In the world of financial trading, automation and artificial intelligence (AI) have drastically transformed the way traders and investors approach markets. Among the various AI technologies, neural networks have gained significant traction due to their ability to learn from data, identify complex patterns, and make predictions that drive profitable trading decisions. In this comprehensive guide, we’ll explore how neural network solutions are revolutionizing trading automation, the methods used to implement them, and how traders can optimize their strategies using neural networks.

What Are Neural Networks?

A neural network is a computational model inspired by the way biological neural systems work. It consists of interconnected layers of nodes (or “neurons”), which process and transmit information to make predictions or decisions based on input data. In trading, these networks can analyze vast amounts of historical market data to predict price movements, identify trends, or automate trading strategies.

There are different types of neural networks used in trading, such as:

- Feedforward Neural Networks (FNN): Simple neural networks used for predicting a single output based on multiple inputs.

- Convolutional Neural Networks (CNN): Primarily used for image recognition, CNNs are also adapted for analyzing market data patterns, such as candlestick charts.

- Recurrent Neural Networks (RNN): These are ideal for sequence prediction tasks, where past data points (like historical stock prices) influence future outcomes.

By leveraging neural networks, traders can develop strategies that adapt to market conditions, making them crucial for quantitative trading and algorithmic trading.

How Neural Networks Improve Trading Automation

1. Pattern Recognition in Market Data

Neural networks excel at recognizing complex patterns in large datasets. In trading, market behavior often follows non-linear patterns that are difficult to predict using traditional statistical methods. By training neural networks on historical price data, traders can identify patterns that indicate future price movements, even when those patterns are not immediately obvious.

Example: Predicting Stock Price Movements

Using a Recurrent Neural Network (RNN), traders can analyze historical price data (like stock prices over the past month) to predict whether a stock’s price will rise or fall in the near future. The model learns from past trends, market conditions, and technical indicators, allowing it to predict potential price changes with high accuracy.

Pros:

- Neural networks can detect complex relationships that human traders might miss.

- They adapt to new data, learning continuously to improve predictions.

Cons:

- Requires a large volume of data for training.

- May suffer from overfitting if not properly optimized, meaning it could perform well on historical data but fail in live trading conditions.

2. Automated Strategy Execution

Neural networks play a crucial role in trading automation by enabling the automatic execution of trading strategies based on model predictions. Once a neural network has been trained and validated, it can automatically execute trades when certain conditions are met. This reduces the need for manual intervention and allows for faster, more efficient trading.

Example: Algorithmic Trading Systems

Traders use neural network-based trading algorithms to execute trades on platforms like MetaTrader or QuantConnect. These systems continuously analyze real-time market data and execute trades when they detect signals of potential profit, such as a price pattern or a specific technical indicator crossing a threshold.

Pros:

- Eliminates human emotion and error from trading decisions.

- Executes strategies at a speed and frequency that would be impossible for a human trader.

Cons:

- Requires careful design to ensure the algorithm is robust and avoids market risks.

- Can lead to unforeseen risks if market conditions drastically change and the model is not designed to adapt quickly.

Different Types of Neural Networks for Trading

1. Feedforward Neural Networks (FNN)

FNNs are the simplest form of neural networks and are widely used for regression and classification tasks in trading. In trading, they can be used to predict future prices or decide whether to buy, sell, or hold a position based on current and historical market data.

Example: Predicting Stock Price Using FNN

An FNN can be trained on features like technical indicators (Moving Averages, RSI, MACD) and fundamental data (P/E ratios, earnings growth) to forecast stock prices. After training, the model can provide real-time predictions for future stock prices.

Pros:

- Simple and easy to implement.

- Effective for problems with a clear relationship between input data and outputs.

Cons:

- Limited ability to handle sequential or time-series data (like stock prices) compared to more advanced architectures like RNNs.

- May not perform well on more complex data with non-linear dependencies.

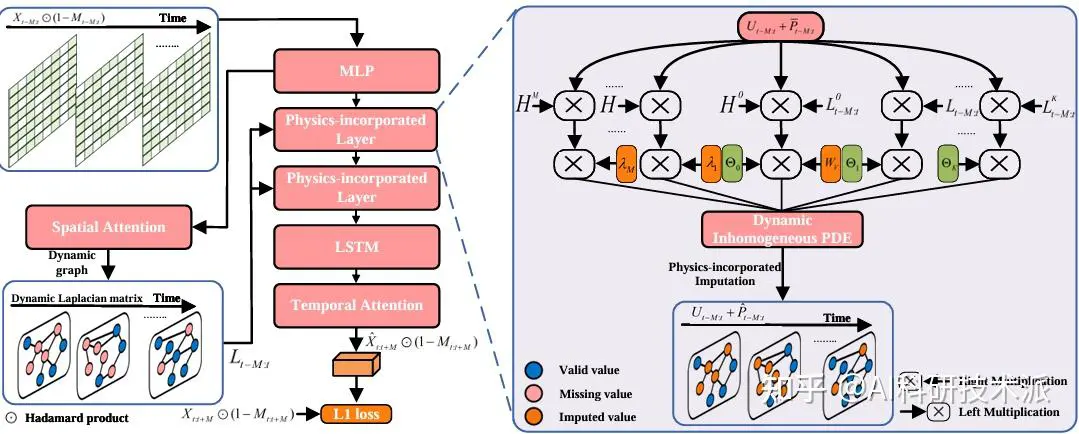

2. Recurrent Neural Networks (RNN)

RNNs are designed to handle sequential data, making them ideal for time-series analysis, which is fundamental in trading. Since RNNs retain information from previous time steps, they are particularly effective at forecasting stock prices based on past trends.

Example: Time-Series Forecasting with RNN

An RNN can be trained using historical stock prices to predict the future price of a stock. The model remembers previous prices and adjusts its predictions accordingly, making it well-suited for dynamic financial markets.

Pros:

- Can model sequential data, making it ideal for stock price prediction.

- Able to account for time dependencies in financial data.

Cons:

- Can suffer from vanishing gradients during training, making it difficult for the network to learn long-term dependencies.

- Requires significant computational resources for training.

3. Convolutional Neural Networks (CNN)

Though primarily used in image recognition, CNNs have found applications in trading, especially for analyzing chart patterns. By converting price charts into image-like representations, CNNs can recognize patterns such as head-and-shoulders, triangles, and other technical chart formations that signal price movements.

Example: Pattern Recognition in Trading Charts

By treating candlestick charts as images, CNNs can detect specific patterns that historically indicate a bullish or bearish trend. This can be used to automate the identification of entry and exit points.

Pros:

- Excellent for recognizing complex chart patterns.

- Can process visual data that humans might overlook.

Cons:

- May not be as effective for raw time-series data without transformation.

- Requires significant training data and computational power.

Where to Learn Quantitative Trading with Neural Networks

For those interested in diving into the world of neural network solutions for trading automation, there are several resources available to learn about the application of these techniques in quantitative trading:

- Online Courses: Platforms like Coursera and edX offer courses in machine learning, deep learning, and neural networks, often with a focus on financial applications.

- Books: Titles like “Advances in Financial Machine Learning” by Marcos López de Prado provide a deep dive into using machine learning and neural networks for financial analysis.

- Communities and Forums: Platforms like QuantConnect and Kaggle allow traders and developers to collaborate on algorithmic trading strategies using neural networks.

FAQ: Frequently Asked Questions

1. Why are neural networks used in quantitative trading?

Neural networks are particularly effective in quantitative trading because they can process large amounts of market data, identify complex patterns, and adapt to new information. This allows traders to develop predictive models that improve their decision-making and trading performance.

2. How do neural networks predict market trends?

Neural networks predict market trends by analyzing historical market data, technical indicators, and macroeconomic factors. By training on past data, the network learns to recognize patterns that often precede specific market movements, such as price increases or decreases.

3. What are the challenges in using neural networks for trading?

The main challenges include overfitting (where the model performs well on historical data but fails on live data), the need for large volumes of data, and the complexity of tuning the network for optimal performance. Additionally, neural networks require significant computational power for training.

Conclusion

Neural network solutions for trading automation are changing the way traders approach market analysis, predictions, and execution. By leveraging powerful architectures such as RNNs and CNNs, traders can develop automated systems that identify complex patterns and execute trades based on learned insights. As the field of AI continues to evolve, neural networks will only become more integral in refining trading strategies and enhancing profitability.

If you’re new to quantitative trading with neural networks, starting with foundational courses and gradually advancing to more complex models will provide the knowledge needed to incorporate these techniques into your trading strategies.

0 Comments

Leave a Comment