Neural network models have revolutionized stock prediction, providing traders and quantitative analysts with sophisticated tools to forecast market movements with greater accuracy. By mimicking human brain processing and learning from historical data, these models can uncover hidden patterns, optimize trading strategies, and reduce risk exposure. This article explores neural network models for stock prediction, comparing advanced techniques, highlighting practical implementations, and offering expert insights.

Understanding Neural Networks in Stock Prediction

What Are Neural Networks?

Neural networks are computational models inspired by the human brain, consisting of interconnected nodes (neurons) that process input data and generate outputs. They are particularly effective in identifying non-linear relationships and complex patterns in financial data.

- Input Layer: Receives market indicators such as stock prices, volume, and technical indicators

- Hidden Layers: Perform complex computations to detect relationships and trends

- Output Layer: Provides predictions, e.g., price direction or expected return

Internal Link Example: Traders seeking to enhance their algorithmic systems can learn how neural networks predict market trends to improve quantitative trading accuracy.

Why Use Neural Networks for Stock Prediction?

- Pattern Recognition: Detects subtle trends not visible in traditional analysis

- Non-linear Modeling: Captures complex dependencies in stock prices

- Automation Potential: Facilitates algorithmic trading and decision-making

Key Types of Neural Network Models for Stock Prediction

1. Feedforward Neural Networks (FNNs)

Description:

FNNs are the simplest neural network architecture. Information flows unidirectionally from input to output without feedback loops.

Applications in Stock Prediction:

- Short-term price movement prediction

- Technical indicator-based analysis

- Portfolio optimization

Pros:

- Easy to implement

- Requires relatively low computational power

Cons:

- Limited in capturing temporal dependencies in stock data

Feedforward network structure illustrating input, hidden, and output layers for stock price prediction.

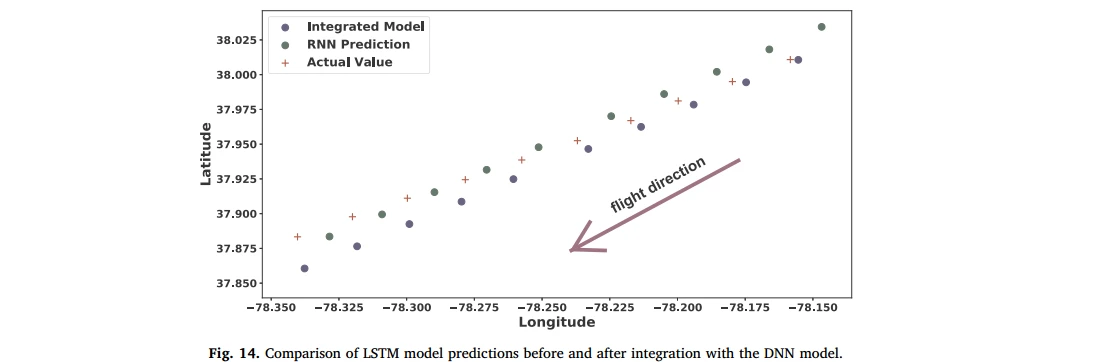

2. Recurrent Neural Networks (RNNs) and LSTM Networks

Description:

RNNs are designed for sequential data, making them ideal for stock price time series. Long Short-Term Memory (LSTM) networks address the vanishing gradient problem in standard RNNs, capturing long-term dependencies.

Applications in Stock Prediction:

- Forecasting future stock prices using historical trends

- Detecting momentum and reversal signals

- Enhancing algorithmic trading strategies

Pros:

- Captures temporal dynamics effectively

- Handles long sequences of data

Cons:

- Computationally intensive

- Requires careful hyperparameter tuning

Internal Link Example: Professionals can explore how to build neural network models for trading to integrate RNNs and LSTMs into predictive analytics frameworks.

Data Preparation and Feature Engineering

Selecting Relevant Features

Key features for stock prediction using neural networks include:

- Historical Prices: Open, high, low, close

- Technical Indicators: Moving averages, RSI, MACD

- Volume Metrics: Trading volume trends

- Market Sentiment Data: News sentiment scores, social media analytics

Data Normalization and Transformation

- Scale inputs to a consistent range (e.g., 0-1)

- Apply logarithmic or difference transformations to reduce skewness

- Use windowing techniques to capture lagged dependencies in time series data

Model Training and Optimization

Training Neural Networks

- Loss Functions: Mean Squared Error (MSE) for regression, cross-entropy for classification

- Optimization Algorithms: Adam, RMSProp, SGD

- Regularization Techniques: Dropout, L2 regularization to prevent overfitting

Model Validation

- Split data into training, validation, and test sets

- Apply cross-validation to ensure model generalization

- Evaluate performance using metrics like RMSE, MAE, and directional accuracy

Workflow illustrating data preprocessing, model training, validation, and testing phases for stock prediction.

Advanced Neural Network Strategies

Strategy 1: Hybrid Models

Description:

Combine LSTM networks with convolutional layers or technical indicators to capture both temporal and spatial patterns in stock data.

Pros:

- Improves prediction accuracy

- Reduces noise from irrelevant features

Cons:

- Increased model complexity

- Longer training time

Strategy 2: Attention Mechanisms

Description:

Attention layers highlight important time steps or features for prediction, improving interpretability and performance.

Pros:

- Focuses on key signals in data

- Enhances model explainability

Cons:

- Requires additional computational resources

- Complex architecture design

Comparing Neural Network Approaches

| Model Type | Best Use Case | Pros | Cons |

|---|---|---|---|

| Feedforward Neural Networks | Quick predictions with limited data | Simple, low resource | Ignores temporal dependencies |

| RNN / LSTM | Time-series forecasting | Captures long-term patterns | High computational cost |

| Hybrid CNN-LSTM | Complex feature integration | Higher accuracy | Complex, slow training |

| Attention-based Models | Emphasizing key signals | Improved interpretability | Requires expertise |

Recommendation: For professional traders, RNN/LSTM combined with attention mechanisms often yields the most accurate and robust results for stock prediction.

Common Pitfalls and Best Practices

- Overfitting: Use dropout and cross-validation to prevent

- Ignoring Market Regimes: Incorporate macroeconomic indicators

- Feature Overload: Select features based on predictive relevance

- Data Snooping: Avoid using future information in training

FAQ: Neural Network Models for Stock Prediction

1. Can neural networks predict stock prices accurately?

Neural networks improve prediction accuracy by capturing complex patterns and dependencies, but no model guarantees 100% accuracy. They are most effective when combined with robust risk management and domain knowledge.

2. How much historical data is required?

Typically, 3-5 years of daily price data is sufficient for LSTM models. More granular data (minute-level) can enhance short-term predictions but increases computational requirements.

3. Which neural network is best for beginners?

Feedforward neural networks are recommended for beginners due to their simplicity. Once comfortable, traders can progress to RNNs, LSTMs, and hybrid models for more advanced forecasting.

Conclusion

Neural network models offer powerful solutions for stock prediction, enabling professional traders and quantitative analysts to uncover hidden market patterns, optimize trading strategies, and improve decision-making. By implementing advanced techniques such as RNNs, LSTMs, hybrid models, and attention mechanisms, traders can enhance predictive performance and manage risk effectively. Integrating these models with real-time data pipelines and algorithmic trading systems ensures a competitive edge in modern financial markets.

Engage and Share: Share your experiences with neural network stock prediction, comment on strategies you’ve implemented, and forward this article to help others explore AI-driven trading analytics.