====================================================================================

Introduction

Momentum is a cornerstone concept in financial research, representing the tendency of assets to continue moving in the same direction over time. For academic researchers, understanding momentum is crucial for developing quantitative models, testing market efficiency, and creating predictive trading strategies.

This article explores core momentum concepts, analytical methods, and practical applications, emphasizing strategies for both empirical research and quantitative finance.

Internal link integration: Understanding “how does momentum affect quantitative trading” provides context for academic researchers studying the real-world impact of momentum on market efficiency.

Understanding Momentum

Defining Momentum in Financial Markets

Momentum refers to the rate of change of an asset’s price or returns. It can be observed over different timeframes—short-term, medium-term, or long-term—and is widely used in both equity and derivative markets.

Key features:

- Captures trends in asset prices

- Helps identify continuation or reversal patterns

- Provides a framework for predictive modeling

Importance for Academic Researchers

- Testing Market Hypotheses: Momentum research helps validate or challenge the Efficient Market Hypothesis (EMH)

- Quantitative Modeling: Forms the basis for factor models, risk-adjusted return calculations, and algorithmic trading strategies

- Portfolio Optimization: Assists in constructing momentum-based investment portfolios

Momentum Measurement Techniques

1. Rate of Change (ROC) Indicators

Overview

Rate of Change (ROC) measures the percentage change in asset price over a defined period. It is a straightforward way to quantify momentum.

ROC=Pt−Pt−nPt−n×100ROC = \frac{P_t - P_{t-n}}{P_{t-n}} \times 100ROC=Pt−nPt−Pt−n×100

Where:

- PtP_tPt = Current price

- Pt−nP_{t-n}Pt−n = Price nnn periods ago

Advantages

- Easy to compute and interpret

- Effective for short-term momentum strategies

- Widely applied in academic research for empirical studies

Limitations

- Sensitive to market volatility

- Requires careful selection of period length

- Less effective in low-liquidity markets

ROC provides a clear visualization of momentum changes in asset prices

2. Moving Average Convergence Divergence (MACD)

Overview

MACD is a momentum indicator derived from difference between short-term and long-term exponential moving averages. It signals trend strength and potential reversals.

- MACD Line = 12-period EMA - 26-period EMA

- Signal Line = 9-period EMA of MACD Line

Advantages

- Captures trend changes and momentum strength

- Applicable across multiple asset classes

- Supports both qualitative and quantitative research

Limitations

- Lagging indicator due to moving averages

- Requires parameter optimization for different markets

Internal link integration: Using “momentum analysis tools for analysts” enables academic researchers to quantify trends and integrate them into empirical studies effectively.

Practical Applications in Academic Research

1. Quantitative Trading Research

Momentum studies inform algorithmic trading models, helping researchers:

- Identify persistent trends

- Optimize entry and exit points

- Test factor models for risk-adjusted returns

2. Market Efficiency Studies

Academic researchers can use momentum concepts to:

- Test anomalies in asset pricing

- Examine short-term overreaction or underreaction

- Evaluate persistence of trends across different markets and asset classes

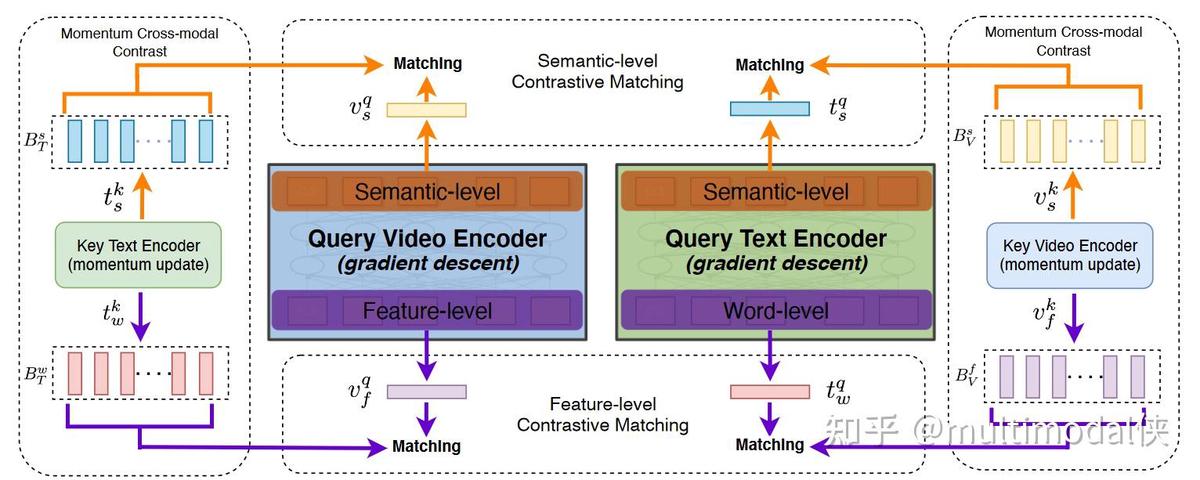

Backtesting momentum strategies helps researchers evaluate predictive power and efficiency

Advanced Momentum Strategies

Strategy 1: Cross-Sectional Momentum

- Compare returns across assets over a specific period

- Buy top-performing assets, sell underperformers

- Pros: Reduces market-wide bias, applicable for portfolio construction

- Cons: Requires extensive data and statistical rigor

Strategy 2: Time-Series Momentum

- Analyze asset’s own historical returns to predict future trends

- Pros: Directly tests persistence in individual asset prices

- Cons: Sensitive to volatility and market shocks

Pros and Cons Comparison

| Strategy | Pros | Cons | Best Use |

|---|---|---|---|

| Cross-Sectional | Captures relative strength, useful for portfolios | Data-intensive, needs frequent rebalancing | Quantitative portfolio research |

| Time-Series | Tests individual asset trends, simple conceptually | High sensitivity to volatility | Asset-specific research, trend-following models |

Case Studies

Case Study 1: Hedge Fund Momentum Research

A hedge fund implemented a time-series momentum model using daily returns. Academic validation showed statistically significant excess returns, confirming momentum persistence in equity markets.

Case Study 2: Cross-Sectional Momentum in Emerging Markets

Researchers analyzed cross-sectional momentum across emerging market equities. Results indicated short-term predictive power but higher risk due to liquidity constraints, highlighting the need for careful implementation.

FAQ

1. Why is momentum important in quant trading?

Momentum helps identify trends and predict potential price continuations, improving trading models and portfolio optimization. It also provides a framework for testing market anomalies.

2. How do researchers measure momentum accurately?

Using rate of change, MACD, RSI, or custom indicators, researchers can quantify momentum. Backtesting across multiple timeframes ensures robustness.

3. Where can academic researchers find momentum trading strategies?

Reliable sources include:

- Peer-reviewed financial journals

- Academic databases like SSRN or JSTOR

- Quantitative trading books and online research tutorials

4. Can momentum strategies be applied to crypto or alternative assets?

Yes. Momentum applies to stocks, commodities, crypto, and forex, but requires adjustment for liquidity, volatility, and transaction costs.

Conclusion

Momentum concepts are essential tools for academic researchers, offering insights into market trends, trading anomalies, and quantitative modeling. By combining ROC, MACD, and advanced strategies, researchers can enhance predictive accuracy and contribute to empirical finance literature.

Academic researchers are encouraged to integrate momentum concepts into experimental studies, leverage backtesting, and share findings to advance understanding in both quantitative finance and market efficiency studies.

0 Comments

Leave a Comment