=====================================

Understanding market microstructure for hedge funds is crucial in today’s sophisticated financial environment. Market microstructure provides insights into how financial markets operate, how prices are formed, and how liquidity, order flow, and trading strategies interact. For hedge funds, leveraging these insights can enhance trading efficiency, reduce costs, and optimize risk-adjusted returns.

This article offers a comprehensive analysis of market microstructure tailored for hedge funds, discussing key methodologies, comparative strategies, practical applications, and emerging trends. It also addresses common questions to help fund managers and analysts make informed decisions.

What is Market Microstructure?

Market microstructure is the study of how trades are executed, how prices are determined, and how information flows in financial markets. It examines the mechanics of trading platforms, the behavior of market participants, and the impact of order types on market dynamics.

Key Components of Market Microstructure

- Order Flow – The sequence and nature of buy and sell orders, which impacts price discovery and liquidity.

- Liquidity – Availability of assets to trade without significantly affecting prices.

- Bid-Ask Spread – The difference between the buying and selling prices, a key cost factor for hedge funds.

- Information Asymmetry – Differences in access to information among market participants, influencing trading strategies.

Visual representation of market microstructure components impacting trading decisions

Embedded Link: For hedge funds seeking to deepen their technical expertise, exploring how market microstructure affects pricing provides actionable insights for optimizing trading strategies.

Why Hedge Funds Should Focus on Market Microstructure

Hedge funds operate in fast-paced environments where microsecond execution differences can translate into significant profit or loss. Understanding microstructure allows funds to:

- Optimize execution by selecting the best venues and order types

- Minimize transaction costs, including slippage and spreads

- Enhance algorithmic and high-frequency trading by integrating market dynamics into models

- Manage liquidity risk, ensuring large trades do not impact market prices adversely

Strategies for Leveraging Market Microstructure

1. Order Execution Optimization

Approach

Hedge funds can use smart order routing, iceberg orders, and limit order strategies to reduce trading costs and market impact. Real-time market data and predictive analytics help determine optimal execution times and order sizes.

Advantages

- Minimizes slippage and transaction costs

- Maintains anonymity in large trades

- Supports high-frequency trading strategies

Limitations

- Requires advanced technology infrastructure

- Dependence on accurate real-time data

2. Market Impact Modeling

Approach

Modeling market impact involves quantifying how trades affect asset prices. Techniques include statistical analysis of historical data, simulation of order books, and predictive algorithms.

Advantages

- Helps in planning large trades without significant market disruption

- Improves risk-adjusted return metrics

- Supports portfolio optimization strategies

Limitations

- Models can be sensitive to changing market conditions

- Requires continuous calibration and testing

Example of order execution strategies to minimize market impact

Embedded Link: Learning where to learn market microstructure can provide hedge fund analysts access to specialized courses and datasets to refine execution and impact models.

Comparative Analysis of Microstructure Strategies

Strategy A: Algorithmic Trade Execution

- Focus: Speed, efficiency, and minimizing spread costs

- Pros: High execution accuracy, low latency advantages

- Cons: High technology and data costs, requires constant monitoring

Strategy B: Human-Led Execution with Market Insight

- Focus: Leveraging trader experience and market intuition

- Pros: Flexibility in volatile markets, incorporates qualitative data

- Cons: Slower execution, potentially higher cost per trade

Recommendation: A hybrid approach combining algorithmic execution for standard trades and human oversight for complex market conditions often yields optimal performance for hedge funds.

Practical Applications in Hedge Fund Operations

- High-Frequency Trading – Integrating microstructure insights to develop ultra-fast trading algorithms.

- Liquidity Provision – Understanding microstructure aids in providing liquidity efficiently while managing inventory risk.

- Arbitrage Strategies – Identifying mispricing across venues using microstructure-aware models.

- Risk Management – Quantifying market impact and spread costs in portfolio risk assessments.

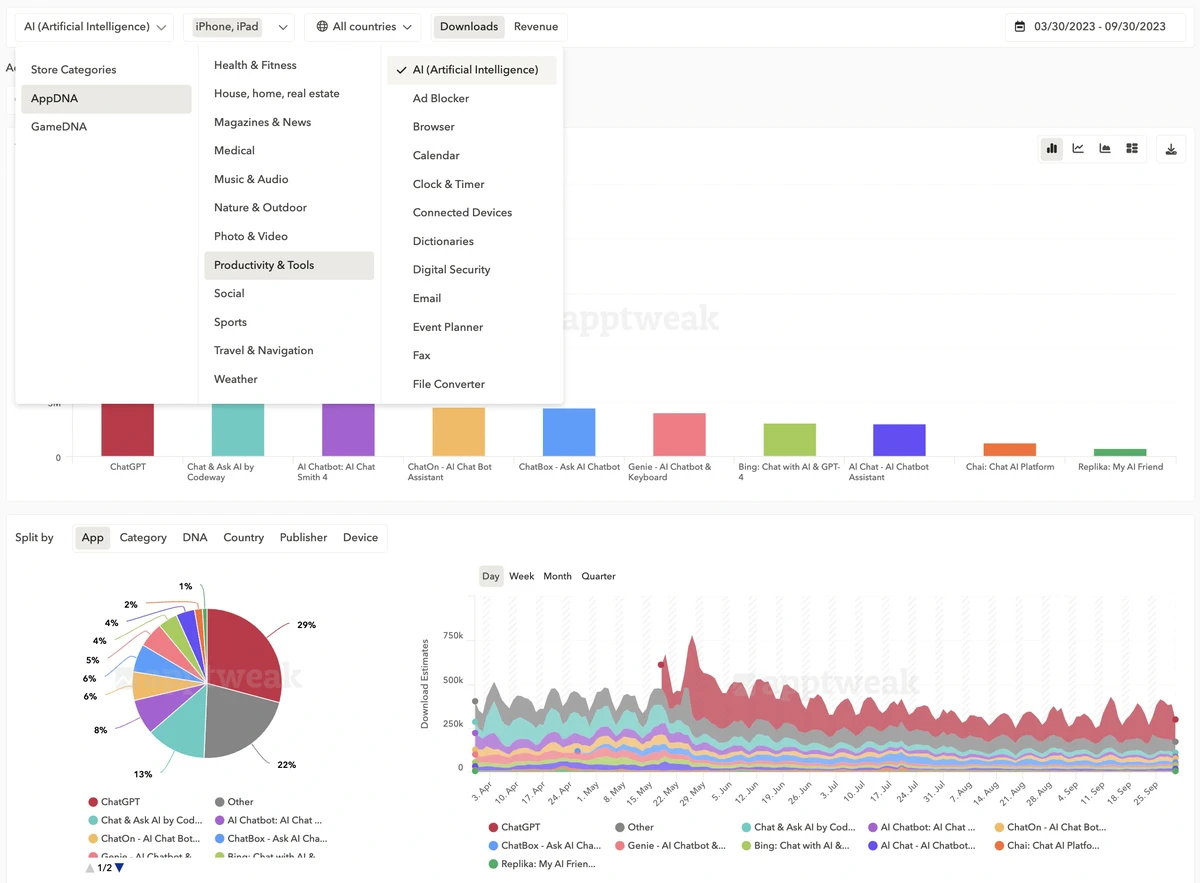

Market microstructure analysis applied to hedge fund trading strategies

Skills and Tools Required

- Quantitative Modeling: Statistical analysis, econometrics, and stochastic modeling

- Programming & Software: Python, R, MATLAB, C++, Bloomberg Terminal

- Trading Platforms: Familiarity with exchange APIs, ECNs, and order routing systems

- Data Analytics: High-frequency data analysis, predictive modeling, and visualization

Emerging Trends in Market Microstructure

- AI and Machine Learning Integration – Enhancing trade prediction, liquidity forecasting, and execution strategies.

- Big Data Analytics – Leveraging historical and real-time data for more accurate market microstructure modeling.

- Cross-Market Strategies – Applying microstructure insights across equities, futures, FX, and crypto markets.

- Regulatory Developments – Adapting to new rules affecting transparency, order types, and reporting.

FAQ: Market Microstructure for Hedge Funds

1. How does market microstructure influence hedge fund profitability?

Market microstructure directly affects execution costs, slippage, and liquidity access, which are critical for optimizing returns. Funds leveraging microstructure insights can design trading strategies that reduce costs and improve performance.

2. What resources are available for learning market microstructure?

Hedge fund professionals can access specialized courses, research papers, and simulation tools to study order flow, price formation, and execution strategies. Participating in workshops or consulting experts also enhances practical knowledge.

3. How can hedge funds apply microstructure insights in algorithmic trading?

Insights guide order placement, timing, and size, allowing algorithms to minimize market impact and optimize trading efficiency. Predictive models can incorporate liquidity, volatility, and spread dynamics to improve trade execution.

Conclusion

Understanding market microstructure for hedge funds is essential for enhancing execution efficiency, reducing costs, and improving risk-adjusted returns. By leveraging both algorithmic and human-led strategies, hedge funds can navigate complex market dynamics effectively. Continuous learning, data analysis, and adaptation to emerging trends are key to maintaining a competitive edge in today’s rapidly evolving markets.

💬 Share your insights on market microstructure strategies for hedge funds in the comments and help elevate industry knowledge. Spread this article to connect with peers and foster a community of informed trading professionals.

0 Comments

Leave a Comment