===============================================

Monte Carlo simulation has become one of the most powerful tools in modern financial modeling, offering traders and investors a way to quantify uncertainty, manage risks, and optimize strategies. When applied effectively, Monte Carlo for quantitative trading allows individuals and institutions to assess probabilities, stress test portfolios, and refine algorithmic trading systems with greater accuracy.

This guide will explain how to use Monte Carlo for quantitative trading, compare different methods, provide practical examples, and integrate industry insights that reflect real-world applications.

What Is Monte Carlo Simulation in Trading?

Monte Carlo simulation is a statistical technique that uses random sampling and repeated simulations to model uncertainty. In trading, it helps answer questions like:

- What is the probability of a strategy achieving a target return?

- How would a portfolio behave under different market conditions?

- What is the worst-case scenario for risk exposure?

Instead of relying on a single deterministic forecast, Monte Carlo generates thousands of possible outcomes, creating a distribution of results that traders can analyze.

Why Monte Carlo Matters in Quantitative Trading

In financial markets, uncertainty is the norm. Market prices are influenced by countless variables, from interest rates to political events. Monte Carlo addresses this complexity by:

- Capturing randomness in returns, volatility, and correlations.

- Improving strategy design by revealing how strategies behave in extreme conditions.

- Supporting portfolio optimization through risk-return analysis.

- Reducing overconfidence in backtested results by showing a wider range of potential outcomes.

This directly relates to why Monte Carlo is effective in quantitative models, as it provides flexibility and realism that traditional linear models lack.

Core Applications of Monte Carlo in Trading

1. Backtesting Trading Strategies

Monte Carlo enhances backtesting by introducing randomness into trade orders, market conditions, or parameter values. Instead of testing one rigid scenario, traders can explore thousands of simulated paths to ensure robustness.

Example: A momentum strategy can be tested under different market volatility regimes to check its sustainability.

2. Portfolio Risk Management

Monte Carlo is widely used to estimate Value at Risk (VaR) and Conditional Value at Risk (CVaR). By simulating various return distributions, traders can evaluate downside risks more accurately.

Example: A diversified equity-bond portfolio can be stress tested for interest rate shocks and equity drawdowns simultaneously.

3. Options Pricing and Derivatives

Monte Carlo is a cornerstone in pricing complex derivatives, particularly when analytical solutions (like the Black-Scholes model) are limited. It allows traders to simulate millions of possible price paths for the underlying asset.

Example: Pricing exotic options such as barrier or Asian options that depend on the path of the asset price.

4. Trading Strategy Optimization

Monte Carlo can evaluate how different parameter choices affect strategy profitability. By introducing uncertainty into model inputs, traders can avoid overfitting and build more resilient algorithms.

This fits naturally with how to improve trading strategies using Monte Carlo, as parameter tuning is essential in systematic trading.

Step-by-Step Guide: How to Use Monte Carlo for Quantitative Trading

Step 1: Define the Trading Strategy

Clearly outline rules for entry, exit, position sizing, and asset universe.

Step 2: Identify Key Risk Factors

List variables such as volatility, correlation, execution delays, or slippage.

Step 3: Build a Simulation Model

Use tools like Python (NumPy, pandas, Monte Carlo libraries) or specialized platforms such as MATLAB and R.

Step 4: Generate Random Scenarios

Simulate thousands of market paths using probability distributions (e.g., normal, lognormal, or fat-tailed).

Step 5: Analyze Results

Evaluate distributions of returns, Sharpe ratios, drawdowns, and probabilities of ruin.

Step 6: Adjust and Optimize

Refine the strategy based on weaknesses identified in the simulations.

Monte Carlo simulation generates multiple random paths to model uncertainty in financial returns.

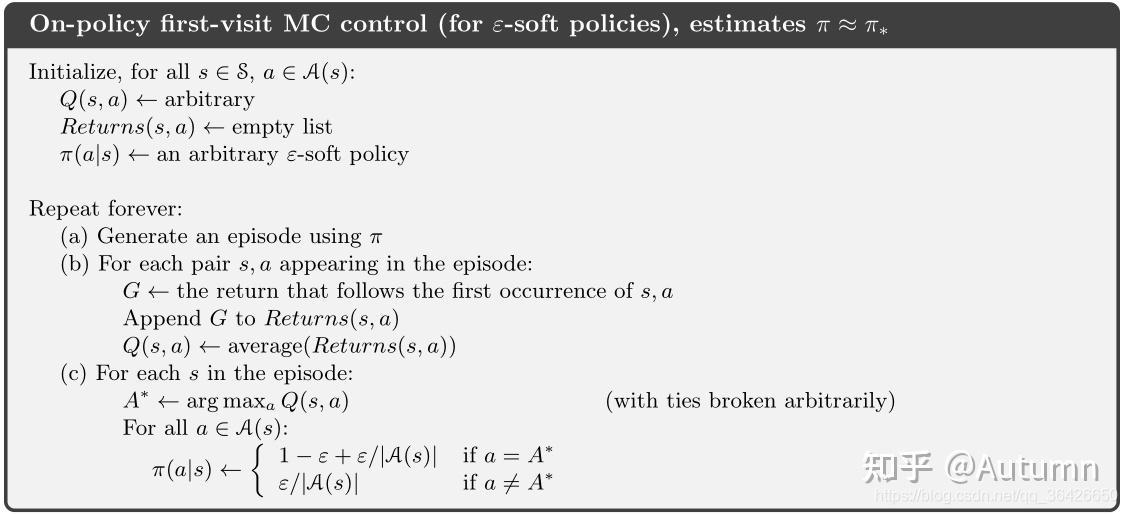

Comparing Monte Carlo Methods

| Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| Basic Monte Carlo | Random sampling from distributions | Simple, easy to implement | May miss rare events |

| Bootstrapping Monte Carlo | Resampling from historical data | Captures market-specific features | Limited by past market patterns |

| Quasi-Monte Carlo | Uses low-discrepancy sequences | Faster convergence, greater accuracy | More complex to implement |

| Adaptive Monte Carlo | Adjusts sampling dynamically | Efficient for complex problems | Requires advanced algorithms |

Industry Trends: Monte Carlo in Modern Trading

- AI-Enhanced Simulations: Machine learning integrates with Monte Carlo to create smarter scenario selection.

- Cloud-Based Computation: Retail traders can now access high-performance Monte Carlo tools without expensive infrastructure.

- Stress Testing Applications: Regulators require stress testing, and Monte Carlo is increasingly part of compliance frameworks.

- Crypto and DeFi Integration: Monte Carlo is applied in analyzing highly volatile digital assets.

Practical Example: Monte Carlo for a Trading Strategy

Imagine a retail trader designing a mean reversion strategy on U.S. equities.

- They define their strategy rules.

- They estimate volatility from historical data.

- They run 10,000 Monte Carlo simulations, adding slippage and transaction costs.

- Results show a 70% chance of profitability with moderate drawdowns.

- They adjust position sizing to reduce tail-risk.

By doing this, the trader avoids relying solely on backtest results and gains confidence that the strategy can handle different market environments.

FAQs: Monte Carlo for Quantitative Trading

1. How many simulations should I run for Monte Carlo trading models?

A typical rule of thumb is at least 10,000 simulations for reliable results. For complex derivatives or portfolios, traders may run millions of simulations.

2. Do individual traders need advanced math to use Monte Carlo?

Not necessarily. Many trading platforms and Python libraries provide built-in Monte Carlo functions. However, understanding probability distributions and random processes is essential for meaningful results.

3. Can Monte Carlo guarantee profits in trading?

No simulation guarantees profits. Monte Carlo reduces overconfidence and highlights risks, but real markets involve unknowns that models cannot fully capture.

Conclusion: Why Monte Carlo Is Essential for Quantitative Traders

Monte Carlo simulation is not just an academic concept—it’s a practical, real-world tool for traders of all levels. From backtesting and risk management to derivatives pricing and portfolio optimization, Monte Carlo provides a robust way to deal with uncertainty.

For beginners, start with simple portfolio stress tests. For advanced quants, explore quasi-Monte Carlo or adaptive methods. In both cases, the insight gained can transform raw trading ideas into resilient, risk-aware strategies.

If you found this guide useful, share it with fellow traders and leave a comment on how you’ve used Monte Carlo in your own trading journey. Together, we can build a smarter, data-driven trading community.

0 Comments

Leave a Comment