robust latency management.

- Limited effectiveness in illiquid or niche markets.

Use Case

Institutional traders and hedge funds often use SOR to manage liquidity across fragmented crypto exchanges or dark pools in equity markets.

Comparing Strategies: Which Is Better?

- Passive Market Making is best suited for firms with advanced risk models and the ability to hedge exposure quickly. It generates steady returns but carries inventory risk.

- Smart Order Routing & Liquidity Aggregation works best for large orders that require discreet execution without moving markets.

Best Practice Recommendation: For most algorithmic trading firms, a hybrid approach combining passive liquidity provision with smart order routing offers the best balance between profitability and risk.

Practical Techniques to Improve Liquidity Management

1. Dynamic Order Sizing

Algorithms can adjust trade size based on real-time liquidity. For example, they may scale down orders during low-volume sessions.

2. VWAP/TWAP Execution

Using time-weighted or volume-weighted average price algorithms allows traders to blend into the market and reduce slippage.

3. Liquidity Forecasting Models

Advanced machine learning models predict liquidity availability by analyzing historical volume, volatility, and macro events. This falls under liquidity forecasting method guides increasingly used by quants.

Industry Trends in Liquidity Management

- AI-Powered Liquidity Prediction – Deep learning is being used to forecast order book dynamics.

- Crypto Liquidity Pools – In DeFi, liquidity management often involves decentralized pools and automated market makers.

- Regulatory Considerations – Rules on best execution push institutions to adopt more advanced liquidity solutions.

Images for Better Understanding

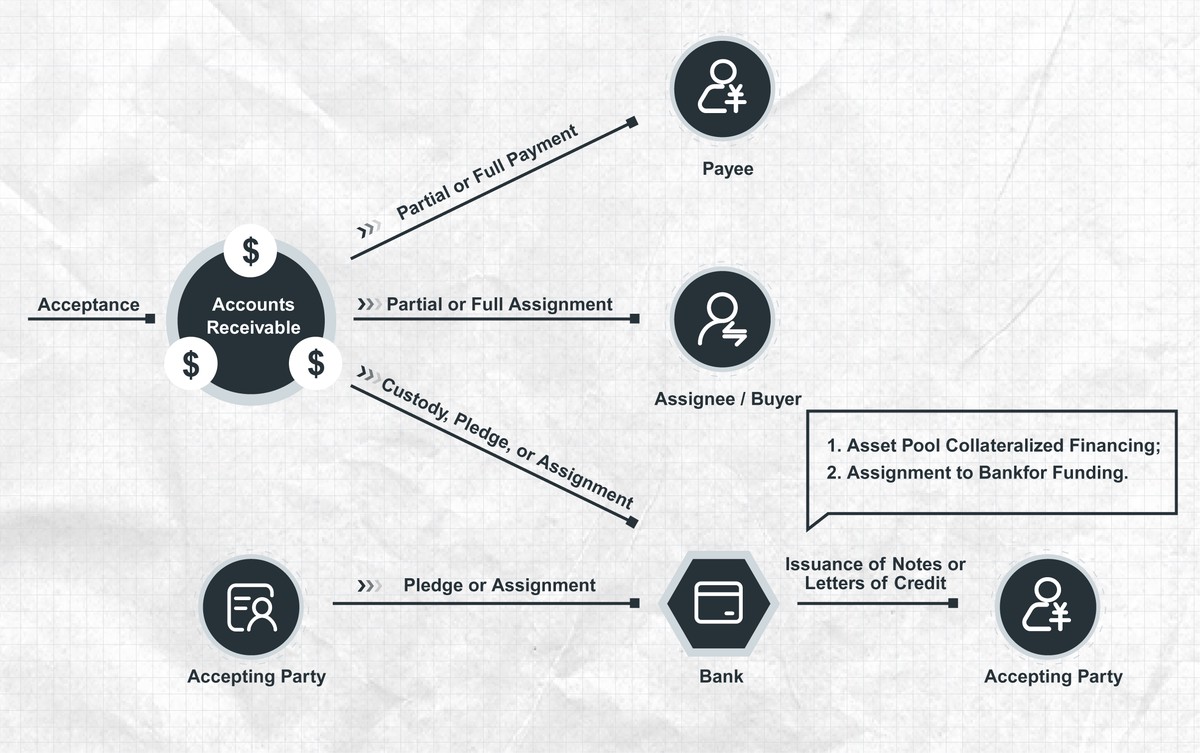

Order Book Depth and Liquidity Visualization

Smart Order Routing Execution Flow

FAQ: Managing Liquidity in Algorithmic Trading

1. How do I measure liquidity in real time?

Traders can use metrics such as bid-ask spreads, market depth snapshots, and volume analysis. Advanced setups often integrate real-time order book analytics with historical models to forecast liquidity availability.

2. What’s the biggest risk when trading in low-liquidity markets?

The biggest risk is slippage. A single large order can move the price significantly, leading to execution far from expected levels. Additionally, liquidity may disappear during stress events, leaving positions unhedged.

3. How does liquidity management differ in crypto markets?

Crypto markets are fragmented across many exchanges. Effective liquidity management often requires smart order routing, arbitrage tools, and sometimes participation in decentralized liquidity pools. Unlike equities, centralized exchanges in crypto may have highly uneven liquidity.

Conclusion: Building a Robust Liquidity Framework

Knowing how to manage liquidity for algorithmic trading is not just a technical detail—it’s a survival strategy in modern markets. Traders who master liquidity can reduce execution costs, minimize risks, and improve strategy resilience. Whether through passive liquidity provision, smart order routing, or predictive analytics, robust liquidity management is key to long-term profitability.

If you found this article helpful, share it with your network, comment with your experiences managing liquidity, and join the discussion on advanced algo trading practices.

Would you like me to also create a visual infographic summarizing liquidity management strategies so the article feels more professional and shareable on LinkedIn and Twitter?

0 Comments

Leave a Comment