==================================================================

Introduction

Momentum indicators are vital tools in technical and quantitative trading. They help traders measure the speed and strength of price movements, identify potential reversals, and optimize entry and exit points. A momentum indicators comparison chart provides a clear overview of different indicators, their applications, and effectiveness in various markets.

This guide dives deep into momentum indicators, comparing popular tools, discussing their strategies, and providing actionable insights for both retail and professional traders.

Internal link integration: Understanding “how momentum indicators work in trading” is essential to grasp how these tools can influence your trading decisions and strategy development.

Understanding Momentum Indicators

What Are Momentum Indicators?

Momentum indicators are technical analysis tools that evaluate the speed of price changes over time. They do not measure price direction alone but focus on the velocity of price movements.

Key Concepts

- Momentum: The rate of change in price over a specified period.

- Overbought/Oversold Conditions: Indicate potential reversals.

- Trend Confirmation: Momentum can confirm whether a trend is strong or weakening.

Why Momentum Matters

Momentum analysis helps traders avoid false signals and capture sustained trends. It is widely used in both day trading and longer-term strategies.

Advantages:

- Enhances trend-following strategies

- Helps identify entry and exit points efficiently

- Reduces exposure to whipsaws in volatile markets

Popular Momentum Indicators

1. Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to identify overbought or oversold conditions.

Formula:

RSI = 100 - [100 / (1 + RS)], where RS = Average Gain / Average Loss

Pros:

- Simple to interpret

- Effective for range-bound markets

Cons:

- May generate false signals in strong trending markets

2. Moving Average Convergence Divergence (MACD)

MACD combines moving averages to identify changes in momentum and trend strength.

Components:

- MACD Line = 12-day EMA - 26-day EMA

- Signal Line = 9-day EMA of MACD Line

- Histogram = MACD Line - Signal Line

Pros:

- Shows both trend direction and momentum

- Useful for spotting crossovers

Cons:

- Lagging indicator in highly volatile markets

3. Stochastic Oscillator

Compares a closing price to a price range over a specified period.

Pros:

- Identifies overbought and oversold conditions

- Helps detect potential reversals

Cons:

- Can remain overbought/oversold for extended periods during strong trends

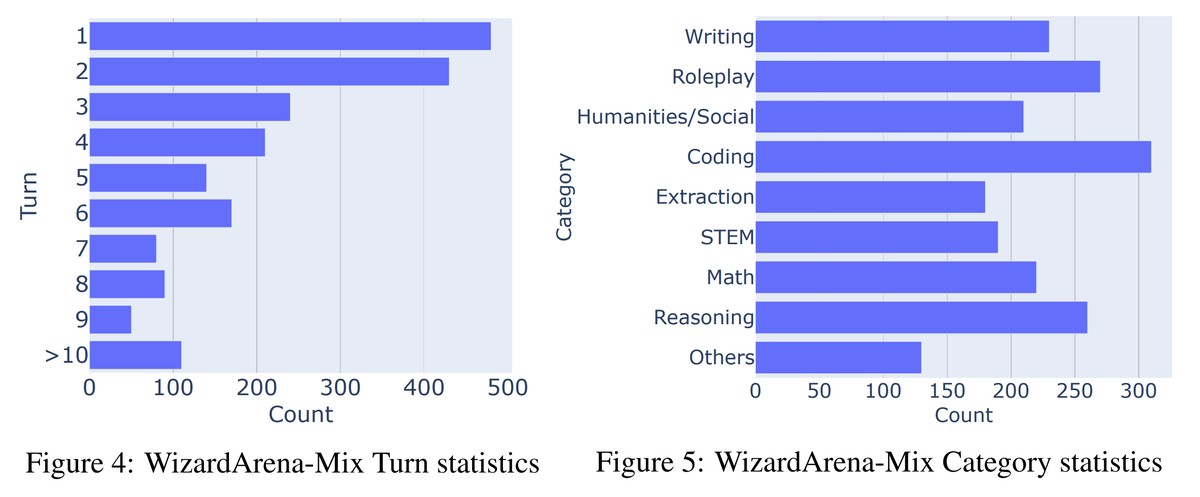

Momentum Indicators Comparison Chart

| Indicator | Timeframe | Best For | Signals | Pros | Cons |

|---|---|---|---|---|---|

| RSI | Short/Medium | Overbought/Oversold | >70 = Overbought, <30 = Oversold | Easy to use, effective in range-bound markets | False signals in trending markets |

| MACD | Medium/Long | Trend confirmation | Crossovers, divergence | Shows trend and momentum, good for trend following | Lagging, slower in volatile markets |

| Stochastic Oscillator | Short | Reversal signals | %K and %D lines crossover | Detects early reversals | Can give premature signals |

| Commodity Channel Index (CCI) | Short/Medium | Overbought/Oversold | >+100 = Overbought, <-100 = Oversold | Good for cyclical markets | Sensitive to volatile price swings |

| Rate of Change (ROC) | Short/Medium | Momentum strength | Above/Below zero line | Simple, shows acceleration | Needs confirmation with other indicators |

Comparison of key momentum indicators with signals, pros, and cons

Internal link integration: Traders can learn “where to find momentum trading strategies” to see practical applications of these indicators in real trading scenarios.

Applying Momentum Indicators

1. Trend-Following Strategy

Momentum indicators confirm strong trends, helping traders enter in the direction of momentum.

Steps:

- Identify strong upward or downward trend

- Confirm trend using RSI or MACD

- Enter trades when momentum aligns with trend direction

2. Reversal Strategy

Indicators like RSI and Stochastic Oscillator help identify overbought/oversold conditions to spot potential reversals.

Steps:

- Monitor indicator extremes (RSI >70 or <30)

- Look for divergence with price trends

- Enter trades anticipating reversal

Combining Multiple Indicators

- Combining RSI and MACD provides confirmation for both momentum and trend

- Using ROC with Stochastic Oscillator improves accuracy for short-term trades

Example of using RSI and MACD together to identify trend continuation

Advanced Techniques for Professional Traders

1. Momentum Oscillator Backtesting

Backtesting momentum indicators against historical data improves strategy effectiveness and reduces risk.

2. Quantitative Momentum Analysis

Advanced traders integrate momentum into algorithmic trading systems to automate entries and exits.

3. Risk Management Integration

- Use stop-loss orders based on momentum thresholds

- Adjust position sizing based on momentum strength

FAQ

1. Which momentum indicator is best for beginners?

RSI is typically recommended due to its simplicity and clear overbought/oversold signals. Beginners should combine it with trend confirmation tools like MACD.

2. Can momentum indicators predict long-term trends?

Momentum indicators are more effective for short- to medium-term trends. For long-term trends, combine them with moving averages and macroeconomic analysis.

3. How do I avoid false signals in momentum trading?

- Use multiple indicators for confirmation

- Incorporate volume analysis

- Avoid trading solely on extremes; consider overall market trend

Conclusion

A momentum indicators comparison chart is a crucial resource for traders seeking to understand the strengths and limitations of each tool. By combining indicators like RSI, MACD, and Stochastic Oscillator, traders can develop more reliable strategies, minimize false signals, and improve market timing.

Engaging with interactive tools, backtesting strategies, and following real-time signals enhances the practical application of momentum indicators, ensuring both novice and professional traders maximize their trading potential.

Share your experiences, comment on your favorite momentum indicators, and discuss strategies with other traders to refine your trading edge.

0 Comments

Leave a Comment