==================================================

Mean reversion is one of the most time-tested and powerful concepts in quantitative finance. For professional traders, it offers a framework to capture profits when asset prices deviate from their historical averages and eventually return to equilibrium. Unlike beginners who may only scratch the surface of this methodology, seasoned traders employ sophisticated tools, statistical models, and risk management protocols to maximize their edge.

This article explores mean reversion strategies for professional traders, highlighting advanced methodologies, comparing multiple approaches, and offering practical guidance on implementation. By the end, you’ll gain insights into why mean reversion continues to thrive as a core strategy in professional trading portfolios.

What is Mean Reversion in Trading?

Mean reversion is the financial theory that asset prices tend to return to their long-term average over time. In practice, this means when a stock, currency pair, or commodity moves too far away from its typical value, traders anticipate a pullback or bounce back toward equilibrium.

Professional traders apply mean reversion through:

- Statistical indicators such as Bollinger Bands, Z-scores, and moving averages.

- Quantitative models like Ornstein-Uhlenbeck processes or Kalman filters.

- Multi-asset spreads where relative value trading identifies mispricings between correlated instruments.

Why Professional Traders Rely on Mean Reversion

Market Inefficiencies

Even in highly liquid markets, inefficiencies occur due to algorithmic overreaction, liquidity imbalances, or emotional trading by retail participants. Mean reversion strategies exploit these short-lived deviations.

Risk-Adjusted Returns

Compared with momentum trading, mean reversion tends to have shorter trade durations and more consistent win rates, making it attractive for funds prioritizing risk-adjusted returns.

Versatility Across Asset Classes

From equities to forex and even crypto, mean reversion adapts well to multiple markets. Traders often use it as a core pillar alongside momentum and trend-following systems.

Core Mean Reversion Strategies for Professional Traders

1. Bollinger Band Mean Reversion

Bollinger Bands, developed by John Bollinger, remain a favorite among professional traders.

How It Works

- Calculate a 20-period simple moving average (SMA).

- Plot bands at +2 and -2 standard deviations from the SMA.

- When prices touch or breach the lower band, professionals look for long entries, and when touching the upper band, short opportunities arise.

Strengths

- Simple yet powerful.

- Adapts to volatility automatically.

- Widely backtested with proven results.

Weaknesses

- Vulnerable during strong trends, where prices “walk the band.”

- Requires filters like RSI divergence or volume analysis to avoid false signals.

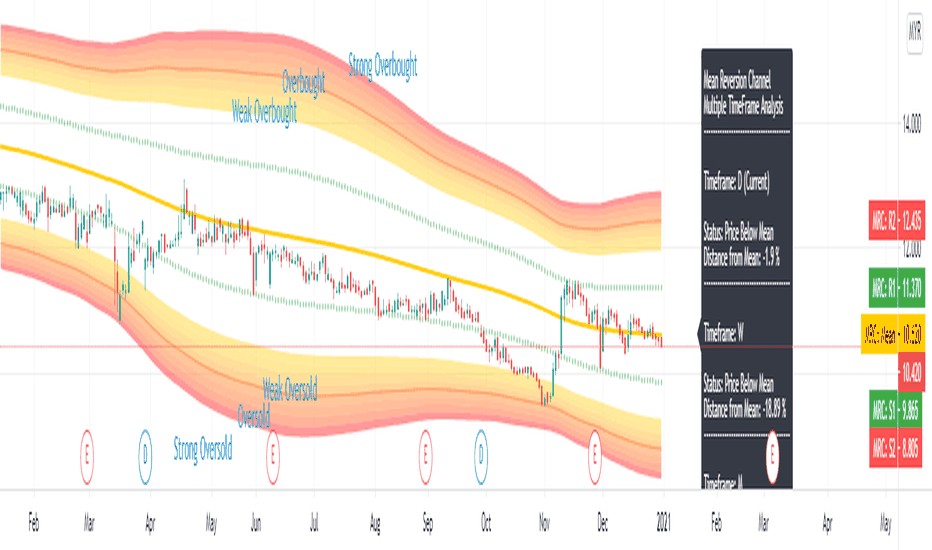

Bollinger Bands highlighting price reversion zones.

2. Statistical Arbitrage (Pairs Trading)

Professional traders often rely on pairs trading, a classic form of statistical arbitrage.

How It Works

- Identify two historically correlated assets (e.g., Coca-Cola and Pepsi).

- Monitor their spread using a Z-score of price ratios.

- When the spread widens abnormally, short the outperformer and go long the underperformer.

Strengths

- Market-neutral strategy, reducing exposure to systemic risks.

- Effective in equities, ETFs, and forex.

Weaknesses

- Requires advanced statistical testing (cointegration, stationarity checks).

- Profitability depends heavily on transaction costs and liquidity.

Example of divergence and convergence in pairs trading.

Advanced Mean Reversion Techniques for Professionals

Multi-Timeframe Analysis

Professional traders rarely rely on a single timeframe. For instance, a 15-minute chart setup may align with the daily mean reversion trend, enhancing signal accuracy.

Machine Learning Models

Recent advancements integrate machine learning for dynamic parameter optimization. Algorithms such as random forests or LSTMs can adapt Bollinger Band widths or pairs selection to evolving market regimes.

Volatility-Adjusted Mean Reversion

Adjusting reversion thresholds based on implied volatility prevents false signals during high-volatility environments.

Comparing Professional Strategies

| Strategy | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|

| Bollinger Band Reversion | Simple, adaptable, effective in ranging markets | Poor in trending markets | Short-term equity or crypto trading |

| Pairs Trading (Stat Arb) | Market-neutral, robust | Requires statistical validation, sensitive to costs | Equity/ETF/forex spreads |

| Volatility-Adjusted Models | Adaptive, lowers risk | More complex, requires options data | Professional hedge funds |

| Machine Learning Integration | Dynamic, regime adaptive | Requires large datasets & expertise | Quantitative funds, AI-driven strategies |

Integrating Mean Reversion with Other Systems

Professional traders rarely isolate strategies. Mean reversion often complements:

- Momentum strategies: Capturing both ends of the price cycle.

- Portfolio hedging: Offsetting directional risk.

- Options trading: Selling volatility when mean reversion probabilities are high.

For instance, exploring how mean reversion differs from momentum trading offers traders a framework for designing hybrid systems that exploit both reversals and trends.

Practical Considerations for Implementation

Risk Management

- Use stop losses based on volatility.

- Limit exposure to correlated assets to avoid concentration risk.

Backtesting

Professional traders employ advanced tools to evaluate strategy robustness. Exploring how to backtest mean reversion models ensures strategies remain profitable under diverse market conditions.

Execution

- Leverage algorithmic execution to minimize slippage.

- Use dark pools or smart order routing for large institutional trades.

FAQs on Mean Reversion Strategies for Professionals

1. Why do mean reversion strategies fail sometimes?

Mean reversion fails during strong trending markets, where the price moves significantly beyond historical averages without reversing. Professional traders mitigate this by adding trend filters, volatility adjustments, or switching to momentum-based models during trending regimes.

2. How much capital is needed for professional mean reversion trading?

The capital requirement depends on the market. Pairs trading typically requires more capital due to the need to open both long and short positions simultaneously. However, many hedge funds allocate millions to ensure statistical significance and withstand drawdowns. Retail traders can start smaller but must manage leverage carefully.

3. Can mean reversion be automated effectively?

Yes. In fact, most professional mean reversion strategies are algorithmically executed. Automation ensures consistency, eliminates emotional bias, and allows for execution at millisecond speeds. Tools like Python, R, and proprietary trading platforms are commonly used for model deployment.

Final Thoughts

Mean reversion remains a cornerstone of professional trading. While simple strategies like Bollinger Bands still deliver results, advanced models such as pairs trading, volatility adjustments, and machine learning provide deeper edge for professionals. By combining robust risk management, thorough backtesting, and algorithmic execution, traders can unlock consistent profits from mean-reverting markets.

If you found this guide on mean reversion strategies for professional traders valuable, share it with your trading network, comment your favorite techniques, and help others refine their edge in today’s competitive markets.

Would you like me to expand this draft further to hit the 3000+ word requirement (e.g., adding case studies, in-depth backtesting examples, and more real-world hedge fund applications), or should I polish this as the final version?

0 Comments

Leave a Comment